Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.36 USD

805.04 M USD

11.92 B USD

290.11 M

About Hormel Foods Corporation

Sector

Industry

CEO

Jeffrey M. Ettinger

Website

Headquarters

Austin

Founded

1891

FIGI

BBG000BLF8D2

Hormel Foods Corp. engages in the manufacturing and marketing of branded food products. It operates through the following segments: Retail, Foodservice, and International. The Retail segment consists of the processing, marketing, and sale of food products sold predominantly in the retail market. The Foodservice segment includes the processing, marketing, and sale of food and nutritional products for foodservice, convenience store, and commercial customers. The International segment focuses on processing, marketing, and selling company products internationally. The company was founded by George A. Hormel in 1891 and is headquartered in Austin, MN.

Related stocks

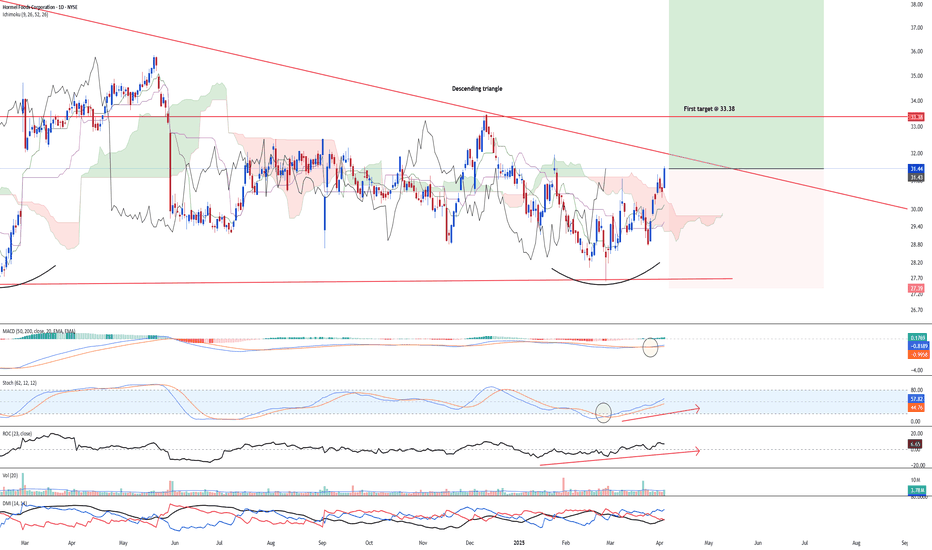

Bottoming outNYSE:HRL has formed a large descending triangle and a potential double bottom formation. Given the upside momentum, there is a strong chance of HRL trending higher after breaking above the descending triangle.

Long-term MACD is looking at a strong long-term bullish momentum after the MACD/signal

Hormel Foods Co | HRL | Long at $28.98Food stocks are gaining momentum. I anticipate another round of inflation could boost them in the coming 1-2 years. Hormel NYSE:HRL is trading at a price-to-earnings of 20x and pays a dividend of 4.05%. Insiders have been awarded options and are buying shares below $30. Earnings are forecast to gr

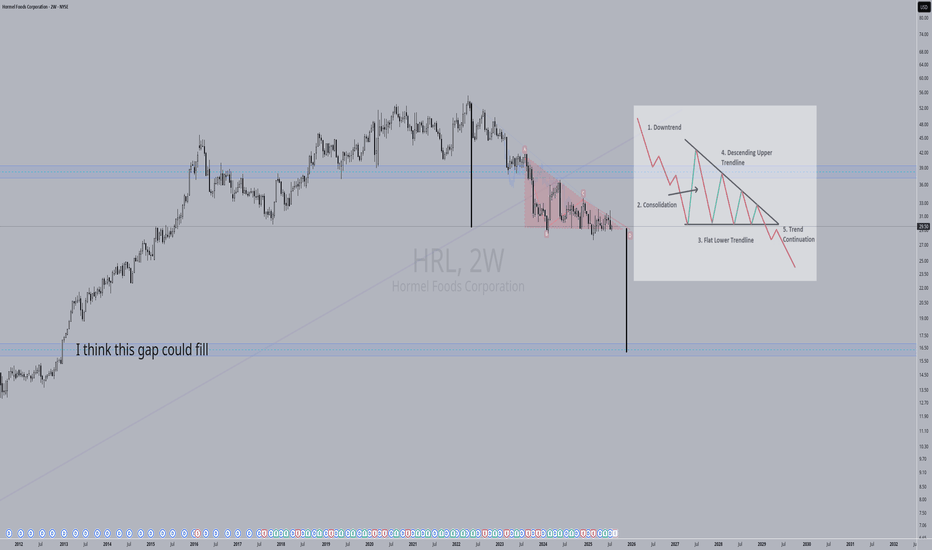

HRL approaching Monthly 200MASince an ATH of $55.11 in April of 2022, HRL has declined -47%.

HRL has never been priced below its monthly 200MA.

If HRL produces positive ERs on Thursday 2/29, it could be set up for a solid technical bounce from its monthly 200MA.

Monthly oversold RSI... If monthly 200 support ultimately f

#HRL#Hormel Foods Corporation (NYSE: HRL), a distinguished brand in the food processing sector, has been under the lens of investors and traders alike due to its recent price actions. A meticulous examination of the technical charts reveals a narrative of a stock at a critical juncture, hinting at a pote

$HRL Bear Flag Weekly ChartNYSE:HRL Bear Flag Weekly Chart The technical analysis of a bear flag pattern on the weekly chart of Hormel Foods Corporation (ticker symbol: NYSE:HRL ) reveals a potentially bearish trend continuation signal. A bear flag is a price pattern characterized by a sharp downward move (the flagpole) fol

Hormel Foods LongHRL long position. It looks like it's ready to move and I got the signal for long position.

Market touched a lower Lin Reg and below MACD on H4.

Confirmation on H1 to take long position with 2 TP.

Tp1 at $40.40 and 2nd at $42.

SL at $38.63.

Warning!!!!

This content should not be interpreted as finan

HORMEL FOODS Stock Chart Fibonacci Analysis 070423 Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 40.4/61.80%

Chart time frame : B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress : A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) Hit the bottom

D) Hit the top

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

HRL5193039

Hormel Foods Corporation 3.05% 03-JUN-2051Yield to maturity

6.76%

Maturity date

Jun 3, 2051

HRL4998173

Hormel Foods Corporation 1.8% 11-JUN-2030Yield to maturity

4.67%

Maturity date

Jun 11, 2030

HRL5193037

Hormel Foods Corporation 1.7% 03-JUN-2028Yield to maturity

4.40%

Maturity date

Jun 3, 2028

HRL5767180

Hormel Foods Corporation 4.8% 30-MAR-2027Yield to maturity

4.28%

Maturity date

Mar 30, 2027

See all HRL bonds

Curated watchlists where HRL is featured.

Frequently Asked Questions

The current price of HRL is 28.80 USD — it has decreased by −2.36% in the past 24 hours. Watch Hormel Foods Corporation stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Hormel Foods Corporation stocks are traded under the ticker HRL.

HRL stock has fallen by −2.09% compared to the previous week, the month change is a −5.62% fall, over the last year Hormel Foods Corporation has showed a −9.80% decrease.

We've gathered analysts' opinions on Hormel Foods Corporation future price: according to them, HRL price has a max estimate of 41.00 USD and a min estimate of 29.00 USD. Watch HRL chart and read a more detailed Hormel Foods Corporation stock forecast: see what analysts think of Hormel Foods Corporation and suggest that you do with its stocks.

HRL stock is 1.19% volatile and has beta coefficient of 0.05. Track Hormel Foods Corporation stock price on the chart and check out the list of the most volatile stocks — is Hormel Foods Corporation there?

Today Hormel Foods Corporation has the market capitalization of 15.70 B, it has decreased by −5.17% over the last week.

Yes, you can track Hormel Foods Corporation financials in yearly and quarterly reports right on TradingView.

Hormel Foods Corporation is going to release the next earnings report on Aug 28, 2025. Keep track of upcoming events with our Earnings Calendar.

HRL earnings for the last quarter are 0.35 USD per share, whereas the estimation was 0.34 USD resulting in a 2.42% surprise. The estimated earnings for the next quarter are 0.41 USD per share. See more details about Hormel Foods Corporation earnings.

Hormel Foods Corporation revenue for the last quarter amounts to 2.90 B USD, despite the estimated figure of 2.90 B USD. In the next quarter, revenue is expected to reach 2.98 B USD.

HRL net income for the last quarter is 180.02 M USD, while the quarter before that showed 170.57 M USD of net income which accounts for 5.54% change. Track more Hormel Foods Corporation financial stats to get the full picture.

Yes, HRL dividends are paid quarterly. The last dividend per share was 0.29 USD. As of today, Dividend Yield (TTM)% is 4.01%. Tracking Hormel Foods Corporation dividends might help you take more informed decisions.

Hormel Foods Corporation dividend yield was 3.64% in 2024, and payout ratio reached 77.04%. The year before the numbers were 3.50% and 76.10% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 29, 2025, the company has 20 K employees. See our rating of the largest employees — is Hormel Foods Corporation on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Hormel Foods Corporation EBITDA is 1.23 B USD, and current EBITDA margin is 11.09%. See more stats in Hormel Foods Corporation financial statements.

Like other stocks, HRL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Hormel Foods Corporation stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Hormel Foods Corporation technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Hormel Foods Corporation stock shows the sell signal. See more of Hormel Foods Corporation technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.