Time to double down on ACHR > Target 20$+This is a short post:

Archer aviation respects 50MA. The Fib retracement to 0.5 lvl is achieved and we will see a Hard rally to the upside from here onwards. I am expecting this stock to make ATH within next few months. My target is still 20$ for this year. Which means if you hold this stock, you can double the money within 4 to 6 months.

ACHR trade ideas

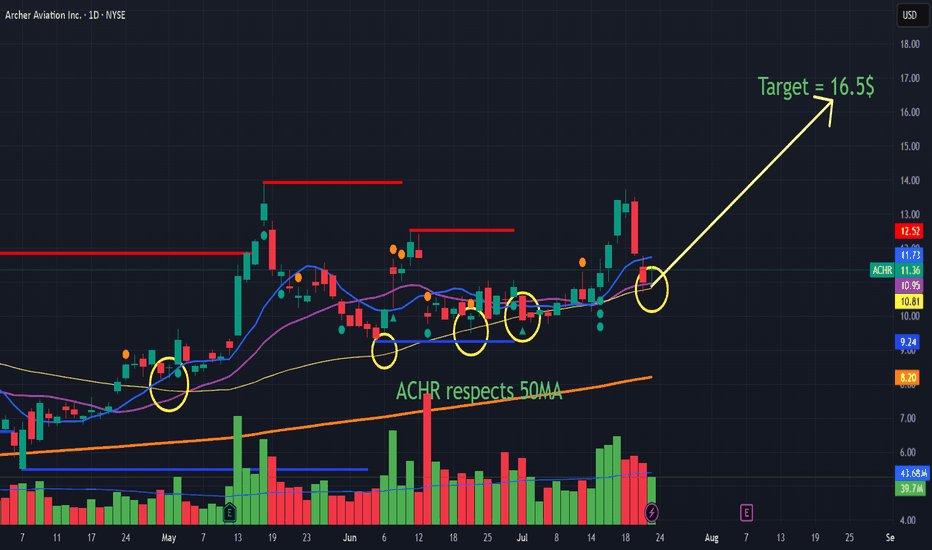

ACHR has bounced of 50MA and Next target is 16.5$ before 20$🚁 Archer Aviation (ACHR) NYSE:ACHR : $16.5 Could Arrive Fast

🔥 Pentagon Partnership Powers the Bull Case

Big News: Archer and Anduril team up to build a next-gen military hybrid VTOL for the Pentagon. This exclusive defense project fast-tracks Archer for major U.S. military contracts and funding.

www.axios.com

Cash Confidence: Archer just raised $430M, now sitting on $500M+ in cash—no near-term dilution risk, making it a strong, stable bet.

📈 Technicals: Chart Looks Strong!

50MA Support: ACHR keeps bouncing off its 50-day moving average (yellow circles), showing strong buying momentum.

Price Target: Technically, the $16.5 target is in play, with a sharp uptrend and volume surges bolstering bullish sentiment.

⚡ Why $16.5 Could Hit in August

🚀 Defensive Catalyst: Pentagon contract talk = institutional and retail buyers flood in.

💰 Balance Sheet Strength: No funding worries attracts more investors.

📊 Momentum: Chart, volume, and sentiment point to rapid upside—especially if military deals are announced.

Summary:

ACHR is set for a possible quick move to $16.5 on Pentagon news, strong funding, and powerful technical momentum. A major contract update could push it there as soon as August. If you are a trader then next levels are 16.5 and then 20$ but as an investor, this could easily reach 100$ over next 5 years.

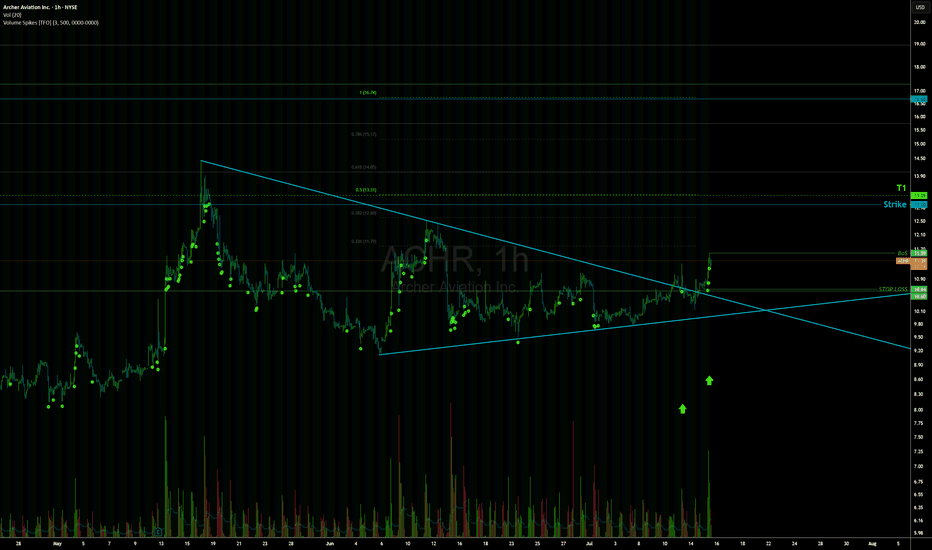

ACHR Eyes Breakout: eVTOL Sector Surges on Regulatory Tailwinds The eVTOL space is lighting up today, ACHR included. Shares have rallied ~7%, tapping into a bullish breakout off its ascending triangle and challenging its descending resistance (see chart). Analyst ratings lean strong‑buy, and technicals support further gains.

📈 Why the excitement?

A Trump executive order is fast‑tracking drone and air taxi regulations, boosting investor confidence across the sector.

Archer recently secured ~$850M in funding to accelerate U.S. rollout — fortifying its balance sheet and manufacturing plans.

The company is part of a new global alliance aiming to streamline eVTOL certification, joining forces with the FAA and five countries.

🚁 What’s next?

If ACHR breaks the red trendline resistance near ~$12, we could see a sharp move toward $14+ (green arrow on chart) as momentum builds. Watch closely for strong volume on the breakout — it could offer a clean entry.

Bottom line:

eVTOL is flying high today, and Archer stands poised to lead the charge. A breakout here could spark a fast move — keep it on your watchlist.

15 near term?NYSE:ACHR has been consolidating very well in this range, and today we saw a very strong candle with a lot of volume. This can be used as confirmation that it's breaking out of this channel to move higher. My first target is 12.48, then the ATH. After that, we should quickly reach the 14.5-15.8 range.

ACHR – 50 SMA Bounce with Sympathy Momentum from JOBYNYSE:ACHR – 50 SMA Pullback + Options Play Into Support

Archer Aviation ( NYSE:ACHR ) is showing signs of life right at the 50 SMA, and with competitor NYSE:JOBY ripping to new highs today on news, this could be the sympathy setup traders are looking for.

🔹 Technical Setup

After a strong run, NYSE:ACHR has pulled back in an orderly fashion, now resting on the 50-day moving average — a key support zone.

The stock is sitting on clean support, showing signs of stabilization.

🔹 Sector Tailwind from NYSE:JOBY

NYSE:JOBY is breaking out today on headlines — and NYSE:ACHR often moves in sympathy.

If momentum spills over, this could be the launchpad for NYSE:ACHR to retest prior highs.

🔹 My Trade Plan:

1️⃣ Position: Buying the August 1st $11 calls around the $0.90 area.

2️⃣ Reasoning: Strong reward-to-risk if NYSE:ACHR bounces from here.

3️⃣ Trigger: Watching for a reclaim of the short-term EMAs and increased volume as confirmation.

Why I Like This Setup:

50 SMA bounce + sympathy play = great combo.

Options are cheap, offering leverage without heavy risk.

If this breaks out again, it could move fast — this name has range.

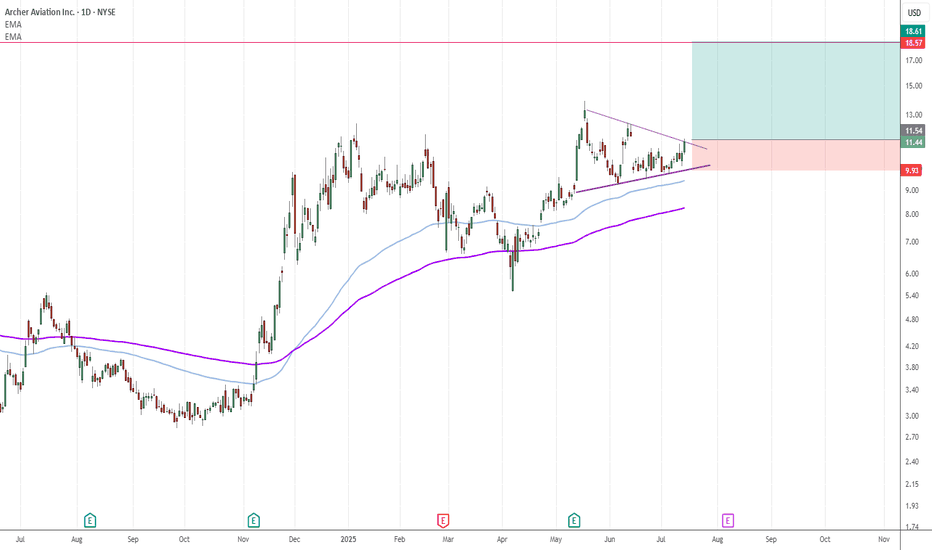

BULLS IN CONTROL NYSE:ACHR , on the 1-month chart, the stock has broken out of a prominent ascending triangle pattern, a bullish technical signal..Notably, also a smaller ascending triangle has now been surpassed with rising volume. The projected trendline suggests a potential target of 18$ at least.

the set up remain bullish!

Levels to watch:

9$ 18$

ACHR weeklyThe chart for Archer Aviation (ACHR) currently reflects a price of $10.14 exhibiting a potential “cup and handle” pattern in weekly basis. A sustained close above $12.48 could signal the onset of bullish momentum, potentially driving the stock toward a target of approximately $18 per share in the short term. If the price breaks and holds above $18, it may pave the way for further upside, possibly reaching $20-21 per share.

no buy or sell recommendations are being offered here.

ACHR Fibonacci levelsAt present, ACHR is priced at $9.99, nearing the 0.5 Fibonacci level of $9.72, which may indicate a possible upward bounce or a consolidation area. This analysis suggests that the stock could keep testing these levels, with the $10.71 resistance serving as a key point to monitor for any potential rise. This information is provided for observation only and does not constitute a recommendation to buy or sell.

Archer Aviation a Bullish case. Target 20 $Archer Aviation (ACHR) has been making significant strides in the electric vertical takeoff and landing (eVTOL) sector, positioning itself as a leader in the future of urban air mobility. Despite some volatility, recent developments suggest a strong bullish case for the stock to reach $20 in the near future.

Accelerated Test Flights & Certification Progress – Archer has completed 402 test flights ahead of schedule, a crucial milestone toward FAA certification. This progress strengthens investor confidence in its ability to launch commercial operations soon.

Strategic Partnerships & Expansion – The company has secured key partnerships, including a defense application collaboration with Anduril Industries and a commercial launch plan with Abu Dhabi Aviation. These deals enhance revenue potential and global market reach.

Strong Financial Backing – Archer has boosted its liquidity by over $1 billion, ensuring it has the capital to fast-track production of its Midnight aircraft. This financial strength supports its ambitious growth plans.

Wall Street Optimism – Analysts remain bullish on Archer, citing its strong order book and potential for significant revenue growth. As the eVTOL industry gains traction, investor sentiment could drive the stock higher.

With these tailwinds, Archer Aviation is well-positioned to capitalize on the growing demand for sustainable air mobility. If momentum continues, a $20 price target may not be far off. 🚀

ACHR Weekly Trade Plan – 2025-06-09🧾 ACHR Weekly Trade Plan – 2025-06-09

Bias: Moderately to Strongly Bullish

Timeframe: 1 week

Catalysts: eVTOL momentum + hedge fund exposure + technical breakout

Trade Type: Long call, short-duration swing

🧠 Model Summary Table

Model Direction Entry Price Strike Option Type Target Stop Confidence

Grok Moderately Bullish $0.34 $10.50 Call $0.51 (+50%) $0.15 65%

Claude Moderately Bullish $0.34 $10.50 Call $0.51 (+50%) $0.20 68%

Gemini Moderately Bullish ~$0.34 $10.50 Call $0.60 (+75%) $0.17 70%

Llama Cautious Bullish $0.60 $10.00 Call $0.90 (+50%) $0.30 70%

DeepSeek Strongly Bullish $0.34 $10.50 Call $0.68 (+100%) $0.17 80%

✅ Consensus: Buy calls targeting $10.50 breakout

📈 Common Trade Theme: Bullish price action supported by falling VIX and positive news

⚠️ Minor Divergence: Strike choice ($10.00 vs $10.50); risk tolerance (41–50% loss)

🔍 Technical & Sentiment Recap

Trend: Price above 5-min/daily EMAs, bullish MACD

Momentum: RSI overbought on 5-min but neutral daily

Volatility: VIX falling (low-risk macro backdrop)

Sector Sentiment: Positive eVTOL headlines + hedge fund inflows

Options Positioning: Max Pain at $10.50; high call OI above current price

✅ Final Trade Recommendation

Parameter Value

Instrument ACHR (Archer Aviation)

Strategy CALL (LONG)

Strike 10.50

Entry Price $0.34 (ask)

Profit Target $0.51 (≈50% gain)

Stop-Loss $0.20 (≈41% loss)

Expiry 2025-06-13 (Weekly)

Size 1 contract

Confidence 70%

Entry Timing Market open

🎯 Rationale: Short-term continuation following bullish breakout and sector strength.

⚠️ Risk Checklist

RSI overbought on short-term may trigger pullback before continuation

Resistance levels $10.20–$10.44 may create rejection

Weekly options decay fast—exit within 1–3 days ideal

Macro/VIX reversal could quickly change risk appetite

📊 TRADE DETAILS SNAPSHOT

🎯 Instrument: ACHR

🔀 Direction: CALL (LONG)

💵 Entry Price: 0.34

🎯 Profit Target: 0.51

🛑 Stop Loss: 0.20

📅 Expiry: 2025-06-13

📏 Size: 1

📈 Confidence: 70%

⏰ Entry Timing: open

🕒 Signal Time: 2025-06-09 00:29:19 EDT

Super Performance CandidateNYSE:ACHR , Pioneering in e-VTOL market, in which the e-VTOL market is growing exponentially at a rapid pace, Positioning this security to capture significant market share due to its strategic partnerships and strong financial position. At a RS Rating of 98,

I have reasons to believe this security can increase in value

Technical and Fundamental Alignment: New Rally on the Horizon?- The company's valuation multiples appear expensive relative to its own historical averages.

- However, there is a positive momentum in both growth and profitability indicators.

- Price momentum remains intact, and it is encouraging that this is supported by positive analyst revisions.

- According to visual (technical) analysis, the emergence of buyers around the 61.8% Fibonacci

level makes it highly likely that an impulsive trend could begin, potentially extending towards

the 161.8% level.

Archer Aviation: Fact or Fiction in the Skies?Archer Aviation, a prominent player in the burgeoning electric vertical takeoff and landing (eVTOL) industry, recently experienced a significant stock surge, followed by a sharp decline. This volatility was triggered by a report from short-seller Culper Research, which accused Archer of "massive fraud" and systematically misleading investors on key development and testing milestones for its Midnight eVTOL aircraft. Culper's allegations included misrepresentations of assembly timelines, readiness for pilot-controlled flights, and the legitimacy of a "transition flight" to unlock funding. The report also criticized Archer's promotional spending and claimed stalled progress on FAA certification, challenging the company's aggressive commercialization timeline.

Archer Aviation swiftly and forcefully refuted these claims, labeling them "baseless" and questioning Culper Research's credibility, citing its founder's "shorting and distorting" reputation. Archer emphasized its strong first-quarter 2025 earnings, which saw a dramatic narrowing of net losses and a substantial increase in cash reserves to over $1 billion. The company highlighted its operational momentum, including strategic partnerships with Palantir for AI development and Anduril for defense applications, a $142 million U.S. Air Force contract, and significant early customer orders exceeding $6 billion. Archer also pointed to its progress on FAA operational certifications, having secured three of four essential licenses, and its preparation for "for credit" flight testing for Type Certification, a critical step towards commercial passenger operations.

Culper Research's past track record presents a mixed picture, with previous targets like Soundhound AI experiencing initial stock declines followed by strong financial rebounds, though some legal challenges persisted. This nuanced history suggests that while Culper's reports can cause immediate market disruption, they do not consistently predict long-term corporate failure or fully validate the most severe allegations. The eVTOL industry itself faces immense challenges, including stringent regulatory hurdles, high capital requirements, and the need for extensive infrastructure development.

For investors, Archer Aviation remains a high-risk, long-duration investment. The conflicting narratives necessitate a cautious approach, focusing on verifiable milestones such as FAA Type Certification progress, cash burn rate, successful commercialization execution, and Archer's comprehensive response to the allegations. While the "fraud" thesis might be "overblown" given Archer's verifiable progress and strong financial position, ongoing due diligence is crucial. The company's long-term success hinges on its ability to navigate these complexities and meticulously execute its ambitious commercialization plan.

ACHR has broken the resistance range and has retraced.ACHR has been a watchlist stock for many people.

It has broken the resistance with huge amount of volume in past few days. And it has already retraced to the resistance range, it is trading in that range. By simple price action one would buy up the stock when it retraces in the resistance range.

ACHR - KUMO BREAKOUTACHR broke nearest resistance. There is a bullish divergence in MACD. Based on ICHIMOKU CHART, the stock is BULLISH because :

i) Price breakout cloud

ii) Tenkan sen already cross above Kijun sen recently

iii) Chikou Span is above candlestick

ENTRY PRICE : 9.33 - 9.40

TARGET : 10.37 and 12.75

STOP LOSS : 8.16

Trade Setup Summary – ACHR/USD (30-Min Chart)!📈

Setup Type: Ascending Triangle Breakout (Bullish Continuation)

✅ Entry Zone:

Around $12.19 (Breakout confirmation above horizontal resistance with volume)

🔒 Stop-Loss (SL):

Below $11.32 (Below ascending trendline and recent structure support)

🎯 Take Profit (TP) Targets:

TP1: $13.12 – First major resistance (red line)

TP2: $14.36 – Previous swing high (green line / stronger resistance)

📊 Technical Highlights:

Clear ascending triangle with bullish consolidation near breakout.

Volume support and candle strength around breakout zone (yellow line).

Good risk-to-reward structure: tight SL, wider potential upside.

📌 Summary:

This is a long trade setup with bullish momentum. Watch for a sustained move above $12.19 to validate strength. Ideal for traders looking for momentum and breakout confirmation.

potentional of Strong Buying ZoneI strongly believe Archer Aviation is good stock for swing traders.

We have Two Scenarios:

One: the Previous Low (P. Low) Line indicate a good potentional of Strong Buying Zone.

Two "Worse Case Scenario": the 1h Green Zone @ roughly 6.73 consider a good potentional of Strong Buying Zone.

Note: "potentional of Strong Buying Zone" Means that:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

ACHR - Daily - Minor Correction In PlayClick Here🖱️ and scroll down👇 for the technicals, and more behind this analysis!!!

________________________________________________________

________________________________________________________

..........✋NFA👍..........

📈Technical/Fundamental/Target Standpoint⬅️

1.) Concerns:

- High Volatility: Rapid stock price increases can be followed by significant declines, potentially erasing gains.

- Weak Fundamentals: Consistent net income losses since 2020. While losses are reducing, the company still isn't profitable.

- Low Trading Volume: Suggests limited investor interest, potentially impacting price movement and liquidity.

2.) Positives:

- Production Ramp-up: Tooling load-in for aircraft production is underway, indicating progress towards commercialization.

- Strong Financial Position: Low debt and sufficient cash reserves suggest the company is financially sound for the long term.

3.) Short-Term Outlook:

- Limited Upside: A modest price decrease to the mid-$6 range is possible, but a drop to the mid-$5 range is also a potential scenario.

- Unlikely to Reach $13: Significant upside to $13 before earnings is considered unlikely due to the company's current fundamentals and limited market interest.

4.) Overall:

- This appears to be a high-risk, long-term investment. While the production ramp-up is a positive development, the company's financial performance and low trading volume present significant challenges.

🌎Global Market Sentiment⬅️

1.) January Caution: Historically, January has shown a tendency for negative monthly closes. This trend extends to March and April, suggesting a period of caution for investors.

==============================

...🎉🎉🎉Before You Go🎉🎉🎉…

==============================

Leave a like👍 and/or comment💬.

We appreciate and value everyone's feedback!

- RoninAITrader

ER Targets! Using the Gann Fann I see:

11 on ER runup

12-13 post ER

16-17 long term PT (within a year prob)

Gap fill at 8.5 if ER is a letdown

7 if the ER is awful

WHAT AM I DOING? Buying 10C for 2027. Best to go long with this company. I also bought a 10C 3/21 to play the ER runup, def sell any short term calls before the ER. LEAPS OR SHARES are the way to go