DVA trade ideas

DVA DaVita Options Ahead of EarningsAnalyzing the options chain and the chart patterns of DVA DaVita prior to the earnings report this week,

I would consider purchasing the 175usd strike price Puts with

an expiration date of 2025-2-21,

for a premium of approximately $8.45.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

THC Tenet Healthcare Corp Financial

- Company has grown fast.

- Outperforming the market in general.

- Good outlook for the coming time.

Techinical

- Good risk-reward setup.

- Sector is in favor by many investors.

- Other stocks in the sector are just like this stock outperforming the market and I think this will continue for a while.

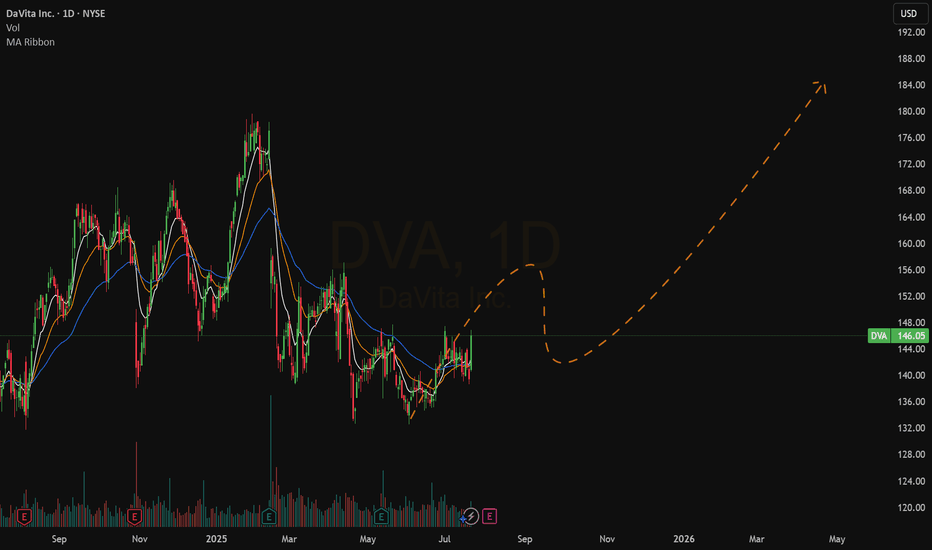

DVA DaVita Inc (Long) Financial

- Company shows great results.

- Company passed the Hanhart fundamental growth test.

- Earnings + outlook + 10%.

- Growth outlook is one of the bests in these times.

Marco

- Company seems to perform well in most market conditions that are coming up.

Techincal

- Company is outperforming the market for a longer time.

- Buyers are making the market place.

- Healthcare, in general, are very common investments in these market times.

- This is one of the most outperforming stocks at the moment so that's why I'm getting on in this point.

DaVita Inc. DaVita Inc. (NYSE: DVA) currently sits at a pivotal point, poised for potential growth. The RSI (14) is neutral at 43.97, indicating neither an overbought nor oversold condition. This neutrality often precedes a directional move, making DVA a prime candidate for a strategic entry.

The stock closed at $137.92, with key support levels identified at $134.28 (S1) and $129.99 (S2) on the pivot chart. Resistance levels are marked at $140.79 (P) and $145.08 (R1). The current price action shows consolidation within the Ichimoku Cloud, suggesting a potential breakout.

Momentum indicators, such as the MACD level of -0.80, are currently bearish, which could indicate a short-term pullback. However, the Commodity Channel Index (CCI) at -115.68 signals a buy, often a precursor to upward momentum. The Stochastic %K (14, 3, 3) at 15.50 also suggests a buy, reflecting a potential bottoming pattern.

DVA’s volume profile shows an average of 979.97K over 30 days, with recent upticks suggesting increased interest. The stock’s exponential moving averages (EMAs) show resistance at the 50-day EMA ($138.72) and support at the 200-day EMA ($122.67).

Given the technical setup, a long position is recommended if DVA breaks above $140.79 with strong volume, targeting the $146.07 price prediction within the next quarter. Set a stop loss at $134.28 to mitigate downside risk.

For shorting opportunities, wait for a breach below $134.28 with a target of $129.99. Use a tight stop loss at $137.92 to limit potential losses.

Conclusion:

DaVita Inc. presents a compelling trading opportunity. The blend of neutral RSI, bullish momentum indicators, and consolidation within the Ichimoku Cloud suggests a breakout is imminent. Monitor volume and price action closely to capitalize on this potential move.

DaVita (DVA) AnalysisLeading Dialysis Service Provider:

DaVita NYSE:DVA stands as a top kidney dialysis service provider in the U.S., demonstrating strong resilience post-COVID-19. CEO Javier Rodriguez emphasized the company's strengthened position and continued investments in staff and systems.

Expansive Market Potential:

With 40 million Americans affected by kidney disease, the dialysis market is valued at an impressive $100 billion. DaVita, as a major player, serves a significant portion of the 786,000 people requiring dialysis or transplants annually.

Financial Performance:

DaVita boasts a robust financial performance with a remarkable 53% Return on Equity (ROE) over the past five years, indicating effective value creation and investor capital management.

Investment Outlook:

Bullish Outlook: We are bullish on DVA above the $125.00-$126.00 range.

Upside Potential: With a target set at $195.00-$200.00, DaVita’s strong market position and impressive financial metrics suggest strong growth potential in this essential healthcare sector.

📊🩺 Stay tuned for promising investment opportunities with DaVita! #DVA #HealthcareServices 📈🔍

DVA LONG 041824I understand there may be some noise in the market regarding weight loss drugs, as such it has created a bit of a rift in prices of healthcare services relating to patient diets, lifestyles and procedures, could also be COVID lag/residue etc.

At this time however the Senior Living sector is expected to grow in America substantially in the next decade, thusly dialysis will continue being at the forefront of our carbonated sugary beverage society, diet or not otherwise.

I like taking a long here for DVA as it reached a substantial pocket of fair value.

Target Profit 136-138 per share.

Happy Trading,

DaVita (DVA) Stock Spike on Hope for Chronic Kidney Disease CureDaVita ( NYSE:DVA ) stock witnessed a significant surge as Novo Nordisk (NVO) unveiled promising results from its weight-loss drug study, offering newfound hope for patients battling chronic kidney disease. The groundbreaking findings have ignited investor optimism and reshaped the landscape for dialysis companies like DaVita and Fresenius Medical Care (FMS).

Novo Nordisk's Study Breakthrough:

Novo Nordisk's study, known as Flow, demonstrated that a weekly dose of semaglutide, the weight-loss drug, substantially reduced the risk of death for chronic kidney disease patients by an impressive 24%. This revelation dispels concerns that weight-loss drugs might diminish the need for dialysis machines, reaffirming the critical role of companies like DaVita in kidney disease treatment.

Market Reaction and Stock Performance:

The announcement sent shockwaves through the market, propelling DaVita stock up by 7.1% to 134.65, while shares of rival dialysis company Fresenius Medical Care (FMS) also surged by 11.2%. Despite Novo Nordisk's stock dipping by 2.6%, the implications of the study have set a positive tone for the future of kidney disease treatment.

Semaglutide's Potential Approval:

With the encouraging results from the Flow study, Novo Nordisk is poised to seek FDA approval for semaglutide as a treatment for type 2 diabetes and chronic kidney disease. If approved, semaglutide would mark a groundbreaking advancement, potentially becoming the first drug in its class to gain approval for this purpose.

Market Outlook and Future Prospects:

The positive momentum in DaVita stock signals an extension of its breakout trajectory, with shares approaching record highs achieved in mid-2021. Novo Nordisk's executive vice president for development, Martin Holst Lange, expressed excitement about semaglutide's potential to revolutionize kidney disease treatment, particularly for the significant percentage of type 2 diabetes patients grappling with chronic kidney disease.

Competition and Industry Dynamics:

As Novo Nordisk vies for FDA approval, its chief rival, Eli Lilly (LLY), remains a formidable competitor with its drug tirzepatide. The evolving dynamics in the pharmaceutical landscape underscore the fierce competition and relentless pursuit of innovation in the quest to address the unmet needs of patients with chronic conditions.

Conclusion:

In conclusion, Novo Nordisk's groundbreaking study represents a pivotal moment in the fight against chronic kidney disease, offering renewed hope and optimism for patients and investors alike. With DaVita and Fresenius poised to play a central role in delivering care to those in need, the future holds promising prospects for advancements in kidney disease treatment and improved outcomes for patients worldwide.

A 80% edge - Mostly unused. Why?The Medianline/Pitchfork Tool provides a high probability (~80%) to reach the Centerline from any parallel line.

That means, if you can figure out how to buy as low as possible, or short as high as possible, your trade works out ~80% of time.

Why would one not use this edge?

Ask me questions, I'l answer.

FlagEarnings 2-22 AMC.

Price has broken up from a triangle and looks to be forming a flag.

Earnings close and there has been some Medicare reimbursement issues which could affect earnings.

No recommendation.

EPS (FWD)

6.40

PE (FWD)

12.96

Div Rate (TTM)

-

Short Interest

3.04%

Market Cap

$7.47B

DaVita Inc. provides kidney dialysis services for patients suffering from chronic kidney failure. The company operates kidney dialysis centers and provides related lab services in outpatient dialysis centers. It also provides outpatient, hospital inpatient, and home-based hemodialysis services; owns clinical laboratories that provide routine laboratory tests for dialysis and other physician-prescribed laboratory tests for ESRD patients; and management and administrative services to outpatient dialysis centers. In addition, the company provides disease management services to 16,000 patients in risk-based integrated care arrangements and 7,000 patients in other integrated care arrangements; vascular access services; clinical research programs; physician services; and comprehensive kidney care services. As of December 31, 2021, it provided dialysis and administrative services in the United States through a network of 2,815 outpatient dialysis centers serving approximately 203,100 patients; and operated 339 outpatient dialysis centers located in 10 countries outside of the United States serving approximately 39,900 patients. Further, the company provides acute inpatient dialysis services in approximately 850 hospitals and related laboratory services in the United States. The company was formerly known as DaVita HealthCare Partners Inc. and changed its name to DaVita Inc. in September 2016. DaVita Inc. was incorporated in 1994 and is headquartered in Denver, Colorado.

Symmetrical TriangleGap overhead.

Gaps can cause resistance at both the top and the bottom of the window.

Triangles are neutral until broken.

EPS (FWD)

6.40

PE (FWD)

11.38

Div Rate (TTM) * 0

Short Interest

3.45%

Market Cap

$6.56B

DaVita Inc. provides kidney dialysis services for patients suffering from chronic kidney failure. The company operates kidney dialysis centers and provides related lab services in outpatient dialysis centers. It also provides outpatient, hospital inpatient, and home-based hemodialysis services; owns clinical laboratories that provide routine laboratory tests for dialysis and other physician-prescribed laboratory tests for ESRD patients; and management and administrative services to outpatient dialysis centers. In addition, the company provides disease management services to 16,000 patients in risk-based integrated care arrangements and 7,000 patients in other integrated care arrangements; vascular access services; clinical research programs; physician services; and comprehensive kidney care services. As of December 31, 2021, it provided dialysis and administrative services in the United States through a network of 2,815 outpatient dialysis centers serving approximately 203,100 patients; and operated 339 outpatient dialysis centers located in 10 countries outside of the United States serving approximately 39,900 patients. Further, the company provides acute inpatient dialysis services in approximately 850 hospitals and related laboratory services in the United States. The company was formerly known as DaVita HealthCare Partners Inc. and changed its name to DaVita Inc. in September 2016. DaVita Inc. was incorporated in 1994 and is headquartered in Denver, Colorado.

Dialysis is not going away unfortunately.

No recommendation.

Pull Back FishingSymmetrical Triangle/neutral until broken.

Gap down after an earnings miss and a bad news event.

An Ohio court ruled in favor of an employer benefits plan run by Marietta Memorial Hospital surrounding out-of-network dialysis care. DaVita had argued that the plan violated federal law by not having an in-network option for dialysis and instead steered patients towards Medicare, which has lower reimbursement rates.

My first and Worst job was in this field. We all have one )o:

Dialysis is not going away. People who need it can not live without it, so it will always be covered.

No recommendation.

Bottoms are difficult to get off of much of the time. 3 year low is 62.20. ATL 0.69.

DaVita Inc. provides kidney dialysis services for patients suffering from chronic kidney failure. The company operates kidney dialysis centers and provides related lab services in outpatient dialysis centers. It also provides outpatient, hospital inpatient, and home-based hemodialysis services; owns clinical laboratories that provide routine laboratory tests for dialysis and other physician-prescribed laboratory tests for ESRD patients; and management and administrative services to outpatient dialysis centers. In addition, the company provides disease management services to 16,000 patients in risk-based integrated care arrangements and 7,000 patients in other integrated care arrangements; vascular access services; clinical research programs; physician services; and comprehensive kidney care services. As of December 31, 2021, it provided dialysis and administrative services in the United States through a network of 2,815 outpatient dialysis centers serving approximately 203,100 patients; and operated 339 outpatient dialysis centers located in 10 countries outside of the United States serving approximately 39,900 patients. Further, the company provides acute inpatient dialysis services in approximately 850 hospitals and related laboratory services in the United States. The company was formerly known as DaVita HealthCare Partners Inc. and changed its name to DaVita Inc. in September 2016. DaVita Inc. was incorporated in 1994 and is headquartered in Denver, Colorado.

Possible Targets but are guesstimates. IT is difficult to do targets on a symmetrical triangle that is not broken due to the slope and the targets are calculated using the point of the break.

DVA - 52-week Low followed by 2 Up Weeks - Bullish Pattern3-weeks ago DaVita Inc (DVA) recorded a 52-week Low & has just posted 2 consecutive up weeks. Historically, following this type of weekly reversal pattern, DVA had a tendency to continue this upward move (7-week interval).

7-week average return of 9.39%, win rate of 12 from 12, standard deviation 6.36%.

Disclaimer: This data is not financial advice. Past performance is not a guide to future performance and may not be repeated. Past performance does not diminish the 'risk' expectancy of any strategy. By its very nature ‘risk’ means you could and most likely will experience losses. No representation or warranty is given as to the accuracy or completeness of any information provided. Data is for educational and informational purposes only.