Gravity’s Calling, JobyIt´s hot sector for the future, but at this point the valuation does not make sence. It´s going down. The only problem with this trade is that we do not know when.

Commercial service expected post‑2025 at earliest; certification delays, FAA regulatory environment, infrastructure buildout, and low

Key facts today

Joby Aviation announced plans to acquire Blade Air Mobility's air taxi business, excluding the Medical division, which contributed to a 17% increase in Blade's stock on August 4.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−1.06 USD

−608.03 M USD

136.00 K USD

430.60 M

About Joby Aviation, Inc.

Sector

Industry

CEO

JoeBen Bevirt

Website

Headquarters

Santa Cruz

Founded

2009

FIGI

BBG00X2MYTC2

Joby Aviation, Inc. is a transportation company, which engages in developing an all-electric, vertical take-off and landing aircraft that intends to operate as a commercial passenger aircraft. The company was founded by Bevirt Joebenn in 2009 and is headquartered in Santa Cruz, CA.

Related stocks

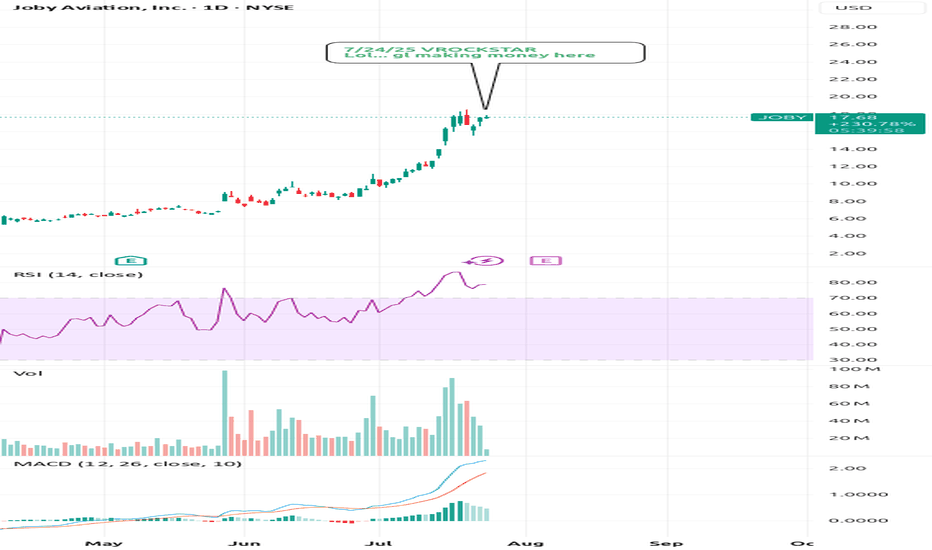

7/24/25 - $joby - Lol... gl making money here7/24/25 :: VROCKSTAR :: NYSE:JOBY

Lol... gl making money here

- have long followed the evtol "space" which is a bit more quantum-mechanical in nature... because it "is here" and also "not here"

- will be a long wait here

- somehow retail $ has allowed story tellers to write season after season of

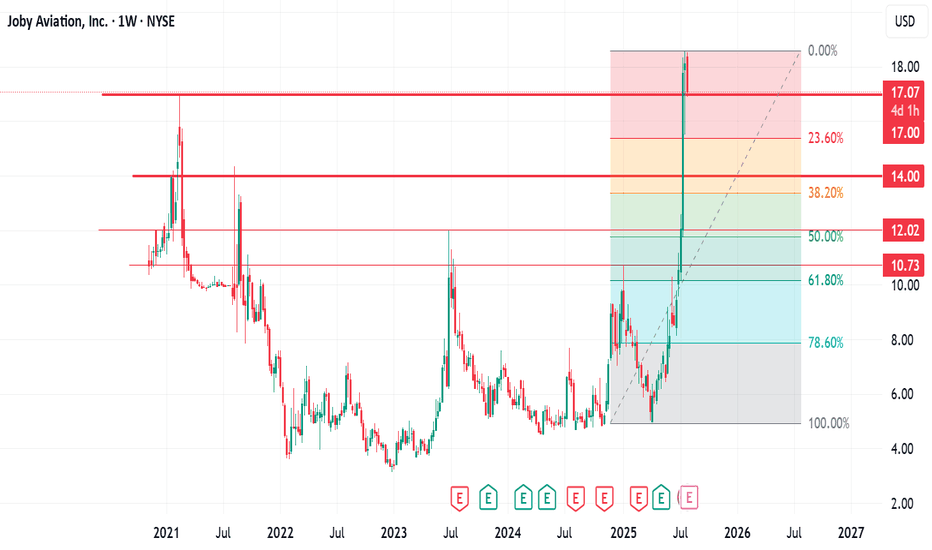

JOBy Aviation (JOBY) Price Action and Accumulation OutlookJOBy Aviation (JOBY) Price Action and Accumulation Outlook.

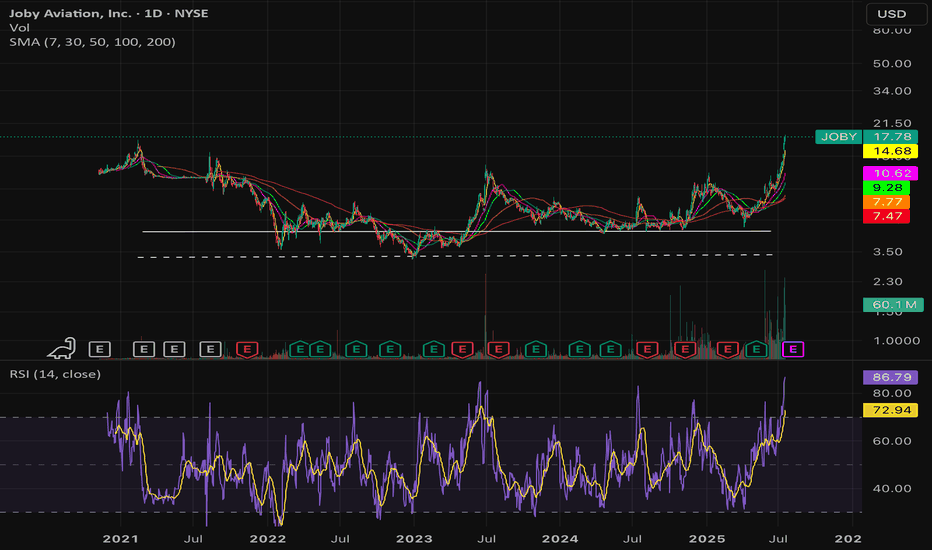

JOBy Aviation (NASDAQ: JOBY) has experienced a notable upward trend since its reversal on April 7, 2025, when it was trading around $4.96. The stock reached an all-time high of approximately $18.60 on July 25, 2025.

However, in today’s tr

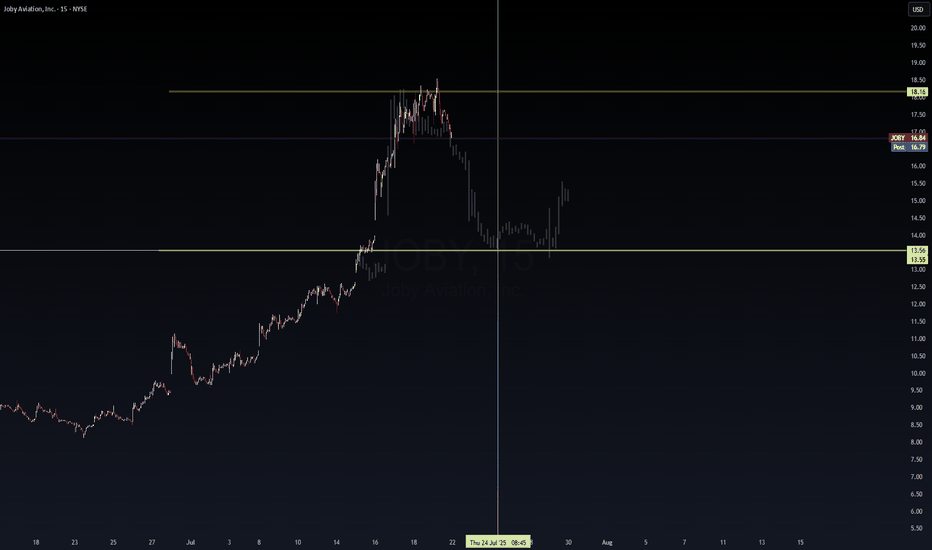

$JOBY Aviation – Bounce Off Target Zone Status: Partial Forecast📈 NYSE:JOBY Aviation – Bounce Off Target Zone Status: Partial Forecast Completion

Posted by: WaverVanir International LLC | VolanX Protocol Timeframe: 15m + Forecast Confirmation

The $13.55–13.56 support zone — highlighted in our institutional forecast — was tagged and defended. Price respect

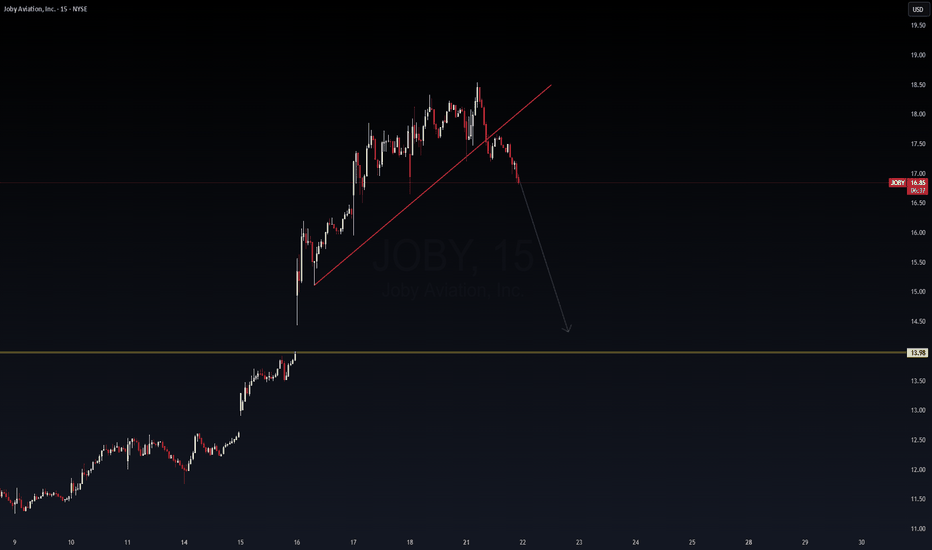

JOBY Aviation – Bearish Breakdown Watch📉 JOBY Aviation – Bearish Breakdown Watch

Timeframe: 15m

Structure: Rising wedge breakdown

Bias: Bearish

Target: $13.98

Posted by: WaverVanir International LLC | VolanX Protocol

JOBY just snapped a rising support line with increasing downside pressure. Weakening momentum and clear trendline break s

$JOBY pre-mature ejaculation fueled by Hopium- NYSE:JOBY pumped by X/Twitter gurus. They claim themselves to be early picker of innovative company whereas truth is they have massive following which is causing pump and dumps.

- SEC should investigate these X influencers pumping small cap companies and then claiming that they are picking 10

$JOBY Long Trade Setup – July 10🚀

Price coiled up in a tight pennant — and broke out right on time. Trendline support is intact, and momentum is building.

📌 Entry: $11.55

🎯 Target: $12.23

🛑 Stop Loss: Below $11.30

⏱️ Timeframe: 30-min chart

🔍 Why I Like This Trade:

Bullish pennant breakout with solid trend support

Holding stro

Joby Aviation, Inc.Key arguments in support of the idea:

Over the past quarter, Joby Aviation has made meaningful progress toward certification of its electric air taxi. The company has now completed 62% of Stage 4, advancing 12 ppts in just one quarter. Engineers successfully conducted piloted transition flights, a

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where JOBY is featured.

Frequently Asked Questions

The current price of JOBY is 18.01 USD — it has increased by 6.33% in the past 24 hours. Watch Joby Aviation, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Joby Aviation, Inc. stocks are traded under the ticker JOBY.

JOBY stock has fallen by −12.46% compared to the previous week, the month change is a 48.39% rise, over the last year Joby Aviation, Inc. has showed a 255.23% increase.

We've gathered analysts' opinions on Joby Aviation, Inc. future price: according to them, JOBY price has a max estimate of 22.00 USD and a min estimate of 6.00 USD. Watch JOBY chart and read a more detailed Joby Aviation, Inc. stock forecast: see what analysts think of Joby Aviation, Inc. and suggest that you do with its stocks.

JOBY reached its all-time high on Aug 4, 2025 with the price of 20.95 USD, and its all-time low was 3.15 USD and was reached on Dec 27, 2022. View more price dynamics on JOBY chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

JOBY stock is 8.24% volatile and has beta coefficient of 2.25. Track Joby Aviation, Inc. stock price on the chart and check out the list of the most volatile stocks — is Joby Aviation, Inc. there?

Today Joby Aviation, Inc. has the market capitalization of 14.61 B, it has increased by 0.52% over the last week.

Yes, you can track Joby Aviation, Inc. financials in yearly and quarterly reports right on TradingView.

Joby Aviation, Inc. is going to release the next earnings report on Nov 6, 2025. Keep track of upcoming events with our Earnings Calendar.

JOBY earnings for the last quarter are −0.41 USD per share, whereas the estimation was −0.19 USD resulting in a −119.56% surprise. The estimated earnings for the next quarter are −0.19 USD per share. See more details about Joby Aviation, Inc. earnings.

Joby Aviation, Inc. revenue for the last quarter amounts to 0.00 USD, despite the estimated figure of 49.67 K USD. In the next quarter, revenue is expected to reach 17.83 K USD.

JOBY net income for the last quarter is −324.67 M USD, while the quarter before that showed −82.41 M USD of net income which accounts for −293.99% change. Track more Joby Aviation, Inc. financial stats to get the full picture.

No, JOBY doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 13, 2025, the company has 2.03 K employees. See our rating of the largest employees — is Joby Aviation, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Joby Aviation, Inc. EBITDA is −600.45 M USD, and current EBITDA margin is −412.63 K%. See more stats in Joby Aviation, Inc. financial statements.

Like other stocks, JOBY shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Joby Aviation, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Joby Aviation, Inc. technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Joby Aviation, Inc. stock shows the buy signal. See more of Joby Aviation, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.