Gravity’s Calling, JobyIt´s hot sector for the future, but at this point the valuation does not make sence. It´s going down. The only problem with this trade is that we do not know when.

Commercial service expected post‑2025 at earliest; certification delays, FAA regulatory environment, infrastructure buildout, and low public adoption slow momentum.

No confirmed pre-orders yet—only MoUs signaling future potential.

Until order contracts are signed, there's no concrete customer commitment.

Today´s news and why it went up 20%

They plan to acquire Blade's (BLDE) helicopter rideshare business for up to $125 million as it looks to scale its electric air taxi service, and this news only, puts another 3 billion into their valuation.

Freefall Mode: ON

JOBY trade ideas

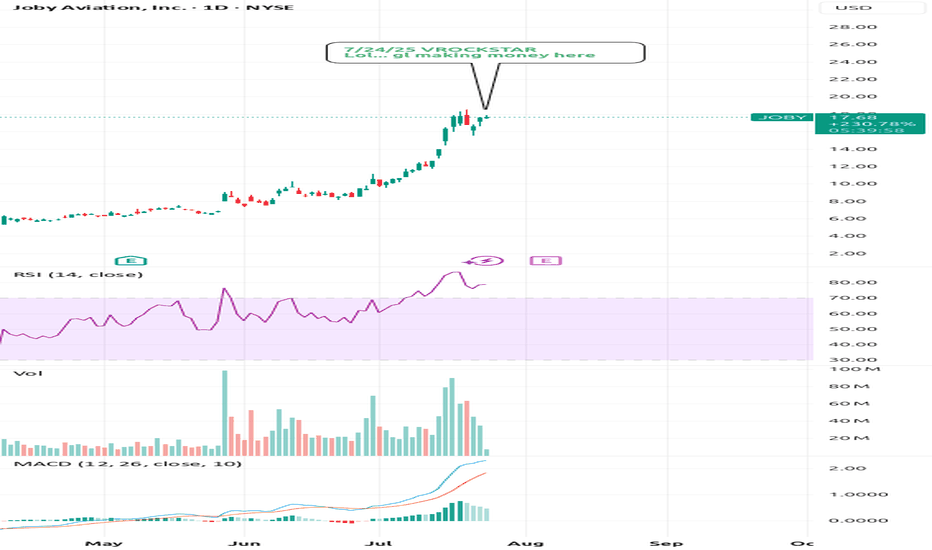

7/24/25 - $joby - Lol... gl making money here7/24/25 :: VROCKSTAR :: NYSE:JOBY

Lol... gl making money here

- have long followed the evtol "space" which is a bit more quantum-mechanical in nature... because it "is here" and also "not here"

- will be a long wait here

- somehow retail $ has allowed story tellers to write season after season of "wait and trust me bro" and this is no exception

- perhaps they are a winner

- but this valuation doesn't even require an explanation, sorry (heuristics, and i could get into it if anyone is genuinely curious and not going to just write silly short retorts - happy to debate)

- with that being said this will likely find it's way right back to the single digits, sooner vs later

- welcome to the short portfolio JOBY... you're joined with 10 other small positions that should make you feel like part of the club. i keep em small, so emotion stays ice cold, and when i run em big, i will make a comment. but until then. comfy short here, almost a lobotomized position for a hedge to my long book in this whacky tape

V

JOBy Aviation (JOBY) Price Action and Accumulation OutlookJOBy Aviation (JOBY) Price Action and Accumulation Outlook.

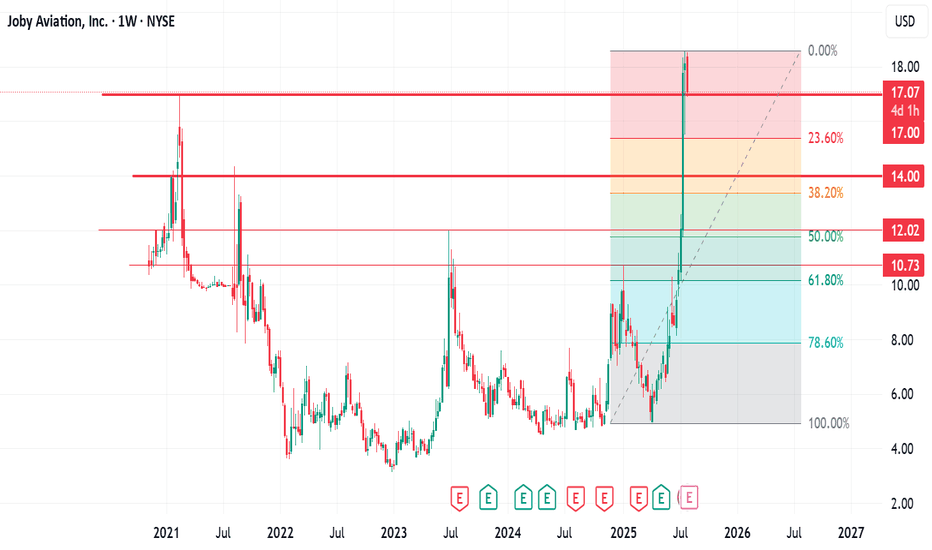

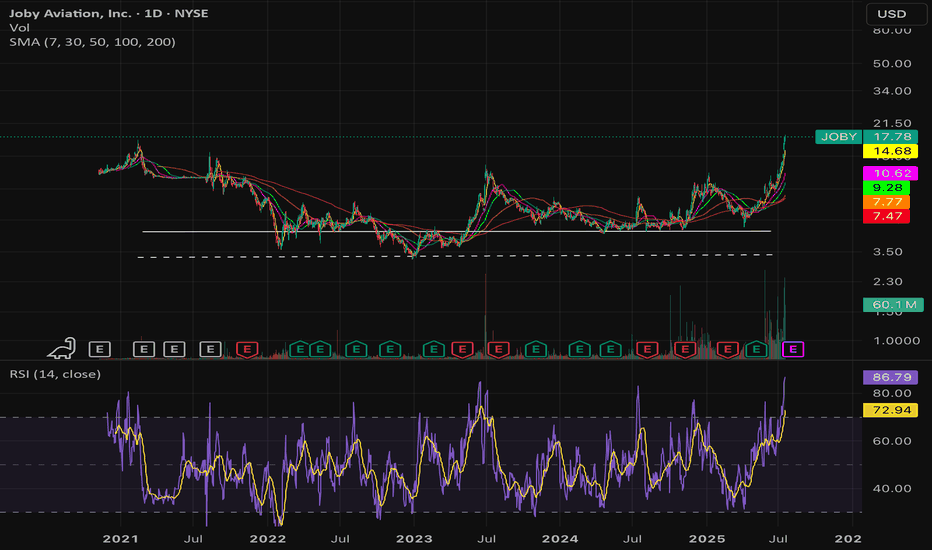

JOBy Aviation (NASDAQ: JOBY) has experienced a notable upward trend since its reversal on April 7, 2025, when it was trading around $4.96. The stock reached an all-time high of approximately $18.60 on July 25, 2025.

However, in today’s trading session, the stock declined by over 8%, testing a key support level at $17.00. From a technical standpoint, if this support level fails to hold, the next potential downside target could be around $14.00.

At this level, I plan to begin accumulating shares using a dollar-cost averaging (DCA) strategy. Should Fibonacci retracement levels become relevant in the correction, we may see the price retrace to the 50% level, which lies around $12.00 per share — a zone that could offer an attractive long-term entry point.

Given JOBY’s position as a frontrunner in the eVTOL (electric Vertical Takeoff and Landing) sector, this may represent a long-term investment opportunity worth considering.

I look forward to connecting with you.

Let's keep winning together

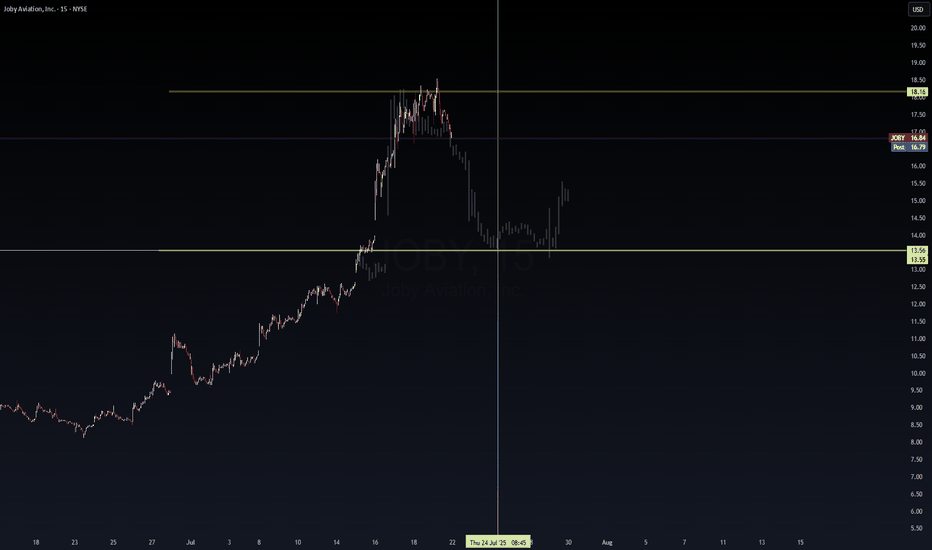

$JOBY Aviation – Bounce Off Target Zone Status: Partial Forecast📈 NYSE:JOBY Aviation – Bounce Off Target Zone Status: Partial Forecast Completion

Posted by: WaverVanir International LLC | VolanX Protocol Timeframe: 15m + Forecast Confirmation

The $13.55–13.56 support zone — highlighted in our institutional forecast — was tagged and defended. Price respected the projected -13.1% pullback from $16.91 to $14.70, dipping slightly lower before rebounding.

✅ Forecast Outcome: Target 1 ($14.70) hit

🎯 Liquidity Reaction: Sharp reclaim off $13.55 demand zone

📊 Current Price: $15.50s and climbing

VolanX Commentary: This marks a critical pivot. If JOBY reclaims $16.16 with strong volume, we may flip bias into neutral or begin planning an upside mean reversion.

Scenarios:

🔺 Above $16.16 = Liquidity vacuum toward $18.16

🔻 Below $13.55 = Opens macro fade to $11.60 VolanX Protocol: Recalibrating risk model.

No long until VWAP and trend alignment confirm!

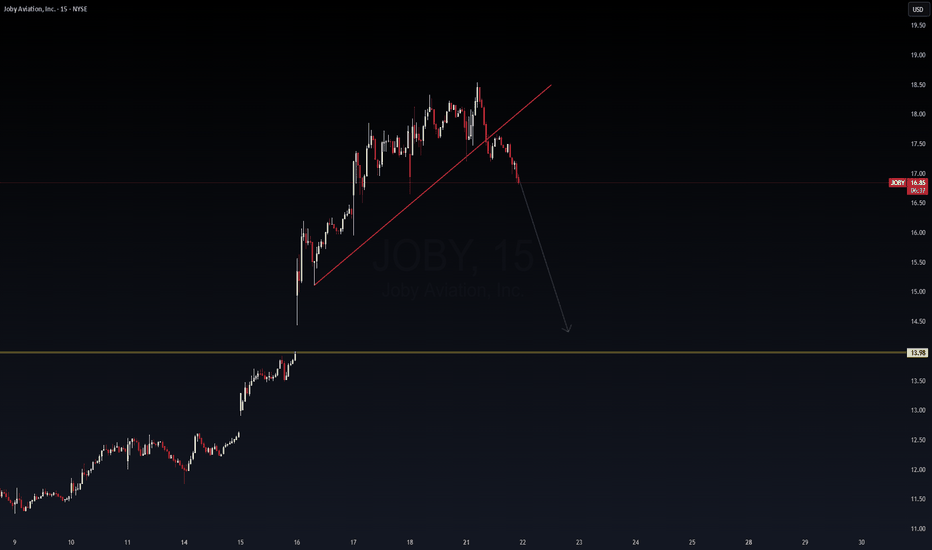

JOBY Aviation – Bearish Breakdown Watch📉 JOBY Aviation – Bearish Breakdown Watch

Timeframe: 15m

Structure: Rising wedge breakdown

Bias: Bearish

Target: $13.98

Posted by: WaverVanir International LLC | VolanX Protocol

JOBY just snapped a rising support line with increasing downside pressure. Weakening momentum and clear trendline break suggest a potential retest of the $13.98 zone — a key prior resistance now flipped to potential demand.

🔻 VolanX Signal: Bearish Breakdown Triggered

📊 If volume expands on the next candle, we expect continuation

⚠️ Macro risk still tilted toward profit-taking in growth names

VolanX Protocol Active – Smart Futures Framework engaged

We are actively tracking order flow and liquidity zones for confirmation.

$JOBY pre-mature ejaculation fueled by Hopium- NYSE:JOBY pumped by X/Twitter gurus. They claim themselves to be early picker of innovative company whereas truth is they have massive following which is causing pump and dumps.

- SEC should investigate these X influencers pumping small cap companies and then claiming that they are picking 1000% gainers.

- I don't know how the F, a company making 15 mil in revenue is sitting with 15 billion market cap. Someone needs to investigate these X pumpers and the connection with these companies like NYSE:JOBY execs if they are getting money under the table.

$JOBY Long Trade Setup – July 10🚀

Price coiled up in a tight pennant — and broke out right on time. Trendline support is intact, and momentum is building.

📌 Entry: $11.55

🎯 Target: $12.23

🛑 Stop Loss: Below $11.30

⏱️ Timeframe: 30-min chart

🔍 Why I Like This Trade:

Bullish pennant breakout with solid trend support

Holding strong above previous resistance now turned support

Price action shows continuation potential after consolidation

✅ Disciplined setup, clean structure, good R:R.

This is how confidence builds—one trade at a time.

Joby Aviation, Inc.Key arguments in support of the idea:

Over the past quarter, Joby Aviation has made meaningful progress toward certification of its electric air taxi. The company has now completed 62% of Stage 4, advancing 12 ppts in just one quarter. Engineers successfully conducted piloted transition flights, and a series of fault-tolerance tests—where batteries, tilt mechanisms, and even half of the engines were deliberately shut off—ended in safe landings, showcasing the robustness of Joby’s safety systems.

Progress on the certification front is complemented by tangible manufacturing achievements. Five fully functional flight prototypes have already been assembled, with each new unit being produced faster, more efficiently, and at lower cost. Scaling efforts are supported by a strong strategic partnership with Toyota, which plans to invest up to $500 million this year to help Joby refine its production processes. The company’s order backlog stands at approximately 1,500 units.

Joby is looking beyond California for operations. A pilot service is scheduled to launch in Dubai in spring 2026, with the first vertiports already under development. Test flights are expected to begin by mid2025. Simultaneously, a MoU has been signed with Virgin Atlantic, paving the way for future service networks in London and Manchester.

Joby’s monetization strategy is highly flexible—ranging from direct aircraft sales and defense contracts to joint ventures and proprietary passenger routes in partnership with Delta, Uber, and Virgin. The company currently holds $813 million in cash and has a disciplined 2025 spending plan of $500–540 million.

While Archer Aviation (ACHR) didn’t surprise with its latest report, its stock still saw impressive gains. We believe Joby could follow suit—especially given the overlap in their operational zones, as Joby’s stock typically reacts to competitor moves with a slight delay. Investors are beginning to price in the upcoming launch of eVTOL commercial operations, which could periodically trigger strong upward momentum in the stock. Technically, the chart also shows signs of an "inverse head and shoulders" formation.

2-month target price for JOBY is $8.50. We recommend setting a stop loss at $6.10.

JOBY closed above MA200 - Is it good to buy the dip now?BUY ENTRY $6.00 - $6.45

1st TARGET $7.20

2nd TARGET $8.00

STOPLOSS BELOW $5.75

---

OUR BUY CALL OPTIONS

Strike $6 Exp 7/18, price $1.35

Strike $7 Exp 7/18, price $0.90

---

HIGH RISK HIGH REWARD BUY CALL OPTION

Strike $7 Exp 4/17, price $0.35

---

Disclaimer

$JOBY: Strategic Entry into the eVTOL MarketI spend time researching and finding the best entries and setups, so make sure to boost and follow for more.

Joby Aviation, Inc. ( NYSE:JOBY ): Strategic Entry into the eVTOL Market

Trade Setup:

- Entry Price: $6.91

- Stop-Loss: $3.61

- Take-Profit Targets:

- TP1: $12.76

- TP2: $21.08

Company Overview:

Joby Aviation, Inc. is a leading player in the emerging electric vertical takeoff and landing (eVTOL) aircraft industry. The company focuses on developing zero-emission aircraft to revolutionize urban air mobility. With substantial investments in technology and partnerships, Joby aims to launch commercial operations by 2025.

Earnings Reports:

- In Q3 2024, NYSE:JOBY reported a net loss of **$476.86 million**, as expected for a pre-revenue company heavily investing in research and development.

- Total cash reserves stand at **$1.1 billion**, ensuring sufficient runway for operational and developmental goals.

Valuation Metrics:

- Market Cap: **$6.54 billion**.

- Given its pre-revenue status, traditional valuation metrics like P/E or P/B are not applicable. Instead, the company is valued on its growth potential in the emerging eVTOL market.

Dividends:

- NYSE:JOBY does not pay dividends, prioritizing reinvestment into its development and expansion plans.

Market News:

- Recent announcements include plans to raise **$300 million** through equity sales, strengthening financial resources ahead of the anticipated commercial launch.

- Joby also received its first production airworthiness certificate, a critical milestone toward FAA certification.

Analyst Ratings:

- Analyst consensus: **Moderate Buy**.

- Average price target: **$8.35**, reflecting mixed sentiment due to the stock’s volatility and developmental stage.

Risk/Reward Analysis:

With a stop-loss at **$3.61**, the downside risk is approximately **47.75%**, while the upside potential to TP1 ($12.76) offers a reward of **84.66%**. TP2 at **$21.08** provides an extended reward potential of over **200%**. This setup appeals to long-term investors with high-risk tolerance.

Conclusion:

Joby Aviation represents a compelling opportunity for growth investors looking to capitalize on the eVTOL market's potential. While the stock's volatility and pre-revenue status introduce risk, its significant milestones and industry positioning make it a high-reward prospect.

When the Market’s Call, We Stand Tall. Bull or Bear, Just Ride the Wave!

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Traders should conduct their own due diligence before making investment decisions.

Joby Aviation going for a 80% dump?Following the successful “short” of eVTOL manufacturer Lilium (idea below - read for deep dive), we’re now going to target another. This time, Joby Aviation.

The principles behind this idea are the same as was with Lilium, mixture of fundamentals and technical analysis.

A lot of the criticism from my own quarter comes from the promises that certification is just around the corner. It has been 11 years now, and still no certification.

Don’t listen to what the say.

Pay attention to what they do.

As the money runs out the business now looks to collect $200 million from investors:

“Joby Aviation Stock Drops After Pricing Public Offering of 40M Shares”

source:

www.businesswire.com

The chart -

On the above 2 week chart price action has been printing lower highs for the last year. Since then there is broken market structure with uptrend channel support failure.

The uptrend flag continuation pattern projects a 80% correction. On confirmation, such flag patterns meet the target 77% of the time. This would take price action to the 1.60 area.

On RSI, a breakout of support is also visible.

Is it possible price action grows? Sure.

Is it probable? No.

Ww

Go short from current price action.

Lilium short

In TOYOTA We Trust..!In this latest edition of the rankings, Lexus and Toyota ranked first and second, respectively, as Consumer Reports' most reliable car brands.

But should we trust them in early detection of companies with new technologies?

their history with TSLA could be a good example!

A 7-Year Collaboration with Joby:

Toyota has invested nearly $900 million in Joby, an electric vertical takeoff and landing (eVTOL) company that develops air taxis:

Investment: Toyota's latest $500 million investment will support Joby's certification and commercial production of its air taxis. The investment will be made in two tranches, with the first closing later this year and the second in 2025.

Collaboration: Toyota and Joby have been collaborating for nearly seven years. Toyota engineers work with Joby's team in California, and Toyota supplies powertrain and actuation components for Joby's aircraft.

#Skin_In _The_Game

Clear for a breakout positioned favorably in bullish sentiment Look at the stochastic level of the buying area. In the last three sessions, we had a catalyst that performed well for the stock in a time of extreme volatility. The indicators have positioned themselves and now move towards an imminent breakout. We will continue to watch for any sell-off and monitor the price action in the upcoming session/sessions.

Joby Aviation Surges Over 24% After Major Toyota InvestmentJoby Aviation (NYSE: NYSE:JOBY ) saw its stock soar by over 24% to $5.99 after a significant announcement that Toyota will invest an additional $500 million into the electric air taxi company. This brings Toyota’s total investment in Joby (NYSE: NYSE:JOBY ) to $894 million, underscoring the automaker’s commitment to the future of urban air transportation.

Toyota’s Investment and Strategic Partnership

Toyota’s new investment is not just a financial endorsement but also a strategic partnership aimed at advancing the certification and commercial production of Joby's electric vertical takeoff and landing (eVTOL) aircraft. The investment will come in two equal installments, the first to be completed in 2024 and the second in 2025, further cementing the relationship between the two companies.

Toyota has been involved with Joby (NYSE: NYSE:JOBY ) for almost seven years, providing technical expertise, components, and manufacturing support for the company’s air taxis. Toyota’s engineers are embedded with Joby’s team in California, working closely on the development of these groundbreaking aircraft. This partnership goes beyond just capital infusion, as Toyota also signed a long-term agreement to supply key powertrain and other critical components for Joby’s aircraft.

Other automakers are also eyeing the electric air taxi space, signaling a broader interest in sustainable urban transportation solutions. For instance, Stellantis recently invested $55 million in Archer Aviation, while Delta Airlines has a $60 million stake in Joby, aiming to offer air taxi services for passengers traveling to and from major airports in cities like New York and Los Angeles.

With this backing, Joby Aviation is positioning itself as a leader in the electric air taxi market, which aims to reduce urban traffic congestion and lower carbon emissions. The company has already rolled out its third aircraft from its pilot production line and is expanding its manufacturing capabilities. Joby is targeting a commercial deployment of its air taxis in the next few years.

Technical Aspect: Bullish Momentum

From a technical perspective, Joby’s stock has been in a downtrend since August 2024 but showed a strong reversal with today’s surge. As of this writing, the stock is up over 25%, with a Relative Strength Index (RSI) of 66.19, indicating bullish momentum. The stock has now broken above key moving averages, a positive sign for traders and investors looking at technical patterns.

If the bullish trend continues, NYSE:JOBY could aim to revisit its July highs, as today’s price action suggests a potential shift in the overall market sentiment for the stock. The recent investment news provides a strong fundamental backdrop, and if Joby continues to demonstrate progress in its production and certification milestones, the stock could see sustained upside.

With Toyota’s deepening involvement and the broader market’s growing interest in sustainable air travel, Joby Aviation is positioned to become a major player in the electric aviation space. Investors should keep an eye on upcoming developments, particularly Joby’s progress in certification and commercial production, which could serve as major catalysts for the stock.

Conclusion

Joby Aviation’s (NYSE: NYSE:JOBY ) recent surge in stock price, buoyed by Toyota’s additional $500 million investment, is a positive signal for both the company’s future and its investors. The strong technical performance, with the stock trading above key moving averages and a bullish RSI, suggests that NYSE:JOBY may have broken out of its recent downtrend. Coupled with a strong fundamental outlook, including strategic partnerships with Toyota and Delta Airlines, the company is well-positioned to revolutionize urban air transportation. Keep an eye on this stock as it could be poised for more gains, especially as the market for eVTOL technology heats up.

JOBY | Vertical Take Off EVs | LONGJoby Aviation, Inc. is a transportation company, which engages in developing an all-electric, vertical take-off and landing aircraft that intends to operate as a commercial passenger aircraft. The company was founded by Bevirt Joebenn in 2009 and is headquartered in Santa Cruz, CA.

JOBY - Electric Air Taxi EcosystemJoby Aviation, Inc. is a transportation company, which engages in developing an all-electric, vertical take-off and landing aircraft that intends to operate as a commercial passenger aircraft. The company was founded by Bevirt Joebenn in 2009 and is headquartered in Santa Cruz, CA.

Investment Overview (As of April 27, 2024)

Short Interest:

Short Float: 19.62%

Market Activity:

Recent trading includes significant block buys, highlighting a surge in trading volume and investor interest.

Latest Developments (Dated April 25, 2024):

Joby has inked a multilateral agreement with three Abu Dhabi government departments to foster the development of its air taxi service in Abu Dhabi and potentially other Emirates.

The partnership encompasses training, infrastructure development, flight operations, and establishing a manufacturing base in Abu Dhabi.

This strategic collaboration paves the way for intra- and inter-emirate air taxi services, enhancing connectivity and transport efficiency.

Upcoming Events:

Earnings Report due on May 7, 2024.

Key Technical Levels:

Current support breakthrough at $5.50 is critical for continued upward movement.

Resistance levels to watch: $6.40, $7.20, and $7.60, with these points being opportune for partial profit-taking.

Trading Strategy:

Take Profit (TP): Set a profit target of approximately $9.00 to realize earnings.

Stop Loss (SL): Place a stop loss order below $5.00 to mitigate substantial losses.

Chart Analysis:

For detailed insights into price actions and trends, refer to the attached chart.

Risk Advisory:

Investing in the market carries substantial risks. It's essential to assess market conditions and your personal risk tolerance. Engage in diligent research or seek advice from a financial advisor before initiating any trades.

JOBY Aviation Options Ahead of EarningsAnalyzing the options chain and the chart patterns of JOBY Aviation prior to the earnings report this week,

I would consider purchasing the 7usd strike price Calls with

an expiration date of 2024-4-19,

for a premium of approximately $0.45.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Joby Aviation Set to Launch An Air-Taxi Service in Dubai By 2026Joby Aviation ( NYSE:JOBY ), a pioneering air-taxi company based in California, has unveiled plans to launch regular air-taxi services in Dubai by 2026. This ambitious endeavor marks a significant leap forward in the evolution of urban mobility, positioning the United Arab Emirates (UAE) at the forefront of cutting-edge transportation technology.

The agreement between Joby Aviation ( NYSE:JOBY ) and the Dubai government represents a historic partnership aimed at revolutionizing the way people move within cities. With operations set to commence as early as next year, Joby ( NYSE:JOBY ) is poised to establish the world's first regularly operating air-taxi service, heralding a new era of aerial transportation.

Joby's remarkable journey towards this milestone has been characterized by a series of pivotal achievements. Notably, the company's innovative air-taxi design was showcased in 2021, highlighting its superior noise reduction capabilities compared to conventional vertical takeoff and landing vehicles. June 2023 witnessed a significant milestone as Joby secured a crucial permit from the Federal Aviation Administration (FAA) for flight testing in the United States, underscoring its commitment to safety and regulatory compliance.

September saw Joby ( NYSE:JOBY ) advancing its production capabilities with the commencement of construction on an aircraft production facility in Ohio, laying the foundation for scalable manufacturing of its revolutionary air taxis. In November, the company made history by conducting the first-ever air taxi flight in New York City, demonstrating the feasibility and potential of urban aerial mobility.

The planned launch of the air-taxi service in Dubai promises to redefine urban transportation, offering unparalleled speed, convenience, and efficiency to passengers. Several strategic locations have been identified as takeoff and landing zones, including Dubai International Airport (DXB), Palm Jumeirah, Dubai Marina, and Dubai Downtown, ensuring seamless connectivity across the city.

Equipped to accommodate a pilot and up to four passengers, Joby's air taxis boast impressive capabilities, capable of reaching speeds of up to 200 mph. This remarkable speed translates to unprecedented time savings, with a journey from Dubai International Airport to Palm Jumeirah reduced to a mere 10 minutes, compared to the current 45-minute car journey.

The announcement has sparked significant investor enthusiasm, with Joby Aviation's stock ( NYSE:JOBY ) surging over 6% in premarket trading to $6.33 per share, reflecting growing confidence in the company's disruptive potential and transformative impact on urban transportation.

As Joby Aviation ( NYSE:JOBY ) continues to push the boundaries of innovation and collaboration, its visionary pursuit of a sustainable, efficient, and accessible urban air mobility ecosystem holds immense promise for cities worldwide. With the skies of Dubai set to be transformed by the advent of air taxis, the future of transportation has never looked more exhilarating or closer within reach.

In summary, Joby Aviation's ( NYSE:JOBY ) bold venture in Dubai represents a monumental stride towards realizing the vision of a seamless, interconnected urban transportation network, propelling humanity towards a future where the sky is no longer the limit.