HIMS trade ideas

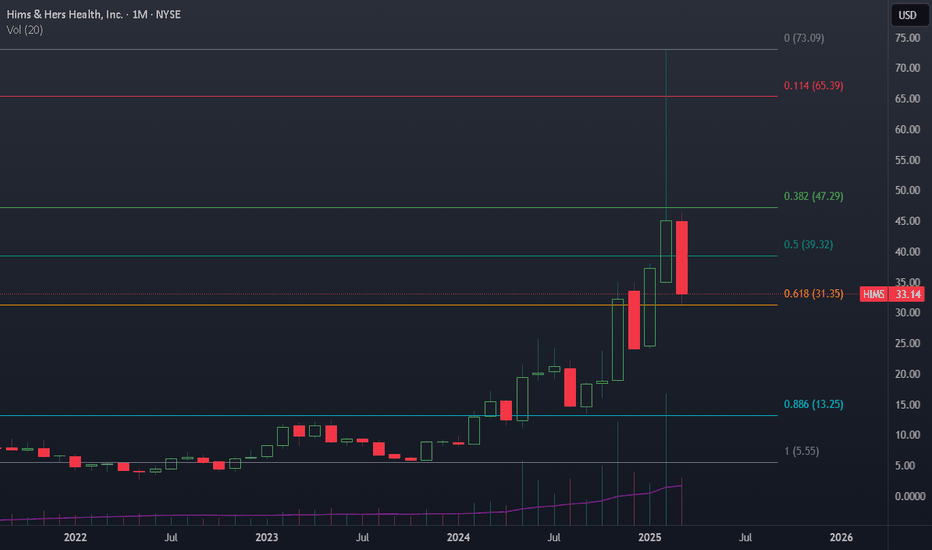

Hims perfect golden pocket on monthlyHims has entered the deep value zone after a blow off top on irrational markets. I was able to roll covered calls way up and out due to this and collect ~18k on my shares. I have since rolled backwards and lower to capture my premiums. I believe the bottom is in on this move, and I find it very interesting that Hims fell perfectly to the golden fib.

My plan:

I am going to sell covered calls on the next major pump when the stock is closer to 40$ I did trim some shares to buy hood since that 20% down day was obnoxious

HIMS - The Full MonthyNo, no weed involved in this analysis.

As I said before, sometimes chart analysis is simple. But sometimes we need to extend it, combining all our knowledge to find the facts.

Let's see what we have here:

1. The white Fork.

...it's crazy, isn't it? ;-)

It looks like I was looking to fit it somehow.

But the truth can't be farther away. If you understand the principles behind this tool, WHAT it really measures, and what INFORMATION it really provides, then you get it, why this Fork is drawn like it is.

For the non Forkers:

a) Forks measure extremes, cut swings in upper, lower extremes and show where the center is.

b) they project the most probable path of price.

The A-Point was the old high.

The B-Point was the lowest low.

The C-Point is, where we had the last low, after the High was breached. So, in essence, it's a very stretched Pullback-Fork.

2. The slanted grey lines:

They just bring the natural Swings to light, and project them into the future. That's it.

I'm not going into the the minor drawings here, since they are self explaining. Just give yourself a little bit time, watch the Chart from a distance, and let your thoughts flow.

Any trades here?

Let's observe and trade from one extreme to the Center and beyond...

HIMS/USD – 30-Min Long Trade Setup !📌🚀

🔹 Asset: HIMS (Hims & Hers Health, Inc.)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bullish Breakout Trade

📌 Trade Plan (Long Position)

✅ Entry Zone: Above $41.80 (Breakout Confirmation)

✅ Stop-Loss (SL): Below $36.03 (Support Breakdown)

🎯 Take Profit Targets:

📌 TP1: $50.32 (First Resistance Level)

📌 TP2: $60.38 (Extended Bullish Move)

📊 Risk-Reward Ratio Calculation

📈 Risk (SL Distance): $41.80 - $36.03 = $5.77 risk per share

📈 Reward to TP1: $50.32 - $41.80 = $8.52 (1:1.47 R/R)

📈 Reward to TP2: $60.38 - $41.80 = $18.58 (1:3.22 R/R)

🔍 Technical Analysis & Strategy

📌 Triangle Breakout: Price is forming a bullish wedge, indicating possible breakout above resistance.

📌 Bullish Momentum Building: A breakout above $41.80 with strong volume will confirm upward movement.

📌 Volume Confirmation Needed: Ensure high volume at breakout to confirm buying pressure.

📌 Momentum Shift Expected: If price sustains above $41.80, a move toward $50.32 and then $60.38 is likely.

📊 Key Support & Resistance Levels

🟢 $36.03 – Strong Support / Stop-Loss Level

🟡 $41.80 – Entry / Breakout Level

🔴 $50.32 – First Resistance / TP1

🟢 $60.38 – Final Target / TP2

📉 Trade Execution & Risk Management

📊 Volume Confirmation: Ensure strong buying volume above $41.80 before entering.

📈 Trailing Stop Strategy: Move SL to entry ($41.80) after TP1 ($50.32) is hit.

💰 Partial Profit Booking Strategy:

✔ Take 50% profits at $50.32, let the rest run to $60.38.

✔ Adjust Stop-Loss to Break-even ($41.80) after TP1 is reached.

⚠️ Fake Breakout Risk

❌ If price fails to hold above $41.80 and drops back, exit early to avoid losses.

❌ Wait for a strong bullish candle close above $41.80 for confirmation before entering aggressively.

🚀 Final Thoughts

✔ Bullish Setup – Breaking above $41.80 could lead to higher targets.

✔ Momentum Shift Possible – Watch for volume confirmation.

✔ Favorable Risk-Reward Ratio – 1:1.47 to TP1, 1:3.22 to TP2.

💡 Stick to the plan, manage risk, and trade smart! 🚀🏆

🔗 #StockTrading #HIMS #BreakoutTrade #TechnicalAnalysis #MomentumStocks #ProfittoPath #TradingView #StockMarket #SwingTrading #RiskManagement #ChartAnalysis 📈🔥

Opening (IRA): HIMS April 17th 28 Covered Call... for a 26.33 debit.

Comments: Throwing a few bones at this high IVR/IV (57.5/109.4) single name post-earnings, selling the ~84 delta, 2 x expected move call against shares to emulate the delta metrics of a 16 delta short put, but with the built-in defense of the short call.

Metrics:

Buying Power Effect/Break Even: 26.33/share

Max Profit: 1.67

ROC at Max: 6.34%

50% Max: .84

ROC at 50% Max: 3.17%

Will generally look to take profit at 50% max/roll out short call if my take profit is not hit.

Hims pulls back to golden fibHims had a major overheated run from 40-70 way too rapidly. Despite this being one of my largest holdings I was not a fan of this price action. With that said the shorts are at it again and here we are. If you zoom back to September 2024 and draw a fib retrace to the swing high you will note the most recent wick slammed off this level around 36.4$. We also note a triple red firing on BBWP, and a now bottoming stochastic RSI setup.

I think we consolidate between 37-42$ for a bit and let that stochastic really dig deep before some drives of bullish divergence form

My plan:

I pulled the trigger too early and started buying at 50$, but I am in for the long term. I was able to close my Jan covered calls for 12,000$ realized by rolling back to August with a lower strike, this made sense here.

GLP1 shortage over, who’s buying the dip?There’s no doubt that HIMS is a strong growth stock but it’s largely dependent on the GLP-1 shortages. I had previously warned that the shortage ending would cause a huge dump on the stock. I was slightly ahead of the curve, the shortage remained for another quarter and the price pumped higher.

Alas, here we are and the shortages have come back. Personally I’m not looking to trade the stock but I’ve been asked about potential areas of support for ‘buy the dippers’.

My opinion on the matter is if we don’t get a bullish bounce around $37, this will sink to $30 which is the golden ratio retracement. But I will warn you that this drop is strong and you should only DCA if you believe this business can maintain its growth without the GLP-1 product. I view the stock as peaking in a wave 5 and therefore we should get an ABC corrective wave.

Not financial advice, do what’s best for you.

himm full correctionNow that I have 2,000 shares of hims this wide is pretty wild but my conviction remains high. First off, the market kept using net earnings to value the company, bad idea. Since hims spends so much on ads and stock based compensation you need to use operating cash flow. If you use this number the company is growing at multiples per year.

Next, the GLP story. First off hims was growing immensely without this sector, their weight loss program was growing steadily without GLP. Compounded GLP is the cherry on top, if they are allowed to keep making these it will be good for the company, but they do not need them to grow very quickly. Hims is currently in hair loss, skin care, anxiety, ED, and primary care (huge market). They are soon adding sleep, fertility, more diabetes, and cholesterol. With their recent acquisition to be able to do at home blood draws, the sky is the limit.

My plan:

My covered calls printed, and I bought commons and a LEAP call for 2027

Hims (HIMS) Stock Chart Analysis: Observing a Cup and HandleThe HIMS stock chart displays a pattern resembling a cup and handle. If confirmed, technical analysis suggests a possible price target exceeding $24.

While the cup and handle pattern suggests a potential price increase, it's important to consider other factors that can influence the stock price, such as the company's fundamentals, industry trends, and overall market conditions.

It's also crucial to understand the limitations of technical analysis and avoid solely relying on it for investment decisions.

HIMS, how we captured 225% Move and added multiple TOP upsHere is at the chart for HIMS Stock which we traded as part of my subscribers group. Stock idea was posted as buy and Investment idea total 3 times in last 3 months giving returns of 225%, 161% and 150% till date. There is one more leg possible and can do the 100 levels if the results are positive.

HIMS/USD – 30-Min Long Trade Setup!📊 🚀

🔹 Asset: HIMS/USD

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bullish Pennant Breakout

🚀 Trade Plan (Long Position):

✅ Entry Zone: Above 59.63 USD (Breakout Confirmation)

✅ Stop-Loss (SL): Below 55.00 USD (Breakout Invalidated)

🎯 Take Profit Targets:

📌 TP1: 66.72 USD (First Resistance Level)

📌 TP2: 75.55 USD (Extended Bullish Target)

📊 Risk-Reward Ratio Calculation:

📈 Risk (SL Distance): Below 55.00 USD

📈 Reward to TP1: 66.72 USD

📈 Reward to TP2: 75.55 USD

🔍 Technical Analysis & Strategy:

📌 Breakout Confirmation: A strong push above 59.63 USD signals bullish momentum.

📌 Pattern Formation: Bullish Pennant Breakout, indicating potential upside continuation.

📊 Key Support & Resistance Levels:

🟢 55.00 USD – Strong Support / Stop-Loss Level

🟡 59.63 USD – Breakout Zone / Entry Level

🔴 66.72 USD – First Profit Target / Resistance

🟢 75.55 USD – Final Target for Momentum Extension

🚀 Momentum Shift Expected:

📌 If price stays above 59.63 USD, it could rally towards 66.72 USD and 75.55 USD.

📌 A high-volume breakout would strengthen the trend continuation.

🔥 Trade Execution & Risk Management:

📊 Volume Confirmation: Ensure strong buying volume above 59.63 USD before entering.

📈 Trailing Stop Strategy: Move SL to entry (59.63 USD) after TP1 (66.72 USD) is hit.

💰 Partial Profit Booking Strategy:

✔ Take 50% profits at 66.72 USD, let the rest run to 75.55 USD.

✔ Adjust Stop-Loss to Break-even (59.63 USD) after TP1 is reached.

⚠️ Fake Breakout Risk:

If price falls below 59.63 USD, wait for a retest before considering re-entry.

🚀 Final Thoughts:

✔ Bullish Setup – Holding above 59.63 USD could lead to higher targets.

✔ Momentum Shift Possible – Watch for volume confirmation.

✔ Favorable Risk-Reward Ratio – 1:1.13 to TP1, 1:2.46 to TP2.

💡 Stick to the plan, manage risk, and trade smart! 🚀🏆

🔗 #StockTrading #HIMSUSD #BreakoutTrade #TechnicalAnalysis #MarketTrends #ProfittoPath

HIMS: Two situationsOn HIMS as you can see in the graph, we are faced with two situations.

It is at the opening of the market that we would know if we would have a continuation of the upward trend or if we would have a reversal of the trend.

So we would have:

1- a continuation of the upward trend when the resistance line will be broken forcefully by a large green candle and followed by a large green volume, you can at this time enter a buying position as soon as the second green candle appears accompanied by a green volume;

2- A reversal of the trend (bearish trend) when the support line will be broken forcefully by a large red candle and followed by a large red volume. Therefore you can enter a sell position as soon as the second red candle appears.

Furthermore, you must wait until all the analysis conditions are met before taking a position on the market.

Can we enhance the most popular Indicator on TradingView?I describe my implementation of the TTM Squeeze indicator, first coded by Lazybear and that became the most popular indicator on TradingView.

There's gotta be a reason for that to be the most popular, right? I wanted to find out and make it much easier to navigate as well as adding to it with my own touch.

Hope you enjoy it.