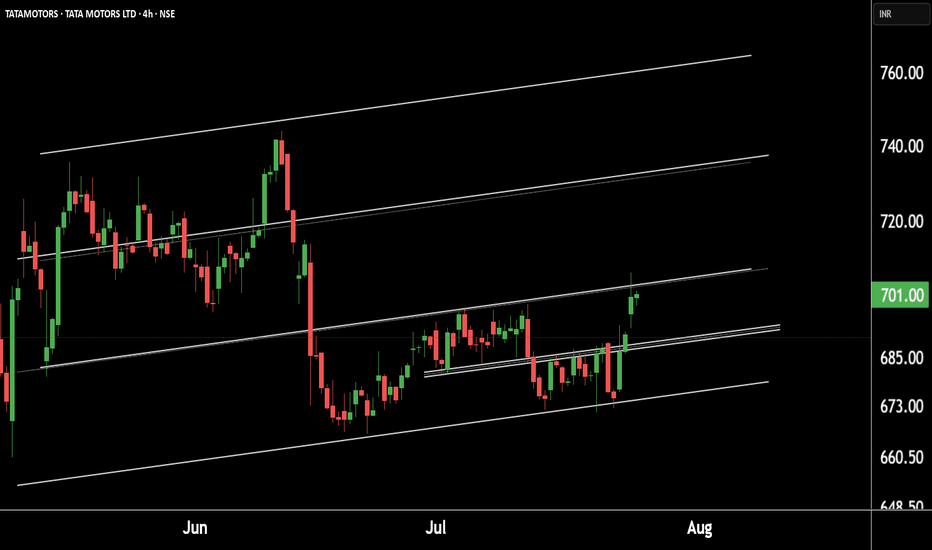

Tata Motors Gearing Up for a Fresh Rally! Technical Breakout !!This is the 4 hour chart of tata motor.

Tatamotor is moving in well defined parallel channel and bounced from it's supportt level near at 680, now ready for the breakout level at 705 .

If this level is sustain after the breakout then , we will see higher price in Tata motor.

Thank you !!

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

61.35 INR

278.30 B INR

4.38 T INR

2.05 B

About TATA MOTORS LTD

Sector

Industry

Website

Headquarters

Mumbai

Founded

2019

ISIN

INE155A01022

FIGI

BBG000D0Z853

Tata Motors Ltd. is an automobile manufacturer with a portfolio that includes a range of cars, utility vehicles, trucks, buses, and defense vehicles. It operates through the Automotive and Others segments. The Automotive segment includes all activities relating to the development, design, manufacture, assembly and sale of vehicles including vehicle financing, as well as sale of related parts and accessories. It also consists of sub-segments, such as, Tata Commercial Vehicles, Tata Passenger Vehicles, Jaguar Land Rover, and Vehicle Financing. The Others segment includes information technology and insurance broking services. The company was founded on September 1, 1945 and is headquartered in Mumbai, India.

Related stocks

Tata Motors: From Profit Pressure to Growth Potential... Company Overview

* Name: Tata Motors Ltd.

* Industry: Automotive

* Key Segments: Passenger Vehicles (PV), Commercial Vehicles (CV), Electric Vehicles (EV), Jaguar Land Rover (JLR)

* FY25 Milestone: The Automotive business became debt-free

Q4 FY25 Performance Overview

* Net Profit: ₹8,556 cro

Will rate cut by rbi play out in auto sector???Recently RBI cuts rates by 50 basis points on 6th june

this will help auto sector in volume pickup by sales& and revenue

according to reports rbi will cut rate by 25 basis points if this happens

then surely its a good bet for auto sector. we can add autos in our portfolio

for next Q-2 and Q-3.....

View Point on Tata Motors" Important Note: The views expressed here are solely my personal opinions and should not be considered financial advice or a trading recommendation. It's crucial that you do your own thorough research and consult with a certified financial advisor before making any investment choices. I hold no re

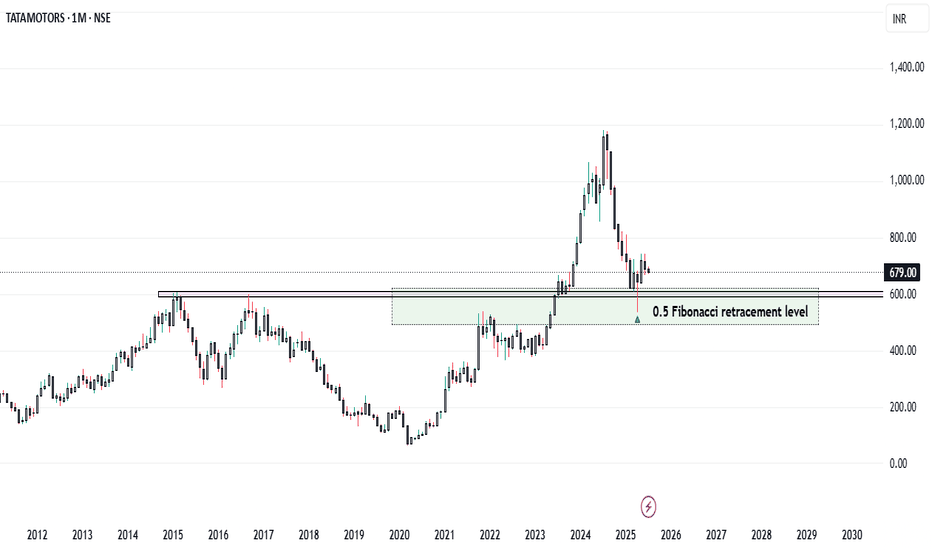

TATA- ko"bye-bye"bolna mana hain!!The structure suggests a completed Wave 4 correction at 0.5–0.618 Fibonacci retracement, setting up for the final Wave 5 leg. A bullish reversal is underway, supported by improving RSI and rising volume.

Key Levels:

Support: ₹603, ₹500, ₹465

Resistance: ₹725 (Fib), then new highs

RSI at 42.6 sho

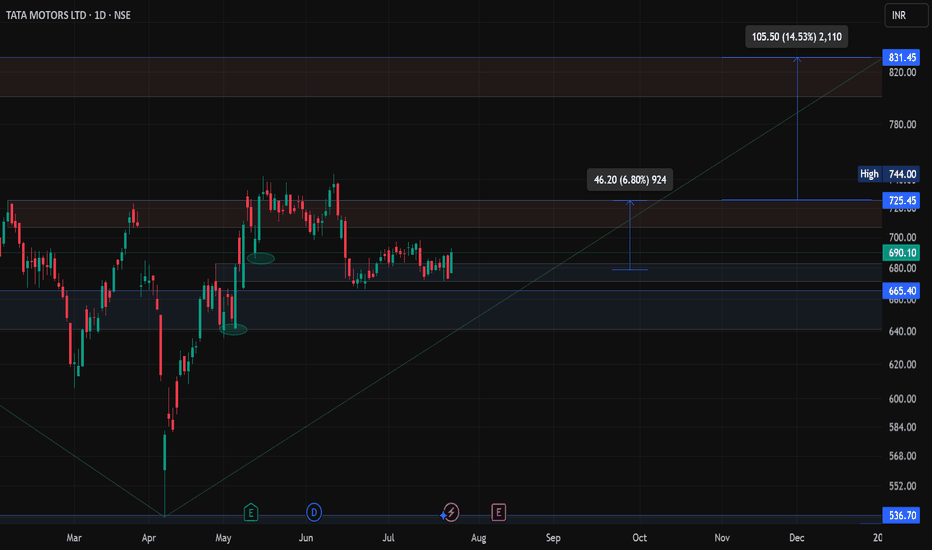

TATA MOTORS LTD at BEST SUPPORT !!This is the Daily chart of TATA MOTORS LTD.

TATA MOTORS having good law of polarity at 660 range.

TATAMOTORS has given a positive EMA crossover, with its support range lying around 660-680.

If this level is sustain , then We may see higher price in TATAMOTORS.

Thank you !!

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

J

TTM5059311

Jaguar Land Rover Automotive plc 7.75% 15-OCT-2025Yield to maturity

7.88%

Maturity date

Oct 15, 2025

J

US47010BAJ35

JaguarLandRAuto 7,75% 15/10/2025 Rule 144AYield to maturity

7.36%

Maturity date

Oct 15, 2025

J

TTM5093492

Jaguar Land Rover Automotive plc 5.875% 15-JAN-2028Yield to maturity

5.80%

Maturity date

Jan 15, 2028

J

TTM5219232

Jaguar Land Rover Automotive plc 5.5% 15-JUL-2029Yield to maturity

5.41%

Maturity date

Jul 15, 2029

J

US47010BAF13

JaguarLandRAuto 4,5% 01/10/2027 Rule 144AYield to maturity

5.35%

Maturity date

Oct 1, 2027

See all TATAMOTORS bonds

Curated watchlists where TATAMOTORS is featured.

Frequently Asked Questions

The current price of TATAMOTORS is 687.40 INR — it has decreased by −1.87% in the past 24 hours. Watch TATA MOTORS LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange TATA MOTORS LTD stocks are traded under the ticker TATAMOTORS.

TATAMOTORS stock has risen by 0.61% compared to the previous week, the month change is a 1.69% rise, over the last year TATA MOTORS LTD has showed a −33.20% decrease.

We've gathered analysts' opinions on TATA MOTORS LTD future price: according to them, TATAMOTORS price has a max estimate of 900.00 INR and a min estimate of 600.00 INR. Watch TATAMOTORS chart and read a more detailed TATA MOTORS LTD stock forecast: see what analysts think of TATA MOTORS LTD and suggest that you do with its stocks.

TATAMOTORS reached its all-time high on Jul 30, 2024 with the price of 1,179.00 INR, and its all-time low was 11.05 INR and was reached on Apr 3, 2001. View more price dynamics on TATAMOTORS chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

TATAMOTORS stock is 2.59% volatile and has beta coefficient of 1.26. Track TATA MOTORS LTD stock price on the chart and check out the list of the most volatile stocks — is TATA MOTORS LTD there?

Today TATA MOTORS LTD has the market capitalization of 2.53 T, it has decreased by −2.37% over the last week.

Yes, you can track TATA MOTORS LTD financials in yearly and quarterly reports right on TradingView.

TATA MOTORS LTD is going to release the next earnings report on Aug 8, 2025. Keep track of upcoming events with our Earnings Calendar.

TATAMOTORS earnings for the last quarter are 23.39 INR per share, whereas the estimation was 20.22 INR resulting in a 15.69% surprise. The estimated earnings for the next quarter are 9.62 INR per share. See more details about TATA MOTORS LTD earnings.

TATA MOTORS LTD revenue for the last quarter amounts to 1.20 T INR, despite the estimated figure of 1.16 T INR. In the next quarter, revenue is expected to reach 964.66 B INR.

TATAMOTORS net income for the last quarter is 84.70 B INR, while the quarter before that showed 54.51 B INR of net income which accounts for 55.38% change. Track more TATA MOTORS LTD financial stats to get the full picture.

Yes, TATAMOTORS dividends are paid annually. The last dividend per share was 6.00 INR. As of today, Dividend Yield (TTM)% is 0.87%. Tracking TATA MOTORS LTD dividends might help you take more informed decisions.

TATA MOTORS LTD dividend yield was 0.89% in 2024, and payout ratio reached 7.61%. The year before the numbers were 0.30% and 3.68% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 26, 2025, the company has 58.44 K employees. See our rating of the largest employees — is TATA MOTORS LTD on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. TATA MOTORS LTD EBITDA is 568.37 B INR, and current EBITDA margin is 12.08%. See more stats in TATA MOTORS LTD financial statements.

Like other stocks, TATAMOTORS shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade TATA MOTORS LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So TATA MOTORS LTD technincal analysis shows the neutral today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating TATA MOTORS LTD stock shows the neutral signal. See more of TATA MOTORS LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.