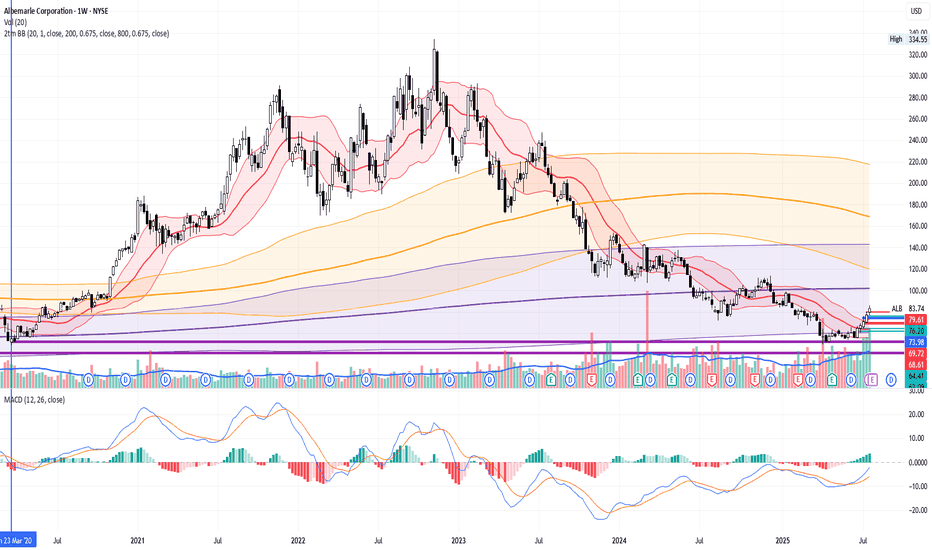

Correction over? Worth keeping an eye on itIs this the end of the final 5th wave? It’s hard to tell. This stock has been a disaster for those trying to pick bottoms. I’m waiting for a sign of strength before jumping in. We may be seeing that as the RSI is slowly gaining strength.

Personally I’d like to see it change market structure and ta

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−11.12 USD

−1.18 B USD

5.38 B USD

116.59 M

About Albemarle Corporation

Sector

Industry

CEO

Jerry Kent Masters

Website

Headquarters

Charlotte

Founded

1993

FIGI

BBG000BJ26K7

Albemarle Corp. engages in the development, manufacture, and marketing of chemicals for consumer electronics, petroleum refining, utilities, packaging, construction, transportation, pharmaceuticals, crop production, food-safety, and custom chemistry services. It operates through the following segments: Energy Storage, Specialties, Ketjen, and All Other. The Energy Storage segment develops and manufactures a broad range of basic lithium compounds, including lithium carbonate, lithium hydroxide, and lithium chloride. The Specialties segment focuses on optimizing a portfolio of bromine and specialized lithium solutions. The Ketjen segment consists of clean fuels technologies, fluidized catalytic cracking catalysts and additives, and performance catalyst solutions, which is primarily composed of organometallics and curatives. The All Other segment refers only to the FCS business that did not fit into any of the company’s core businesses. The company was founded in 1993 and is headquartered in Charlotte, NC.

Related stocks

ALB Long, Resurrection of lithium trendALB have started to rise in recent weeks. It's price stays near 5-year lows.

Long-term Price Levels already have worked to bounce the stock by around 50%+.

Most likely funds have started to trade it in Mean Reversion strategies. So, the movement back to 200MA and 800MA on Weekly time-frame is qui

ALB | Price PredictionNYSE:ALB is one of my key assets in the stock portfolio. I believe that the price of this stock is highly related to the resource price and cycles. I expect massive upside because of the potential rise in lithium demand. Moreover, new EVs, robots, drones, and next-gen gadgets all need lithium.

Pri

$Albemarle Harmonic Pattern and Short stock infoLooking at the daily chart for Albemarle, it appears to be to have a short sale harmonic pattern. The second pattern finished up today's trading with dramatic fashion. I'm looking for the same rebound to the $110 area in the next few weeks.

First go at publishing an idea!

$ALB suggesting potential undervaluation.Albemarle Corporation (NYSE: ALB) is a leading global producer of lithium, a critical component in electric vehicle (EV) batteries. The company's performance is closely tied to lithium market dynamics, which have experienced significant fluctuations recently.

Technical Analysis:

As of February 15,

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

A

ALB5009903

Albemarle Wodgina Pty Ltd 3.45% 15-NOV-2029Yield to maturity

5.47%

Maturity date

Nov 15, 2029

A

ALB4914616

Albemarle Wodgina Pty Ltd 3.45% 15-NOV-2029Yield to maturity

4.33%

Maturity date

Nov 15, 2029

See all ALB bonds

Curated watchlists where ALB is featured.

Frequently Asked Questions

The current price of ALB is 83.74 USD — it has decreased by −0.52% in the past 24 hours. Watch Albemarle Corporation stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Albemarle Corporation stocks are traded under the ticker ALB.

ALB stock has risen by 8.32% compared to the previous week, the month change is a 39.20% rise, over the last year Albemarle Corporation has showed a −7.52% decrease.

We've gathered analysts' opinions on Albemarle Corporation future price: according to them, ALB price has a max estimate of 125.00 USD and a min estimate of 57.00 USD. Watch ALB chart and read a more detailed Albemarle Corporation stock forecast: see what analysts think of Albemarle Corporation and suggest that you do with its stocks.

ALB stock is 3.44% volatile and has beta coefficient of 1.64. Track Albemarle Corporation stock price on the chart and check out the list of the most volatile stocks — is Albemarle Corporation there?

Today Albemarle Corporation has the market capitalization of 9.85 B, it has decreased by −5.20% over the last week.

Yes, you can track Albemarle Corporation financials in yearly and quarterly reports right on TradingView.

Albemarle Corporation is going to release the next earnings report on Jul 30, 2025. Keep track of upcoming events with our Earnings Calendar.

ALB earnings for the last quarter are −0.18 USD per share, whereas the estimation was −0.66 USD resulting in a 72.75% surprise. The estimated earnings for the next quarter are −0.79 USD per share. See more details about Albemarle Corporation earnings.

Albemarle Corporation revenue for the last quarter amounts to 1.08 B USD, despite the estimated figure of 1.16 B USD. In the next quarter, revenue is expected to reach 1.22 B USD.

ALB net income for the last quarter is 41.35 M USD, while the quarter before that showed 75.29 M USD of net income which accounts for −45.08% change. Track more Albemarle Corporation financial stats to get the full picture.

Yes, ALB dividends are paid quarterly. The last dividend per share was 0.41 USD. As of today, Dividend Yield (TTM)% is 1.93%. Tracking Albemarle Corporation dividends might help you take more informed decisions.

As of Jul 26, 2025, the company has 8.3 K employees. See our rating of the largest employees — is Albemarle Corporation on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Albemarle Corporation EBITDA is 159.34 M USD, and current EBITDA margin is −0.74%. See more stats in Albemarle Corporation financial statements.

Like other stocks, ALB shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Albemarle Corporation stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Albemarle Corporation technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Albemarle Corporation stock shows the sell signal. See more of Albemarle Corporation technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.