CS trade ideas

CS – Spiraling Around the DrainGee, Imagine that, another European Insolvent Bank Walking…

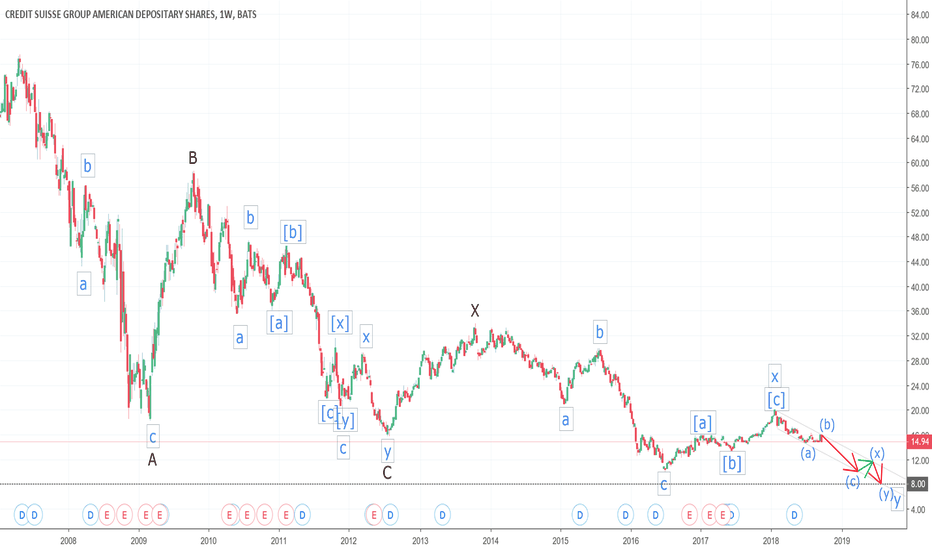

Short Term, Credit Sleaze looks like it is working its way down to $8.

Long Term, Credit Fleas is projecting a massively negative valuations, complements of the massive pile of derivatives they like to play with…

Bank vs. Cryptocurrency #15 (CS)When I pick financial stocks, I always look the highs of 2007-2008

in a past post I comment about leading companies in a Industry and lagging companies in the same Industry

For example in my past post: Bank vs. Cryptocurrency #14 (-COF-)

I comment: this stock now is trading above the 2007 highs this mean this is a leading company in this sector

And in this post, this stock is trading well below the 2008 highs

But this stock have potential even now is trending the last year the stock went up 24%. and with the movement,

the price breakout a key resistance around 15.70 (Red line)

Now is testing a new support in 17.20 (Blue line) is a good entry point, is a retracement in a trend

I use moving averages. I interpret they in discretionary way

My Moving Average Set-up also confirms that is trending

CS: Short term bulling movement spottedI believe that successful trading strategies rely heavily upon identifying consolidation zones. Consolidation zones provide us the right direction of the market. Consolidation happens when a market move sharply upside or downside. Later, a trader can use these consolidation zones to identify patterns, whether it be a continuation or reversal.

It requires attention and care. Rather than turning out to be a factory of producing signals, it is better to sit down and look for a setup. Setups are important because we are planning a trade and execute them on time. If you fail to plan a setup, then you are planning to fail.

Another advantage of trade setup is that we know where to get out and the right time to go in. Know the market. Study the price movements and make your trades.

My charts use price movements, patterns, structures and indicators such as moving averages and oscillators. Trading intelligence is combining multiple knowledge to produce a favorable trade setup and plans.

In the case of CS Two other important profitability ratios for investors to know are both returns-based ratios that measure a company’s ability to create wealth for shareholders. They are return on equity and return on assets.

2nd Shot on CS on Formation of Bullish Signal + PatternWrote 2 CS Jan17 15 Put contracts for .55 each.

Break even - 14.45 (neckline)

Stop - 12.95 (below right shoulder).

Target 1 Reward:Risk - 4.25:1

Plan:

Recieve 1.10 credit.

Get put shares on retest of neckline.

Hold stock and replace stop-loss with costless collar

Lot of upside potential if 14.34 can hold

Inverse (bullish) head and shoulders PT 15This inverse head and shoulders pattern has the same price target as a bull flag that formed recently.

Distance top of head to neckline is 13.67 - 12.25 = 1.42

Giving a price target of 13.75 + 1.42 = 15.17 USD

See the linked idea below for more details, using the chart of the Swiss listing.

Bull flag BreakoutCS formed a bull flag and broke out above, testing the upper resistance, which is now support.

It is a broadening flag.

The price target is around 15.50, which is in the upper part of the trading range (see my previous post for the trading range).

The Swiss listing of Credit Suisse CSGNZ of course shows the same pattern, but it is not broadening:

it suggests the same price target.

Wyckoff Accumulation Phases of Credit SuisseSome remarks on the price evolution of CS

Credit Suisse stock was in a downtrend which ended with a selling climax (SCLX) on February 11 this year. After that CS showed signs of being accumulated. The Brexit vote initiated a huge shake out. During this shake out it broke below its trading range, after which it trended back up into the trading range. Here it tested the 12.56 support twice; once on the Deutsche Bank fine news and also today after CEO Tidjane Thiam said he expects a challenging third quarter. Currently it is in Phase D, or alternatively it might still be in phase B.

Notice the volume peaks on down swings. This is a sign of buying pressure caused by the Composite Operator (or Insiders as Anna Coulling calls them) which buy in the lower end of the trading range, as discussed in the book "A Complete Guide to Volume Price Analysis " by Anna Coulling.

I posted this idea before (linked below).

On that chart you see the On Balance Volume indicator. Notice the explosion of the on balance volume for CS, right after the Brexit. And you know what they say: "volume precedes price".

I also labeled the chart of CSGNZ. Notice the differences in volume, particularly during the selling climax:

Some facts that support the hypothesis suggested by the technical analysis:

STRONG HANDS HOLDING CS

A very large part of CS shares is held by a few very large long-term investors that don't sell on weakness but use it to add to their core position (smart money). In fact they've added just recently. These kinds of buyers and shareholders explain the pattern we see in the CS and CSGNZ charts.

In the last couple of weeks more than 20 percent of Credit Suisse shares is owned by three shareholders:

Harris Associates (with David Herro as fund manager) owns more than 10 percent of shares ( August 22 , 2016).

The Saudi Arabian Olayan Group , through its registered entity Crescent Holding GmbH, holds more than 5 percent of shares and about 5 percent in convertible bonds ( September 12 , 2016) and is/was represented by someone on the board.

The Capital Group holds more than 5 percent of shares ( August 30 , 2016).

www.credit-suisse.com

www.thecountrycaller.com

www.finews.com

Besides these shareholders there is the state fund of Qatar that owns more than 5 percent of shares and about 13 percent in convertible bonds ( June 17 , 2016) and is represented by someone on the board.

Considering the long and intimate relationship of the Qatar state fund and Credit Suisse it is safe to assume they didn't sell in the past 3 months and this would imply no less than 25% of shares being owned by no more than 4 shareholders in the past month.

Another shareholder worth mentioning is the Norwegian Sovereign Fund (Norges Bank), which claimed beneficial ownership the day after the selling climax on February 11 (owning 5 percent of shares on February 12).

These are the shareholders that were required to file a Schedule 13D with the SEC, due to beneficial ownership. But I bet there are a lot of other institutions buying CS without reaching beneficial ownership.

Long & Aggressive Because She Said It's Too Big to FailLooking to get in this trade with a trigger@$15.14 with a stop@14.14

The reason this stop is so aggressive and not below the ALL TIME LOWS is because the stock today closed above a historic support level of $15.14. This means that if 15.14 is broken again then I do not want to be in the trade anyway so I'm willing to tighten up my stop.

What I want the stock to do:

retest this support level, which will trigger me in, and and form a bullish hammer with a long lower wick that that doesn't poke thru the $15.14 support level.

Credit Suisse - CS - Bollinger Band Squeeze + Head and Shoulders1) Bollinger Band Squeeze + breakout

2) Inverse head-and-shoulder pattern (L=29.97, H=16.09, R=30.40; L+(L-H)=44

3) Breakout over declining tops line + retest and uptrend

4) Low volume (volatility on increase in volume)

5) Improved, high accumulation

6) MACD crossover to the upside

7) Overhead resistance currently at 36.00, 39.75, 40.00, 43.50

Credit Suisse - CS - is showing a tight squeeze on its weekly bollinger bands from an inverse head-and-shoulders pattern. Considering its decline from above $60 share in the last several years (Euro Crisis), it has consolidated above 16.00-30/share range. It is starting to break out over multi-year highs. Pattern has it going to about $44/share, or a 33% gain from its current price. Very buyable 32.00-33.00 and over 34.00 (most recent high).