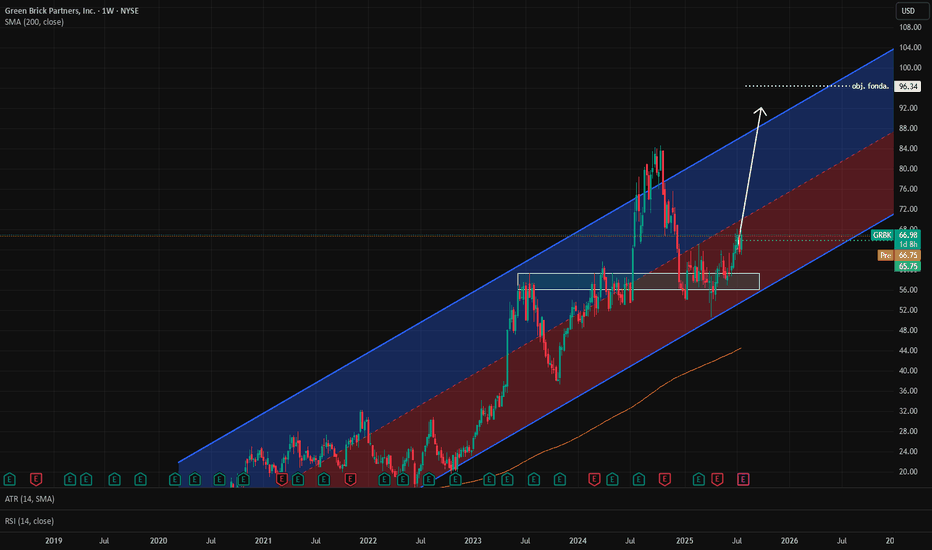

GBRK: Fundamental Analysis +46 %With 2024 revenue of $2.1 billion, Green Brick Partners is the 3rd largest builder of single-family homes in the Florida, Georgia, and Texas regions. EverStock identifies a fundamental revaluation potential of + 46 %.

Valuation at 7.7x net earnings

Currently valued at $2.94 billion, Green Brick Partners posted a profit of $382 million in its latest fiscal year (2024).

Balance sheet and debt

In Green Brick’s latest annual report, tangible net asset value stood at $1.58 billion, giving a market capitalization / tangible net asset value ratio of 1.75.

The gearing ratio is excellent, at 0.24.

Current share price : $66.98

Target price : $97.57

Upside potential : + 46 %

Dividend : $1.44

Yield : 2.15%

GRBK trade ideas

GRBK – 30-Min Short Trade Setup!📉

🔹 Ticker: GRBK (NYSE)

🔹 Setup: Ascending Triangle Rejection + Breakdown Risk

🔸 Rejection Zone: ~$57.80 (yellow zone + trendline confluence)

📊 Trade Plan (Short Bias)

✅ Entry Range: $57.65–$57.85

✅ Stop Loss (SL): Above $59.54 (white resistance zone)

✅ Profit Zones:

• TP1: $55.10 (Post level retest)

• TP2: $53.40 (green structure support)

• TP3: $51.77 (major support base – orange zone)

📐 Risk-Reward View

• Bearish confluence at horizontal + trendline resistance

• Price stalling under supply zone

• Weak bullish momentum with signs of fading volume

• Key breakdown could unlock deeper downside potential

🔍 Technical Highlights

• Price rejected triangle resistance cleanly

• Bearish structure forming lower highs

• Tight range under rejection = breakout likely

⚙️ Trade Management Tips

• Trail stop loss after TP1

• Lock profits gradually into support zones

• Watch for volume drop below $55 for confirmation

⚠️ Setup Invalidation

❌ Break and hold above $59.54

❌ Strong bullish breakout with volume

❌ Price closing above trendline & horizontal resistance