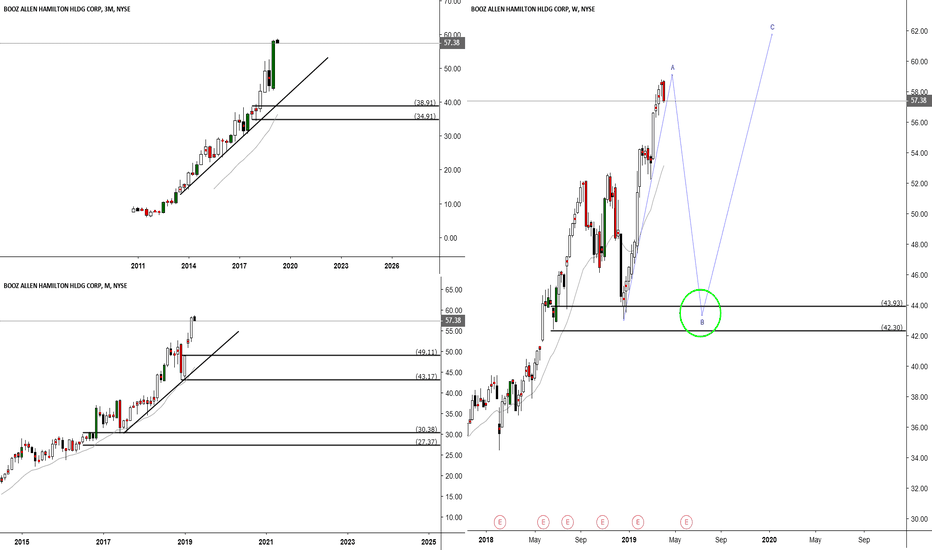

BAH, Long , Trend Following Setup, Second attempt . Booz Allen Hamilton Holding Corporation provides management and technology consulting, analytics, engineering, digital, mission operations, and cyber solutions to governments, corporations, and not-for-profit organizations in the United States and internationally.

Here is a company with positive margins , lots of free cash flow and I think that although we did break trend-line support , there is a good potential of a reversal up from here . I have set my stop under previous low and intend to trade this as a trend following setup.

Once/if we exceed 2X risk I will adjust stop to break even and move up my stop from there .

Good luck .

BAH trade ideas

Pullback FishingBAH has broadening trendlines, also called a megaphone pattern.

Fell out of megaphone trendline, which can be a negative situation. BAH fell through bottom bollinger band set on 80 as well. Usually if a security breeches the top or bottom trendline of the bands, it moves back inside the bands.

Megaphone patterns can break up or down, and this one looked like it was breaking down. Then poof, up it went.

I though I saw a Cypher pattern but CD leg did not quite make it to the .786, very close and may not go down that far and the bollinger band pierce may have saved it. Remains to be seen.

This pattern is labeled X, A, B, C. D

Some do not consider the Cypher pattern a true harmonic pattern, but is similar to a shark as both have a BC leg higher than the AB leg. The shark has a much deeper D.

Stock is oversold on daily RSI set at 80 and 30.

Cautious due to megaphone pattern but these patterns can go back up as well and reach the top trendline until they break up or down. This one did break down, briefly.

Not a recommendation

BAH LONG SETUP SIGNIFICANT PULL BACK AFTER REVENUES MISSED , UP UNTIL THAT WAS DISCLOSED THE STOCK WAS CLIMBING INSIDE OF A ASCENDING CHANNEL MAKING HIGHER LOWS AND HIGHER HIGHS WITH A FRESH ATH PRINTED .

CURRENTLY WE ARE SITTING AT THE BOTTOM OF THE CHANNEL AND FOR THE MEANTIME HOLDING , THE STOCK IS OVERSOLD AND PRESENTS A GREAT OPPERTUNITY TO FILL LONGS WITH A TIGHT STOP .

BAH, Technical LongBooz Allen Hamilton Holding Corporation provides management and technology consulting, analytics, engineering, digital, mission operations, and cyber solutions to governments, corporations, and not-for-profit organizations in the United States and internationally.

This is a technical play I have been watching for a while. I like their institution ownership, EPS and margins too but primarily technical based , I put an initial target on chart but I plan on following this one up as I think there is greater potential than profit target on chart .

Good Luck ~

BAH - rocketWhen I think of Booz Allen Hamilton, I think of rockets. You think of Booze. That's the difference between you and I... Lay off the Booze and get some calls in BOOZ! This rocket is about to take off!

The 200MA battle. On the daily here we see consistency. Can it do it all over again? Wait for that cross to happen. Be patient. This is the daily chart so once it happens your probability of success is high for the coming weeks. Cheers and good luck on this one!

If you like my charts press that like button/follow, and ask me any questions you may have! Thank you!

Pull Back FishingBAH missed on revenue a significant pull back occurred..

There was a small bearish divergence on rsi before earnings, not huge though. BAH was overbought when earnings were released which definitely did not help the issue..Overbought and Oversold conditions can go on for a while.

It is now oversold and looks to be trying to find a bottom. I do notice there is a bit an ascending broadening formation (megaphone) when I drew the trendlines but this is like a symmetrical triangle, in fact opposite in appearance of a triangle. It is a slight slope and the trendlines are not perfectly parallel, but in the scheme of things, not that unusual...just noted it in my pea brain (o:

I am not sure this is finished pulling back yet and I see a fairly strong support level just above 79. The recent pull backs formed a pivot low I noticed (red line).This has not happened as of yet and it may or may not happen as the Mr Market does not usually repeat the same exact behavior. He likes to mix it up a little to keep us on our toes (o:

Just watching and not recommending this ..just one I follow and glad I sold when I saw the overbought signal the day before earnings.

It is impossible to guess what a stock will do post earnings unless you are in congress or something and know things we do not know, and I do not think anyone knows how a stock will respond to earnings unless they are psychic. (makes me want to stick to forex sometimes (o: But often there are little clues left laying around if you look for them. I have noticed stocks in rising wedges have been getting a haircut after earnings whether they beat or not, as well as some of the parabolic stocks. A rising wedge differs from an ascending broadening wedge in the both trendlines slope up but slope towards each other and converge.

Anyway, as a rule this stock is not super volatile and usually just an easy stock to trade because it is somewhat predictable in the scheme of things. When I started learning to trade, I watched a lot of YouTube videos and a named David (I cant remeber his last name ) said to pick a basket of stocks and trade them over and over so you know how they move and get a half way decent idea on where they pull back and how far they pull back.

Good luck!

Booz Allen Hamilton Holding Corporation provides management and technology consulting, analytics, engineering, digital, mission operations, and cyber solutions to governments, corporations, and not-for-profit organizations in the United States and internationally. The company offers consulting solutions for various domains, business strategies, human capital, and operations. It also provides analytics services, which focuses on delivering transformational solutions in the areas of decision analytics, including operations research and cost estimation; automation; and data science that include predictive modeling and machine learning, as well as new or emerging areas, such as deep learning and artificial intelligence. In addition, the company designs, develops, and implements solutions built on contemporary methodologies and modern architectures; delivers engineering services and solutions to define, develop, implement, sustain, and modernize complex physical systems; and provides cyber risk management solutions, such as prevention, detection, and cost effectiveness. Booz Allen Hamilton Holding Corporation was founded in 1914 and is headquartered in McLean, Virginia.

BAH Long Chance after another Higher Low BAH shows to be in an upward trend with higher lows @ 68$, 72$, 75$ and higher highs @ 82$, 89$, and a cup with handle breakout all up to 100$.

After the major sell-off at the all time high 100$, we are looking for a possible Entry Point @ 78$-82$.

The RSI is already below 30 and could potentially be with an additional bullish Candle Stick Pattern a strong buy signal.

Stop-Losses are the previous lows @ 68$, 72$ and 75$.

Potential Take Profits are the cup handle @ 88$ or the all time high @100$.

Cup and HandleBah has had trouble holding on to the high. Not pulling back a lot as of late when it pulls back.

Possible stop below handle low or last pivot low.

Long slow uptrend.

In a up trending market you can add 100%, 127% and 161% of cup depth to target. My focus for now are targets 1.

No rising wedges in yearly chart.

Not a recommendation

BAH (Booz Allen Hamilton) long trade. First entry point.A company with a nice long term upward trend but recently indicated as oversold. Currently trading at the first of two entry points. First entry point here (~$78.35) with your stop at $75.22 and take profit at $89.35. Final entry point at 61% (~$78.38) with the same stop and take profit levels.

BAH - It’s a BreakoutClassic consolidation and breakout. This is exactly the type of stock that will do well in an uncertain geopolitical climate with potential military conflict on the horizon. I will hold as long as the green trend line is underneath price.

Thank you for your likes and your FOLLOW! Let me know if you have any questions or comments. Cheers!

BHA on the way upBooz Allen Hamilton Holding Corporation - BHA

from the services sector

gap up, which broke a significant level five days ago.

It is still continuing a post-GAP rally. If this is the type of gap that I think is, we will expect further increases.

note the high volume, OBV supports the idea, RSI is high so there may be some declines before the expected continuation up.

possible entry point 53.5

not a recommendation.

BAH looking to breakoutShares of BAH look set to breakout and finally push thru the $40 level. It's currently in a rising wedge, and given geo-risk and defense sector strength, I like this name. I think $45 will come quick (161.8% extension) if shares breakout. Earnings aren't until May 21st, so I don't see much downside catalyst in the near term.

I want to give it time to work and limit risk, so I just bought June $45 calls for 20c.