ABC Bullish Earnings 8-9 BMOAPD formed a cup and handle previously and made a good run to it's top at 304.47. Long term, slightly bumpy uptrend noted on monthly.

Price fell but not quite to the previous handle low. Short interest is low and NV is high. APD is consolidating for the last few weeks and seems to be in "wait" mode. There is resistance over price. The structure that price is in at the moment formed after a downtrend brought it here. Hesitant to call it anything at this moment although it is making higher lows. A bear pennant looks more like a symmetrical triangle and a bear flag has trendlines that are more parallel like a channel down. Ascending triangles, as any triangle can, break to the downside or the upside and are neutral until price breaks a trendline. Earnings will put price where Mr. Market intends it to be.

APD recently had a switch at the CFO position in their company which many consider negative until things fall in to place. From what I read their is a moderately bearish sentiment on APD right now. This does not mean that they will do awful at earnings. There are a lot of misses in their history including last quarter. I plan to watch this one as I have owned it during cup and handle and I like the stock. I like it at the right price and did well with it the last time I traded it. Entry level means a lot though on how well one does with a security.

I am not a fan of buying before earnings most of the time, especially as of late. Some sell stocks they own if earnings are approaching. I guess you have to go with your gut. Does not really matter as I did not see this until just now and earnings will be over by the time the market opens on Monday. I will either be bumbed out or relieved I did not buy it yet. LOL I can watch it and pick it up possibly at a lower price at a later date. Who knows?

Earnings can be considered an event pattern. Half of securities with a positive earnings surprise (and positive market reaction) peak in less than 2 weeks on average. Positive earnings surprises leading to a gain work best in a bull market. Bad earning surprises (or good earnings with a bad market reaction) can bottom out in less than a week depending on market conditions. If price gets stuck down there and this week is prolonged in to weeks or months, then many look at selling especially if bear flags or bear pennants appear. If earnings are received poorly (be it a hit or a miss) and price gaps down, then maybe look at how tall the gap is (the taller the gap is, the more bearish that gap can become) and look at the candle price closed at the gap down. Dead cat bounces can also occur after a gap down where price reaches up to close the gap only to fall again.

No recommendation.

Mr. Market can be irrational. Sometimes everything seems to be interpreted positively, then the very next day that this can change and everything is interpreted negatively. I suppose no one can accurately predict the weather, but I can know if it is raining today (o:

APD trade ideas

$APD with a Bullish outlook following its earnings #Stocks The PEAD projected a Bullish outlook for $APD after a Positive under reaction following its earnings release placing the stock in drift A

If you would like to see the Drift for another stock please message us. Also click on the Like Button if this was useful and follow us or join us.

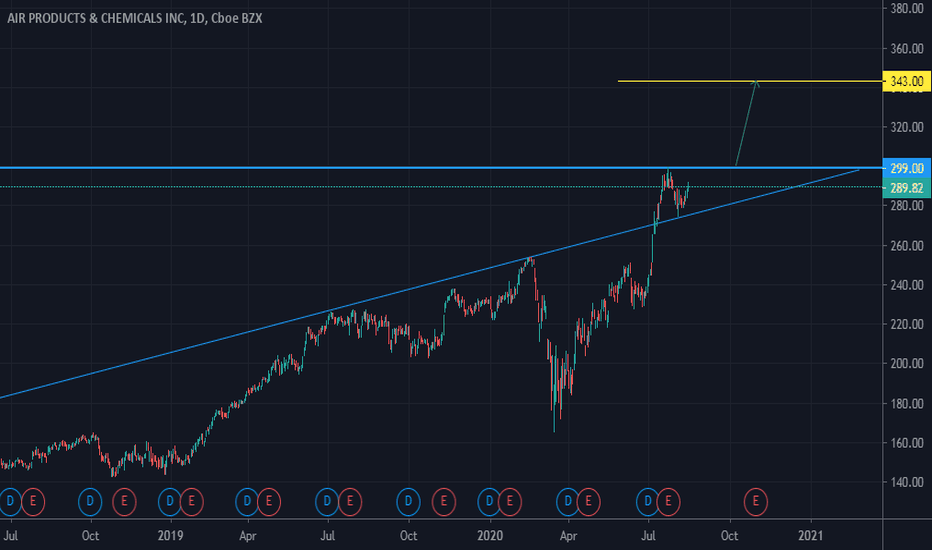

APD repeating yearly pattern, golden cross into bull run??Hi. In this 1D chart I've plotted out the price increase of 2019 and 2020, marked their golden crosses in the first halves of the year and placed the resistance line from 2020 that the current golden cross could indicate will result in the price breaking through and rising past it during this year.

Keep in mind that the fundamentals of APD are also very good.

Thank you. Please if you have any thoughts or comments do leave them below and I would gladly discuss or adjust my interpretations and methods.

This does not constitute financial advice.

Any prices, even if explicitly stated, are presented with intent to discuss the symbol and potential interpretations.

Any trades shown or mentioned are examples and neither recommendations or mandates.

APD inter market analysis ➡️Pattern recognized:

Running flat

➡️Hypothesis:

Bearish

➡️Catalyst:

Earnings in 16 days. I expect a drop followed by a rally in anticipation to earnings.

➡️Conclusion:

Buy puts once it break the 288 price alert

***This does not constitute financial advice.***

If you like what you see why not support us?

👇

Looks like no-brainer, what am i missing?Solid company

Analyst recommend very much. fundamentals are reasonable. Expected to grow EPS annually 9% for next 5 years and 14% next year. pays dividend. solid quick ratio, solid current ratio.

Price is at support

what else do would you need to know before hitting that buy button

APD - EW analysis - ABC zigzag down APD - It seems like the impulse cycle completed at the major top and now correcting down. The down move is so far ABC zigzag down and B is in progress as flat correction abc. Sell once the B wave finished with new high as 5th internal wave of final sequence for down cycle of C wave.

Give thumbs up if you really like the trade idea.

Falling WedgeAll in all, this chart does not look good..lol

moving averages are out of order..the 50 is under the 100.

But a falling wedge can be bullish and can serve as a reversal pattern. At he bottom it is pointed in the direction of the trend, downward. At the top is tilts countertrend. It is a longer formation (at least 3 weeks to form) than a flag, plus it often lacks a flag pole. This formation is just over 15 trading days. Both trendlines point downward and converge at the apex,

Possible H&S top

Just an observation.

NV is high on this one/Negative volume is volume on down days...and is when larger players often buy.

OBV/on balance volume is also high. Short is on the low side

shortsqueeze.com

The market does not form chart patterns, psychology does

$APD with a slight bullish outlook following earning releaseThe PEAD projected a slight bullish outlook following $APD earning release with a negative under reaction, placing the stock in Drift D

If you would like to see the Drift for another stock please message us. Also click on the Like Button if this was useful and follow us or join us.

Long on $APDHello Everyone,

We are going Long $APD, It is currently showing a stong set up relative to the market and we believe that is could rally . We have set a price target at $237.23 and plan on putting a sell signal at that price. For safety measures, we have incorporated a stop loss at $194.66.

Best of Luck,

Tashua Financial