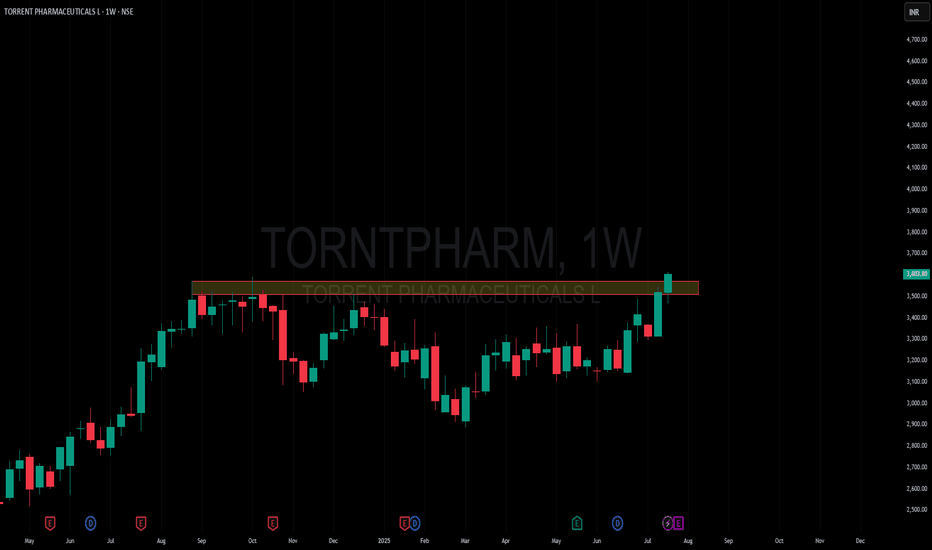

Amazing breakout on WEEKLY Timeframe - TORNTPHARMCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

Check this stock which has made an all time low and high chances that it makes a "V" shaped recovery.

> Taking support at last years support or breakout level

> High chances that it reverses from this point.

> Volume dried up badly in last few months / days.

> Very high suspicion based analysis and not based on chart patterns / candle patterns deeply.

> VALUABLE STOCK AVAILABLE AT A DISCOUNTED PRICE

> OPPURTUNITY TO ACCUMULATE ADEQUATE QUANTITY

> MARKET AFTER A CORRECTION / PANIC FALL TO MAKE GOOD INVESTMENT

DISCLAIMER : This is just for educational purpose. This type of analysis is equivalent to catching a falling knife. If you are a warrior, you throw all the knives back else you will be sorrow if it hits SL. Make sure to do your analysis well. This type of analysis only suits high risks investor and whose is willing to throw all the knives above irrespective of any sectoral rotation. BE VERY CAUTIOUS AS IT IS EXTREME BOTTOM FISHING.

HOWEVER, THIS IS HOW MULTIBAGGERS ARE CAUGHT !

STOCK IS AT RIGHT PE / RIGHT EVALUATION / MORE ROAD TO GROW / CORRECTED IV / EXCELLENT BOOKS / USING MARKET CRASH AS AN OPPURTUNITY / EPS AT SKY.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

TORNTPHARM trade ideas

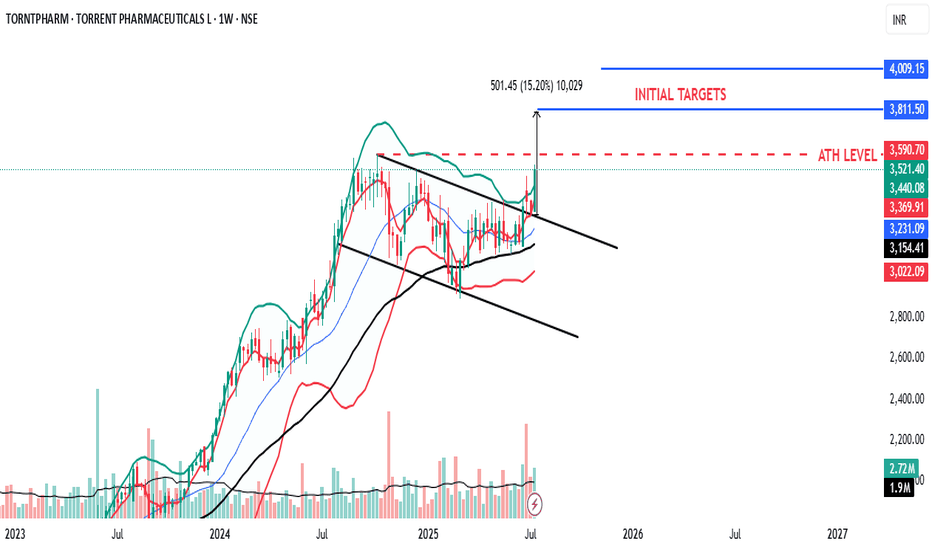

TORRENT PHARMA, Kindly do your own studyThis stock is ready to zoom. Stock is near all time high level and ready to break that level.

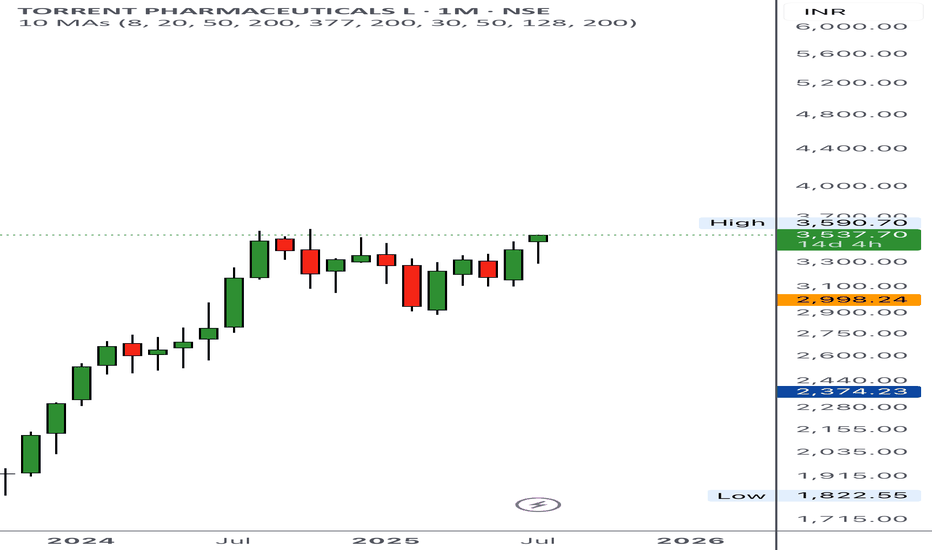

Monthly price is above 5 EMA

Monthly MACD flat after down

Monthly RSI is above 60

Weekly price is challenged upper bollinger band with good volume

Weekly MACD is in PCO stat and above zero line

Weekly RSI is above 60

Weekly ADX is strong

Daily RSI is in momentum

Daily ADX is strong

Torrent Pharmaceuticals 1DTorrent Pharmaceuticals, currently trading around ₹3,200, is poised to potentially break its all-time high. The stock has formed a bullish triangle pattern, indicating strong upward momentum

Disclaimer: The information provided is for educational and informational purposes only and should not be considered as financial advice. Investing in the stock market involves risk, and past performance is not indicative of future results. Please consult with a certified financial advisor or conduct your own research before making any investment decisions. We are not responsible for any losses incurred as a result of using this information. Stock market investments are subject to market risks; read all related documents carefully.

Torrent Pharma Ltd for Intraday 31st October #TORNTPHARM Torrent Pharma Ltd for Intraday 31st October #TORNTPHARM

Resistance 3150-3160. Watching above 3162 for upside movement...

Support area 3080. Below 3110 ignoring upside momentum for intraday

Support 3080 .Watching below 3078 for downside movement...

Resistance area 3150

Above 3110 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

TORRENT PHARMA S/R Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA: If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

RSI: RSI readings greater than the 70 level are overbought territory, and RSI readings lower than the 30 level are considered oversold territory.

Combining RSI with Support and Resistance:

Support Level: This is a price level where a stock tends to find buying interest, preventing it from falling further. If RSI is showing an oversold condition (below 30) and the price is near or at a strong support level, it could be a good buy signal.

Resistance Level: This is a price level where a stock tends to find selling interest, preventing it from rising further. If RSI is showing an overbought condition (above 70) and the price is near or at a strong resistance level, it could be a signal to sell or short the asset.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

Triangle pattern on TORNTPHARMTORNTPHARM formed a triangle pattern on daily chart with multiple test of support and resistance. Price broke out of resistance and subsequently retesting now support (previous resistance line). Looking at the aggressive bears once brought the price down compared with recent swing low, it appears bears aggressiveness has weekend. Also the recent swing high shows bulls are aggressive. Wait for the price to bounce back from support before entering long. Stop loss can be held just below recent swing low. with Target the larger width of triangle. This would be a low risk trade with potential 1:3 risk reward.

Hope you liked this idea. If so please boost this idea so others can benefit from it or leave a comment below on your thoughts on this setup. I'll be glad to hear from you. Otherwise, happy trading :-)

Torrent Pharma - Sell below 2546Hello All,

The recommendations are purely for educational purpose only, consult you financial advisor before trading.

Targets are mentioned in charts (either red lines or balck lines), keep Stop Loss as per your risk..

If you like my Idea, Don't forget to Boost and comment on my Analysis..

Have a profitable year ahead

Gautam Khanna

Technical Analyst by Passion :-)

TORRENR PHARMA READY FOR AN UP MOVE??Torrent pharma can give a nice up move as it is sustaining in the zone and tested both support and resistance several times and made them weak and usually can break through either side but in here price action is showing clear up move with a small STOPLOSS

ENTRY - 2620

STOPLOSS - 2580

TARGET - 2790, 2800++

Note- if any trade or value that's gone from the marked levels then that's not our trade just let it go or wait for it to come back

I'm not sebi registered this is my personal view

Please like or boost my idea if you like it or traded it

Double Bottom Found in TorentPharmaDouble bottom pattern fount in TorntPharma. Buy only if once price the head. sl is neckline.

target price difference between head and neckline from the entry price.

Don't Wait for the Target.Once you are in profit zone put trailing sl.Trade your own Risk. Education Purpose Only. Good Luck all

Unlocking Profit Potential: TORNTPHARM Analysis 🚀In the thrilling world of trading, decoding charts can be as exciting as a rollercoaster ride. Buckle up, we're about to unravel the secrets of TORNTPHARM.

📊 Current Positioning of TORNTPHARM

Currently, TORNTPHARM is perched near the 75-minute zone (LTF). On the intermediate timeframe (ITF), it basks in the daily demand zone, close to the daily 20EMA, with an upward trend. Zooming out to the higher timeframe (HTF), the weekly chart reveals it's in a weekly demand zone after reaching all-time highs.

The 75-minute demand zone is of the RBR type – Rally Base Rally. Plan your entry just above this zone, set the stop loss below, and target the 75-minute supply zone. The risk-to-reward ratio is an impressive 1:5.

🔍 Interpreting the Time Frames

LTF (Lower Time Frame): Timeframe for executing trades.

ITF (Intermediate Time Frame): Where we identify the overall trend.

HTF (Higher Time Frame): Timeframe for location analysis.

Lastly, remember, this analysis is for educational purposes only, and I am not a SEBI registered analyst