BBAI - Good Time to buy?Hello Everyone,

Happy Sunday to All.

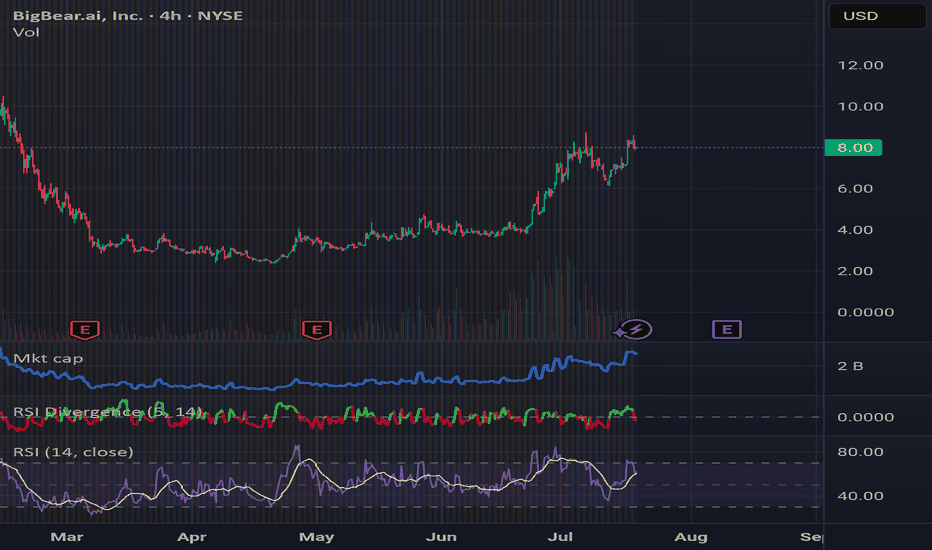

is it a good time to buy BBAI Bigbear AI?

I tried to analyze possibilities and you can monitor next week and make your decisions.

It is almost %26 down from previous high which was hit last month.

5.85 - 5.95 is a first support level and looks like it reacte

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.77 USD

−295.55 M USD

158.24 M USD

280.93 M

About BigBear.ai, Inc.

Sector

Industry

CEO

Kevin McAleenan

Website

Headquarters

McLean

Founded

2020

FIGI

BBG00Z4HKRV4

BigBear.ai Holdings, Inc. engages in data-driven decision dominance and advanced analytics that provide its customers with a competitive advantage in a world driven by data that is growing in terms of volume, variety, and velocity. The firm operationalizes artificial intelligence and machine learning at scale through its end-to-end data analytics platform. It deploys its observe, orient and dominate products to customers throughout the defense, intelligence, and commercial markets. The company was founded in 2020 and is headquartered in McLean, VA.

Related stocks

XABCD pattern playing out $12 targetBBAI is looking like it will play out the XABCD butterfly pattern if it continues to rally from the .382 of the pull back from previous $2.35 lows and 8.73 highs.

Breaking down and close below the $6.06 daily candle will potentially expose the previous consolidation POC at $3.87, which is a .75 pu

HISTORICAL DATAWhen researching institutional holdings like BlackRock's purchases of a specific stock, it's important to look for Form 13F filings with the Securities and Exchange Commission (SEC). These filings are required from institutional investment managers with over $100 million in assets under management a

BigBear.ai, Inc. (BBAI) Powers AI-Driven DecisionsBigBear.ai, Inc. (BBAI) provides artificial intelligence-powered decision support solutions for defense, healthcare, logistics, and manufacturing. Its platform helps clients process complex data to make faster, smarter decisions using predictive analytics and machine learning. BigBear.ai’s growth is

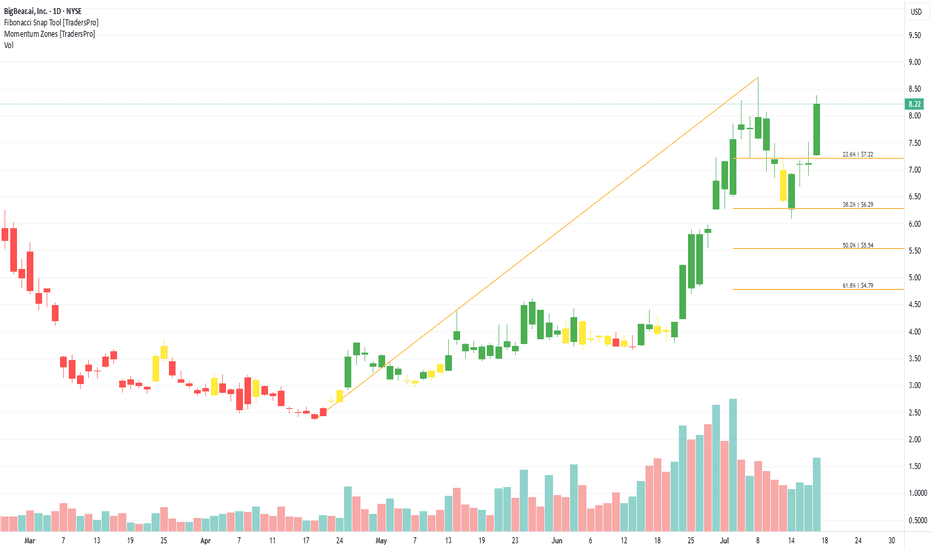

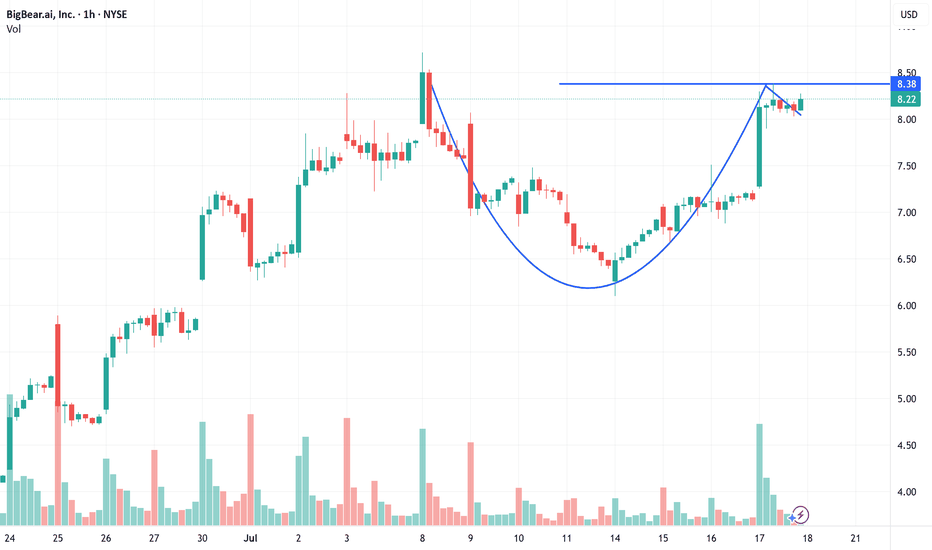

BBAI - Cup with Handle Long Cup Formation: BBAI carved out a rounded base over several months, bottoming near $4.00 and gradually climbing back toward resistance around $8.00.

Handle Formation: After testing the $8.00 zone, the stock pulled back slightly into a tight range between $6.80 and $7.50, forming the “handle”—a sign

Mapping Out a Probable Basing Structure for ContinuationI’m tracking price as it retraces into the 0.5–0.618 Fibonacci zone, where I expect a potential base to form. With declining volume confirming the pullback is losing momentum, I’ll look for a clear basing pattern or double-bottom on lower timeframes before entering long. If confirmed, the plan is to

Piercing Candle?Do we have a Piercing candle around the golden zone 0.5 Fibonacci level 6.19$, also this candlestick pattern is resting at the moment on top of the 21 EMA? Will the bulls continue the march? is the pull back over? We need to close a bullish candle above the halfway candle of today's candle this wee

Downward Parallel StructureWe need a break of the downward parallel structure and the 50EMA 6.89, for the Bulls take charge. Buyers did a good job raising the price from the 6.45 closing price from Friday, but the bulls need to finish the job and make a HLs and HHs through the 50 EMA. If not Bears going to cycle the price bac

Is BigBear.ai the Next Titan of Defense AI?BigBear.ai (NYSE: BBAI) is emerging as a significant player in the artificial intelligence landscape, particularly within the critical national security and defense sectors. While often compared to industry giant Palantir, BigBear.ai carves its niche by intensely focusing on modern warfare applicati

6/30/25 - $bbai - FAFO w/ PE overlords6/30/25 :: VROCKSTAR :: NYSE:BBAI

FAFO w/ PE overlords

- let me share a lil advice

- whenever private equity is your overlord and main shareholder: run

- you can always make up stories as to why you own this. trust me, there are better options out there

- good luck

- and hope you don't have

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of BBAI is 6.72 USD — it has decreased by −4.55% in the past 24 hours. Watch BigBear.ai, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange BigBear.ai, Inc. stocks are traded under the ticker BBAI.

BBAI stock has risen by 2.36% compared to the previous week, the month change is a −13.46% fall, over the last year BigBear.ai, Inc. has showed a 425.00% increase.

We've gathered analysts' opinions on BigBear.ai, Inc. future price: according to them, BBAI price has a max estimate of 9.00 USD and a min estimate of 3.50 USD. Watch BBAI chart and read a more detailed BigBear.ai, Inc. stock forecast: see what analysts think of BigBear.ai, Inc. and suggest that you do with its stocks.

BBAI reached its all-time high on Apr 6, 2022 with the price of 16.12 USD, and its all-time low was 0.58 USD and was reached on Dec 30, 2022. View more price dynamics on BBAI chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

BBAI stock is 5.55% volatile and has beta coefficient of 3.47. Track BigBear.ai, Inc. stock price on the chart and check out the list of the most volatile stocks — is BigBear.ai, Inc. there?

Yes, you can track BigBear.ai, Inc. financials in yearly and quarterly reports right on TradingView.

BigBear.ai, Inc. is going to release the next earnings report on Aug 11, 2025. Keep track of upcoming events with our Earnings Calendar.

BBAI earnings for the last quarter are −0.25 USD per share, whereas the estimation was −0.06 USD resulting in a −341.17% surprise. The estimated earnings for the next quarter are −0.06 USD per share. See more details about BigBear.ai, Inc. earnings.

BigBear.ai, Inc. revenue for the last quarter amounts to 34.76 M USD, despite the estimated figure of 36.26 M USD. In the next quarter, revenue is expected to reach 40.59 M USD.

BBAI net income for the last quarter is −61.99 M USD, while the quarter before that showed −108.03 M USD of net income which accounts for 42.62% change. Track more BigBear.ai, Inc. financial stats to get the full picture.

No, BBAI doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 7, 2025, the company has 630 employees. See our rating of the largest employees — is BigBear.ai, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. BigBear.ai, Inc. EBITDA is −41.18 M USD, and current EBITDA margin is −21.37%. See more stats in BigBear.ai, Inc. financial statements.

Like other stocks, BBAI shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BigBear.ai, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So BigBear.ai, Inc. technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating BigBear.ai, Inc. stock shows the buy signal. See more of BigBear.ai, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.