NG1! trade ideas

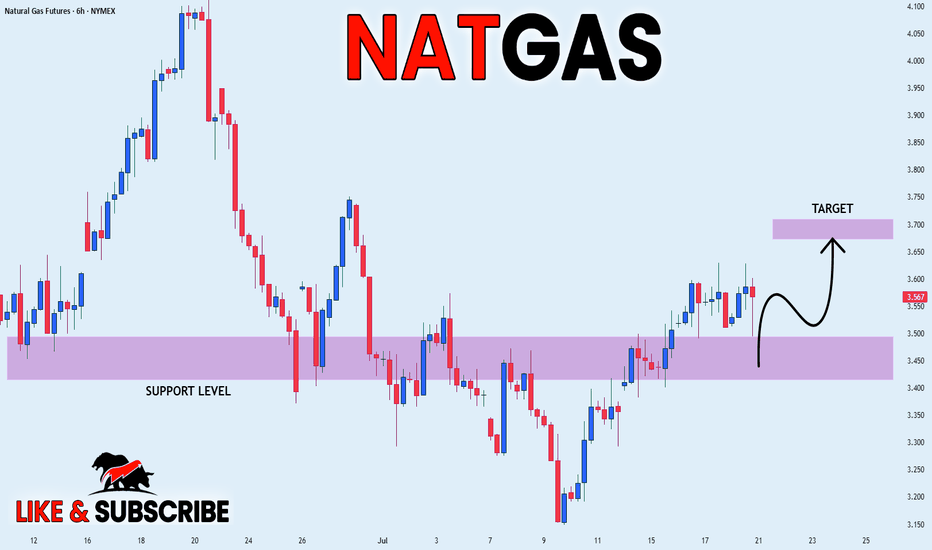

NATGAS REBOUND AHEAD|LONG|

✅NATGAS is going up now

And the price made a bullish

Rebound from the horizontal

Support level around 3.50$

So we are bullish biased and

We will be expecting a

Further bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

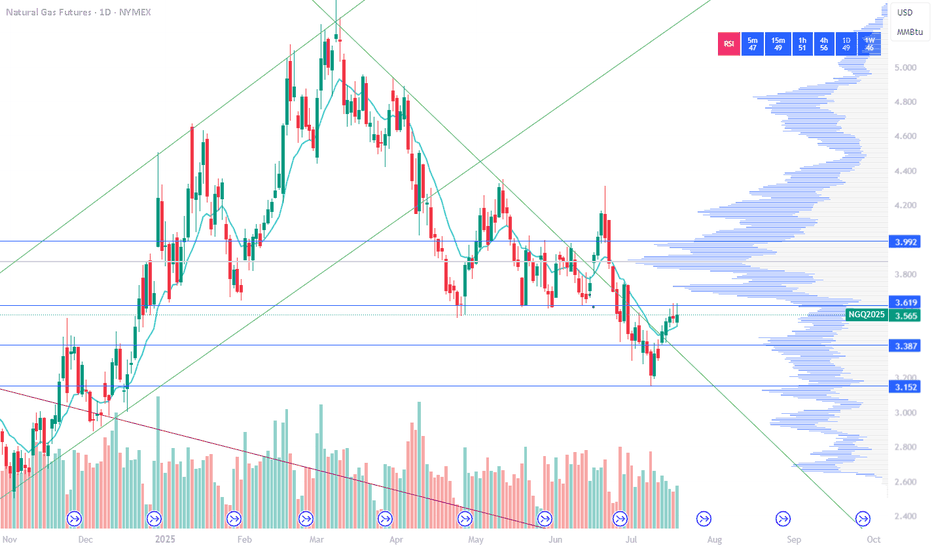

NG1! BEARS ARE STRONG HERE|SHORT

NG1! SIGNAL

Trade Direction: short

Entry Level: 3.568

Target Level: 3.162

Stop Loss: 3.837

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 12h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NATGAS: Bearish Continuation & Short Signal

NATGAS

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell NATGAS

Entry Level - 3.567

Sl - 3.625

Tp - 3.432

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

$NATURALGAS - 4H Breakout After Support ReclaimPattern formation: falling wedge pattern (4 Hour)

Price executed a clean reversal from the demand zone, reclaimed key EMAs, and broke out of the falling channel — hinting at a potential trend shift on the mid-timeframe.

✅ Support zone held strong near 270–280

✅ Breakout of falling wedge/channel

✅ Reclaim above 25 & 55 EMA

✅ Bullish structure with clean HH-HL formation

✅ Momentum building with volume confirmation

Possible Scenarios:

Retest near 296–298 zone may offer the best risk-reward long entries.

Targeting 308 - 314 - 320 (+6.3%) from the breakout zone.

#CrudeOil #naturalgas #MCXCrude #PowerOfCommodity #TriangleBreakout #TradingViewIndia #EnergyMarkets #TechnicalAnalysis

Comment below if you think it's bullish?

Pre-Market PrepToday’s market insights show a lot of potential opportunities across the board:

S&P 500: We’re in a strong upward imbalance, trading above the prior day’s range and value area. The focus is on long opportunities, but waiting for confirmation on any pullbacks.

NASDAQ & Russell 2000: Similar to the S&P, both are also in an upward imbalance. For the Russell, there’s a specific focus on looking for long setups around the prior day’s high.

Gold: The market is rotational within the prior day’s range and value area, with a slight bias toward looking for long opportunities from the lower end of that range.

Crude Oil: After some initial volatility, it has settled back into the prior day’s range. Long opportunities look promising, especially on a pullback to the CVA low.

Euro Dollar: The market is a bit low on volume and holding below the CVA. Longs are considered if we see acceptance back into that area, while shorts are on the table if we remain below the prior day’s value area.

Yen Dollar: Trading below the prior day’s range and value area, the focus is on short opportunities, especially if we see continued acceptance below key levels.

Aussie Dollar: It’s rotational and currently above the prior day’s value area, making both long and short opportunities viable, depending on how the market moves.

Nat Gas: It’s also rotational within the prior day’s range, but further analysis is needed after updating levels.

Overall, the strategy is to trade smart, confirm setups, and stay aware of the bigger trends while managing risk.

NG1! SHORT FROM RESISTANCE

NG1! SIGNAL

Trade Direction: short

Entry Level: 3.356

Target Level: 3.150

Stop Loss: 3.493

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 2h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NG1!: Strong Growth Ahead! Long!

My dear friends,

Today we will analyse NG1! together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 3.377 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 3.408.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

NATURAL GAS Best buy opportunity of the Channel Up.Natural Gas (NG1!) touched yesterday the bottom (Higher Lows trend-line) of the 1.5-year Channel Up, marginally below the 1D MA200 (orange trend-line) and is reacting so far today with a bullish tone.

If this evolves in a full-scale rebound, then technically it will be the pattern's new Bullish Leg. The previous one rose by +161.12% and a repeat of that will take this Leg back to the top of the Channel Up.

Our Target is marginally below that mark, on the 2.5 Fibonacci extension level at 6.800.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

NATGAS Support Ahead! Buy!

Hello,Traders!

NATGAS keeps falling but

The price will soon hit a

Horizontal support of 2.90$

From where we will be expecting

A local bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Europe Shudders over Winter Gas FearsEurope Shudders over Winter Gas Fears: Germany Puts Market on Edge

By Ion Jauregui – Analyst at ActivTrades

Europe is once again sounding the alarm over a potential energy crunch this coming winter. The continent’s gas reserves—particularly Germany’s—are significantly below normal levels for this time of year, amid soaring energy demand, heatwaves, and weaker renewable generation. The result: a volatile market that anticipates a new global scramble for liquefied natural gas (LNG).

As we approach the third quarter, storage levels are well below those recorded last year. High summer temperatures and reduced renewable output are pushing up demand and straining the energy market. According to recent data, this German weakness is spreading across the EU: European gas storage is currently at around 58% capacity, compared to 76% at this time in 2024. Germany is among the most exposed, with just 52% of its storage filled. Its largest facility—Rehden—is operating at only 2.45%, down sharply from 85% a year ago. By contrast, France sits at around 60%, and Spain slightly exceeds 70%, thanks to its regasification infrastructure and pipeline connections with Algeria.

However, the issue is not just about volume. Recent heatwaves across much of the continent have driven up air conditioning use and thus electricity demand. The situation has been worsened by a sharp 40% drop in European wind power generation this July, forcing a heavier reliance on gas for backup power.

Against this backdrop, markets are already pricing in a strong uptick in LNG imports. S&P Global estimates a year-on-year increase of 50% for Q3, reflecting nervousness over a potentially cold winter and a volatile geopolitical environment. This could further drive up prices—especially if Asia, and notably China, ramps up its purchases.

Spain: Both Supplier and Consumer

Spain, traditionally reliant on Algerian pipeline gas and maritime LNG, is in a less vulnerable position than Germany. Its six regasification plants and direct link to Africa via the Medgaz pipeline offer logistical advantages, but they also place Spain at the heart of Europe’s growing LNG import pressure. In fact, Spain has become a key hub for redistributing LNG to countries with limited infrastructure, like Germany and Austria. Rising domestic demand and exports to France and others could lift local prices, particularly if Algeria curbs flow due to technical or political reasons. Additionally, the spike in temperatures and the 40% drop in wind power have increased gas usage for electricity generation. This has led to higher electricity prices across Europe. Germany has seen peaks of up to €550/MWh, while Spain has benefited from a more balanced mix of renewables and gas.

Risks and Opportunities for Spain

While Spain’s strategic position and supply diversification offer some protection, an uncontrolled surge in prices—especially if Asia aggressively enters the LNG market—could still affect Spanish consumers. On the other hand, energy companies with export or storage capacity could benefit if Central Europe sees a spike in demand.

Ultimately, the third quarter of 2025 will set the tone for the coming winter. Europe is hoping for a globally balanced LNG market and subdued Asian demand to reach a storage target of 86% by October. But if weather or geopolitics turn adverse, gas could again be at the center of an energy crisis in the heart of Europe.

Gas Prices Seek Direction: Technical Consolidation

Henry Hub Natural Gas (NGAS) is currently trading at $3.216, within a consolidation range between $2.887 and $4.037. Since late June, the bias has been slightly bearish, with moving averages crossing above the price and the RSI showing oversold levels (41.29%). The point of control sits at $3.458—just above the current level—acting as resistance. A breakout above this level could target the highs at $4.796. Conversely, support at the lower end of the range at $2.467 may activate as a downside technical objective.

In Europe, the Dutch TTF gas contract—a key benchmark on the continent—is holding around €34.220/MWh, consolidating between €31.385 and €36.899. The RSI stands at 44.28%, and moving averages continue to signal downward pressure. Still, positive delta pressure zones remain, and a breakout above €36 could push prices towards €40–42, levels last seen during prior geopolitical crises in the Middle East. A drop below €30 would trigger bearish technical signals toward €27–28, regions where industrial demand tends to rebound in spring.

The Key Once Again: Weather, Asian Competition, and Geopolitics

If winter arrives early or global tensions escalate, Europe could face another surge in prices—just as inflation seemed under control.

Conclusion: Europe’s Winter Is Being Decided in Summer

Europe’s energy balance for the winter is being determined now. If weather, Asian demand, and geopolitics do not align in its favor, the continent could be headed toward a fresh spike in gas prices. Germany, due to its structural vulnerability, may act as a trigger for broader tensions. In this scenario, countries like Spain have an opportunity to position themselves as key players in supply redistribution and market stabilization. But the risk is clear: if the pattern of scarcity and uncertainty repeats, gas could once again be the centerpiece of an energy crisis with direct consequences for households, inflation, and industrial competitiveness across Europe.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance and forecasting are not a synonym of a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Political risk is unpredictable. Central bank actions can vary. Platform tools do not guarantee success. Regulated status does not guarantee security.

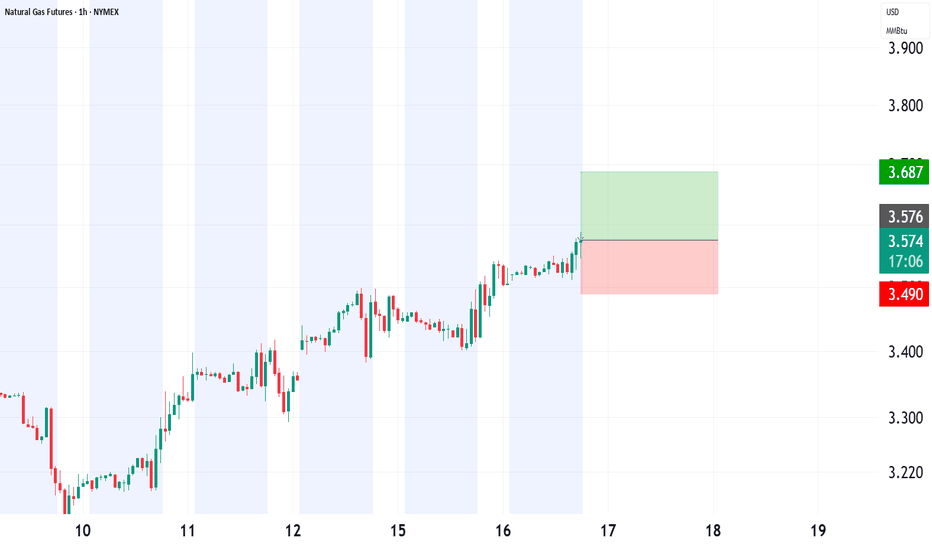

NG1! SENDS CLEAR BULLISH SIGNALS|LONG

NG1! SIGNAL

Trade Direction: long

Entry Level: 3.387

Target Level: 3.635

Stop Loss: 3.222

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NG1!: Move Up Expected! Long!

My dear friends,

Today we will analyse NG1! together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 3.403 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 3.429.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

NATGAS My Opinion! BUY!

My dear followers,

This is my opinion on the NATGASnext move:

The asset is approaching an important pivot point 3.387

Bias - Bullish

Safe Stop Loss - 3.269

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 3.630

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

NATURALGAS1! Short time Breadkdown Alert !!This is the 4 hour chart of Natural Gas Futures.

NATURALGAS1 has given a short-term channel breakdown; the previous support may now possibly act as resistance at 300 level.

The breakdown target is the lower boundary of the broader channel, which may now act as support near at 240 level.

If lop is sustain then we may see lower prices in NATURALGAS1.

Thank You !!