RPOWER trade ideas

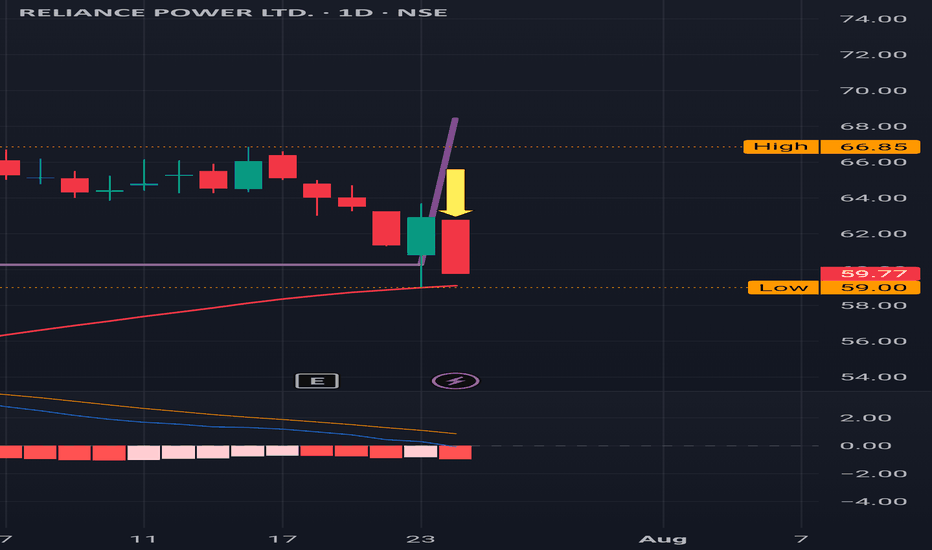

REL Power : Feeling the resistance , couldn't sustain above it REL Power : Feeling the resistance , couldn't sustain above it and got a pulled back

This is 3 months Time frame .

( Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

Cup & handle Breakout - RPOWERCurrent Price: ₹71

Technical Analysis:

Cup & Handle Breakout Pattern: The provided chart for RPOWER shows a pattern that resembles a Cup & Handle, and it appears to be currently breaking out or is near a breakout point.

Waiting for Confirmation: Your statement "Waiting for confirmation" is crucial. A confirmed breakout typically involves the price sustaining above the resistance level with strong trading volume.

Immediate Target: Multibagger stock. This is an ambitious long-term target, implying a significant increase from the current price.

Time Frame: 3 to 6 Years. This suggests a long-term investment horizon.

Fundamental Analysis :

Sales (Revenue from Operations): Sales have been volatile over the years. They peaked at ₹10,396 Cr. in Mar 2017, declined to ₹7,562 Cr in Mar 2020, and then recovered to ₹7,583 Cr in Mar 2025.

Operating Profit: Fluctuating, reaching a high of ₹4,506 Cr in Mar 2017 and a low of -₹2,823 Cr in Mar 2020. It has recovered to ₹2,108 Cr in Mar 2025.

Net Profit: The company reported significant losses from Mar 2020 (-₹2,952 Cr) to Mar 2023 (-₹4,068 Cr). Crucially, Reliance Power has reported a positive Net Profit of ₹2,948 Cr in Mar 2025. This marks a significant turnaround from previous years' losses.

EPS in Rs.: Corresponding to the net profit, EPS was negative from Mar 2020 to Mar 2023, but turned positive at ₹9.34 in Mar 2025.

Compounded Sales Growth: TTM: -4%. 3 Years: 0%. 5 Years: -7%. 10 Years: 1%. This indicates recent flat to declining sales growth, despite the recent profit recovery.

Compounded Profit Growth: TTM: 91%. 3 Years: 22%. 5 Years: 7%. 10 Years: %. The TTM and 3-year profit growth figures are very strong, largely due to the turnaround from losses to profit.

Return on Equity (ROE): Last Year: 0%. 3 Years: -10%. 5 Years: -7%. 10 Years: -1%. Despite the recent net profit, the compounded ROE remains negative, which suggests that the company is still grappling with past accumulated losses impacting equity.

Key Fundamental Observations:

Turnaround in Profitability: The most significant fundamental development is the sharp turnaround from consistent losses to a substantial positive Net Profit of ₹2,948 Cr and a positive EPS of ₹9.34 in March 2025.

Valuation: Based on the current price of ₹71 and the FY25 EPS of ₹9.34, the trailing P/E ratio would be approximately 7.6. This is a very low P/E if the profit is sustainable and represents a significant re-rating opportunity if the turnaround holds.

Debt: While not explicitly detailed in the provided images, Reliance Power has historically carried a high debt load. The recent profit might be linked to debt restructuring or asset sales, which could significantly improve its financial health.

Sales Growth: Despite the strong profit recovery, the compounded sales growth figures for the last 1, 3, and 5 years are negative or flat, indicating that the profit recovery might be driven more by cost efficiencies, debt reduction, or non-operating income rather than core revenue expansion.

Corporate Actions & Latest News:

News related to RPOWER would predominantly focus on its financial restructuring efforts, debt resolution, asset sales, and the operational performance of its power plants. The recent positive financial results would be a major highlight. Any new power projects or significant Power Purchase Agreements (PPAs) would also be key news.

Order Book: For a power generation company, the "order book" primarily refers to its Power Purchase Agreements (PPAs). The stability and duration of these agreements are crucial for revenue visibility.

Overall Assessment & Viability of Target:

The technical Cup & Handle breakout pattern is generally bullish, and the recent shift to profitability is a major positive fundamental development for Reliance Power. The low P/E ratio, based on the latest EPS, could indicate that the market has not yet fully priced in the turnaround.

However, the "Multibagger" target within 3-6 years is still highly aggressive and depends on several critical factors:

Sustainability of Profitability: The company must demonstrate consistent and growing profits over multiple quarters and years, proving that the Mar 2025 profit is not a one-off event.

Debt Management: Continued success in reducing and managing its historical debt burden is crucial.

Core Business Growth: Improving sales growth in addition to profit growth will be vital for a sustained upward trajectory.

Market Re-rating: The market needs to be convinced of the long-term viability and growth prospects to assign a higher valuation multiple.

While the current technical and recent fundamental data show promise, the "Multibagger" target requires an exceptional and sustained turnaround in all aspects of the business.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Investing in turnaround stories and highly volatile stocks carries significant risks, and considerable capital loss is possible. Always conduct your own exhaustive research, assess the company's current and future financial viability, understand all associated risks, and consult with a qualified financial advisor before making any investment decisions.

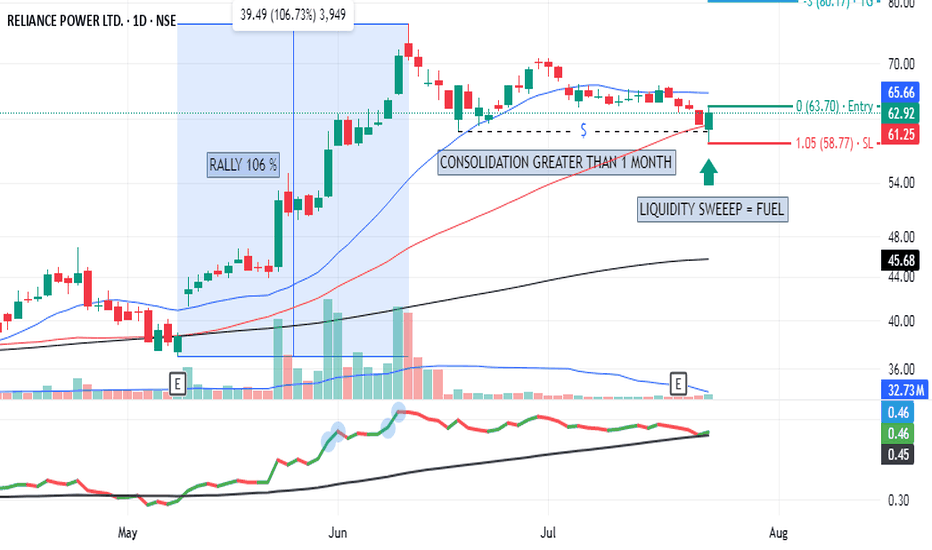

REL Power : Fantastic rally after a buy signal in March 2025 REL Power : Fantastic rally after a buy signal in the last week of March 2025 after few initial hiccups. From 40 to now at 70.

It got momentum mainly from the last week of May 2025 .

( Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

REL Power : Crossed the major resistance and sitting just above REL Power : Crossed the major resistance and sitting just above it at 70.

Hopefully it sustains there .

(This is 3 Month time frame )

-------------

On a Monthly time frame it has just surpassed 200 SMA which also an important milestone.

( Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

Ascending triangle in RPOWEROn short term chart, Rpower has created ascending triangle. This is after stock has moved up with a higher relative volume. This triangle suggests consolidation of upmove and further movement is highly probable.

As you can see, volume on up bars is huge as compared to down bars. This suggests higher interest in stock.

Breakout of 63.43 can give further upside.

Cup & handle Breakout - RPOWERCurrent Price: ₹58.10

Technical Analysis:

Cup & Handle Breakout Pattern: The provided chart for RPOWER shows a pattern that resembles a Cup & Handle, with a recent breakout above the resistance level around ₹58.10. A confirmed breakout with strong volume is typically a bullish signal.

Target: ₹3100

Time Frame: 3 to 6 Years. This is an extremely ambitious long-term target, implying a massive increase from the current price.

Fundamental Analysis :

Sales (Revenue from Operations): Sales have been volatile over the years, with a peak in Mar 2017 at ₹10,396 Cr., declining to ₹7,562 Cr in Mar 2020, and then showing a recovery to ₹7,583 Cr in Mar 2025.

Operating Profit: Fluctuating, reaching a high of ₹4,506 Cr in Mar 2017 and a low of -₹2,823 Cr in Mar 2020. It has recovered to ₹2,108 Cr in Mar 2025.

Net Profit: The company has reported significant losses for several years. It posted substantial net losses from Mar 2020 (-₹2,952 Cr) to Mar 2023 (-₹4,068 Cr). Crucially, Reliance Power has reported a positive Net Profit of ₹2,948 Cr in Mar 2025. This marks a significant turnaround from previous years' losses.

EPS in Rs.: Corresponding to the net profit, EPS was negative from Mar 2020 to Mar 2023, but turned positive at ₹9.34 in Mar 2025.

Compounded Sales Growth: TTM: -4%. 3 Years: 0%. 5 Years: -7%. 10 Years: 1%. This indicates recent flat to declining sales growth, despite the recent profit recovery.

Compounded Profit Growth: TTM: 91%. 3 Years: 22%. 5 Years: 7%. 10 Years: %. The TTM and 3-year profit growth figures are very strong, largely due to the turnaround from losses to profit.

Return on Equity (ROE): Last Year: 0%. 3 Years: -10%. 5 Years: -7%. 10 Years: -1%. Despite the recent net profit, the compounded ROE remains negative, which suggests that the company is still grappling with past accumulated losses impacting equity.

Key Fundamental Observations:

Turnaround in Profitability: The most significant fundamental development is the shift from consistent losses to a positive Net Profit of ₹2,948 Cr in March 2025, and a positive EPS of ₹9.34. This is a crucial change.

Debt: While not explicitly shown in the provided Profit & Loss or Shareholding Pattern images, Reliance Power has historically been burdened by high debt. The recent profit might be linked to debt restructuring or asset sales.

P/E Ratio: Given the recent positive EPS of ₹9.34 and current price of ₹58.10, the trailing P/E would be around 6.22 (58.10 / 9.34). This is very low if the profit is sustainable. However, given the negative historical EPS and the "T.T.M. Profit Growth" at 91%, the market may still be cautious about the sustainability of this newfound profitability.

Corporate Actions:

Debt Resolution: Reliance Power has been aggressively pursuing debt reduction strategies. This recent significant profit could be a result of asset monetization, debt settlements, or specific financial restructuring efforts.

Fundraising: The company has previously raised funds through various mechanisms to address its debt and financial obligations.

Company Order Book:

For a power generation company, the "order book" primarily refers to its Power Purchase Agreements (PPAs). The stability and duration of these agreements are crucial for revenue visibility. The recent profit turnaround suggests some improvements in operational performance and potentially better PPA realizations.

Latest News:

News related to RPOWER would predominantly focus on its financial restructuring efforts, debt resolution, asset sales, and the operational performance of its power plants. The recent positive financial results would be a major highlight. Any new power projects or significant PPA signings would also be key news.

Overall Assessment & Viability of Target:

The technical Cup & Handle breakout pattern is generally bullish. The most significant fundamental factor is the remarkable turnaround to a positive Net Profit and EPS in March 2025 after years of losses. This makes the company's financial health appear much stronger than before.

However, the target of ₹3100 from ₹58.10 within 3-6 years is still extremely ambitious (over 50x return). While the recent profit is a massive positive, for such a target to be credible, the company would need to:

Sustain Profitability: Demonstrate consistent, growing profits over multiple quarters and years, not just a one-off.

Continue Debt Reduction: Maintain a strong focus on further reducing its debt burden.

Improve Operational Performance: Ensure its power assets are operating efficiently and securing favorable PPAs.

Re-rate by Market: The market would need to significantly re-rate the company's valuation based on sustained growth and profitability, moving it from a 'turnaround story' to a 'growth story'.

The "Compounded Sales Growth" being negative for TTM and 3/5 years indicates that the profit growth is currently more due to cost control, debt reduction, or non-operating income/asset sales rather than core revenue expansion. For sustained profit growth, sales growth also needs to improve.

Conclusion:

The technical pattern and the very recent fundamental shift to profitability are encouraging. However, the long-term target of ₹3100 is highly aggressive and relies on the company not only sustaining its newfound profitability but also achieving exceptional, compounded growth for several years. Investors would need to carefully monitor the consistency of future profits, debt levels, and core business growth.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Investing in turnaround stories and highly volatile stocks carries significant risks. Always conduct your own exhaustive research, assess the company's current and future financial viability, understand all associated risks, and consult with a qualified financial advisor before making any investment decisions.

RPOWER - Cup Pattern BreakoutRELIANCE POWER LTD

Breakout from CUP pattern and now consolidating in a flag pattern.

High trade and delivery quantity this month.

Within 52 week range.

Stock outperforming benchmark Index.

Disclaimer:

For educational purpose only.

Please do your own research before taking any trades.

Happy Trading!

REL Power : Touched an All time High of 55 in recent years REL Power :

Touched an All time High of 55 in recent years

Important level to watch for is 65 which happened last time in Jan 2018 .

( This is a Monthly Time Frame Chart )

( Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

REL Power : Sitting right at the Red Band Resistance REL Power : Sitting right at the Red band Resistance .

It's already in a Buy trajectory and survived a Sell Signal in past few days and recovered from there.

( Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

REL Power : Pretty decent recovery from the support of 33

REL Power : Pretty decent recovery from the support of 33 in a month , today almost at the previous high of recent days Sitting at a major resistance as seen on the chart .

(Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

REL Power : Holding up quite nicely above Supertrend REL Power : Holding up quite nicely above Supertrend on a Monthly time frame since May 2021 .

53 is an important level to test .

( Monthly Time Frame)

May 2015 : Below Supertrend

May 2021 : Above Supertrend

May 2025 : It seems like it will continue to hold and remain above Supertrend

MACD looks quite strong on a Monthly time frame .

( Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

REL Power : An important milestone achieved, MACD touched 0 REL Power : An important milestone achieved on a 3 months time frame , MACD touched 0 .

On a daily time frame it is already in a Buy trajectory and sitting at the resistance bands .

50 to 70 are the important resistance levels for the REL Power's upcoming journey .

MACD ,200 SMA are both favourable on a Daily time frame

( Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

Reliance Power Breakout Alert!Reliance Power has broken out of a long-term downtrend resistance 📊💥. After multiple rejections, the price has finally closed above the trendline, signaling potential upside momentum!

🔹 CMP: ₹42.97 (+8.87%)

🔹 Resistance Turned Support: ₹44.19

🔹 Target 1: ₹53.64 (+25%)

🔹 Target 2: ₹64 (+48%)

🔹 Stop-loss: Below ₹36 for risk management

💡 Breakout Confirmation:

✅ Strong volume spike 📊

✅ Retest of resistance zone

✅ Higher highs forming

📢 Strategy: If the price sustains above ₹44, we may see a strong rally towards ₹53 and beyond! 📈 Keep an eye on price action & volume confirmation! 🔥

🔁 Share with fellow traders & comment your views! 💬👇