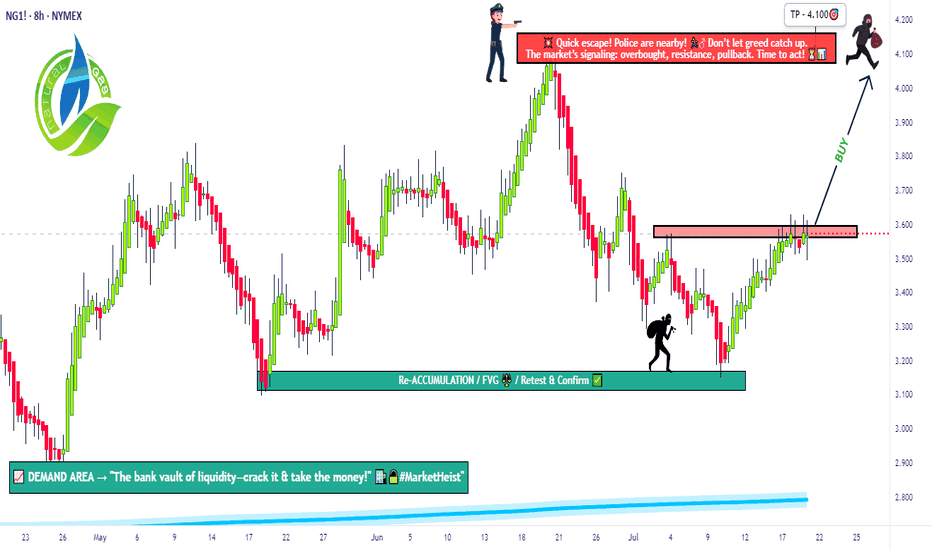

The Great Gas Heist: Load Your Longs Before It Blows💎🚨“Operation Gas Vault: NG1! Breakout Robbery Blueprint”🚨💎

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Welcome to all my Market Hustlers & Silent Robbers 🕵️♂️💼💰

Today’s target: NG1! Henry Hub Natural Gas Futures

📍Strategy: A bullish heist mission with a calculated escape plan.

🔥Thief Trading Bluep

Related commodities

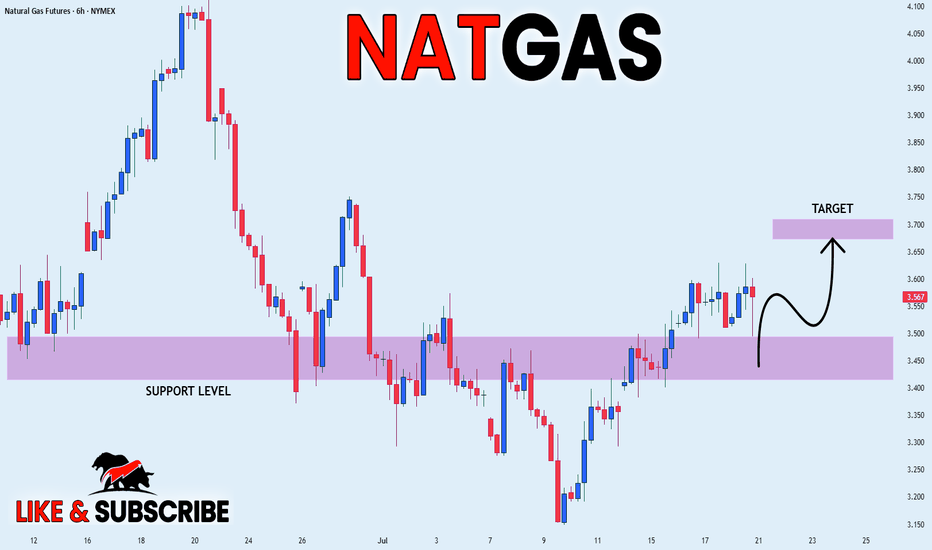

NATGAS REBOUND AHEAD|LONG|

✅NATGAS is going up now

And the price made a bullish

Rebound from the horizontal

Support level around 3.50$

So we are bullish biased and

We will be expecting a

Further bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer

Natural Gas Futures Signal Breakdown Below Mid-Band Support

The most recent candle closed below the middle Bollinger Band (20 SMA), indicating potential downside momentum.

The price recently spiked toward the upper band (~$4.20) but was strongly rejected, creating a bearish reversal pattern.

Volume has been increasing on down days, especially the last fe

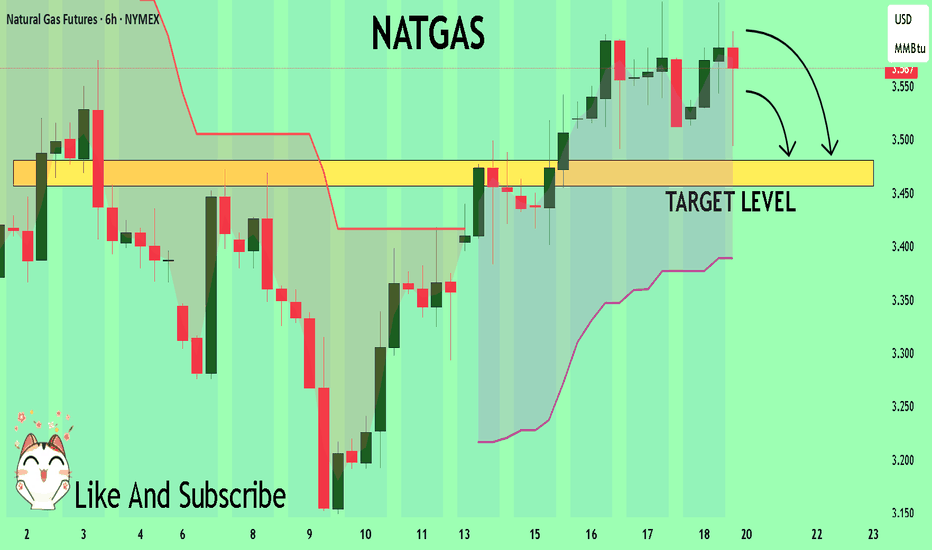

NATGAS Trading Opportunity! SELL!

My dear followers,

This is my opinion on the NATGAS next move:

The asset is approaching an important pivot point 3.567

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal

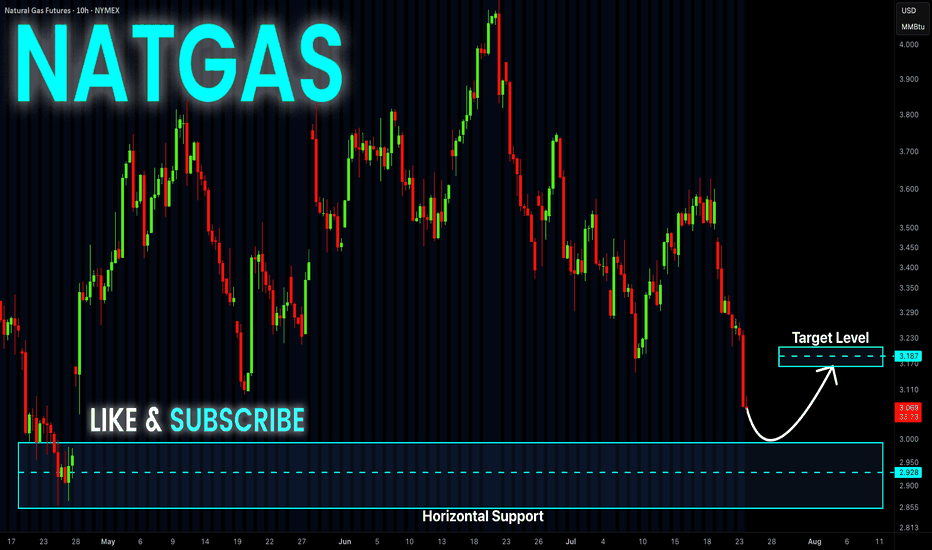

NATGAS Support Ahead! Buy!

Hello,Traders!

NATGAS keeps falling but

A strong horizontal support

Level is ahead at 3.00$ so

After Gas retests the support

We will be expecting a local

Bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Natio

NATGAS: Bearish Continuation & Short Signal

NATGAS

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell NATGAS

Entry Level - 3.567

Sl - 3.625

Tp - 3.432

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly

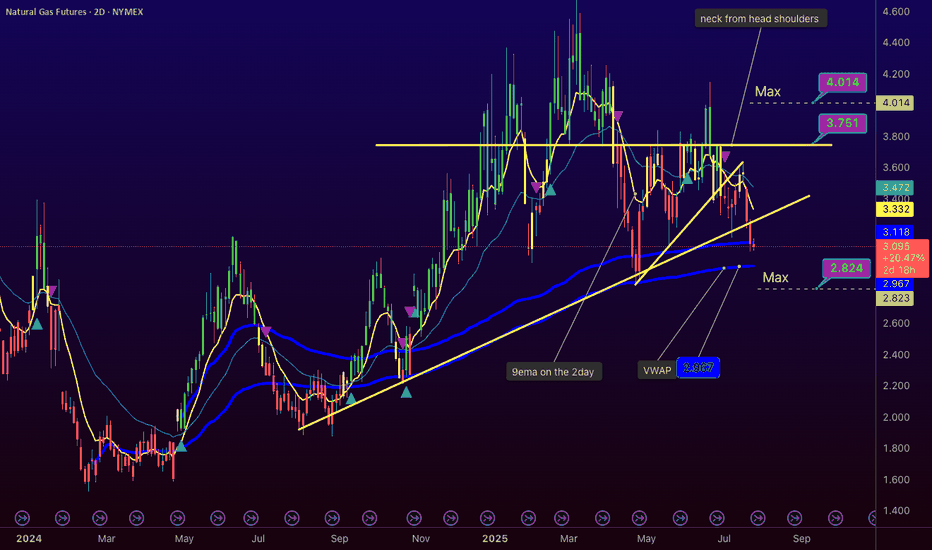

NG1! Bearish Break to $3.00-$2.82 by Tuesday?www.tradingview.com NYMEX:NG1! Update - Bears Pushing, Turnaround Looms Short-Term Odds: ~60% pullback to $3.00-$2.99, ~40% chance to $2.82 - Key Signal: Low volume on 1000-tick chart, holding below VWAP ($3.134). Third test at $3.10 done—$3.00 next if support breaks. - Trend Hint: Bearish with hig

Natural Gas Slips Below Support – More Downside Ahead ?

Recent candles are large-bodied bearish candles, indicating strong selling pressure.

Bollinger Basis is sloping downward, showing short-term bearish momentum.

Price is currently below both the 20-day and 50-day moving averages, reinforcing the bearish outlook.

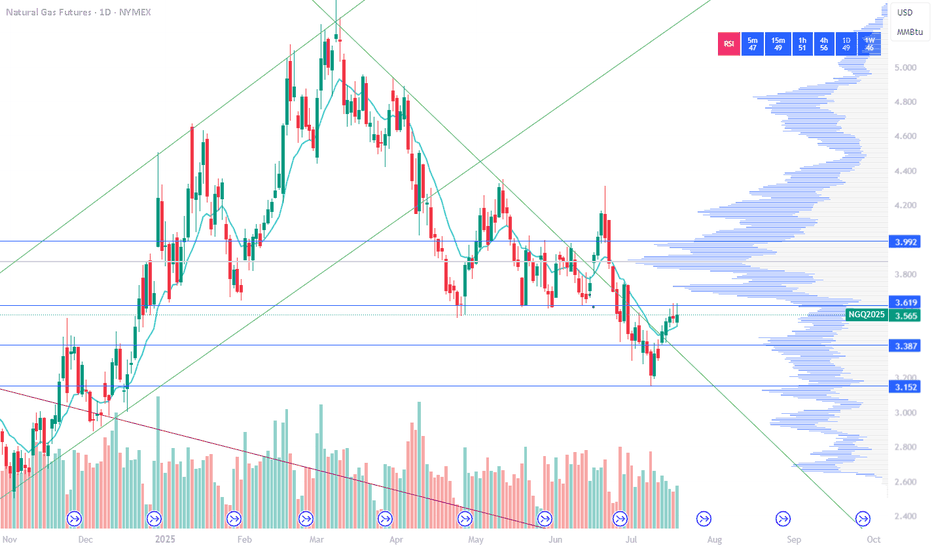

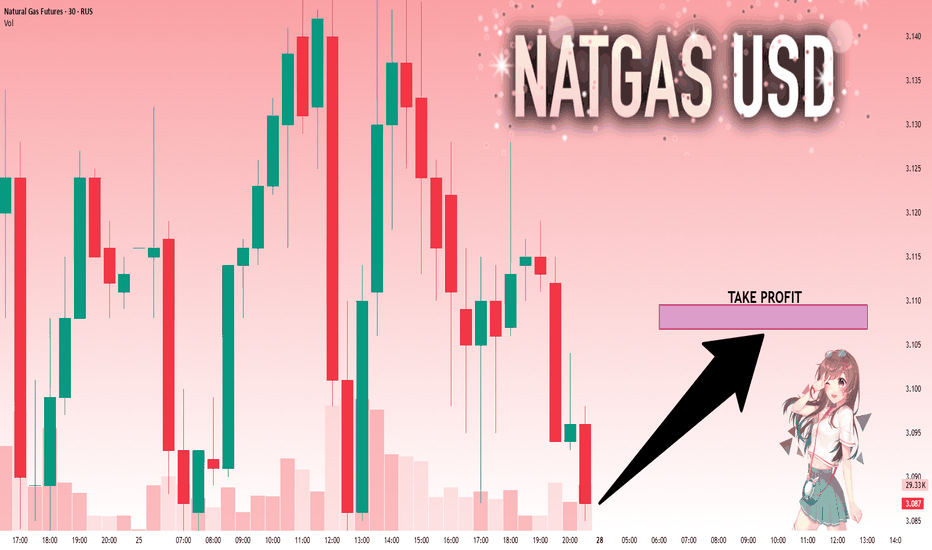

NG1!: Target Is Up! Long!

My dear friends,

Today we will analyse NG1! together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 3.087 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the n

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Natural Gas (Henry Hub) Penultimate Financial Futures (Mar 2027) is 3.849 USD — it has fallen −0.54% in the past 24 hours. Watch Natural Gas (Henry Hub) Penultimate Financial Futures (Mar 2027) price in more detail on the chart.

Track more important stats on the Natural Gas (Henry Hub) Penultimate Financial Futures (Mar 2027) chart.

The nearest expiration date for Natural Gas (Henry Hub) Penultimate Financial Futures (Mar 2027) is Feb 23, 2027.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Natural Gas (Henry Hub) Penultimate Financial Futures (Mar 2027) before Feb 23, 2027.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Natural Gas (Henry Hub) Penultimate Financial Futures (Mar 2027) this number is 3.52 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Natural Gas (Henry Hub) Penultimate Financial Futures (Mar 2027) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Natural Gas (Henry Hub) Penultimate Financial Futures (Mar 2027). Today its technical rating is sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Natural Gas (Henry Hub) Penultimate Financial Futures (Mar 2027) technicals for a more comprehensive analysis.