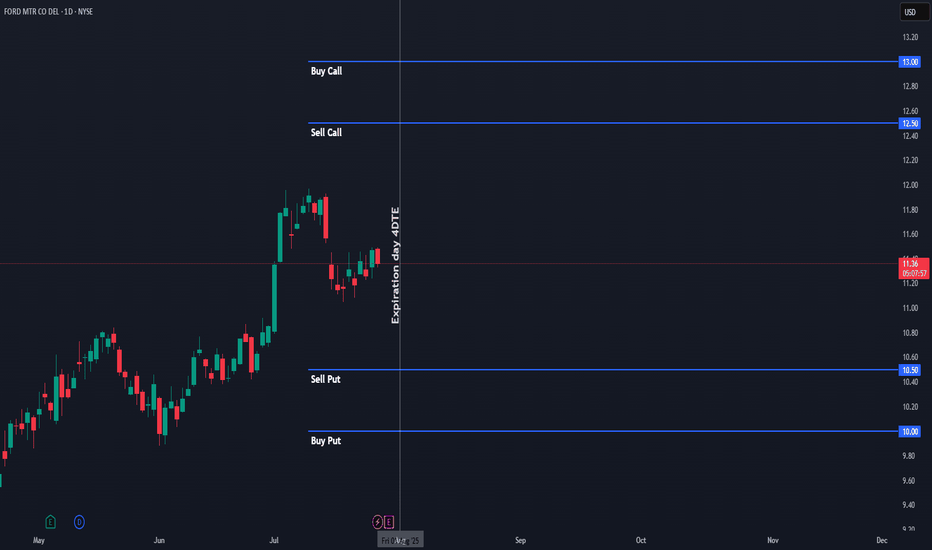

$F Iron Condor – Aug 1st Expiration | $7 Credit | I’m opening an Iron Condor on Ford ($F) with expiration on Friday, August 1st, 2025. The trade is based on the daily chart, using visible support/resistance levels to define the range. I selected strikes with approximately 0.15 delta on each side, giving the setup a high probability of success.

🔹 T

Key facts today

Ford Motor will reveal new electric vehicle tech on August 11 in Kentucky, a key event CEO Jim Farley calls as significant as the Model T launch.

Ford and Lincoln saw a 15% rise in sales in the MENA region for the first half of 2025, making Ford the fastest-growing OEM among the top five competitors.

Genstar Capital plans to sell OEConnection, a Ford-backed automotive software firm, with a potential valuation of $5 billion. The sale process is expected to start later this year.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.79 USD

5.88 B USD

184.99 B USD

3.90 B

About FORD MTR CO DEL

Sector

Industry

CEO

James Duncan Farley

Website

Headquarters

Dearborn

Founded

1903

FIGI

BBG000BQPC32

Ford Motor Co. engages in the manufacture, distribution, and sale of automobiles. It operates through the following three segments: Automotive, Mobility, and Ford Credit. The Automotive segment engages in developing, manufacturing, marketing and servicing of Ford cars, Lincoln vehicles. The Mobility segment includes Ford Smart Mobility LLC and autonomous vehicles business. The Ford Credit segment comprises Ford Credit business on a consolidated basis, which is primarily vehicle-related financing and leasing activities. The company was founded by Henry Ford on June 16, 1903 and is headquartered in Dearborn, MI.

Related stocks

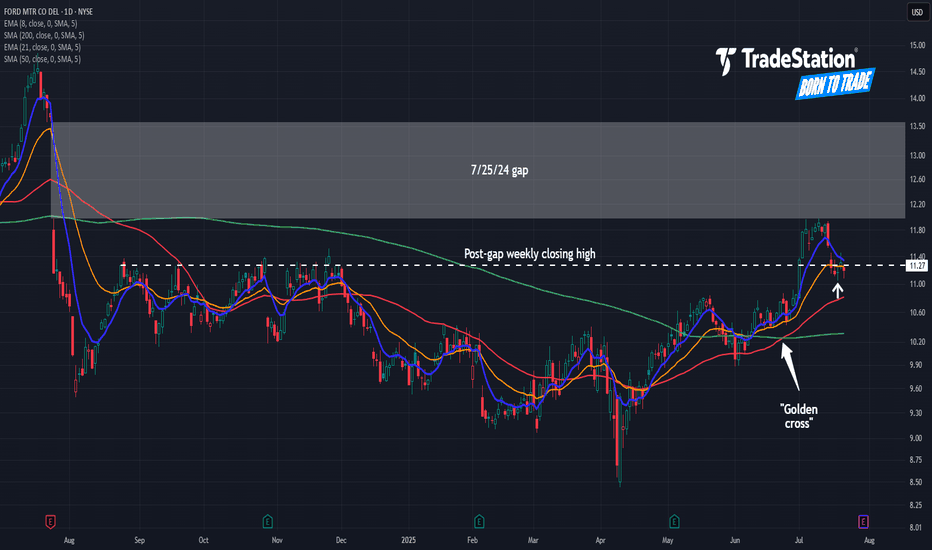

Ford Motor Pulls BackFord Motor began the month with a rally, and now it’s pulled back.

The first pattern on today’s chart is the July 1 surge following a strong monthly sales report. That may reflect healthy fundamentals.

Second is $11.27, a weekly close from last August. The automaker is back around that level, whic

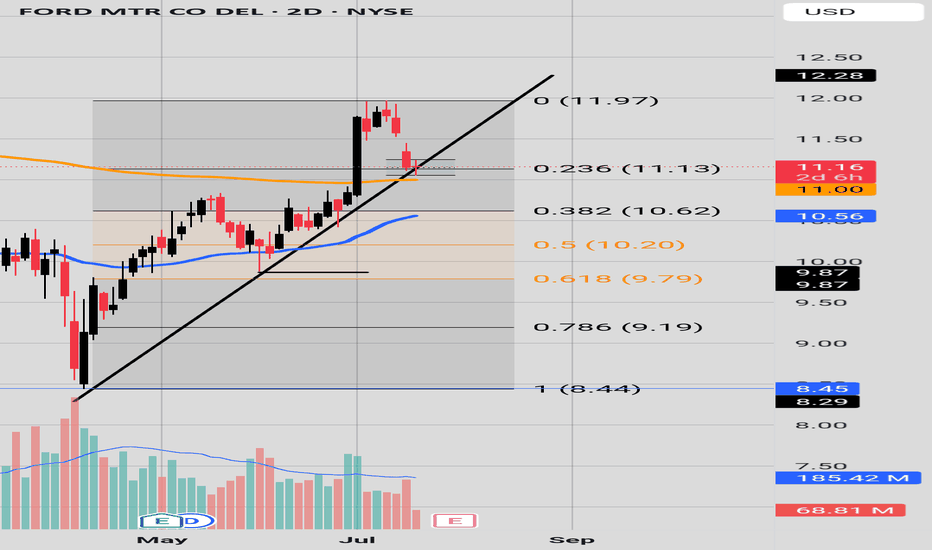

PatienceWe have price sitting on the 200 EMA(in orange).

We have a Doji candle sitting on the 200EMA.

Is this a minor pullback?

Bulls need price to move above the High of the Doji candle.

Bears need price to fall below the low of the Doji candle and then to the 50 EMA(in blue) and then to 9.87 for a CHOC.

F 5M Long Daytrade Aggressive CounterTrend TradeAggressive CounterTrend Trade

- long impulse

- unvolumed T1

+ resistance level

+ biggest volume 2Sp-

+ weak test

+ first bullish bar below close entry

Calculated affordable stop market

T2 5M take profit

1H CounterTrend

"- long impulse

- unvolumed T1

+ resistance level"

1D CounterTrend

"- long im

F Investment 1D Conservative CounterTrend TradeConservative CounterTrend Trade

+ long impulse

- before 1/2 correction

+ expanding T2

+ support level

+ biggest volume 2Sp-

+ weak test

+ first bullish bar close entry

Calculated affordable stop limit

1 to 2 R/R take profit

Monthly CounterTrend

"- short impulse

+ 1/2 correction

- unvolumed T2

- re

Bearish flag on Ford

Ford has been forming this bearish flag since August of last year. When this flag breaks, that would take Ford down to a trendline that goes back almost 20 years, that connects through the 2008 lows as well as the covid lows. I expect this area to likely contain the lows for Ford for the current

Ford Stock Rises Over 5% Following Earnings ReportFord's stock gained more than 5% in the latest session after the company’s earnings were released following the close of yesterday’s trading. For now, investor confidence remains strong, as the company reported earnings of $0.14 per share, significantly beating expectations of $0.02, and revenue of

Bearish Setup???FORD has a hit an historical resistance which was combined with it's 200 EMA(in orange). Key Levels to keep an eye on are the 10.39 price level; bullish activity from there would invalidate the current hypothetical bearish set up; an bearish action to the 10 EMA(blue) and 50 EMA (purple) would valid

Ford +50%Ford, which in recent years had diverged 150% from its main industrial benchmark, is one of the beneficiaries of Trump’s tariffs. Despite its heavy reliance on imported parts, Ford remains a symbol of domestic car manufacturing.

While the market is losing trillions, Ford stays almost unmoved compar

Ford (NYSE:F) Drop 5%+ as Tariffs Threaten Auto Industry marginsFord Motor Company (NYSE: F) is facing a challenging market environment as its stock price fell 5.27% to $9.61 as of 3:24 PM EDT. This drop comes amid declining sales and the looming threat of new tariffs from the Trump administration. In the last 52 weeks, Ford's stock has traded within a range of

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

F

F5246502

Ford Motor Credit Company LLC 2.3% 20-SEP-2025Yield to maturity

8.84%

Maturity date

Sep 20, 2025

F

F5263276

Ford Motor Credit Company LLC 2.4% 20-SEP-2026Yield to maturity

7.10%

Maturity date

Sep 20, 2026

F

F5311538

Ford Motor Credit Company LLC 3.15% 20-DEC-2031Yield to maturity

6.91%

Maturity date

Dec 20, 2031

F

F5386347

Ford Motor Credit Company LLC 4.95% 20-MAR-2032Yield to maturity

6.86%

Maturity date

Mar 20, 2032

F

F5251715

Ford Motor Credit Company LLC 2.25% 20-SEP-2025Yield to maturity

6.86%

Maturity date

Sep 20, 2025

See all F bonds

Curated watchlists where F is featured.

Frequently Asked Questions

The current price of F is 10.95 USD — it has decreased by −2.26% in the past 24 hours. Watch FORD MTR CO DEL stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange FORD MTR CO DEL stocks are traded under the ticker F.

F stock has fallen by −4.54% compared to the previous week, the month change is a −4.92% fall, over the last year FORD MTR CO DEL has showed a 3.79% increase.

We've gathered analysts' opinions on FORD MTR CO DEL future price: according to them, F price has a max estimate of 14.00 USD and a min estimate of 8.00 USD. Watch F chart and read a more detailed FORD MTR CO DEL stock forecast: see what analysts think of FORD MTR CO DEL and suggest that you do with its stocks.

F stock is 1.84% volatile and has beta coefficient of 0.64. Track FORD MTR CO DEL stock price on the chart and check out the list of the most volatile stocks — is FORD MTR CO DEL there?

Today FORD MTR CO DEL has the market capitalization of 43.06 B, it has decreased by −5.63% over the last week.

Yes, you can track FORD MTR CO DEL financials in yearly and quarterly reports right on TradingView.

FORD MTR CO DEL is going to release the next earnings report on Oct 22, 2025. Keep track of upcoming events with our Earnings Calendar.

F earnings for the last quarter are 0.37 USD per share, whereas the estimation was 0.33 USD resulting in a 11.88% surprise. The estimated earnings for the next quarter are 0.35 USD per share. See more details about FORD MTR CO DEL earnings.

FORD MTR CO DEL revenue for the last quarter amounts to 50.18 B USD, despite the estimated figure of 45.79 B USD. In the next quarter, revenue is expected to reach 45.80 B USD.

F net income for the last quarter is −36.00 M USD, while the quarter before that showed 471.00 M USD of net income which accounts for −107.64% change. Track more FORD MTR CO DEL financial stats to get the full picture.

Yes, F dividends are paid quarterly. The last dividend per share was 0.15 USD. As of today, Dividend Yield (TTM)% is 6.93%. Tracking FORD MTR CO DEL dividends might help you take more informed decisions.

FORD MTR CO DEL dividend yield was 7.88% in 2024, and payout ratio reached 53.35%. The year before the numbers were 10.25% and 116.20% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 5, 2025, the company has 171 K employees. See our rating of the largest employees — is FORD MTR CO DEL on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. FORD MTR CO DEL EBITDA is 8.34 B USD, and current EBITDA margin is 5.93%. See more stats in FORD MTR CO DEL financial statements.

Like other stocks, F shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade FORD MTR CO DEL stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So FORD MTR CO DEL technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating FORD MTR CO DEL stock shows the sell signal. See more of FORD MTR CO DEL technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.