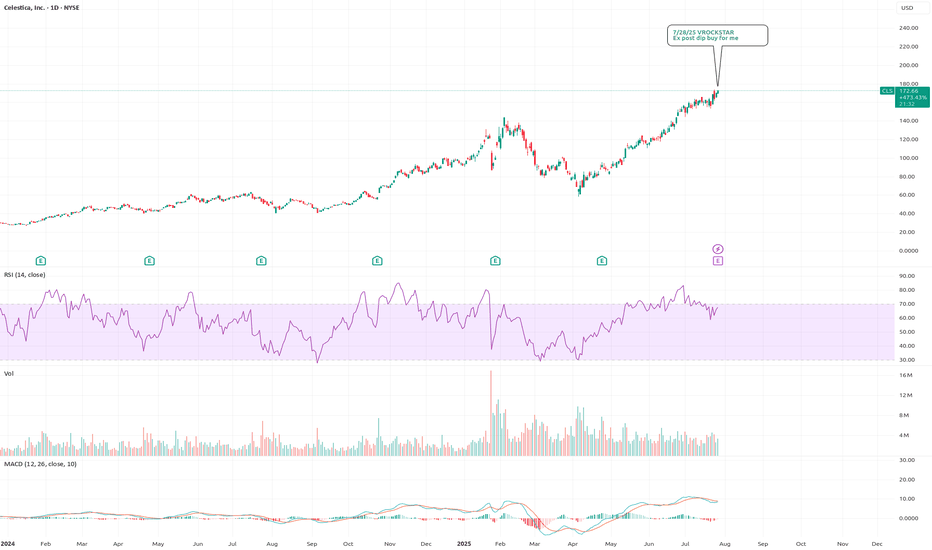

7/28/25 - $cls - Ex post dip buy for me7/28/25 :: VROCKSTAR :: NYSE:CLS

Ex post dip buy for me

- reminds of NYSE:GEV , great product, backlog, growth etc. etc.

- valuation at 2.5% fcf yield, low leverage and mid teens EBITDA for teens EBITDA growth++ is v reasonable

- don't really have an edge here, except to say.. i think any "miss" will quickly get bot and that's where i'd participate

- otherwise i think it's probably a beat/ should head higher all else equal

V

CLS trade ideas

CLS Earnings Play - Bullish Setup (07/28)

📈 **CLS Earnings Play - Bullish Setup (07/28)** 💥

💡 *Earnings Confidence: 75% | Sector: Tech/AI Hardware*

🚀 **THESIS**:

* 🔋 19.9% TTM revenue growth

* ✅ 8-quarter beat streak (avg. +11.5%)

* 📈 RSI > 50D/200D MA → Strong momentum

* 🧠 Sector tailwinds from AI/data infra

* 💬 Analysts lagging price → potential upgrades

📊 **OPTIONS FLOW**:

* 🟢 Calls piling at \$175 (institutions leaning bullish)

* 🛑 Some downside puts at \$170 (hedging only)

* 🧮 IV Rank: 0.65 | Expected Move: ±\$11

🔥 **TRADE PLAN**

> 🎯 **Buy CLS \$175 Call (08/01 Exp)**

> 💵 **Entry**: \$8.80

> 📈 **Profit Target**: \$26.40 (+200%)

> 🛑 **Stop Loss**: \$4.40

> ⏰ **Entry Timing**: *Just before earnings close* (07/30 AMC)

> 💼 **Size**: 2% of portfolio

📉 **Risk**: Moderate IV, downside if earnings miss.

📊 **Reward**: Strong beat history + AI trend = possible upside surprise.

🔔 **Watchlist it now. Execute near close 07/30.**

How Ride the AI Wave in 2025 | Top AI Stocks The AI boom is still making waves on Wall Street

Over the past 15 months, investors have injected more than $ 5 billion into tech sector funds. This surge was fueled by three consecutive interest rate cuts by the Federal Reserve in 2024, coupled with Donald Trump's presidential victory, which led investors to pour over $140 billion into the stock market, hoping tax reforms would boost corporate profits. A significant portion of this activity has been driven by the growing interest in artificial intelligence, with AI driven companies leading a remarkable 25% rally in the S&P 500 this year. Nvidia (NVDA), a key player in the AI sector, has soared 149% in the past year, while major tech firms like Microsoft (MSFT) and its collaboration with OpenAI, and Google’s (GOOG) Gemini project, have also contributed to the rise in stock prices.

The AI market is expected to expand from approximately $540 billion last year to over $1.8 trillion by 2030, with a projected compound annual growth rate (CAGR) of 20% through 2032. In the final weeks of his presidency, Joe Biden's administration introduced new regulations to block the export of US-made semiconductors to adversarial nations, including Russia and China. This move is part of the ongoing AI arms race, with the US aiming to maintain its lead in manufacturing the chips essential for powering AI technology.

AI Stocks: The Only ‘Bubble’ You Want to Be In

North America held the largest share of the global AI market in 2023, accounting for nearly 37%. Europe, Asia Pacific (APAC), and Latin America followed with shares of 25.5%, 24%, and 13.6%, respectively.

Whoever controls AI holds the power and the same is true in the corporate world. AI related stocks, such as Palantir Technologies (PLTR) and Nvidia, delivered triple digit returns and led the market in 2024. Growing investor interest has also made it easier to trade AI focused exchange-traded funds (ETFs), which offer exposure to broader industry themes rather than individual companies. However, performance can vary.

For instance, the Defiance Quantum ETF (QTUM) and the Invesco Semiconductors ETF (PSI) have shown comparable results since 2020, consistently outperforming the broader market.

Meanwhile, the iShares Future AI & Tech ETF (ARTY) has underperformed compared to the S&P 500. So, how can you identify the top AI stocks when certain ETFs are lagging? This is where the Quant Rating System comes in. Quant Ratings combine proprietary computer processing technology with "quantamental" analysis, allowing you to filter out the noise and focus on AI stocks with strong fundamentals that are expected to grow earnings at an above average rate.

Leading AI Companies Worldwide

Major tech giants like Amazon (AMZN), Google, Apple (AAPL), Meta (META), Microsoft (MSFT), and IBM (IBM) have invested billions into AI research to secure a dominant position in this highly profitable space. Whether it's backing high-potential startups like MSFT’s $11 billion stake in OpenAI, or supplying crucial AI hardware such as Nvidia's (NVDA) graphic processing units (GPUs), these companies are striving to stay ahead of competitors.

While generative AI tools like ChatGPT are undeniably shaping the global economy, the potential for significant returns from AI stocks is more nuanced. For instance, Palantir Technologies (PLTR) has dropped over 20% from its all-time high in December, receiving a "hold" rating from Seeking Alpha's Quant system and analysts across Wall Street as of January 9, 2025. Even Nvidia, despite a strong performance in 2024, has seen its stock show signs of stagnation. Other AI stocks are showing signs of potential overvaluation. For example, SoundHound AI (SOUN) recently dropped more than 16%, with analysts highlighting concerns over its unsustainable valuation given its weak fundamentals.

2025 Top AI Stocks

The hype in Silicon Valley can make it challenging to distinguish between AI stocks with long-term potential and those that are overhyped

Our data driven Quant system uses advanced computer processing and proprietary algorithms to analyze thousands of stocks in real time across a range of metrics like value, growth, profitability, EPS revisions, and momentum. To find the top performing AI stocks, I analyzed securities from three leading AI focused ETFs Global X Robotics & Artificial Intelligence ETF (BOTZ), Robo Global Robotics and Automation Index ETF (ROBO), and Global X Artificial Intelligence & Technology ETF (AIQ). From this analysis, I selected six top-performing stocks—three largecap and three small-to-medium-cap (SMID)—which represent the diverse opportunities in the AI space. These stocks, both from tech companies providing AI solutions and non-tech firms utilizing AI to enhance productivity, boast an average levered free cash flow margin of about 18.6% and have returned an average of 60% more than the past 12 months.

1. Twilio Inc

Market Capitalization $16.6B

Twilio, a cloud communications company, has returned nearly 51% over the past year and ranks second in the Top Internet Services and Infrastructure sector, just behind Kingsoft Cloud Holdings. The company’s growth has been driven by stronger revenues, reduced losses, increased cash flow, and the completion of a high-profile ETF investor Cathie Wood’s stake sale. Twilio’s strong Q3’24 earnings suggest it’s well-positioned to capitalize on the growing AI trend well into 2025, with its stock more than doubling since May.

Like many cloud computing companies, Twilio, based in San Francisco, gained prominence during the COVID-19 pandemic but initially struggled with high expenses and slow revenue growth. However, the surge in demand for generative AI, particularly through Twilio's CustomerAI platform which leverages large language models (LLMs) and natural language processing (NLP) to analyze customer data has played a key role in its remarkable recovery.

TWLO Revisions, Momentum, and Valuation

Over the past 90 days, Twilio has seen a remarkable 23 upward revisions to its earnings per share (EPS) and 27 revisions to its revenue projections from analysts, signaling a strong financial rebound. This turnaround is reflected in its ‘A’ Momentum Score, with six-month and nine-month price performances of 93.5% and 81.3%, respectively—both figures vastly outperforming the sector medians by over 1000%. As a result, Twilio has nearly doubled the performance of the S&P 500 in recent months.

Twilio also demonstrates solid growth prospects, with a forward EBITDA growth rate of 50.6% (783% higher than the sector median), year-over-year operating cash flow growth of 520.8% (3,348.45% above the sector median), and an impressive levered free cash flow margin of 107% (603% above the sector median). However, its average forward price-to-earnings (P/E) ratio of 30x indicates that Twilio trades at a premium compared to its peers, nearly 20% higher than the sector median.

2. Celestica Inc

Market Capitalization $12B

Celestica has seen a remarkable 255% increase in its stock price over the past year, driven by its strategic pivot toward AI infrastructure manufacturing. The company has carved out a niche in producing networking switches for data centers, and its Connectivity & Cloud Solutions segment, which makes up 67% of total revenue, has grown 42% year-over-year as tech companies invest more in AI-powered data centers. Its Q3 '24 results highlighted a 22% increase in revenue to $2.5 billion and record adjusted EPS of $1.04.

CLS Valuation, Momentum, and Growth

Celestica stands out for its attractive valuation, even with impressive returns in 2024. With a forward price-to-earnings growth (PEG) ratio of 0.87, the stock appears undervalued compared to its peers. It boasts an ‘A+’ Momentum Grade, having received six upward EPS revisions and eight revenue revisions from analysts in the past 90 days. Its Growth Grade has improved significantly, rising from ‘C+’ to ‘B+’ due to forward EPS growth of 49% and year-over-year diluted EPS growth of 88%, both significantly outperforming the sector median.

3. DocuSign

Market Capitalization $18.3B

DocuSign, known for its electronic signature services, has embraced AI in innovative ways, particularly by adding new AI features to streamline contract agreement processes. These AI-driven tools have helped the company’s stock surge more than 21% following its impressive Q3 '24 earnings, and the growth trajectory is expected to continue in 2025 as DocuSign expands into new markets, both domestically and in Europe. As SA Analyst Noah’s Arc Capital Management notes, DocuSign's AI features have proven invaluable for businesses, simplifying the often complex task of reviewing and managing contracts.

DOCU Growth, Valuation, and Profitability

DocuSign has demonstrated exceptional growth, including an ‘A+’ EBIT growth rate of 239.21% (10,710% above the sector median) and year-over-year diluted EPS growth of 1,852.2% (24,971% higher than its peers). While its overall ‘C+’ Growth Score is somewhat tempered by a low forward return on equity growth forecast of -29.58%, the company’s valuation looks compelling. Its trailing and forward P/E GAAP ratios of 18.6 and 17.9 are 38.6% and 41.5% lower than the sector medians, suggesting that DocuSign's shares are undervalued. Furthermore, its ‘A+’-Rated PEG ratio of 0.01, a 99% difference from the sector median, points to a strong value proposition for investors.

4. FARO Technologies

Market Capitalization $478.2M

FARO Technologies, based in Lake Mary, Florida, specializes in 3D measurement technology and has leveraged AI to establish itself as a leader in "smart factories" and "intelligent automation." Its scanning technology has been instrumental in improving productivity and accelerating production timelines. The company has seen nearly 54% growth over the past six months, benefiting from the expanding global 3D scanning market, projected to grow to $11.85 billion by 2032 at a compound annual growth rate (CAGR) of 13.11%.

In Q3, FARO reported $0.21 of nonGAAP EPS, marking its sixth consecutive quarter of exceeding expectations. This success is part of the company’s strategic plan, which includes the launch of a new line of laser scanners.

FARO Growth and Valuation

FARO's growth metrics stand out, with forward EBIT growth of 112.48%, 1,410.71% higher than the sector median, and an astonishing year-over-year levered free cash flow growth of 24,214.19%, 164,037% above the sector median. The company's forward EBITDA growth of 42.76%, 639.9% higher than the sector median, indicates robust growth ahead.

FARO's stock is undervalued according to its metrics. It has an EV/sales ratio of 1.41, 59% lower than the sector median, and a price-to-book ratio of 1.9, 45% below the sector median, making it an attractive investment at its current valuation.

5. Proto Labs

Market Capitalization $897 M

Proto Labs, a Minnesota-based company, specializes in on-demand manufacturing solutions, enabling businesses to avoid the costs associated with stocking large quantities of products. Despite a recent dip of around 16% in share price, Proto Labs remains a promising investment due to its strong profitability and its impressive cash flow of $24.8 million in Q3 2024, the highest since its 2020 acquisition of 3D printing company 3D Hubs.

Proto Labs has also seen five upward revisions to its EPS and five to its revenue over the last 90 days, signaling stronger-than-expected growth prospects. The company is positioned to benefit from the strong sector tailwinds of the global print-on-demand market, which was valued at $6.18 billion in 2022 and is expected to grow at a CAGR of 25.8% through 2030.

PRLB Valuation

Proto Labs boasts an impressive long-term growth rate of 25%, 119% higher than the sector's 11.4%, and a year-over-year capital expenditure (capex) growth of 74.4%, significantly outpacing the sector's 4.3%. This suggests that Proto Labs is reinvesting a large portion of its cash back into its operations to fuel future growth.

The stock is fairly valued with a forward PEG ratio of 0.06, indicating that it is significantly undervalued compared to its peers, at a 49.3% discount from the sector. Its price-to-book ratio of 1.36 is also an attractive metric, 52.83% lower than the sector median. However, its ‘D’-rated forward and trailing P/E ratios of 39.9 and 48.8, respectively, reflect its recent price decline, leading to an overall Valuation Grade of ‘C’.

6. Freshworks

Market Capitalization $4.9 B

Freshworks, a cloud based SaaS company founded in India, is a strong candidate for a "buy the dip" opportunity. After a rough 2024, shares in Freshworks have begun to rebound, thanks to increasing demand for its AI-enabled software solutions. The company serves over 68,000 customers, including global brands like American Express, Shopify, and Airbus. Its Q3’24 financial results were filled with positive indicators:

- 22% YoY revenue growth to $186.6M

- 21% YoY increase in free cash flow

- Raised full year guidance

- Announced a $400M buyback plan

- Maintains a debtfree balance sheet with strong liquidity

Freshworks also announced a 13% reduction in headcount, which is expected to improve margins further, in addition to the impact of its share repurchase program. The company is poised to benefit from the booming AI SaaS market, which is projected to grow at a CAGR of over 30% by 2031.

FRSH Growth, Valuation, and Momentum

Freshworks boasts an impressive A-’ Growth Score, underpinned by its solid revenue growth and forward revenue expansion of 17.8%, a 221.8% difference from the sector median. The company also has a 3-5 year long-term CAGR of 27.5%, significantly outpacing the sector by 824.2%. Its year-over-year capital expenditure growth stands at 83.3%, signaling reinvestment in future growth.

In terms of valuation, Freshworks has a forward PEG of 1.51, suggesting that the stock is available at a slight discount to its peers. Similar to Proto Labs, its higher-than-average P/E ratios are likely due to its recent dip of around 9.3% over the past month. One of the standout features of Freshworks’ stock is its ‘A’ Revisions Score, which reflects 17 EPS upward revisions and 16 revenue upward revisions in the past three months.

As the AI frenzy continues to dominate Wall Street, some of the valuations of major AI driven companies may be edging into overinflated territory. However,so far my Quant System highlights six ‘Strong Buy’ stocks that still exhibit strong fundamentals. These companies have, on average, risen about 60% over the past year, showcasing strong bullish momentum and solid valuations. For investors looking to integrate AI into their portfolios without succumbing to the hype, these stocks present a promising opportunity

Which AI stock are you loading and why?

New Setup: CLSCLS: I have a swing trade setup. I'm looking to enter long if the stock can manage to CLOSE above the 5SMA. If triggered, I will then place a stop-loss below (SL) and a price target above it(TP-50%,move SL to breakeven), then using the close below the 10SMA as a trailing stop loss.

********

Note: The above setups will remain valid until the stock CLOSES BELOW my set stop-loss level(3).

New Setup: CLSCLS: I have a green setup signal(dot Indictor). It has an good risk-to-reward ratio(RR:). I'm looking to enter long near the close of the day if the stock can manage to CLOSE above the last candle highs(white line). If triggered, I will then place a stop-loss below(SL) and a price target above it(TP-50% and move SL to breakeven).

********

Note: The above setups will remain valid until the stock CLOSES BELOW my set stop-loss level.

MY WATCHLIST: CLSCLS, an IBD50 stock now has a setup signal. Has an excellent risk-to-reward ratio. I'm looking to enter long near the close of the day if the stock can manage to CLOSE above the last candle highs(1). If triggered, I will then place a stop-loss below(2) and a price target above it(3).

CLS Holding at the 50 Fib Pivot Bullish CLS has shown rapid expansion and was well extended past a cup with handle formation and is now forming a base right at the 50 fib pivot level. We saw a pretty healthy retracement and now it is back on track to hit 60’s within the next few weeks. Strong fundamentals and earnings support the idea. Economic data this week will have a potentially large impact on the upward trajectory if the data comes back bearish. Any good news from the Fed will give the stock a push into the 60’s. Giving this Idea a 60% probability of hitting the 60 dollar range by 7/21.

CLS stock in upward trend Stock : CLS ( Celestica Inc )

Date : 27 Mar 2024

Main Trend : Up

preferred Transaction : Buy ( 45.50 $ )

Reasons : The stock is reversed from the support level ( upward trend line again ).

Technical Analysis success at level : 54 $

Technical Analysis fail at level : 39.50 $

🚀 Celestica ($CLS)🌐🔧 Tech Advancements Unveiled! 🔧🌐

🚀 Celestica ( NYSE:CLS ) introduces DS5000 800GbE switch, geared for data center and enterprise access demands. Positioned to thrive in the booming $2.37B digital transformation market (CAGR 18.6% by 2030).

💹 Strategic advantage in a falling Dollar attracts global tech investors. Bullish stance intact, support above $24.00-$25.00, targeting upside at $38.00-$40.00.

#Celestica #TechInnovation #DigitalTransformation #BullishOutlook

CLS is up 135.87% YTD and has lot of upside potentialIt broke through 20.36 which served as major trendline in the past.

Using Fibonacci, 50% lvl is sitting at 44.79 which serves as a critical level.

The supply zone is just above the 50%lvl so my estimate is that will hit the 50% lvl and enter the supply zone. What it does at that point, only time will tell.

I am long on this as long as the price doesn't go below 14.

CLS: Bullish flag, Confirmed (51,12%)(33/1000)(33/1000)

Bullish Flag pattern for CLS. Confirmed

51,12% possible gains.

CLS is part of the S&P Technology sector which is currently showing an upward channel, reinforcing the bullish flag of CLS.

Pros:

1- PPS above 50MA and 200MA

2- RS above 0 and climbing

3- R/R ratio above 5

4- 250RSI above 50 and climbing

5- 50MA above 200MA

6- Both 50MA and 200MA ascending

8- Descending volume during Flag forming

9- Volume during post forming

Cons:

1- No real volume at break out.

Target price is 33.20$

Stay humble, have fun, make money!

MAAX

$CLS July 31, 2023 Game Plan! NYSE:CLS - On Friday, July 28th, 2023, Celestica Inc's stock price rose by 15.05%, from $18.01 to $20.72, with fluctuations between $19.32 and $21.40.

The stock has risen in 8 of the last 10 days and is up by 30.81% over the past 2 weeks. Volume has increased along with the price, which is considered a positive technical sign, with 6 million shares traded for approximately $127.01 million.

The short-term trend indicates a strong rising trend, and further rise is indicated.

Celestica Inc stock holds buy signals from both short and long-term Moving Averages, as well as a buy signal from the 3-month Moving Average Convergence Divergence (MACD).

Support levels are found just below the current price at $18.01 and $16.46, with a medium risk considering the average daily movements and trading volume.

The stock is extremely overbought on the RSI14 (86), but since it has broken the trend up, the chance for a major correction due to high RSI is considered small.

For the upcoming trading day on Monday, July 31st, Celestica Inc is expected to open at $20.48 and could move between $19.84 and $21.60.

Despite several positive signals, Celestica Inc is not considered a strong buy candidate at the current level and is suggested to be a hold/accumulate candidate, awaiting further development.

The technical picture has some small weaknesses, leading to the downgrade of the analysis conclusion from a Strong Buy to a Hold/Accumulate candidate.

CLS BullishPrice gapped up to open yesterday and closed at the .78 fibonacci level after testing the 1 level with a long wick.

In addition the 9 ema crossed the 20 ema and we see a MACD cross starting. Price has made higher highs and higher lows in recent months and D+ crossed D- on the ADX.

Yesterday's long upper wick suggests there could be a pull back today so I will watch the price and look for a possible entry long at the $11.32-$11.10 level.

Targets: 12.05, 13.22, 15.11