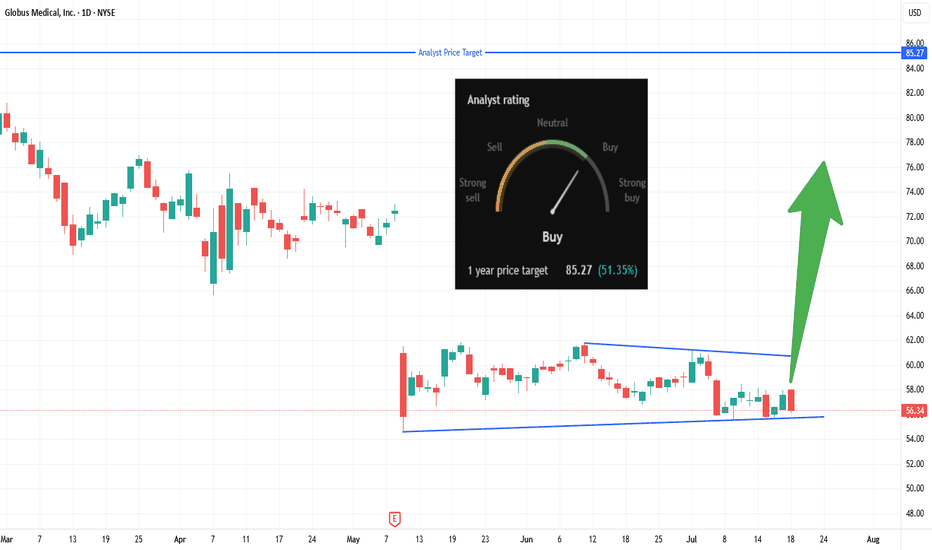

Will GMED Catch a Bid at Channel SupportTrade Summary 📝

Setup: Channel squeeze at multi-week support; volatility contracting.

Entry: Entering at market (current price ~$56.34), bottom of channel.

Stop‑loss: $55.50 (tight stop under structure).

Targets: $62 (channel top), $70+ (gap area), $85.27 (analyst 1-year target).

Risk/Reward: Strong; defined risk, multi-level upside.

Technical Rationale 🔍

Channel base tested several times; buyers defending $56 area.

Compression pattern—price “coiling,” often leads to explosive moves.

Momentum trigger: Break above $60 could attract breakout buyers and short cover.

Catalysts & Context 🚦

Analyst 1-year target: $85.27 (+51%), “Buy” rating.

Recent market pullback has GMED holding steady—showing relative strength.

Watching for sector rotation into healthcare/medtech.

Trade Management Plan 📈

Entry: Executing at market, stop at $55.50.

Stop-loss: Hard stop at $55.50 to minimize risk.

Scaling: First target $62 (channel top), then $70+. Hold a runner for $85.27 if breakout has legs.

What’s your move on GMED?

🔼 Long—Bottom fishing

🔽 Short—Breakdown risk

🔄 Waiting for $60+ breakout

Disclaimer ⚠️: Not financial advice. Trade at your own risk and use stops!

GMED trade ideas

GMED breaking out for another bullish move!Globus Medical, Inc. (GMED), a leader in musculoskeletal solutions, is currently exhibiting strong bullish signals.

The stock has maintained a steady uptrend, forming higher highs and lows on weekly charts.

Trading above its 50-day and 200-day EMAs, GMED recently witnessed a golden cross, further solidifying its bullish momentum.

Key support levels is identified at $80. Volume trends support the uptrend, with higher activity during rallies and lower volumes on pullbacks, indicating weak selling pressure.

Momentum indicators like the RSI at 62 shows hidden divergence.

A recent bullish engulfing candle on the daily chart and a breakout from flag & pole confirm upward momentum. Traders can look for this breakout for continued gains.

Overall, GMED shows promising potential for further upside in the medium term.

The stock can easily go till 108-110 with a stop loss of 80 which is risk reward of 1:3X.

Globus Medical: Approaching resistance, is a breakthrough comingWeekly Chart

● The stock has tested the trendline resistance multiple times.

● Currently, it is trading just below this level.

● A breakout above this resistance is anticipated in the near future.

● Following the breakout, the price may increase.

Daily Chart

● A Symmetrical Triangle pattern has formed.

● A strong breakout has taken place, supported by significant volume.

● The price is now set for a potential upward movement.

Looking for a long term entry into Globus MedicalI’m looking for a long term investment in a sea of overvalued bio & tech companies.

Globus Medical caught my eye as a potential candidate after a large dark pool sell and recent pullback in indexes

Globus Medical's index membership is Russell 1000, Russell 3000 and S&P Midcap 400.

Financial Observations:

PE ratio of 37 a return to 2017 levels.

7B Market Cap

Consistent Year over Year revenue growth.

Nominal Debt

Exceeds earnings expectations

Steady asset growth

Regular employment growth

Personal Experience

A surgical clinic I do marketing and websites for recently added one of the Globus Medical robot arm surgical assistants.

The chief surgeon told me his surgery averages went from 1hr to 10m.

The client has also made it a priority for us to increase marketing spend and patient intake support to increase daily surgery capacity.

I’m curious to know what the more seasoned investors think of GMED and if this is a good time to make an entry for a long term holding.

Not Financial Advice. Just my own Personal Investment Due Diligence.

Globus Medical short term weaknessNYSE:GMED

Globus Medical reported strong quarterly results on Tuesday.

Momentum and stochastic indicator suggest short term price weakness as traders take profits.

My personal plan is to reduce holding in small increments so long as selling persists, with the

intention of buying back once the current correction is complete

Indicators:

Arun - A Bidirectional momentum indicator that is far superior to DMI

DSS long stochastic

Triangle in GMEDScreening through many stocks this morning this was the chart the stuck out to me. A clear triangle. I will be quite surprised if it doesn't play out because of how textbook it looks. Price appears to have broken the triangle upper boundary. A close above this boundary will support continued strength to the upside. Based on the size of the triangle the simple target areas are within the yellow box.

GLOBUS MEDICAL is a breakout above $50GMED recently reported inline earnings but has now come to our attention on the possibility of a substantial breakout, it has also come to light that multiple Investment and Capital management firms have made significant acquisitions of the stock. This has brought it to the attention of many and has helped and will continue to propel the stock higher in our opinion.

AVERAGE ANALYSTS PRICE TARGET $53

AVERAGE ANALYSTS RECOMMENDATION OVERWEIGHT

P/E RATIO 35

SHORT INTEREST 3.4%

COMPANY PROFILE

Globus Medical, Inc. operates as a medical device company that develops and commercializes healthcare solutions. The firm engages in developing products that promote healing in patients with musculoskeletal disorders. It classifies products into Innovative Fusion and Disruptive Technology. It operates through the United States and International geographical segments. The company was founded by David C. Paul in March 2003 and is headquartered in Audubon, PA.

GMED where to next???With Earnings set for 02/21 GMED looks to be chopping around at the key resistance line as indicated in red.

The support line short term uptrend has recently been broken, which indicates that price may push lower and chop around the current resistance point until earnings.

It is probable that price action will build up for a break out and push higher, especially after earnings. Confirmation of the RSI divergence and SMII upward push will give entrance. The double bottom, looks to indicate that there is strong support to push price higher.

Although the longer term looks bearish, GMED may be gearing up for a breakout! Keep an eye on price action at current resistance, with a push towards the upper resistance and a possible breakout.