FSLY trade ideas

Wait for the dust to settle - could test 50% fib retracementGuidance for Q3 2020 revenue was cut to $70 million from $73 million. This ran up way too fast and was extremely overvalued. The street is now giving it a nice haircut. Technicals indicate that this may be headed to the 50% fib retracement at $73.53.

Buy at 80-85 RangeI think its a great opportunity.

Ark investment bought this stock. However according to income statement and balance sheet it is not a buy but for future prospect it can be bought. Tiktok issue can be solved when Biden will be president.

The trade war with china will over when Biden will win.

Suitable for swing trade.

FSLY watch for the relief bouncIt's possible we may see a relief bounce in FSLY tomorrow. This could make for a quick scalp long or a chance for

people holding shares to get out at a better price. I'll be watching for a move back into 100/105 area. Alternatively, if we lose the

post market low, price is likely to test the bottom of the box I have drawn. I would not recommend buying

and holding the dip. These selloffs rarely find bottom in the first 2 days. Better to wait unless you are scalping

or trying to get out.

$FSLY Support Levels to Watch for Fastly IncReally terrible day ahead for FSLY investors, so here are the support levels we are watching for today.

$85.33 is Fibonacci and Monthly candle support.

$81.63 is the 100ma.

$79.37 is the Fixed Range POC

$75.00 held during the September selloff and may very well get tested once again.

Hopefully we have seen a over reaction on what was already a negative environment.

FSLY hit support! Let's go up from here...FSLY's massive after-hours drop today was caught perfectly by our Raygun support/resistance script.

I think we'll bounce back up from here.

If not, these levels will be important as we helix around them fro seeing where we're going to go next.

I'm keeping my eye on this for a S/R flip...

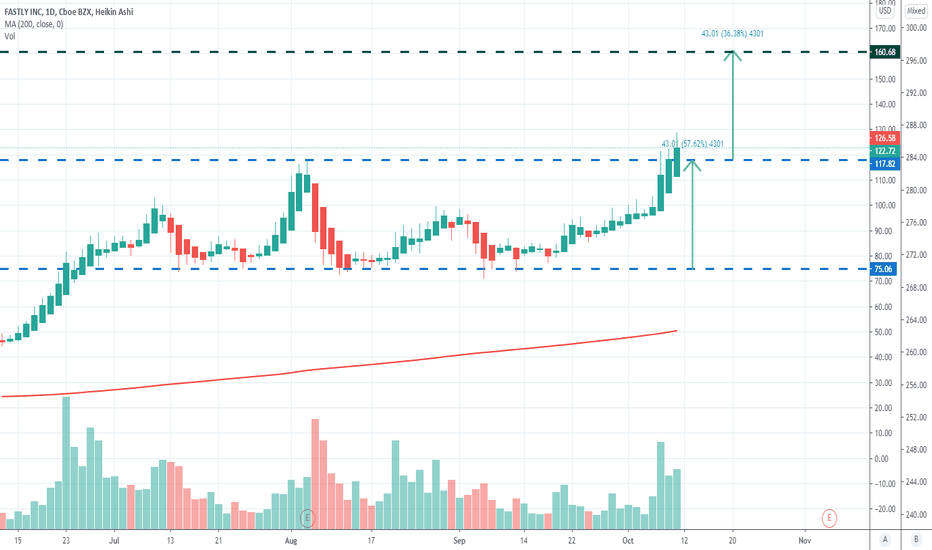

Breakouts are for BuyingWhen we look at the headlines, we have to realize that these are just trying to grab our attention and take away from what we should be really paying attention to. Breakouts! Instead of just looking at the index or tuning into financial media for the latest narrative, we should be looking for things to buy. Today we will look at FSLY. Let’s hop on the chart.

This is the type of chart that we want to own. The pullback that took place didn’t affect every stock the same. Some of the stocks just went into a basing pattern and are now breaking out. This is bullish. Last time we saw a breakout like this, we went all the way to the 200% fib extension. The breakout looks very similar to last time and the stock has stayed in a bullish regime since April. We have a bullish trend and a bullish breakout. What more could you ask for?

Happy Trading!