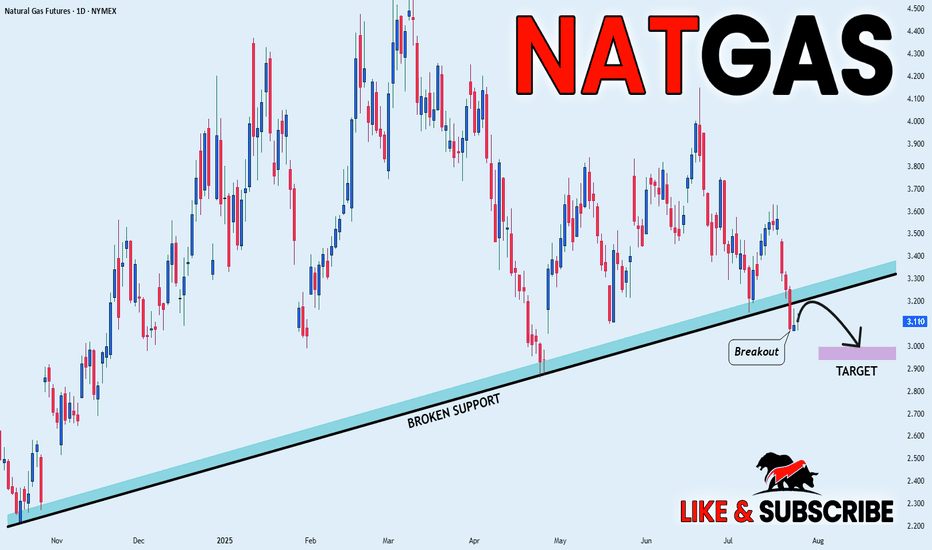

NATGAS BEARISH BREAKOUT|SHORT|

✅NATGAS broke the rising support

While trading in an local downtrend

Which makes me bearish

And I think that after the retest of the broken line is complete

A rebound and bearish continuation will follow

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade

Contract highlights

Related commodities

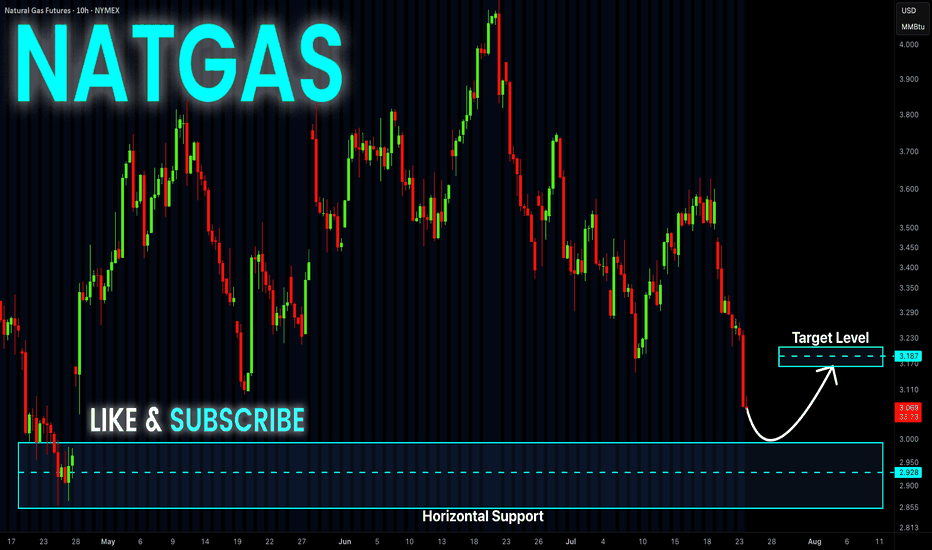

NATGAS Support Ahead! Buy!

Hello,Traders!

NATGAS keeps falling but

A strong horizontal support

Level is ahead at 3.00$ so

After Gas retests the support

We will be expecting a local

Bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Natio

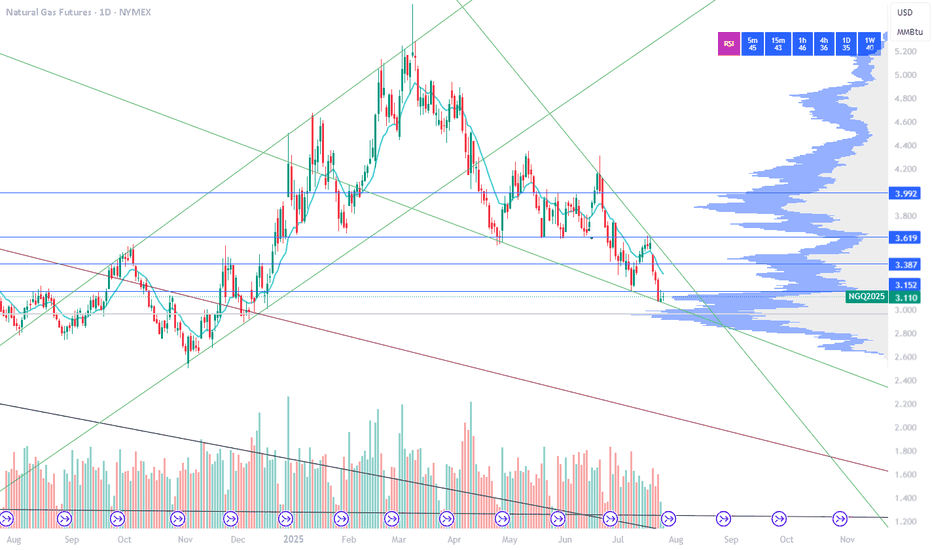

Natural Gas Cooling Near Support Zone – Bounce Ahead!Natural Gas Technical Overview (2-Chart Analysis):

Chart 1 – Parallel Channel Formation:

Natural Gas is moving within a well-defined parallel channel.

The lower support boundary of this channel is observed near 250, indicating a potential bounce zone.

Chart 2 – EMA-Based Support Structure:

Pric

NG1! Bearish Break to $3.00-$2.82 by Tuesday?www.tradingview.com NYMEX:NG1! Update - Bears Pushing, Turnaround Looms Short-Term Odds: ~60% pullback to $3.00-$2.99, ~40% chance to $2.82 - Key Signal: Low volume on 1000-tick chart, holding below VWAP ($3.134). Third test at $3.10 done—$3.00 next if support breaks. - Trend Hint: Bearish with hig

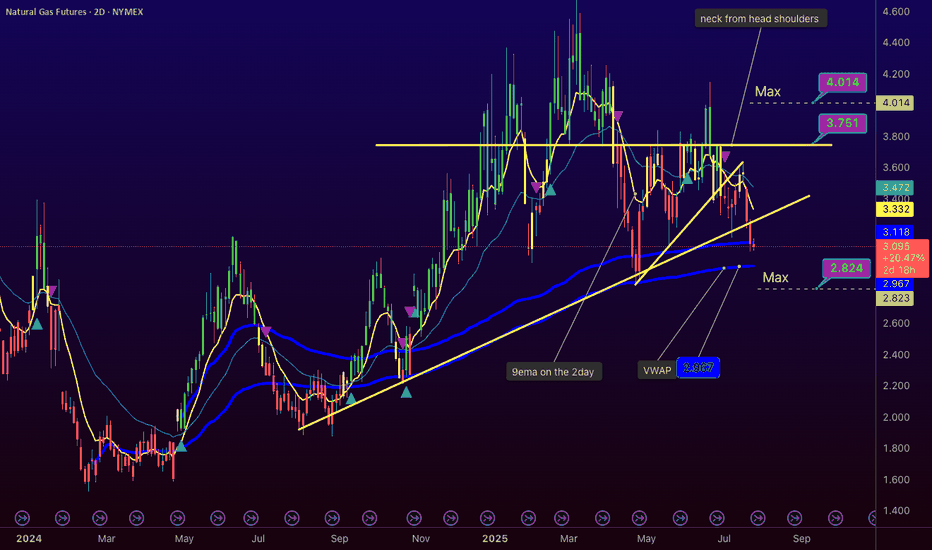

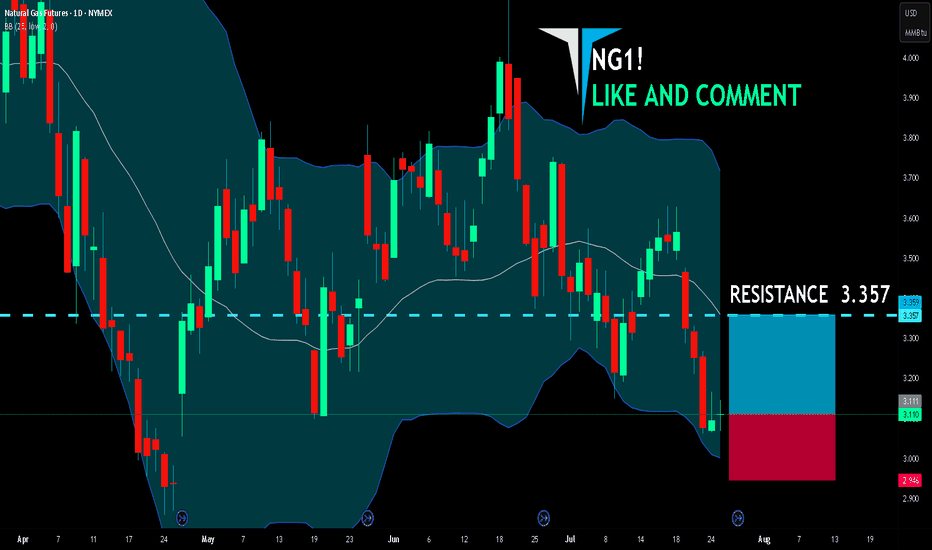

NG1! BEST PLACE TO BUY FROM|LONG

NG1! SIGNAL

Trade Direction: long

Entry Level: 3.111

Target Level: 3.357

Stop Loss: 2.946

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LI

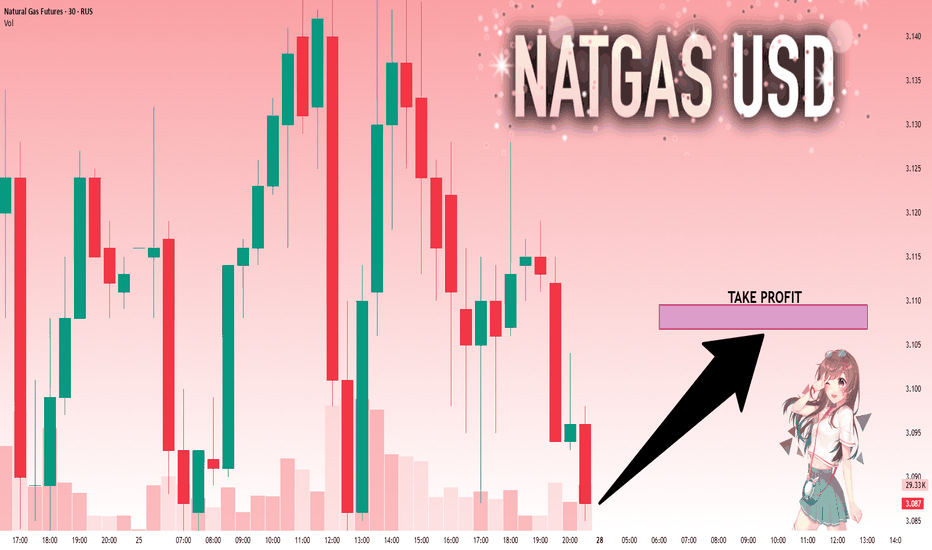

NATGAS Free Signal! Buy!

Hello,Traders!

NATGAS went down and

Almost reached the horizontal

Support of 3.014$ from where

We can enter a long trade

With the Take Profit of 3.066$

And the Stop Loss of 2.981$

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trad

NG1!: Target Is Up! Long!

My dear friends,

Today we will analyse NG1! together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 3.087 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the n

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Henry Hub Natural Gas Futures (Nov 2025) is 3.579 USD / MMBTU — it has fallen −0.40% in the past 24 hours. Watch Henry Hub Natural Gas Futures (Nov 2025) price in more detail on the chart.

The volume of Henry Hub Natural Gas Futures (Nov 2025) is 28.84 K. Track more important stats on the Henry Hub Natural Gas Futures (Nov 2025) chart.

The nearest expiration date for Henry Hub Natural Gas Futures (Nov 2025) is Oct 29, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Henry Hub Natural Gas Futures (Nov 2025) before Oct 29, 2025.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Henry Hub Natural Gas Futures (Nov 2025) this number is 129.14 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Henry Hub Natural Gas Futures (Nov 2025) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Henry Hub Natural Gas Futures (Nov 2025). Today its technical rating is sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Henry Hub Natural Gas Futures (Nov 2025) technicals for a more comprehensive analysis.