PL1! trade ideas

Lets see what happens with Platinum Commercials were in very heavy short positions. Now we are back to the zone before they got long before. Will this price interest them? Lets see if we can beat them this COT Friday..

IMO.... This is just a small bounce in a longer downtrend. Though this time last year we were very close to 1000. So I am torn.In the meantime- I will surly play the counter trade opportunities.

- SKYLOBSTER

Platinum: Top investment for the coming years.In our search for solid long term investments in the coming years we have decided to share our long term outlook on Platinum.

Technically it recently broke above a 3 year Falling Wedge turning bullish on the monthly chart an effect that has since receded as it pulled back on the 1,000 mark (RSI = 50.285, MACD = -8.660, ADX = 25.926, Highs/Lows = 11.4571).

If the 1W MA50 holds this pull back and another spike prints a Golden Cross, then we may come across a unique multi year buy opportunity on Platinum as most parameters will be similar to the late 90's Golden Cross pattern when the metal entered a hyper strong Bull Cycle. The target will be 2-3 times the initial value.

We wish to add at this point that Platinum has fairly reliable pointers both on the short and long term and thanks to that most of our latest XPTUSD signals have met their target on high quality patterns. You can get an idea of those below:

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Platinum Futures Bounce Off Long Term Level Platinum futures just successfully tested a 33 year old support/resistance level at $650-$800. Price is moving hard now (allegedly on China stimulus news) and a challenge of the ~$1,200 area in the next weeks to months looks highly plausible. Entering a long now isn't optimal, but a pullback towards or below $800 is much better.

Platinum- The rocket you wish you hopped on. After slicing the charts 100x different ways I am extremely bullish. Some of these targets are far out of reality, and don't make sense. By 2025 it will. But for the time being the gains shown are just approximations of where price will be somewhere in time. I did not incorporate how long it would take to get there. This is by no means financial advice, just some thoughts on a PRECIOUS metal thats a SAFE HAVEN, called PRECIOUS METAL, and they are PRECIOUS. For oh SO many reasons.

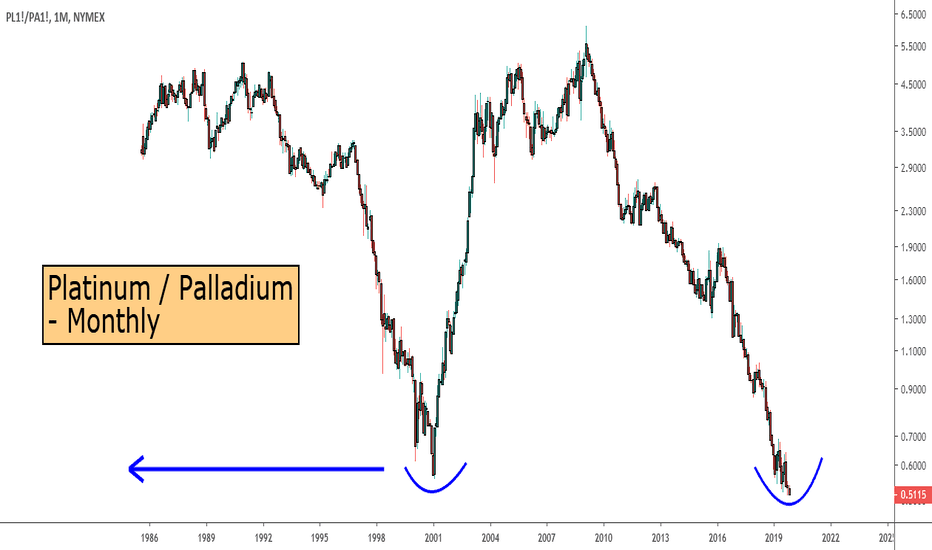

Platinum / Palladium Ratio Breakout from Falling WedgeWeekly chart Platinum / Palladium ratio.

Clear sign of a breakout / retest from the falling wedge after testing all time lows from 2001.

Supports continuation of platinum bullish breakout.

Will post long term chart in the comments to show potential upside.

Price of platinum broke above two key resistance points today.

Extremely undervalued from a historical standpoint.

$PLATINUM moving towards next level of 1000$This is a very long term chart of the Platinum price spanning 2 decades. Interesting how the base has now firmed off the horizontal support level of $750-$800. Looks like we should move to $1000 next which is where price will meet the downtrend resistance which has been in place since the tops in 2008. Should $1000 break (which will be big), we can then expect a move to the next level around $1200 which also coincides with a previous top of 2016 as well as the 200 month moving average.

PLV2019 SHORT TERM BULLISHIf PLV2019 can tests upper S&R Zone and close above 859.0 expect a bullish momentum to TP at 870. Strong showing can continue. But this may be just a short term window as stochastics are peaking at the overbought level. Go long and take opportunity. Exit upon any sign of weakness.