Why is Anil Ambani’s Reliance Power up 40%? Shares of Reliance Power (NSE: RPOWER) have been volatile after the Indian electric company secured a long-term debt agreement for up to 12 billion rupees ($150.4 million) from private equity firm Varde Partners, a US based investment firm focused on distressed assets in India.

RPOWER announced the deal on Sept. 5, sending its shares surging and at close of trading, the company stock price had risen 9.9% to 23.30 rupees. On Sept. 6, the company’s stocks dropped 6.0% at close of trading to 21.95 rupees.

The abrupt increase in Reliance Power's stocks, albeit short lived, elicited a warrant for explanation from the National Stock Exchange of India Ltd. and BSE Ltd. In its response, the company said it couldn't comment on the price movement and assured that it will make an announcement when necessary.

Perhaps more alarming is the climb in RPOWER’s share price before the announcement. In the two days before the announcement was confirmed, RPOWER’s shares climbed 37%.

Reliance's Power in India

Reliance Power is an electric power generation, transmission and distribution company based in Mumbai, India. It is the country's leading private sector power generation and coal resources company with one of the largest portfolio of power projects in the private sector, based on coal, gas, hydro and renewable energy. It has an operating portfolio of 5,945 megawatts.

A member of the Reliance Group conglomerate, the power company has a market capitalization of $992.8 million. In the quarter ended June 30, the company recorded a loss attributable to owners of its parent at 708.4 million rupees against a profit of 122.8 million rupees in the prior-year period.

To support its future plans, the company is considering raising fresh capital from both domestic and international investors. Apart from the recent agreement with Varde Partners, Reliance Power is considering an issuance of equity shares, equity-linked securities or convertible warrants to amass funds that it can utilize in the long run. The company's board will meet September 8 to consider future fund-raising plan.

Operating Within the Ambani Conglomerate

Reliance Power forms part of the Reliance Anil Dhirubhai Ambani Group, which is founded majority-owned by Anil Dhirubhai Ambani. Anil is also the chairman of Reliance Power.

Anil is the youngest son of Indian billionaire Mukesh Ambani, the chairman and managing director of Fortune 500 company Reliance Industrial (NSE: RELIANCE), which is also the most valuable company in India.

The brothers divided their father's business empire a decade ago. While Mukesh, who was Asia's richest man until fellow Indian billionaire Gautam Adani surpassed him, continued expanding his businesses, Anil is currently having troubles with companies defaulting and being put under administration. Nikkei Asia reported that Anil even declared himself to have a personal net worth of zero.

Reliance Power's affiliate, Reliance Capital, is currently on the market with an investor group including the Hinduja Group and Oaktree Capital offering 45 billion rupees for the diversified financial services company, Economic Times of India reported. Also on offer are India's fifth-largest privately owned general insurance company, a stockbroker, a stake in an asset manager and Reliance Capital's 51% share in a life insurance venture with Japan's Nippon Life, among other assets.

While it is yet to be seen if the current troubles of its affiliates will spill through Reliance Power, its recent loss will definitely not boost investor confidence. Furthermore, the company's fundraising initiatives are hardly proving that it is in a very secure position in terms of capital.

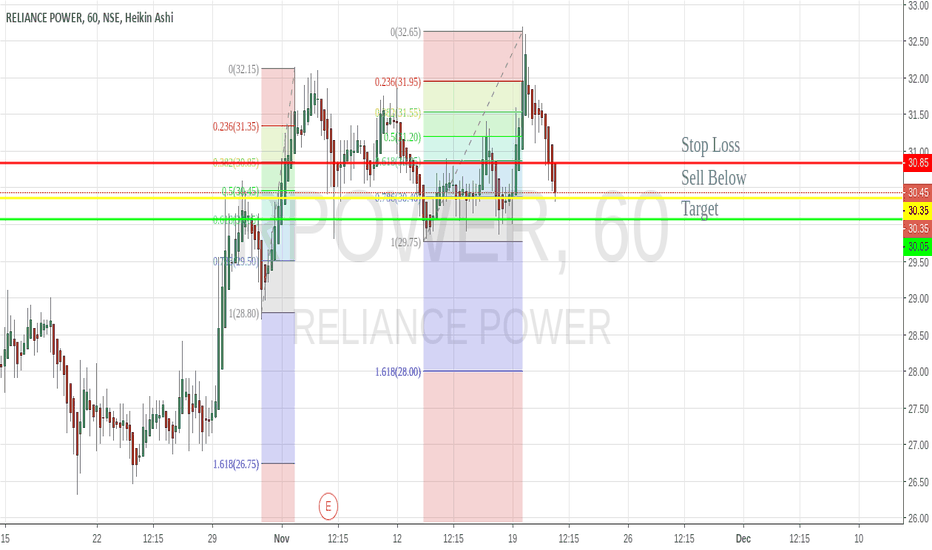

RPOWER trade ideas

Reliance powerI'm headling days of summer cruise fest from Miami to Bahamas June 28- July 1. Super Dope! Book you

Me and #boogie want you to hit us with your #silentridechallenge videos while we finish out this tour.. we'll both be reposting our favourites. Don't embarrass yourself. I'll be watching.

#eminem

Tickets are on sale now for the july 25th show at Cheyenne frontier days ....

Is this the right time to buy RPOWER?An ascending triangle is a chart pattern used in technical analysis. It is created by price moves that allow for a horizontal line to be drawn along the swing highs and a rising trendline to be drawn along the swing lows. The two lines form a triangle.

Good Support at 44 EMA

RELIANCE POWER - RPOWER(NSE) - BULLISH PENNANTRELIANCE POWER - RPOWER(NSE) has been forming a Bullish Pennant since August 2021, when viewed in a 3hr chart. A long candle cutting the upper boundary of the pennant(green line) can be a good buy signal. Watch out thoroughly for a month or so for a breakout.

Most Infamous Stock on the street is giving the best opportunityWhen it comes to wealth destruction this particular stock has made records. Reliance Power NSE:RPOWER opening price on the day of listing was 341. Sadly, It never achieved the same price since 2009. In the Stock Markets - "Sabka Time aata hai". This stock has been in one-digit lines from April 2019 to June 2021. It has been consolidating nicely since then. The pattern that I observe is "Cup and Handle"

Definition of C&H as per Investopedia is as follows

A cup and handle is a technical chart pattern that resembles a cup and handle where the cup is in the shape of a "u" and the handle has a slight downward drift.

A cup and handle is considered a bullish signal extending an uptrend, and is used to spot opportunities to go long.

Hope you observe the same.

Pattern is indication to go long at current levels of 13.90 for a target of 30.

Disclaimer: I am not a SEBI registered IA. We are providing this blog only to help the retail investors and it is only for educational purpose. This blog shall not in any be taken as an investment advice. Viewers are expected to research on their own before Investing.

For futher Ideas visit: Paisopedia.blogspot.com

RPower - Long Term InvestmentReliance Power CMP - 4.70

Looking bullish in higher time frame. One can go for Long Term Investment with the following entry, exit & targets.

Buy Range 4 - 5 / Stop Loss 3

Target 1 - 8

Target 2 - 11

Target 3 - 25

Disclaimer: This is my view and for educational purpose only.

#Rpower - #ReliancePower Need bigger laptop for this one can't fit on my screen!! hahaha

alright looking at possible IH&S forming redone is acting as resistance once we break it will run hard

I understand some think this Targets are unachievable, they are outrageous well see for yourself it is down 300% isn't it? so why can't it go up 300%?!

I majorly trade on crypto & this kind of gains are not new for crypto traders, when it comes to stocks it's all about patience, when you chart on HTF like weekly & monthly it predicts the analysis for next few weeks or months to come, in this case for this pattern to pan out will take well over a year or more

so be smart while getting in to positions!!