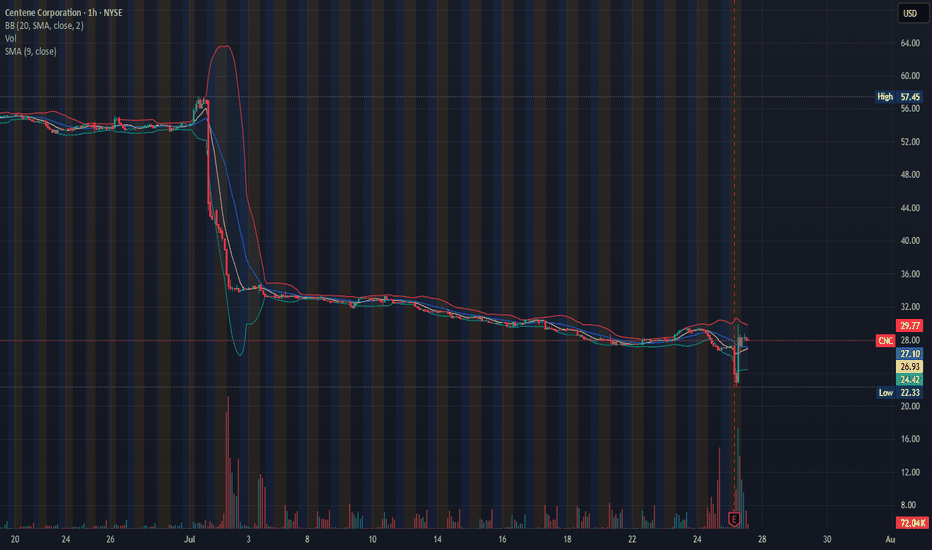

SOMETHING SEEMS NOT RIGHT: INSIDE TRADING?In the early hrs of 07/25/2025, between 6-7 am, right before the earning, the stock plummeted 16.16%. Can you smell inside trading here? because I do. Then, magically, during the earning call, with the promise of a " better future", the stock recovered and gained 6%. If you look for the beginning of the month, when the stock collapsed almost 50% from $57 - $34 you can tell what an empty promise looks like.

CNC trade ideas

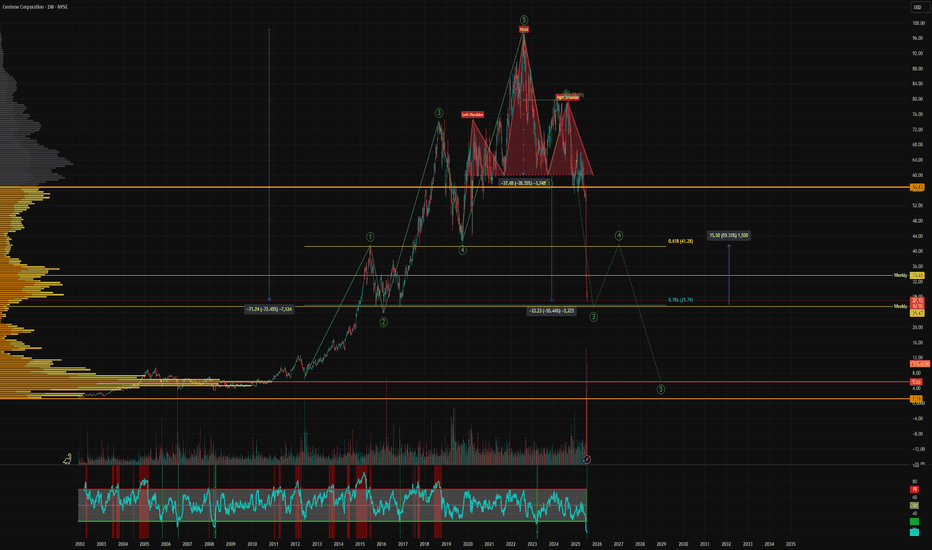

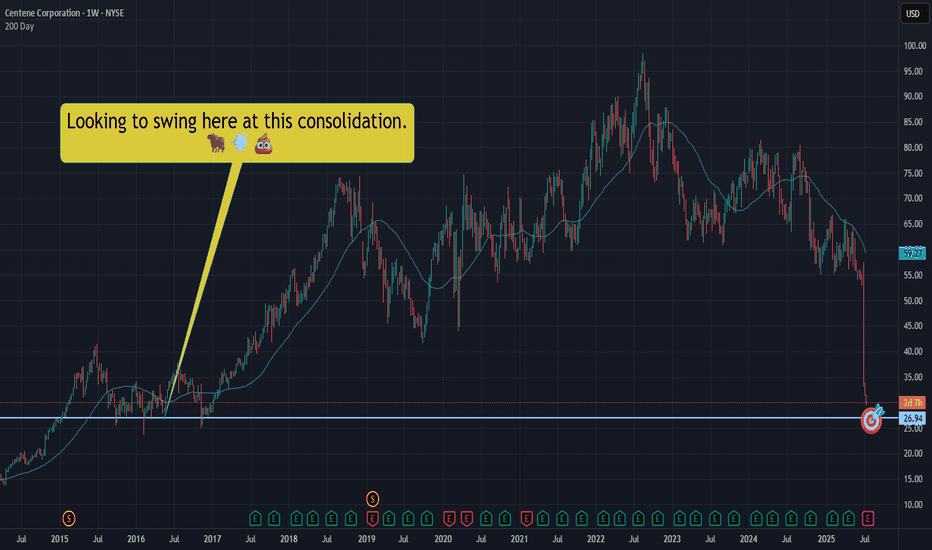

Textbook Head & ShouldersThis looks like an epic wave 3 drop of a larger 5 wave crash, completing a textbook head and shoulders pattern. This is not a stock I'd be looking to be a bag carrier of, but it's peaked my interest as it has the potential of a 59% dead-cat-bounce to the upside. With these types of falling knives you must define your risk and cut your loss if support is lost.

Reasons it could find support - at $25 it has reached a support level from 2014, a whole 10 years ago. A confluence of the weekly level and 0.786 Fib. I must stress, I fully expect this to eventually fail and complete an epic Head & Shoulders pattern down to the Point of Control. We trade the same charts long and short.

Not financial advice, always do what's best for you.

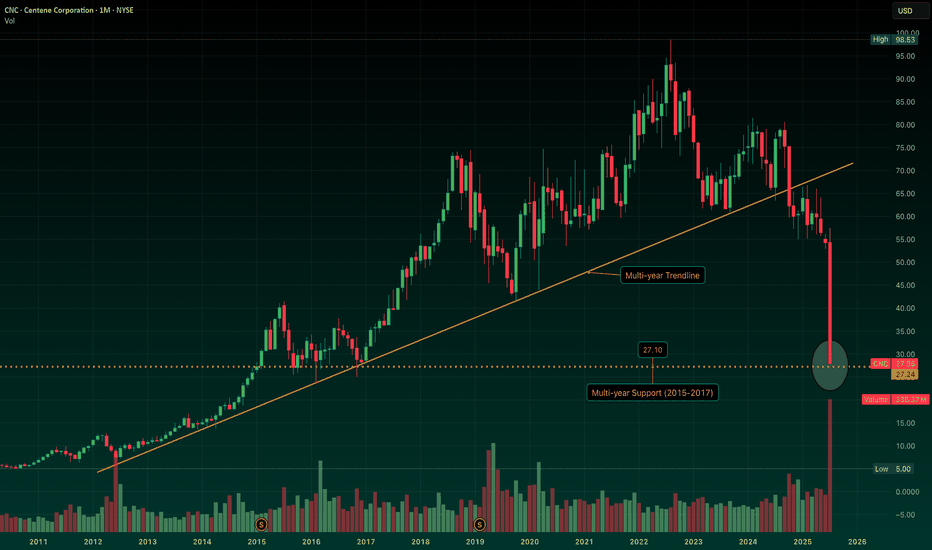

CNC: Strategic Defined Risk LEAPS Entry w/ Room for FlexibilityCNC broke its multi-year trendline months ago, and the recent flush drove it straight into key support from the 2015–2017 range (~$27). Big structural break, but also a spot where longer-term buyers may start stepping in.

As noted earlier, I began building a defined-risk long via 2026 LEAPS (Jun $55s, Sep $50s)... a slow-burn recovery setup targeting stabilization and a re-rating back toward the $50–55 range over time.

Once the dust settles and we get clearer signs of fundamental stabilization, I’ll likely begin layering in short puts at levels I’m comfortable owning. If assigned, great... I lower my basis. If not, the premium helps finance the calls.

This is a long-term rebuild. Not trying to nail the bottom... I’m building around time, structure, and optionality. Giddy up.

Math isn't mathing! Long $CNC for earnings- I'm taking contrarian stance on NYSE:CNC as fears are overdone.

- NYSE:CNC has cash in hand around14 billion and market cap is around 13.5 billion.

- I call bullshit on the market. Math isn't mathing.

- Company isn't going bankrupt. There are headwinds but they will navigate the headwinds and return capital to investors.

- This is not a startup coming out of no where. It has 2 decades of experience navigating difficult times than this in the past be it GFC, Dot Com crash, Covid crash or other bureaucratic hurdles.

CNC|Let's take a swing at a falling dagger! NYSE:CNC slicing through the void, well.... like a falling dagger through a void.

Not trying to catch this bad boi, but we should expect a bounce at some point. Let's swing for a bounce in that $26.90ish area.

This is NOT a YOLO and I hope it's not an "oh no!" Let's keep our wits about us - starter position only. We can add if we need to, but let's just hope we sell and make some quick Christmas money.

THANK YOU FOR YOUR ATTENTION ON THIS MATTER

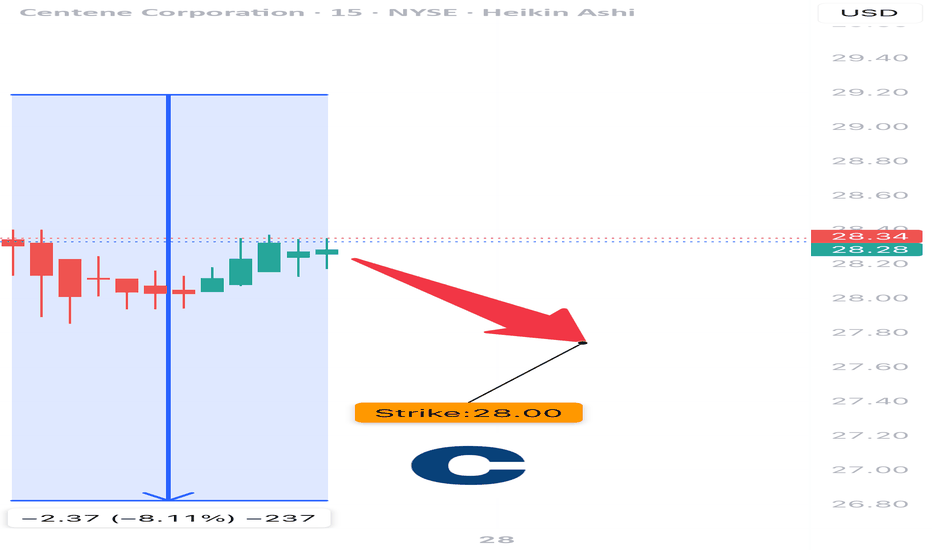

CNC EARNINGS TRADE IDEA – JULY 25, 2025

⚠️ CNC EARNINGS TRADE IDEA – JULY 25, 2025 ⚠️

💊 Healthcare Pressure + Missed Guidance = Bearish Setup for AMC

⸻

📉 Sentiment Snapshot:

• 🚨 Last quarter: Broke 100% beat streak

• 📉 Thin margins + rising medical costs

• 💬 Analyst bias: Neutral to Negative

• 🧮 Fundamentals Score: 4/10

⸻

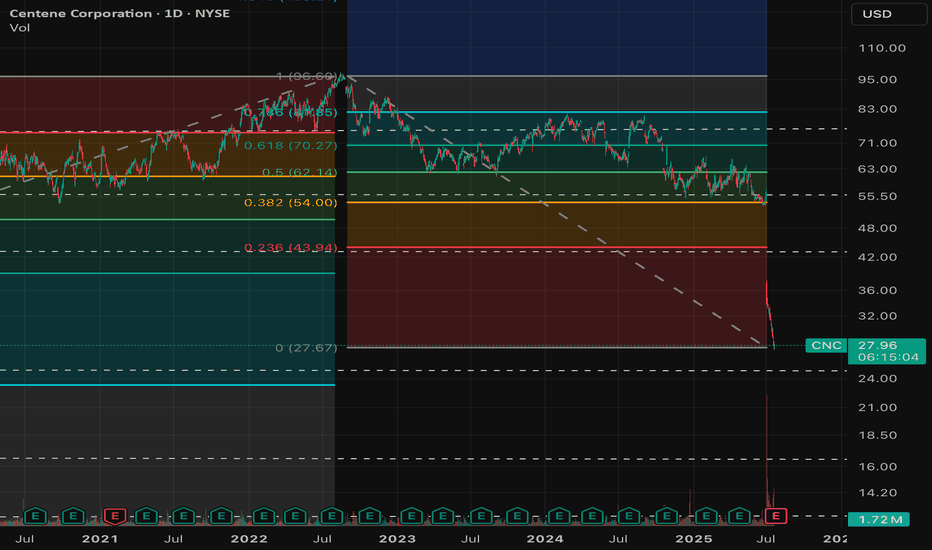

📊 Technical Breakdown:

• 📍 Price: $26.76 (below 50DMA of $48.12)

• 📉 RSI: 32.4 = Oversold but still trending down

• 🛑 Testing 52W Low @ $26.25

• 🔻 Volume = 2.67x Avg → Heavy Distribution

⸻

🧠 Options Flow Insight:

• 🛡️ Heavy institutional put activity @ $28

• ⚠️ Weak call interest = bearish skew

• 📉 IV crush possible post-earnings

• Options Score: 6/10

⸻

🧬 MACRO CONTEXT:

• Rising sector costs crushing providers

• VIX < 15 = complacent market, sharp reactions possible

⸻

✅ TRADE IDEA:

🎯 CNC $28 PUT (0DTE)

💵 Entry: $0.20

🎯 Profit Target: $0.60 (3x 💥)

🛑 Stop Loss: $0.10

📅 Expiry: Today (July 25, 2025)

📈 Confidence: 70%

⏰ Entry Timing: Before earnings (AMC)

📆 Close trade within 2 hours post-earnings

⸻

📍 RISK REMINDER:

• Theta decay will be brutal if flat

• Watch for volatility and potential IV crush

• Ideal exit zone = stock retests $26 support

⸻

💡 Weak guide = collapse risk.

👍 Like & repost if you’re tracking CNC puts tonight!

#CNC #EarningsPlay #PutOptions #HealthcareStocks #OptionsTrading #0DTE #EarningsTrade #TradingView #SPX #GammaRisk

House of Cards CrumblingAnother Healthcare Insurance stock plummeting from it's high. This time it's Centene pulling guidance, this would have been a great short since UNH was the first to do this. Classic head and shoulders pattern formed after the end of the 5 wave move up. The healthcare insurance stocks are tumbling, the house of cards is crumbling.

Does it present an opportunity for a long term investor? Perhaps. From a swing trade idea, if we lose $30-33 then this is tumbling another 25% to the low $20s.

Be careful catching a falling knife. If you are prepared to hold and buy on further dips, it could present an opportunity. As this space continues to crumble, I expect UNH to acquire some of these companies and come out on top. But it could take time for this sector to recover, so patience is required.

Not financial advice, do what's best for you.

Centene Corp | CNC | Long at $35.00Centene Corp NYSE:CNC is a healthcare enterprise providing programs and services to under-insured and uninsured families, commercial organizations, and military families in the U.S. through Medicaid, Medicare, Commercial, and other segments. The stock dropped almost 40% this morning due to recent challenges, such as a $1.8B reduction in 2025 risk adjustment revenue and rising Medicaid costs (leading to withdrawal of 2025 earnings guidance). However, the company has a book value near $56, debt-to-equity of 0.7x (healthy), a current P/E of 5x, and a forward P/E of 9x.

It may be a few years before this stock recovers. But the price has entered my "crash" simple moving average area (currently between $32 and $36) and there is a price gap on the daily chart between $32 and $33 that will likely be closed before a move higher. Long-term, and potentially a new political administration, new life may enter this stock once again as the baby boom generation requires more healthcare services. But holding is not for the faint of heart...

Thus, at $35.00, NYSE:CNC is in a personal buy zone with a likely continued dip into the low $30s or high $20s before a slow move higher (where I will be accumulating more shares). Full disclosure: I am also a position holder in the $60s and cost averaging down.

Targets into 2028:

$45.00 (+28.6%)

$54.00 (+54.3%)

Likely candidate 64 with gaps to fill and trends to bounceGiven the current circumstances, the past 12 months have been exciting, disenfranchising, and failed to meet expectations. It could be dilution, too many acquisitions, an overhaul, or setting expectations for a few years. This stock will take off; the question is how far it can go once it does. For now, a conservative mid-60s may bring us some joy.

Long on CNC. Bullish Wedge. Entering demand zone.Based of technical analysis CNC should reverse and potentially hit or break above resistance. Strong support level of $61. Bullish wedge pattern on weekly timeframe. I see upside for this company due to Trumps presidency and the improvement on healthcare in the US.

Centene Corp | CNC | Long at $65As a managed health care company, Centene Corp NYSE:CNC doesn't get much attention. However, it is an undervalued growth stock. It's been a workhorse historically for slow and steady financial returns with a 3%+ dividend. The biggest dips along my selected moving average have been into the blue lines - which it recently tested. While the stock may close the gap near $62 is the near future, it's a personal buy at $65.

Target 1 = $78.00

Target 2 = $95.00

CNC: bouncing from its 200-day?A price action above 73.00 supports a bullish trend direction.

Increase long exposure for a break above 76.00.

The target price is set at 79.00 (its 23.6% Fibonacci retracement level.

The stop-loss is set at 71.00 its 78.6% retracement).

The price action seems to be bouncing from its 200-dau and 200-week simple moving averages. This can support a bullish long-term trend direction.

CNC: some upside potential?A price action above 75.00 supports a bullish trend direction.

Further bullish confirmation for a break above 79.00.

The profit take is set at 82.00.

The stop-loss price is set at 75.00.

Remains above its 200-day simple moving average, confirming a bullish long-term trend.

The start of upside price momentum further supports the bullish underlying trend.

Centene is BullishCentene posts earnings results pre-market tomorrow

20DMA about to cross the 50DMA. Very strong bullish daily candle today closing near the highs. It's formed a clear cup & handle. Implied price target included.

Watching closely this week.

*No Position but this will have an effect on other healthcare stocks all of which had a strong day today. Humana earnings on Wednesday and Cigna next week

Pull Back FishingCNC is below the neckline of what appears to be a Head and Shoulders pattern.

The 100% level of the downside from the H&S is marked and price is close to the .618 of the possible downside.

Calculated using the distance from the head to the neckline and projected down from the neckline.

Price does not always fall 100% and price can fall further than 100%. A lot depends on when the healthcare sector moves again.

Price is consolidating in a small consolidation zone which could be a bear flag. Flags are neutral until broken.

No recommendation/possible crab but price went a bit below the 1.618 of the 1st leg