CIVI – Civitas Resources, Inc. – 30-Min Long Trade Setup !📈🚀

🔹 Asset: CIVI (NYSE)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Falling Trendline Break + Support Bounce

📊 Trade Plan (Long Position)

✅ Entry Zone: Around $35.00 (trendline break + demand zone confirmation)

✅ Stop-Loss (SL): Below $34.36 (clear structure support zone)

🎯 Take Profit Targets

📌 TP1: $35.85 (immediate resistance / supply zone)

📌 TP2: $36.94 (previous high / major resistance area)

📊 Risk-Reward Ratio Calculation

📉 Risk (SL Distance):

$35.00 - $34.36 = $0.64 risk per share

📈 Reward to TP1:

$35.85 - $35.00 = $0.85 → (1.33:1 R/R)

📈 Reward to TP2:

$36.94 - $35.00 = $1.94 → (3.03:1 R/R)

🔍 Technical Analysis & Strategy

📌 Falling Trendline Breakout: Clean break from descending resistance (highlighted by pink line)

📌 Support Bounce: Price held structure support at $34.36 (white line)

📌 Retest & Reaction: Yellow zone indicates confluence — breakout retest + support hold

📌 Potential Reversal Zone: Bottoming structure visible near key support

⚙️ Trade Execution & Risk Management

📊 Wait for Bullish Confirmation: Entry only valid if price closes above yellow breakout zone

📉 Trailing Stop Strategy:

Move SL to breakeven after TP1

💰 Partial Profit Booking Strategy:

Book 50% at TP1 = $35.85

Let remaining ride to TP2 = $36.94

Trail SL to lock in profits

⚠️ Breakout Failure Risk

❌ Setup invalid if price closes below $34.36

❌ Avoid entry if breakout lacks volume or fails on retest

🚀 Final Thoughts

✔ Beautiful confluence: Trendline break + horizontal support + reaction zone

✔ Clear risk with strong upside potential

✔ Excellent R/R ratio with breakout confirmation

🔗 #CIVI #NYSE #TrendlineBreak #SupportBounce #SwingSetup #TechnicalAnalysis #ProfittoPath #ChartPatterns #BreakoutTrade #BullishBias #SmartTrading

CIVI trade ideas

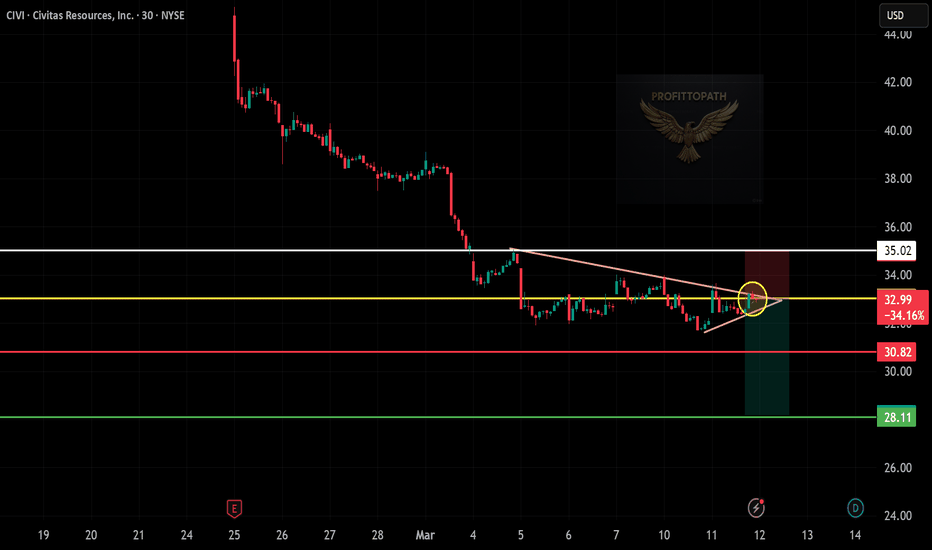

CIVI (Civitas Resources) – 30-Min Short Trade Setup !📉🚀

🔹 Asset: Civitas Resources (CIVI)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bearish Breakdown Trade

📌 Trade Plan (Short Position)

✅ Entry Zone: Below $32.99 (Breakdown Confirmation)

✅ Stop-Loss (SL): Above $35.02 (Invalidation Level)

🎯 Take Profit Targets:

📌 TP1: $30.82 (First Support Level)

📌 TP2: $28.11 (Extended Bearish Move)

📊 Risk-Reward Ratio Calculation

📉 Risk (SL Distance): $35.02 - $32.99 = $2.03 per unit

📈 Reward to TP1: $32.99 - $30.82 = $2.17 (1:1.06 R/R)

📈 Reward to TP2: $32.99 - $28.11 = $4.88 (1:2.40 R/R)

💡 Favorable Risk-Reward Setup – Targeting a 1:2.40 R/R at TP2.

🔍 Technical Analysis & Strategy

📌 Bearish Symmetrical Triangle Breakdown – Price broke below the trendline, indicating further downside potential.

📌 Weak Buying Pressure – Struggling to hold above $32.99, signaling seller dominance.

📌 Volume Confirmation Needed – A strong sell volume spike below $32.99 confirms momentum shift.

📌 Momentum Shift Expected – Breakdown could lead to $30.82, then extend to $28.11.

📊 Key Resistance & Support Levels

🔴 $35.02 – Stop-Loss / Resistance Level

🟡 $32.99 – Breakdown Level / Short Entry

⚪ $30.82 – First Target / TP1

🟢 $28.11 – Final Target / TP2

📉 Trade Execution & Risk Management

📊 Volume Confirmation – Ensure strong selling pressure before entry.

📉 Trailing Stop Strategy – Move SL to breakeven ($32.99) after hitting TP1 ($30.82).

💰 Partial Profit Booking Strategy:

✔ Take 50% profits at $30.82, let the rest run to $28.11.

✔ Adjust SL to breakeven ($32.99) after TP1 is hit.

⚠️ Fake Breakdown Risk

❌ If price moves back above $32.99, exit early to limit losses.

❌ Wait for a strong bearish candle close below $32.99 before an aggressive entry.

🚀 Final Thoughts

✔ Bearish Setup Confirmed – Breakdown signals further downside potential.

✔ Momentum Shift Expected – Watch for volume confirmation.

✔ Favorable Risk-Reward Ratio – 1:2.40 R/R at TP2 makes this a high-quality trade.

💡 Stick to the plan, manage risk, and trade smart! 📉🔥

🔗 #ProfittoPath 🏆 | #TechnicalAnalysis 📉 | #SmartTrading 💰 | #ShortTrade 📊 | #RiskManagement ⚠️

CIVI: Ascending triangle, not confirmed (50,64%)(22/1000)(22/1000)

Ascending Triangle for CIVI.

Not confirmed.

Possible 50,64% gains.

Pros:

1- Bullish Ascending triangle

3- PPS above 50MA and 200MA

3- R/R ratio above 5

4- 250RSI above 50 and ascending

5- 50MA above 200MA

6- 50MA and 200MA ascending

7- RS above 0 and ascending

8- Golden cross in blue

Cons:

1- Pattern Not confirmed yet

2- No descending volume during formation

3- ATR descending, less volatile

Target price is 127,85$.

Stay humble, have fun, make money!

MAAX!

Civintas $CIVI, innovation is not always creating thingsCivintas Resources Inc. is in the Oil & Gas Sector, centered in the Exploration and Production Industry. It should benefit from the current uptrend of oil prices NYMEX:CL1! .

I mentioned innovation because the company is set to "clean up dozens of wells orphaned by others". The state of Colorado has granted this new startegy for NYSE:CIVI to "work hand in hand with landowners and local communities to restore former well sites". This may because of their strategy to protect Colorado’s groundwater resources.

They perform Horizontal Drilling but before, they install multiple layers of cement and steel casing and then performs pressure tests on the well casings. This is a good story funds might see to buy this stock.

Today the price emerge with a strong breakout from a flat base. The base has a 11.48 points of height, TA rules state that the target price after the breakout is to add that up the base, that is at $70.63.

The breakout from today has a gain of 7%, that is far from the pivot so I won't chase it. Also the volume isn't that great. So, as I didn't buy yesterday, I'll wait for a throwback to the previous resistance line and buy there. If it doesn't happens, I'll wait for another opportunity.

$CIVI going short - high confluence, good r:r setupfundamentals: decent fundamentals for a short

sector: XLE at key level (resistance) and already overbought, good short

thesis: horizontal resistance play playing the bounce back down to support

buy confluences: horizontal resistance, no volume above, resistance trendline, poc below, 200MA below, rsi overbought, vortex bulls high bears low (both of them well above the minimum support line they need to be

to bounce), rsi bearish divergence, XLE sector over extended and at resistance - easy short

stop confuences: breaks horizontal resistance zone, breaks all relevant noise wicks, breaks resistance trendline, rsi and vortex will be hugely over extended, will have broken to aths (invalidates my thesis)

risk/reward: risk 1.5%, make 6.9% 1:4.5 conservatively - lovely R R - low risk, decent reward and can run much higher to 12%+ normally

trading plan-

stop: $59.67

tp: $54.73

validation strategy: maybe take profits at TP if happy and market's choppy, if not let it ride with manual trailing which placed as in profit, below key support as high as it wants - let winners run!