CNQ trade ideas

[Long] CNQI added to my CNQ in the morning.

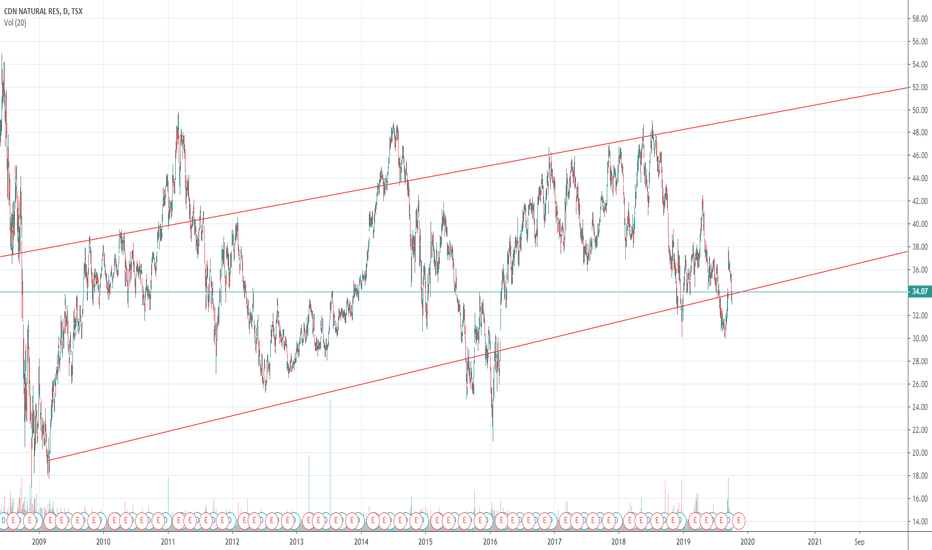

I think it wants to test the monthly trendline in the 34.50 range. Then it could take a break for a few weeks/months, and respond to what the macro data is doing then.

Keep in mind it pays dividends so the chart isn't even adjusted for that, actually much better total returns over time than this chart would suggest.

It is such a strong company fundamentally that when it reaches the target, I think I will keep the shares and sell covered calls against it to manage risk.

On the daily it almost put in a bullish engulfing today:

The buyers are here and it will take a lot of effort to bring this stock (and the energy sector) back down, as long as the Fed is monetizing the US deficit.

Canadian Natural Resources AnalysisCNQ is between two major weekly supply (@ 44.55) and demand (@ 39.82) zones. Considering the trend is down, any relief rallies can be sold until price reaches weekly demand.

At the moment, the weekly downtrend has paused and moved into a ranging environment.

Zones of Interest:

Supply: 45.56 & 47.14

Demand: 40.31

CNQ: The underperformer is gaining some investors attentionI believe that successful trading strategies rely heavily upon identifying consolidation zones. Consolidation zones provide us the right direction of the market. Consolidation happens when a market move sharply upside or downside. Later, a trader can use these consolidation zones to identify patterns, whether it be a continuation or reversal.

It requires attention and care. Rather than turning out to be a factory of producing signals, it is better to sit down and look for a setup. Setups are important because we are planning a trade and execute them on time. If you fail to plan a setup, then you are planning to fail.

Another advantage of trade setup is that we know where to get out and the right time to go in. Know the market. Study the price movements and make your trades.

My charts use price movements, patterns, structures and indicators such as moving averages and oscillators. Trading intelligence is combining multiple knowledge to produce a favorable trade setup and plans.

Canadian Natural Resources Limited (NYSE:CNQ) is another stock that is grabbing investors attention these days. Its shares have trimmed -11.79% since hitting a peak level of $35.28 on Dec. 12, 2016. Meanwhile, due to a recent pullback which led to a fall of almost -4.74% in the past one month, the stock price is now with underperforming -2.38% so far on the year — still in weak zone. In this case, shares are 11.94% higher from $27.8, the worst price in 52 weeks suffered on Jun. 16, 2016, but are collecting gains at -0.83% for the past six months.

Pair Trade - Short CNQ and Long XLEThis is a pair trade idea based on CNQ/XLE pair cointegration. My calculations show that these two stocks diverged by more than 2 standard deviation and, based on mean reversion, should come back to mean. This pair's rolling mean is 28.3 over the last 280 trading sessions. The current value is 23.6 and one standard deviation is 1.8. The trad can be done by shorting CNQ and going long XLE in the proportion calculated through beta. Alternatively, it can be entered as two credit spreads - bear call spread on CNQ and bull put spread on XLE. This is how I will be entering this trade on Monday when the market opens - $CNQ $22/$24 Feb 21 bear call spread for $0.5 cr and $XLE $57/$55 Feb 21 bear put spread for $0.6 cr. Will be watching the bear call side and adjust if necessary.

Canadian Natural Resource Ltd(USA)(NYSE:CNQ) Setting Up For FallThe price of crude oil has been in a downtrend now for about 3 months. With this decline, oil stocks such as Canadian Natural Resource Ltd (USA) (NYSE:CNQ) have also come down in price. In fact, this equity has fallen roughly 13% from its peak back on July 1. However, the thing that really interests me is the pattern that is being formed on the daily chart. It is a head and shoulders pattern, which could see this stock fall all the way down to $33.75 area. While that would be a tremendous return, the most interesting aspect of this trade is the risk reward. Canadian Natural Resource Ltd (USA) (NYSE:CNQ) is hovering right around the neck line, so any close above the line and we stop out for a $0.50 loss. Compare that to a drop of almost $7.00 and you have yourself an amazing return for very minimal risk. Trade set ups like this one are what separates the profitable pro's from the money losing amateurs. So ask yourself which one do you want to be?

If you only read one email again, make sure it comes from the Elite Round Table. Our FREE market emails contain information that can actually make you money. Ask yourself, what email have you read that can do that? Answer = none. Join our list here.

Parm Mann

Elite Round Table

Follow me on twitter: @ParmMannTrader