Oil Market Sentiment Shifts After Trump’s Urgent Warning, but...On June 23, 2025, at 9:35 AM, President Donald J. Trump issued a stark warning via social media:

"EVERYONE, KEEP OIL PRICES DOWN. I’M WATCHING! YOU’RE PLAYING RIGHT INTO THE HANDS OF THE ENEMY. DON’T DO IT!"

Since his post, oil prices experienced a notable bullish impulse. From both fundamental a

About Light Crude Oil Futures

Crude Oil is a naturally occurring liquid fossil fuel resulting from plants and animals buried underground and exposed to extreme heat and pressure. Crude oil is one of the most demanded commodities and prices have significantly increased in recent times. Two major benchmarks for pricing crude oil are the United States' WTI (West Texas Intermediate) and United Kingdom's Brent. The differences between WTI and Brent include not only price but oil type as well, with WTI producing crude oil with a different density and sulfur content. The demand for crude oil is dependent on global economic conditions as well as market speculation. Crude oil prices are commonly measured in USD. Although there have been discussions of replacing the USD with another trade currency for crude oil, no definitive actions have been taken.

Related commodities

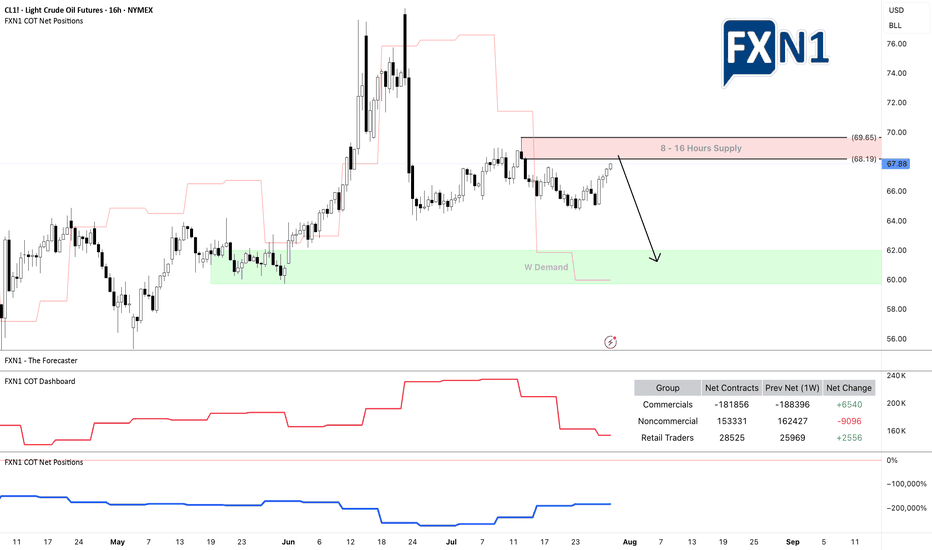

Crude oil: Sell around 70.20, target 65.00-64.00Crude Oil Market Analysis:

Yesterday's crude oil market was very strong, with buying driving the market higher. The daily chart ultimately closed with a clear bullish candlestick. Buying on the daily chart is testing the resistance level between 70.00 and 70.60. After two consecutive days of bullis

WTI(20250723)Today's AnalysisMarket news:

White House officials plan to visit the Federal Reserve headquarters on Thursday local time.

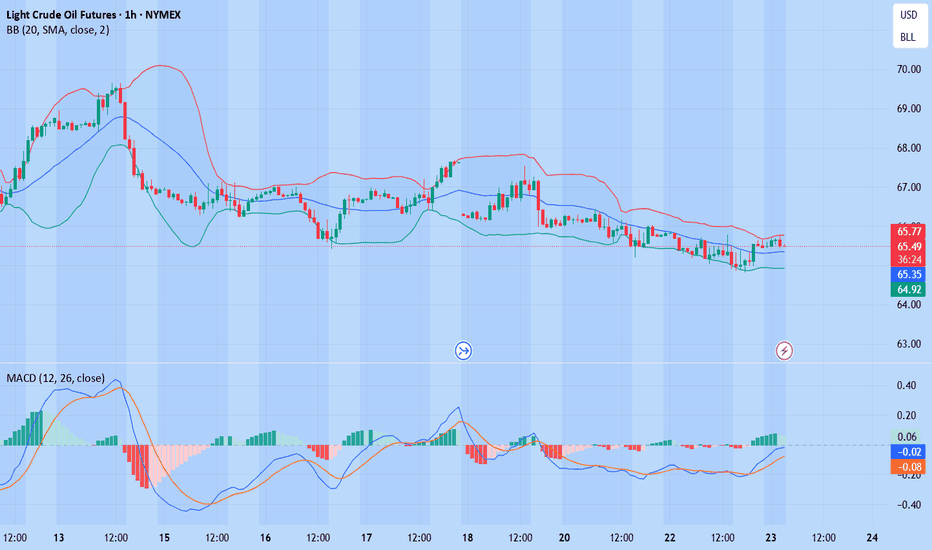

Technical analysis:

Today's buying and selling boundaries:

65.22

Support and resistance levels:

66.22

65.85

65.61

64.84

64.60

64.22

Trading strategy:

If the price breaks through 65.61, co

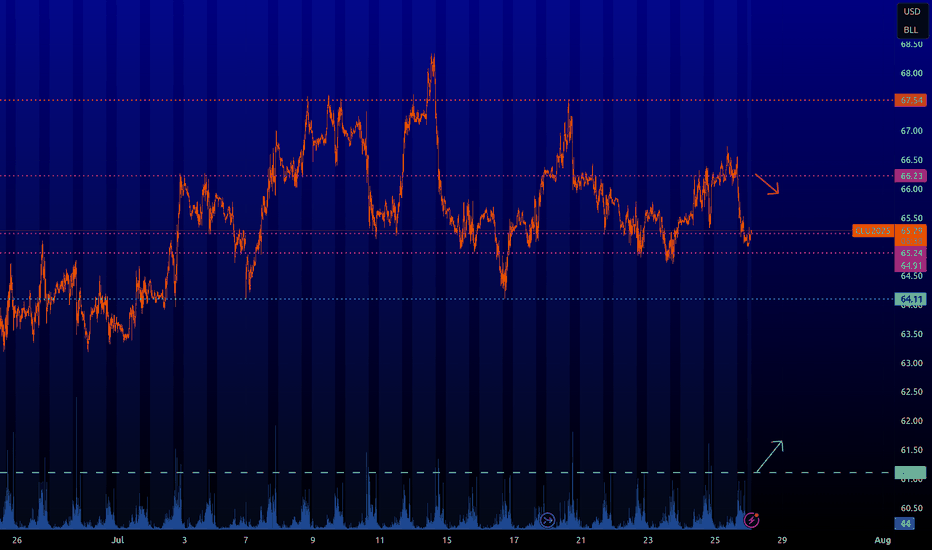

CL : Key levelsFrom the level of 66.23 we can wait for short-term sales.

From the level of 61.12 you can at least buy short-term, and if the price draws certain patterns on it, you can expect a good long position.

The other levels are still inactive, but the market will see them. When they become active, I will i

Oil Trap Activated – Limit Orders Set for the Big Score💥🛢️Crude Oil Vault Breach Plan – DCA Heist Begins!🧨💰

🚨Asset: CL1!

📈Bias: BULLISH RAID MODE ON

🎯Target: $74.50

🛡️Stop Loss: $67.50

🔑Entry: ANY LEVEL – Thief stacking limit orders like layers of gold bars 💼⚖️ (DCA Mode Activated)

🕵️♂️Thief Trader is not chasing, we're ambushing 🧠 — scaling in smart

Price Stability Signals Long OpportunityCurrent Price: $65.45

Direction: LONG

Targets:

- T1 = $67.25

- T2 = $68.50

Stop Levels:

- S1 = $64.15

- S2 = $63.25

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify

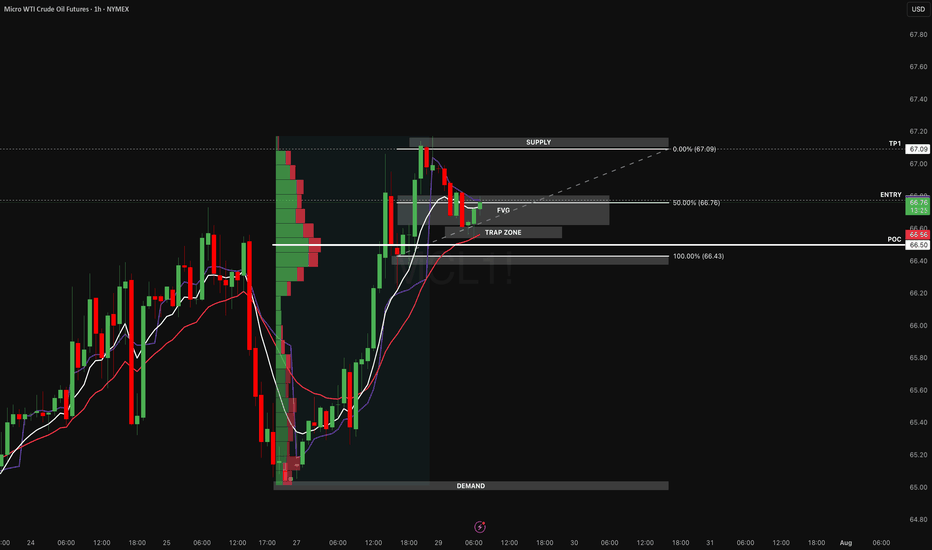

Oil’s Next Bullet: Locked, Loaded, Waiting at ValueOil made a clean move from 66.43 to 67.09 no noise, no hesitation and now it’s consolidating right where we want it: above the most important value zone of the leg. We’re not chasing green candles here. We're setting up for a measured, high-confluence re-entry at the point of balance.

This is the k

Oil Price Pulls Back to Keep RSI Out of Overbought ZoneThe recent rally in oil appears to have stalled as it struggles to extend the bullish price series from earlier this week, with the Relative Strength Index (RSI) pulling back ahead of overbought territory.

Lack of momentum to hold above the $67.60 (61.8% Fibonacci retracement) to $69.10 (38.2% Fibo

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Light Crude Oil Futures is 67.33 USD / BLL — it has fallen −2.79% in the past 24 hours. Watch Light Crude Oil Futures price in more detail on the chart.

The volume of Light Crude Oil Futures is 333.55 K. Track more important stats on the Light Crude Oil Futures chart.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Light Crude Oil Futures this number is 353.48 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Light Crude Oil Futures shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Light Crude Oil Futures. Today its technical rating is buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Light Crude Oil Futures technicals for a more comprehensive analysis.