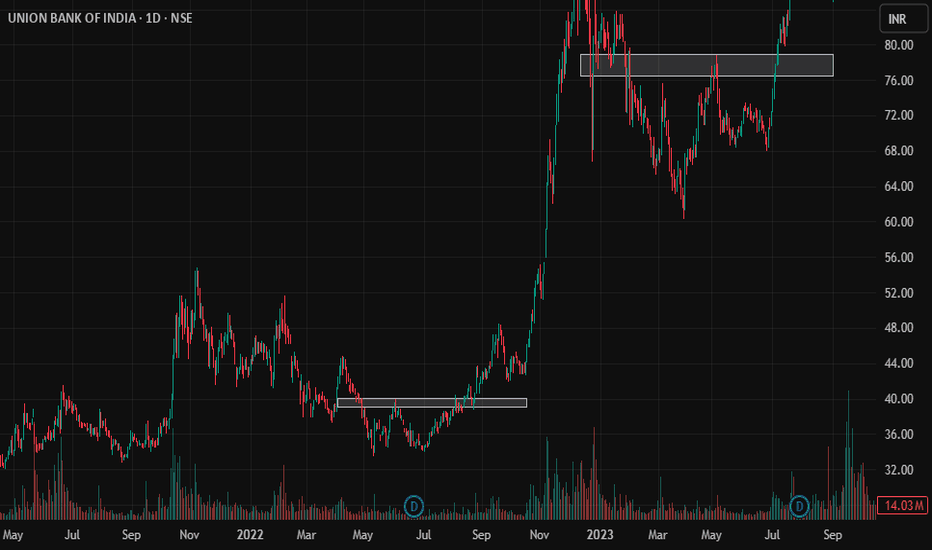

Huge breakout in Union Bank

After it's Q1 results Union bank is trading near it's previous breakout level, and is ready for a huge upside from here.

If we look at the past trends of Union Bank ( See below Images )

We can clearly see after a correction of about 40 to 50%, share rises with a huge breakout and it alway

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

24.64 INR

180.27 B INR

1.30 T INR

1.93 B

About UNION BANK OF INDIA

Sector

Industry

Website

Headquarters

Mumbai

Founded

1919

ISIN

INE692A01016

FIGI

BBG000BR5X63

Union Bank of India engages in the provision of commercial banking services. It also offers personal and corporate loans. The firm operates through the following segments: Treasury Operations, Corporate and Wholesale Banking, Retail Banking Operations and Other Banking Operations. The company was founded on November 11, 1919 and is headquartered in Mumbai, India.

Related stocks

Bullish Bet , UnionBankBanknifty at support.

UnionBank on recent high making sideways moves, which means consolidation.

Once Banknifty Bounce back, UnionBank will break the resistance on weekly and monthly Basis and will start moving higher.

It has higher targets on a short and long term investment.

Good to hold for shor

"Union Bank of India" Cup & Handle PatternI can see a Cup & Handle Pattern in Union Bank of India in Monthly Time Frame. Price is also coming from Monthly Demand Zone.

Rs 160 is a a Resistance line to break this Pattern.

Once we see a breakout of this level of Rs 160 Upside with a Good Volume (Increased from Previous Months) the Price can

UNION BANK OF INDIA SWING TRADE📊 Price Action & Trend Analysis

Analyzing market trends using price action, key support/resistance levels, and candlestick patterns to identify high-probability trade setups.

Always follow the trend and manage risk wisely!

Price Action Analysis Interprets Market Movements Using Patterns And Trend

UNION BANK 1D TFNSE:UNIONBANK has formed a resistance zone with multiple touch points. If the stock breaks out the stock could traded.

Disclaimer:- This analysis is only for educational purpose. Please always do your own analysis or consult with your financial advisor before taking any kind of trades

JUST DON'T MISS THIS - UNION BANK OF INDIA Everything is pretty much explained in the picture itself.

I am Abhishek Srivastava | SEBI-Certified Research and Equity Derivative Analyst from Delhi with 4+ years of experience.

I focus on simplifying equity markets through technical analysis. On Trading View, I share easy-to-understand

Wyckoff Accumulation Schematic :EXPECTING 40% MOVE IN UNION BANKRichard Wyckoff noted that small investors often found themselves at a disadvantage and were frequently outmaneuvered in the markets. To address this, he committed himself to educating the average investor about the inner workings of the markets, as exploited by influential players, or the “smart mo

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of UNIONBANK is 136.22 INR — it has decreased by −6.04% in the past 24 hours. Watch UNION BANK OF INDIA stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange UNION BANK OF INDIA stocks are traded under the ticker UNIONBANK.

UNIONBANK stock has fallen by −7.21% compared to the previous week, the month change is a −7.02% fall, over the last year UNION BANK OF INDIA has showed a 1.75% increase.

We've gathered analysts' opinions on UNION BANK OF INDIA future price: according to them, UNIONBANK price has a max estimate of 172.00 INR and a min estimate of 130.00 INR. Watch UNIONBANK chart and read a more detailed UNION BANK OF INDIA stock forecast: see what analysts think of UNION BANK OF INDIA and suggest that you do with its stocks.

UNIONBANK reached its all-time high on Oct 27, 2010 with the price of 426.95 INR, and its all-time low was 14.60 INR and was reached on Oct 17, 2002. View more price dynamics on UNIONBANK chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

UNIONBANK stock is 6.63% volatile and has beta coefficient of 1.67. Track UNION BANK OF INDIA stock price on the chart and check out the list of the most volatile stocks — is UNION BANK OF INDIA there?

Today UNION BANK OF INDIA has the market capitalization of 1.04 T, it has increased by 3.06% over the last week.

Yes, you can track UNION BANK OF INDIA financials in yearly and quarterly reports right on TradingView.

UNION BANK OF INDIA is going to release the next earnings report on Oct 23, 2025. Keep track of upcoming events with our Earnings Calendar.

UNION BANK OF INDIA revenue for the last quarter amounts to 136.00 B INR, despite the estimated figure of 127.49 B INR. In the next quarter, revenue is expected to reach 132.75 B INR.

UNIONBANK net income for the last quarter is 44.28 B INR, while the quarter before that showed 50.11 B INR of net income which accounts for −11.64% change. Track more UNION BANK OF INDIA financial stats to get the full picture.

Yes, UNIONBANK dividends are paid annually. The last dividend per share was 4.75 INR. As of today, Dividend Yield (TTM)% is 2.64%. Tracking UNION BANK OF INDIA dividends might help you take more informed decisions.

UNION BANK OF INDIA dividend yield was 3.76% in 2024, and payout ratio reached 20.11%. The year before the numbers were 2.35% and 18.79% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 27, 2025, the company has 73.94 K employees. See our rating of the largest employees — is UNION BANK OF INDIA on this list?

Like other stocks, UNIONBANK shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade UNION BANK OF INDIA stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So UNION BANK OF INDIA technincal analysis shows the sell today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating UNION BANK OF INDIA stock shows the buy signal. See more of UNION BANK OF INDIA technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.