BANKNIFTY1! trade ideas

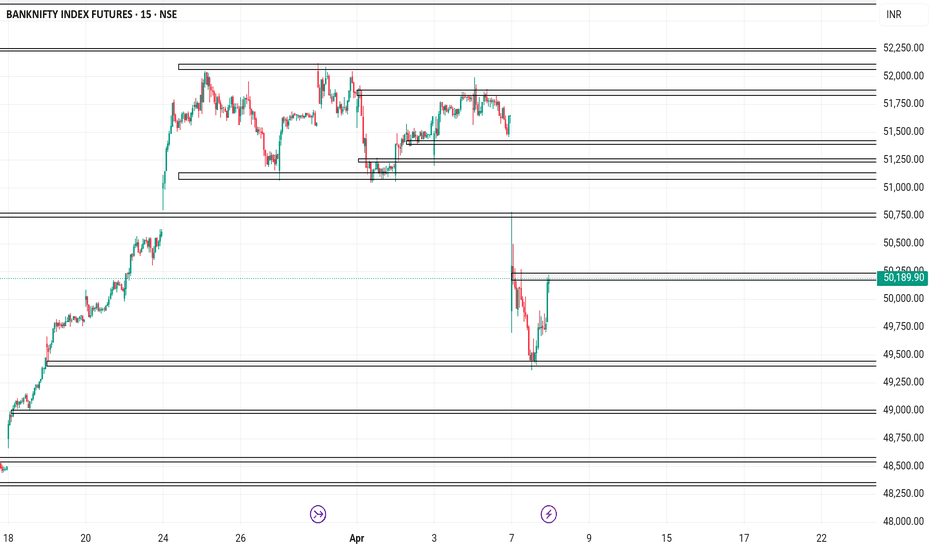

Bank Nifty Futures Simple AnalysisKey Support & Resistance Zones:

Resistance Zone (Top of range): Around 55,400.

Support Zone (Bottom of range): Around 55,000.

Next Major Support below the range:

54,500 ( Immediate Support)

52,700 ( Trenline Support)

52,129 (Horizontal Trenline Support)

Trendlines:

The chart shows a strong ascending trendline from earlier lows.(yellow coloured trendline)

But Looking at Recent Highs bulls are loosing momentum at 55800 to 55900 tried 4 time to break but failed to break range which shows weakness on bull side

What to Look :

If range break from 54900 with high volume and bar candle we can move down towards the immediate support then we can expect a bounce at range support at 54500

Or If Gap up or Gap Down can shift the momentum

Bank Nifty Outlook Powered by iSpark | Trading Made Easy📊 Bank Nifty has been on a strong bullish trajectory, and our proprietary iSpark Indicator was spot-on once again! ✅

📍 Breakout Spotted :

* First breakout identified by iSpark at 52150 on the daily chart.

* Followed by a fresh surge at 5517 0, delivering a solid 3000-point move to a high of 55929 .

* Target was 56000 , narrowly missed – but the trend remains strong!

📈 Current Market Position:

* Bank Nifty CMP: 55209.80

* Chart structure remains bullish across higher timeframes.

* Minor dips are being bought into – signaling continued institutional interest.

⚠️ Caution :

The only overhang is geopolitical tension between India & Pakistan , which is making traders cautious about holding weekly positions . However, if global markets remain stable and there's no major escalation, dips in Bank Nifty remain a buying opportunity .

📌 Trade Plan :

* Buy the dip strategy active above 54780 – 54400

* If 56000 is crossed decisively, expect a fresh leg toward 56500++ levesl

* Trailing SL and disciplined risk management is key.

🔔 iSpark Indicator = Trading Made Easy

Stay tuned for more accurate breakout alerts and momentum tracking. Make smart, high-conviction trades with confidence!

#BankNifty #iSpark #BreakoutTrading #NiftyBank #TechnicalAnalysis #SwingTrading #TradingView #MarketOutlook

Bank Nifty near all-time high – Caution for longsBank Nifty near all-time high – Caution for longs

Bank Nifty is trading near its top levels. It’s better to avoid fresh long positions here unless there’s a proper pullback or confirmation. Wait for a dip to key support zones before entering. Chasing longs at the top can be risky.

Review and plan for 15th April 2025Nifty future and banknifty future analysis and intraday plan in kannada.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Review and plan for 11th April 2024Nifty future and banknifty future analysis and intraday plan in kannada.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Review and plan for 8th April 2025 Nifty future and banknifty future analysis and intraday plan in kannada.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT