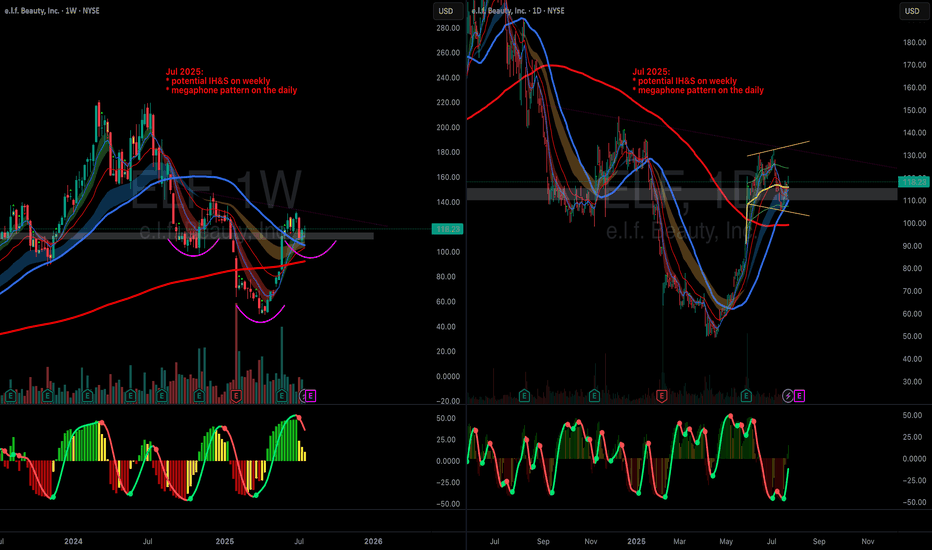

ELF next leg up

NYSE:ELF bounced off of the 50 DSMA and inside a megaphone pattern on daily.

Also, looking at the weekly, there is an Inverse head and shoulder pattern in the making with the current price action forming the right shoulder...

Looking for a continuation move higher here... targets 140 & 150

ELF trade ideas

ELF Beauty Options Ahead of EarningsAnalyzing the options chain and the chart patterns of ELF Beauty prior to the earnings report this week,

I would consider purchasing the 85usd strike price Calls with

an expiration date of 2025-5-30,

for a premium of approximately $5.85.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

$ELF Beauty – Time to Conceal or Reveal?

Bullish Scenario:

Trend Reversal in Play: The stock has reversed and is trading above all major moving averages — the classic sign of a trend reversal.

PMO has a strong bullish crossover and is rising sharply. RSI is at ~60 and climbing — healthy momentum without being overbought.

Next Resistance: Price is aiming for the $88.89 zone — a clean trendline and horizontal resistance. Breaking and closing above that would open up a gap fill toward $121.16.

Volume Profile: There's a volume vacuum above $90 — if price enters it, it could fly quickly toward $100+ due to lack of supply.

Trigger: Breakout above $88.89

Target: $100 → $121

Support on pullback: $76.78 → $70.46

Bearish Scenario:

Rejection Risk at Downtrend Line: The $88.89 level is not just a horizontal resistance, it also aligns with the long-term downtrend line — rejection here would be meaningful.

Gap Below: There’s unfilled liquidity down to $70–$72 — any break below $76.78 could flush price into that gap.

Volume Resistance: Heavy red volume bars stack up from $90 to $121 — any lack of strong buying could stall the rally hard.

Trigger: Rejection at $88.89 + close below $76.78

Target: $70 → $65

Invalidation of uptrend: Breakdown below $69.47

Current Inclination: Bullish Bias

Price is trending up with strong volume, good distance from moving average cluster, and confirmation from PMO and RSI.

We’re in early breakout phase — not full-blown trend yet, but momentum favors more upside.

Risk lies only if $88.89 acts as a brick wall again

SUPER WHOLESALE E.L.F.This company's financials are impressive from a profit perspective alone. (Currency: USD)

Key Metrics (Q2'23–Q3'24):

Total Revenue (TTM): $1.30B

Gross Profit (TTM): $885.23M

Q3'24 (Dec 2024): Revenue $355.32M (+31.14% YoY), Gross Profit $246.21M (+36.77% YoY)

Q1'24 (Jun 2024): Revenue $324.48M (+49.99% YoY), Gross Profit $220.15M (+49.83% YoY)

Strong YoY growth across quarters.

3 Reasons We've Been Buying Up Shares Of e.l.f. BeautyAs generalist investors, we go where the opportunities are. While we've typically avoided fashion and beauty stocks due to constantly changing consumer trends, e.l.f. Beauty NYSE:ELF has recently captured our attention and investment dollars.

Three Key Reasons We're Buying:

1. Impressive Growth

We've been impressed by ELF's revenue expansion from $266 million in 2020 to over $1.3 billion today. Their 23 consecutive quarters of increasing sales and market share demonstrates the kind of product-market fit we look for, and with 5.6 million loyalty program members and a widely-downloaded app, their digital strategy is clearly working. We're particularly encouraged by their omnichannel success, achieving #1 status at Target and climbing to #2 at Walmart.

2. Strong Margins

We place high value on ELF's 71%+ gross margins, which have steadily improved since 2022. This margin expansion signals operational efficiency and scale benefits we love to see. Their gross profits have more than tripled to $925 million in just three years – no mean feat in a highly competitive environment.

3. Attractive Valuation

Finally, after the recent selloff, we believe ELF offers compelling value. At 26x forward P/E for a company with 40%+ YoY growth and robust margins, we see this as an attractive entry point despite near-term headwinds.

Risks we're monitoring include potential sales deceleration, shifting consumer preferences, recent bottom-line concerns, and their reliance on social media platforms for marketing momentum. Tariffs could also impact things, although we'll see how those shake out.

Overall, ELF's combination of growth, margins, and the current valuation presents an opportunity too good to pass up. We're buyers at these levels.

e.l.f. Beauty Aims for a Stunning $147.59e.l.f. Beauty Inc. (ELF) has recently experienced a significant pullback, with its stock price decreasing by approximately 20.91% over the past month, currently trading around $70.68. This decline has created a gap at the $63 level, presenting a potential buying opportunity for investors.

Analyst sentiment remains positive, with a consensus rating of "Moderate Buy" among 18 analysts. The average 12-month price target is $132.94, indicating a potential upside of approximately 87.89% from current levels. Price targets range from a low of $70.00 to a high of $250.00, reflecting confidence in the company's growth prospects.

marketbeat.com

Technically, a breakout above the $98.50 level would signal renewed bullish momentum, positioning the stock to target the $147.59 resistance level. This trade setup offers an attractive risk-to-reward ratio, with a stop-loss set at $57.91 to manage downside risk.

e.l.f. Beauty's strong brand recognition, innovative product offerings, and effective marketing strategies have contributed to its market share expansion in the cosmetics industry. The company's focus on affordability and quality appeals to a broad consumer base, supporting its revenue growth and profitability.

This combination of technical setup and fundamental strength supports a bullish outlook for ELF, with a potential move toward the $147.59 resistance level.

NYSE:ELF

Elf - not looking prettyA breakdown of the neckline confirmed the head & shoulders pattern on this stock. Elf Beauty is not looking very pretty here post earnings. My short was activated at loss of support at $97.94. There is a potential support at $63.88. If we get a bounce here, I may close 50% of my position. I expect the final target of $43 to be reached at some point. The RSI is heading down, I also expect a complete reset.

The Grand Supercycle has peaked with a classic double top and head and shoulders pattern. Be careful buying the dip if you believe in this company, this is a powerful downtrend. We also shorted Celsius using similar TA.

Not financial advice, do what's best for you.

2/7/25 - $elf - I bought $66 AH, BUT... nuanced2/7/25 :: VROCKSTAR :: NYSE:ELF

I bought $66 AH, BUT... nuanced

- this will become a name i follow/ comment on a A LOT more in the coming year

- sub 20x PE is already "value", but it's not "obvious"

- it's not obvious for the simple reason that we don't have a resolution on growth trends until we see more scanner data and another quarter

- while new launches (product, doors e.g. Wmt, DG and geos) should bode well for a brand that is gaining share - and honestly - share gains are more important than category softness... we need more data

- in this tape, unfortunately, this type of reaction is "justified" as silly as it looks

- if you zoom out, the mgns remind me of HQ software, and it's not unreasonable to say put 5x on 1.5 bn of fwd year sales and get to 7.5 bn EV which puts this stock at closer to $135 in a 12-18 mo time frame.

- given stock is at mid 60s, that's nearly a 2x, even risk adjusted

- MIND THE GAP in the low 60s, given the first one (in the mid 80s) filled - see the gray horizontal bars on this chart.

TL;DR... downside likely 15-20% (and probably market-related in the short-term just "fine") and upside probably also 10-25%... so BALANCED. but all else equal, the upside is much more (and possibly has the ability to compound). so the stock *is* a buy here, but it needs to be risk adjusted and ST expectations tempered. I'm at 2% and will park here. as you know i've been stacking high cash (40% of book as of last night), and this is a good parking spot. i won't be trading this one around, just adding each 5% lower.

V

Decent technical spot to enter a long on ELF cosmeticsLooks like a decent spot to go long here with a tight stop.

Enter $85

Stop Loss $74

TP1 $124

TP2 $169

Pros

RSI Oversold

Bollinger Band Oversold

Fibonacci Golden Pocket means good spot for reversal

200 week moving average can act as support

Cons

Tariffs

Large Head & Shoulders pattern with neckline broken

Unknowns

Earnings on Thursday 2/6

ELF - Bullish Cross of the 50 SMA / 100 SMAELF sells quality cosmetics for less than the better known brands. I've ask a few women about ELF brand and they seem to love this company. I'm just a guy, but when I hear this kind of enthusiasm for a company I never heard, I had to check it out.

The chart looks compelling and has given us a buy signal on Jan 7th. They beat estimates last quarter and I believe they are going to do that again on 2/5.

e.l.f. Beauty, Inc. is a holding company, which engages in the provision of inclusive, accessible, clean, vegan and cruelty free cosmetics and skin care products. The company focuses on the e-commerce, national retailers and international business channels. Its brands include elf, elf skin, WELL People and KEYS soulcare. The company was founded in 2004 and is headquartered in Oakland, CA.

This is not investment advice, I'm just a village idiot that likes to think out loud.

Beautiful Gainse.l.f. Beauty is showing strong bullish momentum, with a gap forming around the $109.00 level. A breakout above the $147.33 daily resistance would confirm continued strength, positioning the stock to target the $218.94 resistance level. This trade offers an excellent risk-to-reward ratio, with downside risk managed via a stop-loss at $107.14.

As a leader in affordable, high-quality beauty products, e.l.f. has positioned itself as a go-to brand for value-conscious consumers. The company’s focus on innovation, digital marketing, and expanding its product line has driven consistent growth and strong financial performance. With increasing consumer demand for accessible beauty solutions and its ability to capture market share, e.l.f. Beauty is well-poised for long-term upside.

This combination of technical momentum and robust market fundamentals supports a bullish push toward $218.94, making ELF a compelling opportunity for traders and investors alike.

NYSE:ELF

$ELF ON SALE!? Clearance Tags!?Weekly market analysis suggests a positive trend:

The current weekly price of $14 is below the average trading price, indicating a potential buying opportunity. Additionally, the 4-hour Stochastic Oscillator is showing an increase in bullish momentum. This could be a sign of a reversal in the market, making it a good time to consider a bullish outlook.

Would you agree with this assessment or do you have a different take on the market? Share your thoughts in the comments below!