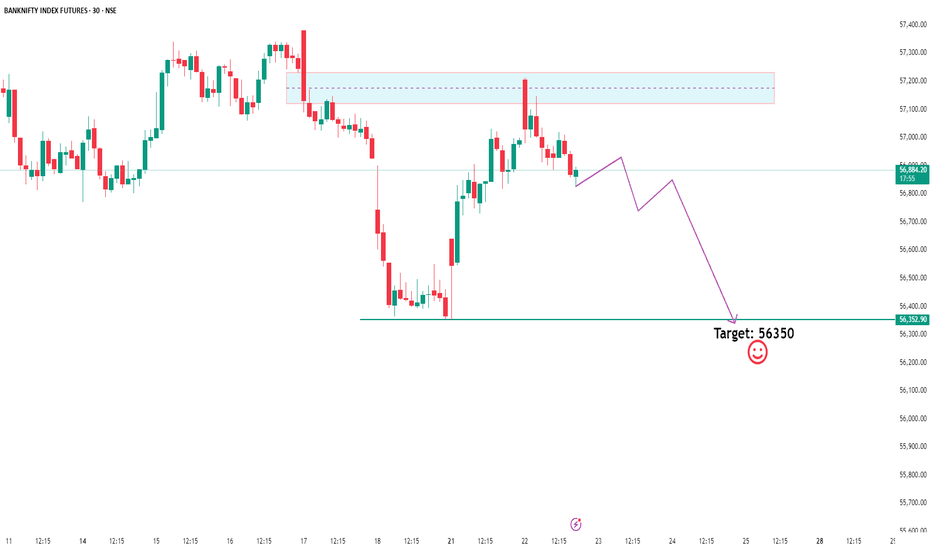

Bank Nifty Breakdown? Eyeing 56,350 –Time to Ride the Sell Wave!Bank Nifty is showing clear signs of distribution as Smart Money appears to be offloading positions near recent highs. Price has swept liquidity above the previous highs and is now rejecting key supply zones, confirming a potential sell-side shift in market structure.

With a break in internal structure and premium zones being respected, we're now watching the 56,350 level as a high-probability target for downside liquidity.

If you're trading with the Smart Money Concept in mind — this could be the move where retail gets trapped while institutions ride the wave down. Stay sharp and manage your risk accordingly. 👀🔥

BANKNIFTY1! trade ideas

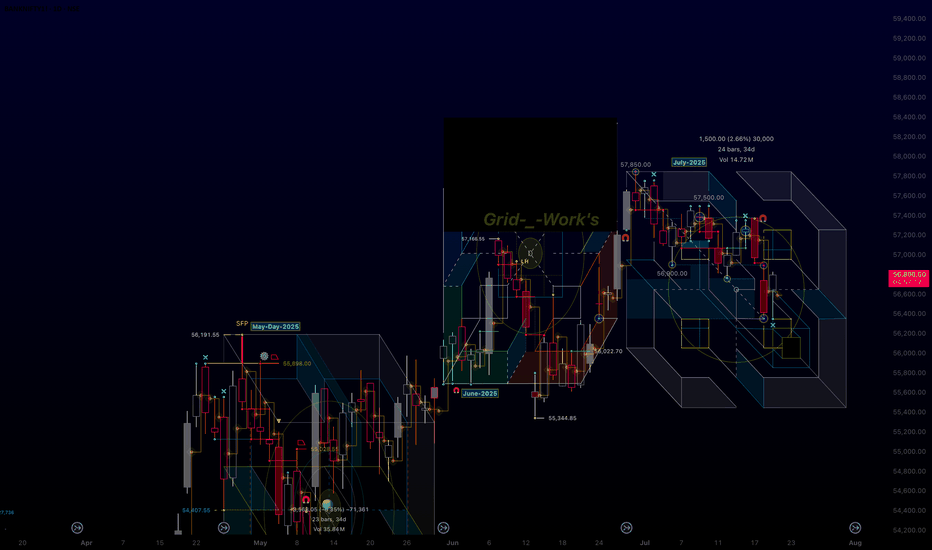

Monthly projection for Bank Nifty Futures (July 2025).Hi Everyone !

This is the monthly box for Bank Nifty futures for July

very precise price action and data points are predictable using this

forward looking technology so you stay ahead of the market with

the measurement of time and price and make a co-ordinate system for the

market's you love and become consistently profitable trader

thank you for your time

Grid-_-Work's

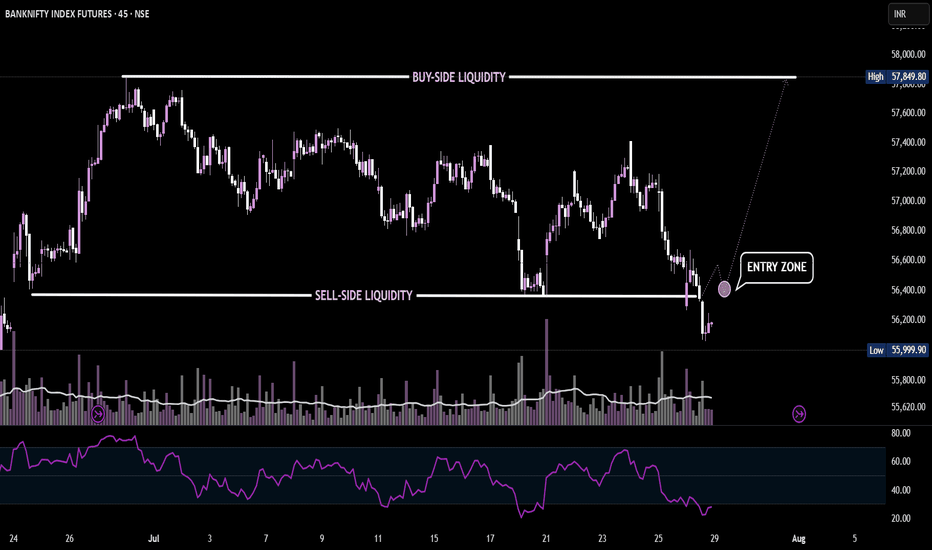

Banknifty Futures 1Hr TFBnf has been taking support from 200ema in Hr TF. trading inside the parallel channel it was near the level of confluence.

good correction after making the new high as well.

can go long if it shows some bullish signs with low risk

analysis it with ur strategy as well

#Banknifty #niftybank

BANKNIFTY LOVERS Ready towards 60000 + ?/ ( SHORT TERM IBANKNIFTY 30 Mins counts indicate a bullish wave structure.

Both appear to be optimistic, and this index invalidation number is 56910 ( 30 Mins closing)

target are already shared as per implus move

Investing in declines is a smart move for long-term players.

Every graphic used to comprehend & LEARN & understand the theory of Elliot waves, Harmonic waves, Gann Theory, and tTme theory

Every chart is for educational purposes.

We have no accountability for profit or loss.

Daily chart of Banknifty for educational purpose only

Required knowledge to understand this chart

Knowledge of Support and Resistance - support when broken can become resistance and vice versa

Using moving average for trend direction

Using moving average for breakout

Using moving average for price retracement or pull back

Knowledge of using RSI - RSI is used as a momentum indicator.

In this chart at vertical line a, the previous support line acted as resistance and momentum fell from there only to find support at the body of the previous low. At vertical line b, the momentum broke out of the previous momentum or RSI high along with price moving above moving average giving a buy signal. The previous pinbars that acted as resistance came into play again between b and c vertical lines and price fell to moving average only to climb back up with momentum also increasing.

Between vertical lines c and d the momentum made a high but failure to stay above the previous momentum or RSI high pressured the price to fall down only to find support at moving average. The week consolidation and negative RSI divergence say the price is weakening. At the fag end of the chart the momentum is sloping down whereas moving average is curving upward gives a mixed signal.

Will the price move above 57850 or fall to 55350, or the price will retrace to moving average makes this chart an interesting watch.

Review and plan for 25th June 2025Nifty future and banknifty future analysis and intraday plan.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Review and plan for 24th June 2025Nifty future and banknifty future analysis and intraday plan.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Review and plan for 13th June 2025Nifty future and banknifty future analysis and intraday plan.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT