Guess?, Inc. Reports Fiscal Year 2025 Fourth Quarter ResultsGuess?, Inc. (NYSE: NYSE:GES ) a company that designs, markets, distributes, and licenses lifestyle collections of apparel and accessories for men, women, and children- operating through five segments: Americas Retail, Americas Wholesale, Europe, Asia, and Licensing, reports fiscal year 2025 fourth quarter results.

Reports Highlights

Fourth Quarter Fiscal 2025 Results:

Revenues Increased to $932 Million, Up 5% in U.S. Dollars and 9% in Constant Currency

Delivered Operating Margin of 11.1%; Adjusted Operating Margin of 11.4%

GAAP EPS of $1.16 and Adjusted EPS of $1.48.

Full Fiscal Year 2025 Results:

Revenues Increased to $3.0 Billion, Up 8% in U.S. Dollars and 10% in Constant Currency

Delivered Operating Margin of 5.8%; Adjusted Operating Margin of 6.0%

GAAP EPS of $0.77 and Adjusted EPS of $1.96

Full Fiscal Year 2026 Outlook:

Expects Revenue Increase between 3.9% and 6.2% in U.S. Dollars

Expects GAAP and Adjusted Operating Margins between 4.3% and 5.2% and 4.5% and 5.4%, Respectively

Expects GAAP EPS between $1.03 and $1.37 and Adjusted EPS between $1.32 and $1.76

Plans to Execute Business and Portfolio Optimization Expected to Unlock Approximately $30 Million in Operating Profit in Fiscal Year 2027

Financial Performance

In 2024, Guess?'s revenue was $3.00 billion, an increase of 7.88% compared to the previous year's $2.78 billion. Earnings were $60.42 million, a decrease of -69.15%.

Analyst Forecast

According to 5 analysts, the average rating for GES stock is "Strong Buy." The 12-month stock price forecast is $21.6, which is an increase of 115.14% from the latest price.

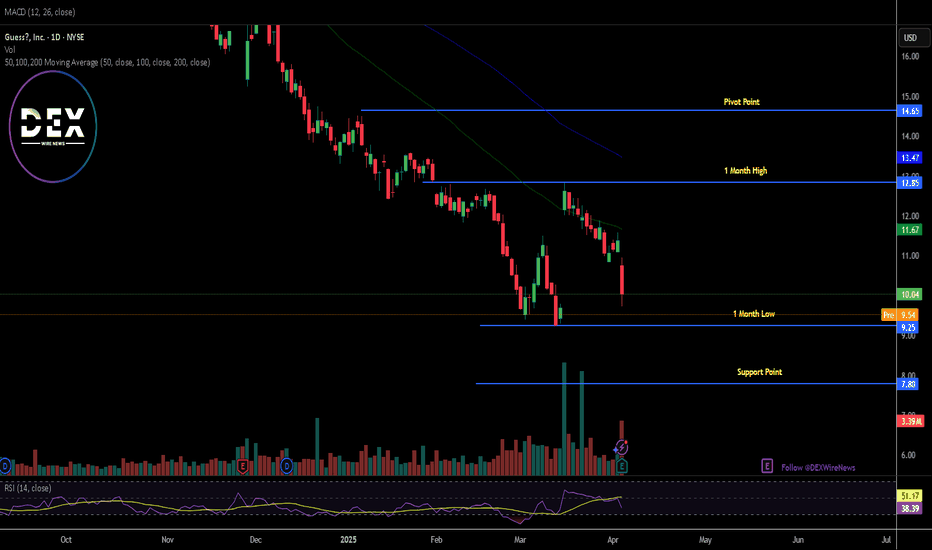

As of the time of writing, NYSE:GES shares closed Thursday's session down 11.78% extending the loss to Friday's premarket trading down by 2.38%. With a weaker RSI of 38, should trades open, NYSE:GES shares might break the 1-month low pivot and dip to the $7 support point. About $2.85 trillion was wiped out from the US stock market yesterday.

GES trade ideas

GES Guess? Options Ahead of EarningsIf you haven`t sold GES before the previous earnings:

Then analyzing the options chain and the chart patterns of GES Guess? prior to the earnings report this week,

I would consider purchasing the 26usd strike price in the money Puts with

an expiration date of 2024-4-19,

for a premium of approximately $2.72.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

GES Guess? Options Ahead of EarningsAnalyzing the options chain and the chart patterns of GES Guess? prior to the earnings report this week,

I would consider purchasing the 23usd strike price at the money Puts with

an expiration date of 2023-12-15,

for a premium of approximately $1.82.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

GES Guess? Options Ahead of EarningsAnalyzing the options chain and the chart patterns of GES Guess? prior to the earnings report this week,

I would consider purchasing the 19usd strike price Puts with

an expiration date of 2023-10-20,

for a premium of approximately $1.07.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

GES- BULLISH SCENARIOGuess? Inc., ticker symbol GES, released its first-quarter fiscal 2024 results, surpassing market estimates for both revenue and earnings. However, compared to the previous year, both metrics experienced a decline.

The company's international business exhibited strength during the quarter. This, coupled with solid product margins and effective cost-control measures, helped mitigate the challenges faced by the Americas Retail business due to reduced customer footfall in stores. Guess? has been successful in enhancing its brand image and maintaining a strong global distribution network, benefiting from its diversified business model.

Looking ahead, management remains positive about fiscal 2024, anticipating low single-digit growth in revenue. Additionally, they expect strong profitability and robust cash flow generation. Following the earnings announcement, Guess? shares saw a 1.3% increase during the after-market trading session on May 24.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

I GES this manipulated stock is fallingHey all, take a look at what's happening now! We're finally sweeping the lows. I suspect that these next few months for GES are going to be very ugly, similar to 2008. This might be a strange way of approaching it, but this could very well be used as a leading indicator for what is next for retail and the broader market.

I GES that this is manipulated?Hey all, I've always found it fascinating how charts can virtually replicate their patterns from previous points in history. This thing looks exactly like 2008, and I'm looking to benefit from it. Though I'm not sure where my entry will be, I am waiting to see if this chart presents a favorable entry for a likely violent markdown phase, much like the ones seen in 2000/2008. Also stood out to me that there is a high short interest on this name.

Repeating market crashes...Hey guys,

If you look very closely, I think GES is repeating the same pattern it made in 2008, with some similarities to what it did in 2000. Today, the stock noticeably held its most critical support level just above $16, and I think it is likely it will rally into mid-late July. That being said, I fully expect that rally to be faded and a violent markdown phase to occur as it did in 2000/2008. Keep an eye out on this one bears as this could move down very fast when the time is right.

GES Stochastic Oscillator left the oversold zone on June 19,2020This is a signal that GES's price trend could be reversing, and it may be an opportunity to buy the stock or explore call options. I identified 69 similar cases where GES's stochastic oscillator exited the oversold zone, and 57 of them led to successful outcomes. Odds of Success: 83%.

GUESS: Look at the Big Picture of Wave HistoryFirst off, please don't take anything I say seriously or as financial advice. As always, this is on an opinion based basis. That being said, here are a few insights into what I think about Guess. I'm not a big fan of the whole fashion retail business, especially given how businesses like JC Penny can easily go from corporate giants to being crushed into the ground. Growth for them has alot of variables, and many businesses in this market segmentation fails to innovate, diversify, or push further. Guess though is one of those brands that does still have somewhat of a following. While not a fan of it, given I like different stock categories that breakout and promote different sets of products, I look at it from an investment perspective. They have lots of potential in terms of the price they are now, and the price they could be. For a long position, I am saying it should at the very least reasonably pass $14 if it keeps the historic trends it had in the past. This is even given the Covid19 hit, many market variable unknowns and how shoppers react.

GUESS Key Level Broken| Bearish Retest| Volume Climax Evening Traders,

Today’s technical analysis will be on GUESS, breaking major structural support and confirming a bearish retest,

Points to consider,

- Bear Trend (consecutive lower highs)

- Structural support breached

- Confirmed S/R Flip

- RSI oversold

- Stochastics in lower regions

- Volume climax evident

GUESS has been in an established bear trend with consecutive lower highs, a new local low has been confirmed with its recent wick down.

Weekly structural support has been breached; this is a high timeframe support, broken with convincing volume with a confirmed bearish retest. Bulls were not able to break above the now resistance – confirming the S/R flip.

RSI is currently oversold; a reversion back to neutral territory is highly probable. The stochastics on the other hand is in the lower regions, can stay trading here for an extended period of time, however lots of stored momentum to the

upside.

Volume climax is evident, signalling a temporary bottom is in; however this is likely to change due to the confirmed S/R flip.

Overall, in my opinion, Guess is likely to test lower lows upon breaking key structural support. This is also combined with the greater economic situation; the retail sector is largely hit.

What are your thoughts?

Please leave a like and comment,

And remember,

“Don't blindly follow someone, follow market and try to hear what it is telling you.” ― Jaymin Shah

Guess is a value play $GESFirst let me remind you of my last four picks:

1. Jd.com I said it is going to 50 . And It tanked bc of corona.

2. Dicks sporting goods I said it is going to 43 and it tanked.

3. Called $INO rally when it was under $5 the stock climbed to $19 in 5 days.

4. Bought $Dell $40 puts for $1.1 dell is Trading under $29 now.

Now what about guess?

1. It took a hit when corona spread to italy, where 10% of revenue come from.

2. It took another hit when almost most of the world got shut down bc of corona

3. It lost 80% of its value in a month .

4. Corona will effect q1 sales. That is usually off season.

5. Guess made $1.18 in last q. It closed at $3.92 yasterday.

6. CEO says they are in good financial position and have enough liquidity to survive the crisis.

7. This is a value play. It may take a couple of years to get back to $20s

8. This is a contrarian pick.

GES Long - Possible counter trend tradeHi Guys,

Below my analysis:

Wkly chart - MACD and OBV bullish divergence. Elder Impulse system turning blue (allowing long positions) @ 14.74.

Daily chart - IS blue (turning red @ 13.87) - long position is allowed. Fresh MACD signal line bullish cross.

Entry @ 14.76

Stop Loss @ 13.73

Take Profits @ 16.94

On the negatives: beware of the earnings call scheduled for August 28 AMC