Natural Gas - The Epic Reversal? Natural gas had an astonishing move to the upside. Closing up over 5% today.

This volatility can make all tarders head spin if youre not used to it.

Why did Nat gas pop today?

Partly from being oversold and into really good technical support, Natural gas inventories were released today at 10:30am.

The inventories showed a smaller build than the market expected which implies stronger demand. 56B consensus vs 53B actual.

This could potentially be the start to a new bullish trend.

Names like EQT & AR hit some major support today. Some call options on these names have been accumulated.

EQT trade ideas

NATURAL GAS - Who can Predict this wild beast?Natural gas got demolished today, down over 8%.

The one headline we saw hitting the tape that is having some partial influence:

"Vessel Arrives at LNG Canada to Load First Cargo, Strengthening Global Supply Outlook – LNG Recap"

Today, we did hedge our core long UNG position with a short dated $56 put on EQT.

We are already green on that trade and looking for $56 level to come into play.

Natural gas volatility sure trades in a world of its own which is why it is key to size accordingly.

Natural Gas - Silver Lining!Natural gas is ending the day with a daily bottoming tail.

Potentially forming an inverse head and shoulder pattern that takes us above the key $3.83 level.

We took profits on our EQT put hedge! The put contract went up over 100%

Lets see if Nat gas can build some pressure.

EQT – 30-Min Long Trade Setup!📈

🔹 Ticker: EQT (NYSE)

🔹 Setup Type: Triangle Breakout + Support Retest

🔸 Breakout Price: ~$53.84

📊 Trade Plan (Long Position)

✅ Entry Zone: $53.70–$53.90 (breakout above yellow zone)

✅ Stop Loss (SL): Below $53.13 (white structure support)

✅ Take Profit Targets:

📌 TP1: $55.00 (red zone – short-term resistance)

📌 TP2: $56.27 (green zone – prior swing high)

📐 Risk-Reward Analysis

📉 Risk:

$53.84 - $53.13 = $0.71

📈 Reward to TP1:

$55.00 - $53.84 = $1.16 → 1.63:1 R/R

📈 Reward to TP2:

$56.27 - $53.84 = $2.43 → 3.42:1 R/R

🔍 Technical Highlights

📌 Breakout from symmetrical triangle (pink lines)

📌 Bullish bounce from rising support trendline

📌 Yellow zone acting as breakout retest zone

📌 Clean upside potential with volume holding

⚙️ Trade Management Strategy

🔄 After TP1:

— Move SL to breakeven

— Lock partial profits

📈 Let the rest run toward TP2 with a trail stop

⚠️ Setup Invalidation

❌ Breakdown below $53.13

❌ Weak follow-through above yellow zone

❌ Volume drop post-breakout

$EQT - BREAKOUT INCOMING LONG TERM BULLISHEQT Corp. is a leading natural gas production company that's been around for over 135 years! Founded in 1888, this Pittsburgh-based company specializes in providing supply, transmission, and distribution of natural gas.

Whether you're interested in the energy industry or just want to learn more about a company with a rich history, EQT Corp. is definitely worth checking out.

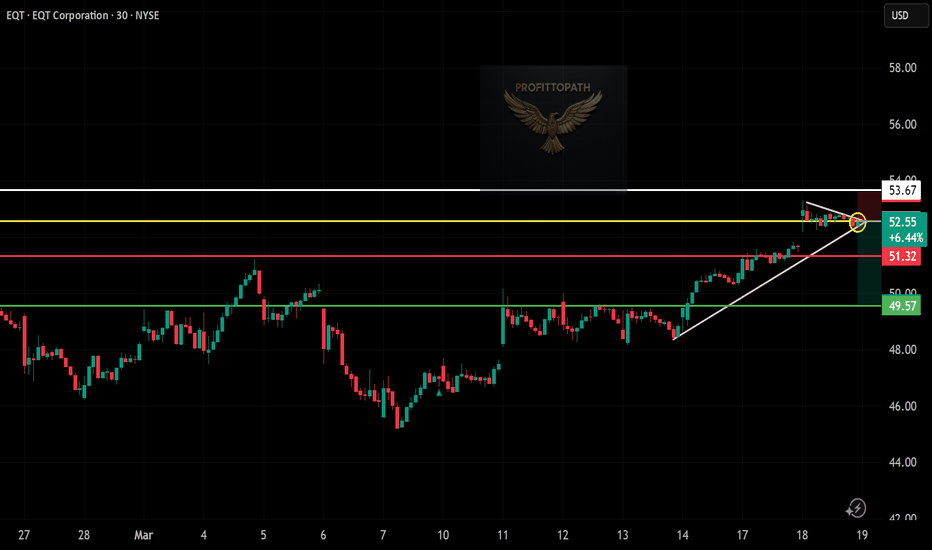

EQT (EQT Corporation) – 30-Min Short Trade Setup! 📉🚨

🔹 Asset: EQT – NYSE

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bearish Breakdown (Rising Wedge Reversal)

📊 Trade Plan (Short Position)

✅ Entry Zone: Below $52.50 (Breakdown Confirmation)

✅ Stop-Loss (SL): Above $53.67 (Key Resistance Level)

🎯 Take Profit Targets

📌 TP1: $51.32 (Support Level)

📌 TP2: $49.57 (Extended Bearish Move)

📊 Risk-Reward Ratio Calculation

📉 Risk (SL Distance):

$53.67 - $52.50 = $1.17 risk per share

📈 Reward to TP1:

$52.50 - $51.32 = $1.18 (1:1.01 R/R)

📈 Reward to TP2:

$52.50 - $49.57 = $2.93 (1:2.5 R/R)

✅ Favorable Risk-Reward Ratio toward TP2

🔍 Technical Analysis & Strategy

📌 Rising Wedge Breakdown: The price is forming a bearish pattern, indicating weakness and potential reversal.

📌 Resistance at $53.67: A key level acting as a rejection point.

📌 Support at $51.32: If price breaks below this, expect further downside toward TP2.

📌 Volume Confirmation Needed: Look for above-average selling volume below $52.50 for confirmation.

📉 Trade Execution & Risk Management

📊 Volume Confirmation: Ensure strong selling volume below $52.50 before entering.

📉 Trailing Stop Strategy: Move SL to break-even ($52.50) after hitting TP1 ($51.32).

💰 Partial Profit Booking Strategy

✔ Take 50% profits at TP1 ($51.32), let the rest run toward TP2 ($49.57).

✔ Adjust Stop-Loss to Break-even ($52.50) after TP1 is reached.

⚠️ Risks & Considerations

❌ Fake Breakdown Risk: If the price reclaims $52.50, exit early.

❌ Confirmation Required: Wait for a 30-min candle close below $52.50 before entering.

🚀 Final Thoughts

✔ Bearish Setup – Strong downside potential.

✔ Momentum Shift Possible – Watch for selling volume confirmation.

✔ Favorable Risk-Reward Ratio – 1:2.5 toward TP2.

💡 Stick to the plan, manage risk, and trade smart! 🚀📉

🔗 #EQT #NYSE #ShortTrade #TradingView #ProfittoPath 💰📊

EQT – 30-Min Long Trade Setup !📌🚀📈

🔹 Asset: EQT Corporation (NYSE: EQT)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bullish Breakout Trade

📌 Trade Plan (Long Position)

✅ Entry Zone: Above 46.99 (Breakout Confirmation)

✅ Stop-Loss (SL): Below 45.91 (Invalidation Level)

🎯 Take Profit Targets:

📌 TP1: 48.40 (First Resistance Level)

📌 TP2: 50.12 (Extended Bullish Move)

📊 Risk-Reward Ratio Calculation

📉 Risk (SL Distance): 46.99 - 45.91 = 1.08 risk per unit

📈 Reward to TP1: 48.40 - 46.99 = 1.41 (1:1.3 R/R)

📈 Reward to TP2: 50.12 - 46.99 = 3.13 (1:2.89 R/R)

🔍 Technical Analysis & Strategy

📌 Bullish Falling Wedge Breakout: Price is breaking above descending resistance, signaling an uptrend.

📌 Support Confirmation: Strong demand zone at 45.91, holding well.

📌 Volume Confirmation Needed: Rising buy volume above 46.99 confirms momentum.

📌 Momentum Shift Expected: If price holds above 46.99, it could rally toward 48.40, then 50.12.

📊 Key Resistance & Support Levels

🟢 50.12 – Final Target / TP2

🔴 48.40 – First Resistance / TP1

🟡 46.99 – Breakout Level / Long Entry

⚪ 45.91 – Stop-Loss / Support Level

📉 Trade Execution & Risk Management

📊 Volume Confirmation: Ensure strong buying pressure above 46.99 before entering.

📉 Trailing Stop Strategy: Move SL to entry (46.99) after TP1 (48.40) is hit.

💰 Partial Profit Booking Strategy:

✔ Take 50% profits at 48.40, let the rest run toward 50.12.

✔ Adjust Stop-Loss to Break-even (46.99) after TP1 is hit.

⚠️ Fake Breakout Risk

❌ If price drops below 46.99 after breakout, exit early to limit losses.

❌ Wait for a strong bullish candle close before entering aggressively.

🚀 Final Thoughts

✔ Bullish Setup – Wedge breakout signals upside potential.

✔ Momentum Shift Possible – Watch for volume confirmation.

✔ Risk-Reward Ratio – Favorable 1:2.89 R/R to TP2.

💡 Stick to the plan, manage risk, and trade smart! 📈🔥

🔗 Hashtags for Reach & Engagement:

#EQT 🚀 #NYSE 📈 #StockTrading 📊 #TradingNews 📰 #MarketUpdate 🔥 #Investing 💰 #LongTrade 🏆 #Finance 📉 #ProfittoPath 🏆 #SwingTrading 🔄 #DayTrading ⚡ #TechnicalAnalysis 📉 #StockSignals 📊 #FinancialFreedom 💡 #MarketTrends 📊 #StockAlerts 🔔 #TradeSmart 🤓 #Bullish 📈 #RiskManagement ⚠️ #TradingCommunity 🤝 #SmartTrading 💰 #MarketAnalysis 📊 #TrendBreakout 🚀

E-cutieAll year EQT, an unloved natural gas producer has been a swing trader's paradise. I've harvested so many gains from these E-cutie trees I thought I'd make a thread just for it and post trading updates.

The macro technical picture is clear. Years of being battered by shorts ended with capitulation in 2020, followed by a swift rebound. Fundamentals are tightening. According to analysts, $25 is fair price for $2.50 NG price. Goldman Sachs has a $23ish target. Price action is showing signs of bottoming. It's lining up but this is much more profitable short term swings.

Currently, price is building a base at previous long term support around $18. More downside is certainly a possibility given that NG prices look overvalued. But, EQT is in a channel and fundamentally undervalued. Investors might front run this sector as demand picks up in later in the year, in which EQT will likely be closer to $25.

s3.tradingview.com

Long EQT

+200 @ 18.10

Building long term position in $EQT I’m changing the process for picking tickers to make it more affordable while avoiding risky penny lots. Comment your favourite TSX tickers under $150 & NYSE or NAS under $100.

Key Stats:

• Market Cap: ~$30B

• P/E Ratio: ~61.21

• Dividend Yield: ~1.5%

• Next Earnings Date: February 18, 2025

• Recent Analyst Sentiment: Upgraded to Buy by key players on Bloomberg

Technical Reasons for Upside:

1. Support Bounce: EQT is holding firm above a key support around $48, and recent bounces indicate the buyers are stepping in.

2. Moving Average Momentum: The short-term moving averages (20-day/50-day) are trending upward, reinforcing the bullish setup.

3. Volume Surge & Indicator Confirmation: Elevated trading volume paired with a bullish MACD crossover and an RSI climbing past 55 confirm the move higher.

Fundamental Reasons for Upside:

1. Improved Production & Cost Discipline: Recent operational reports show better-than-expected production numbers and tighter cost controls, boosting margins.

2. Favorable Energy Market Conditions: Rising energy prices and a rebounding demand in the oil & gas sector are setting the stage for higher revenues.

3. Upgraded Guidance & Analyst Optimism: Management’s upward revision of guidance, along with multiple recent upgrades, lends strong credence to the bullish case.

Potential Paths to Profit:

1. Option 1 (Low-Risk): Buy shares at current levels and hold until the target is reached.

2. Option 2 (Moderate-Risk): Purchase LEAP call options (expiring in 6-12 months) with a strike price near target levels, then sell for a profit as the stock approaches your target.

3. Alternative Strategy: Consider a bull call spread by buying a near-the-money call and selling a higher strike call with the same expiration, reducing your upfront cost while still capitalizing on the upside.

Please LIKE, FOLLOW, SHARE, and COMMENT if you enjoy this idea! Also share your ideas and charts in the comments section below! This is the best way to keep this signal relevant, keep the content free, and allow the idea to reach as many people as possible.

Disclaimer: We are not a brokerage or investment firm. We do not offer financial advice or investment advice and/or signals. This is not certified financial education. We offer access to the daily thought process of an individual and his experiences. We do not offer refunds. All sales are final.

EQT Corporation (EQT) Analysis Company Overview:

EQT Corporation NYSE:EQT is the largest natural gas producer in the United States, headquartered in Pittsburgh, PA, and focused on the prolific Appalachian Basin. The company’s strategy centers on operational excellence, disciplined financial management, and maximizing shareholder value.

Key Growth Catalysts

Streamlined Operations Through Asset Sale:

$1.25 Billion Sale: EQT recently sold non-operated assets in Northeast Pennsylvania, enabling it to concentrate on core, higher-margin operations.

This transaction is expected to enhance cash flow by reducing operating complexities and interest expenses.

Debt Reduction and Financial Flexibility:

Proceeds from the asset sale were allocated to reduce borrowings under the revolving credit facility, lowering leverage and enhancing the company’s ability to invest in future opportunities.

The improved balance sheet strengthens EQT’s resilience amid commodity price volatility.

Mizuho's Upgrade:

Following these strategic moves, Mizuho upgraded EQT’s rating from Neutral to Outperform, reflecting growing confidence in EQT’s long-term potential.

Operational Efficiency Under CEO Toby Rice:

Toby Rice has emphasized global competitiveness through acquisitions, cost optimization, and innovation, aligning EQT with the evolving energy landscape.

Focus on technology and automation further boosts operational efficiency and competitiveness.

Market Position and Strategic Vision

Leadership in Natural Gas:

EQT is well-positioned to capitalize on growing demand for low-cost, low-emission natural gas in domestic and international markets, particularly in light of the global shift toward cleaner energy sources.

Operational Optimization:

The company's emphasis on enhancing drilling efficiencies and leveraging advanced technology supports sustainable growth and margin expansion.

Global LNG Opportunity:

With increasing liquefied natural gas (LNG) exports, EQT has significant upside potential to meet rising global energy needs.

Financial and Stock Outlook

Bullish Momentum Above $40.00-$41.00:

EQT’s current strategic initiatives provide a solid foundation for sustained growth.

Upside Target: $65.00-$67.00, supported by improving fundamentals and investor confidence.

Valuation and Investor Appeal:

EQT’s streamlined operations, robust cash flow potential, and debt reduction efforts make it an attractive option for growth-oriented investors.

Conclusion:

EQT Corporation is well-positioned for long-term growth, supported by strategic asset sales, enhanced financial flexibility, and operational excellence. Its leadership in the natural gas market and focus on global competitiveness make it a compelling investment opportunity.

📈 Recommendation: Bullish on EQT above $40.00-$41.00 with a target of $65.00-$67.00.

EQT Corporation. Oil Gas & Consumable FuelsKey arguments in support of the idea.

▪ Rising natural gas prices.

▪ Undervaluation.

Investment Thesis

EQT Corporation is one of the largest natural gas producers in the US. Natural gas

constitutes over 90% of the Company's hydrocarbon revenues, with LPG sales

comprising 8% and oil contributing 2%. EQT Corporation operates solely in the US

market, which accounts for 100% of its revenue.

In our view, the Company's stock could face potential gains in the coming months

due to several positive factors.

Rising natural gas prices. In the US, power generation companies are gearing up

for peak gas demand as summer temperatures drive up the need for cooling. Based

on the latest data from the US Department of Energy, gas consumption by power

facilities is set to climb 9% m/m in July, hitting 45.2 billion cubic feet per day

(Bcf/d), followed by a further 2% uptick expected in August. Overall gas

consumption in the US could rise by 4% and 2% m/m in July and August,

respectively. The anticipated increase in demand could push gas prices to $3 per

MMBtu (+30% from current levels), which would likely have a positive effect on the

financial performance of gas producers.

Undervaluation. At present, gas-producing companies are undervalued based on

multiples, primarily due to higher debt levels and lower shareholder payouts

compared to oil companies. Debt reduction and increased payouts could lead to a

significant revaluation in favor of gas producers. EQT's estimated EV/EBITDA ratio

for 2024 is 6.8. Notably, the Company has been progressively enhancing its

dividends, with a potential dividend yield of 1.7% by the end of 2024 based on

current prices.

We maintain a Buy rating on EQT stock with a price target of $39.8. A stop-loss

order is recommended at $34.4.

Natural Gas - Time to buy? Natural Gas is going through some much needed consolidation.

Holding above the 50 & 200 MA, a golden cross is setting up.

Typically golden cross signals see sellers in the near term before medium and ling term buyers step in.

Nat gas equities have been struggling lately and appear to be needing to go a touch lower until they are ready for a larger move.

Our members just took 21% win on our AMEX:KOLD short.

Rothschild & Co.'s Five Arrows Acquires Rimes: A Strategic MoveRothschild & Co.'s alternative assets unit, Five Arrows, recently made a strategic acquisition by purchasing Rimes from Swedish investment firm EQT. Rimes, a leading provider of enterprise data management and investment intelligence solutions, has been a significant player in the investment industry, empowering asset managers to efficiently handle market data.

The deal marks a significant milestone in Rimes' journey, which has been bolstered by EQT's support since 2020. Under EQT's ownership, Rimes experienced notable growth, expanding its technology offerings and acquiring Matrix IDM, an Australian investment data management platform. Additionally, Rimes ventured into AI with the establishment of a dedicated product division last year.

Five Arrows' decision to acquire Rimes underscores its commitment to the alternative assets space. With global assets under management exceeding €26 billion, Five Arrows is well-positioned to leverage its long-term fund FALT and principal investments division FAPI to facilitate the acquisition. The transaction, expected to close in the coming months pending regulatory approval, holds promise for both parties.

Brad Hunt, CEO of Rimes, expressed optimism about the acquisition, emphasizing its potential to propel Rimes' growth trajectory. Meanwhile, FAPI partners Vivek Kumar and Sacha Oshry highlighted Five Arrows' intention to unlock new avenues of growth for Rimes.

As the transaction unfolds, industry observers eagerly anticipate how Five Arrows' strategic vision will shape Rimes' future. The move underscores the evolving landscape of data management and investment intelligence, signaling potential shifts in the competitive dynamics within the sector.

In conclusion, Five Arrows' acquisition of Rimes marks a pivotal moment for both companies, poised to catalyze growth and innovation in the ever-evolving realm of enterprise data management and investment solutions.

EQT projected earnings growth of 95.06%, from $2.43 to $4.74EQT is one of the largest natural gas producers in the US, with a strong market position and recent strategic acquisitions that could contribute to its growth.

There is a projected earnings growth of 95.06%, from $2.43 to $4.74 per share, which could drive the stock price up

Earnings for fun EQT Spike up 13% & back downI let my pendulum pick from earnings tonight & for whatever reason, I get this one.

My intuition gives me a big heart, which is my symbol for up & the number 13 very clearly for percent.

Dowsing confirms up with 13 as well, but says it'll be a spike up and reverse down. SO may be a short opportunity if it gets up to the indicated zone. This is just for fun and practice for me.

EQT - Short PositionWe can see that price had a hard time breaking through 44-45 zone in which the price sharply dropped to the 38 area.

I have been patiently waiting for a rebound to a more favourable zone for entry. And now its here.

Today we have the Fed talking, as well as the market has been bullish since open. And most might argue that this is a risky setup going against the current momentum. However, I am still bearish until proven otherwise, and I only follow my trade plan. And you should follow yours.

I want the big move down, and to keep my risk low, I will enter OTM puts, and will close once/if price reaches close to $38. If I happen to be wrong, so be it. Loss is a fraction of what the profit goal is. Risk management is key.

#Options - Beginning of Dec expiry

EQT- Going LongAfter being shorted to the N'th degree, and finally breaking out of the downwards channel EQT has been holding, EQT is seemingly consolidating here within a symmetrical triangle, as buyers continue to step in.

After breaking out of the downtrend, EQT has formed an inverse head and shoulders on the daily timeframe, along with finding support right in the FIB golden pocket, accompanied by a SMA golden cross. (See Attached Chart Below)

Will be keeping a close eye on the daily timeframe to start building a position in some synthetic longs and/or leaps. Bullish and am looking for another push upwards from here.