RBLBANK trade ideas

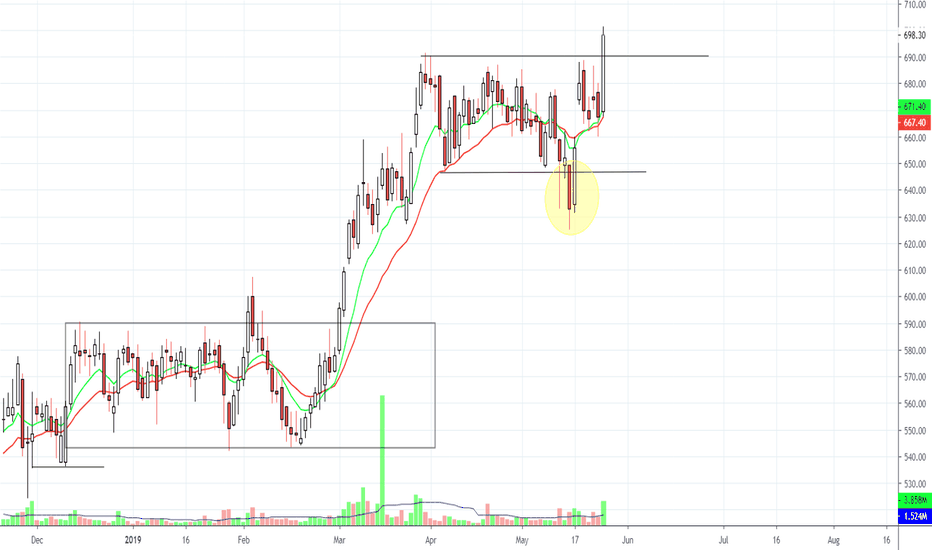

550 SAN; Reversal at 405 or 440 or 410 zone in another 5 to7daysSl Compulsory (SL 390) for long term investment

Accumulation zone at 405 to 440 Zone (better to wait (5 to 7 days) for price stabilization near 420).

Disclaimer:

Please consult with your financial adviser before making any trading or investment decision. Set-up provided here is for informational and educational purposes only.

This is not a sell or buy recommendation. We are not responsible for any gain or loss; Consult your financial advisor before your execution of trade.

There are heavy chance that most of the presented scripts does not meet set (described) entry conditions, as most of the posted analysis are based on Static ANalysis (SAN). Many times scenarios does not arise for good and ideal entry points. Hence needs personalized intraday techniques and strategies (PITS) are required for your entries and exists Always run with SL. WavoZen aims for microtrading, unless specified. Wavozen1 aims to publish real-time entries and exits.

Set-up presented here is for observational purpose only and most of the set-up designed by WavoZen is based on SAN for intraday purpose only to get the basic structure for intra-day short term or ultra-short term purpose only. Most of the set-up is valid for a day or otherwise mentioned. Hence requires your fine tuned personalized intraday techniques and strategies (PITS) based on Real-time Analysis (RT)/ Dynamic ANalysis (DAN) to get benefit from these structures or to have minimum loss, if wrong through your PIT Strategies (your trade plan). Overnight events, Gap-up opening, gap-down opening, news, major economic data release etc may impact the deviation from the assumed scenarios. If entry conditions and criteria are not meet, then we should not take any chance to enter on assumed scenarios. If there is a deviation in assumed scenario in time, speed and angle and these deviations will not encourages for entry as referred as entry not valid (ENV). Daily post appears on stocktwits.WavoZen. Abbreviations: PT1: Profit taking point 1; PT2 =profit taking point 2; SL: Stoploss point. ENT: Entry not Triggered; ENV: Entry not valid. Weekly Review : WR;