DIESEL OIL GOES 'STILL-RUNNING', AND IT IS NOT A MEME AGAINDiesel Oil NY Harbor ULSD December 2025 futures contracts are trading around $2.25/gallon, once again above its 52-week average, with recent technical ratings indicating a strong buy.

The market has shown a 4.50% rise in the past 5-Day time span, reflecting bullish momentum.

Fundamental Perspecti

Related commodities

Daily HO analysisDaily HO analysis

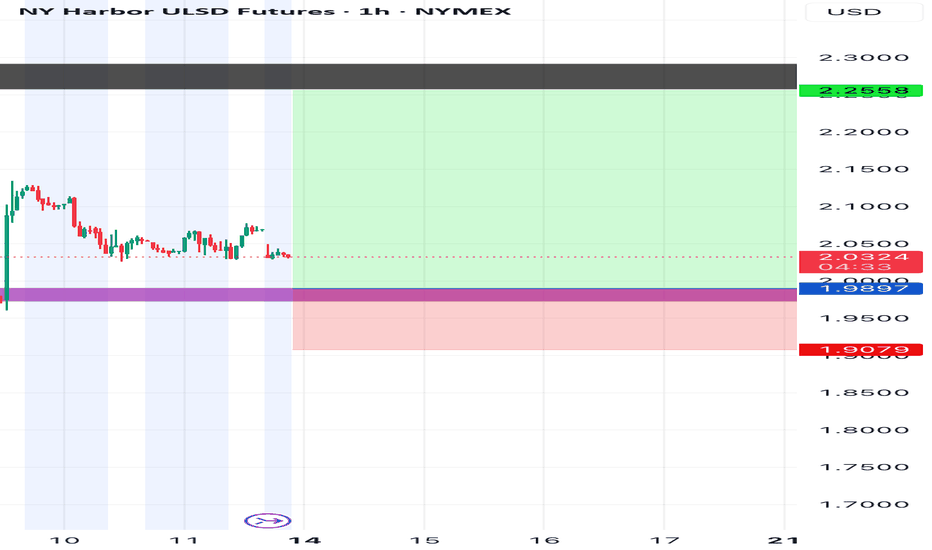

A long position with the target and stop loss as shown in the chart

The trend is up, we may see more upside

All the best, I hope for your participation in the analysis, and for any inquiries, please send in the comments.

He gave a signal from the strongest areas of entry, special

HO Time CycleThere’s a 518 day time cycle from the 2 previous major lows to today. There’s also a falling broadening wedge breakout, DMI cross (not shown), and escalating regional conflict in the Middle East. Iran has launched ballistic missiles at Israel. There is a major downtrend but it’s far enough overhe

Daily HO analysisDaily HO analysis

Sell trade with target and stop loss as shown in the chart

The trend is down and we may see more drop in the coming period in the medium term

All the best, I hope for your participation in the analysis, and for any inquiries, please send in the comments.

He gave a signal from t

Cyclical Analysis - Heating OilIf you follow my channel, you know that I am long Heating Oil, and am looking for more entries long, based on my COT strategy setup.

Today, we look at Heating Oil through the lens of cycles. Do cycles support the COT Buy Setup?

As you will see, there is some compelling cyclical data that is suppo

8/2/24 - VROCKSTAR portfolio snapshot bc mkt is cray craydon't really anticipate doing these so often really.

but so much has happened and i've been maxing out GDLC (as many of you know, then sizing it down), in and out of weird EPS stuff, semi's weren't really even in my portfolio prior, now they are. god knows what happens next. I like a cash buffer, b

7/11/24 - VROCKSTAR portfolio snapshot for start of 2Husing a rando ticker to do this lol

have been a lot of movements since i started writing maybe 2.5-3 mo at this pt. in out, size up, size down. so i'll need to figure out a rhythm to even give these periodic updates. but bc i enjoy the DMs so far and the comments/ interactions... this is probably t

May we fill up the gas tank of the car?Hello Traders

Jerome Powell has spoken and the economy seems to be not so "overheated" and the labor market seems calm after the "spikes" of 2020-2021. This could suggest that perhaps the much talked about interest rate cuts that have been mentioned may be coming. Powell spoke to the Senate informin

Dangerous TradeThis trade has bad idea written all over it. Don’t try this at home. Not investment advice. etc. It has come to my attention that HO i.e.. NY Harbor heating oil which is a proxy petroleum distillate for diesel has gotten more expensive than gasoline in recent years many times and that it has don

The down trend in heating oil startsWe got sell signals based on cot data from #cotreport in crude oil and gasoline. The heating oil is strong correlated with RB and CL. When the sell cot signal stats to work out, we will see also a down trend in HO. The HO is the weakest one in the energies sector, therefore I expect a down trend in

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Frequently Asked Questions

The current price of EIA Flat Tax On-Highway Diesel Futures (Nov 2027) is 3.6062 USD — it has risen 0.13% in the past 24 hours. Watch EIA Flat Tax On-Highway Diesel Futures (Nov 2027) price in more detail on the chart.

Track more important stats on the EIA Flat Tax On-Highway Diesel Futures (Nov 2027) chart.

The nearest expiration date for EIA Flat Tax On-Highway Diesel Futures (Nov 2027) is Dec 2, 2027.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell EIA Flat Tax On-Highway Diesel Futures (Nov 2027) before Dec 2, 2027.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For EIA Flat Tax On-Highway Diesel Futures (Nov 2027) this number is 6.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for EIA Flat Tax On-Highway Diesel Futures (Nov 2027) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for EIA Flat Tax On-Highway Diesel Futures (Nov 2027). Today its technical rating is buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of EIA Flat Tax On-Highway Diesel Futures (Nov 2027) technicals for a more comprehensive analysis.