KODK trade ideas

$765 million government loan to help produce ingredientsEastman Kodak Co. shares more than tripled Tuesday on plans to secure a $765 million government loan to help produce ingredients used in key generic medicines to fight the coronavirus.

The development bank loan is the first of its kind under the Defense Production Act in collaboration with the U.S. Department of Defense. It’s intended to speed production of drugs in short supply and those considered critical to treat Covid-19

Now, the 132-year-old company will be reorienting part of its factory structure to produce drug ingredients

“Americans are dangerously dependent on foreign supply chains for their essential medicines, The U.S. manufactures about 10% of components going to the national generic drug supply.

finance.yahoo.com

www.thestreet.com

DFC to Sign Letter of Interest for Investment in Kodak’s Expansion Into Pharmaceuticals

www.dfc.gov

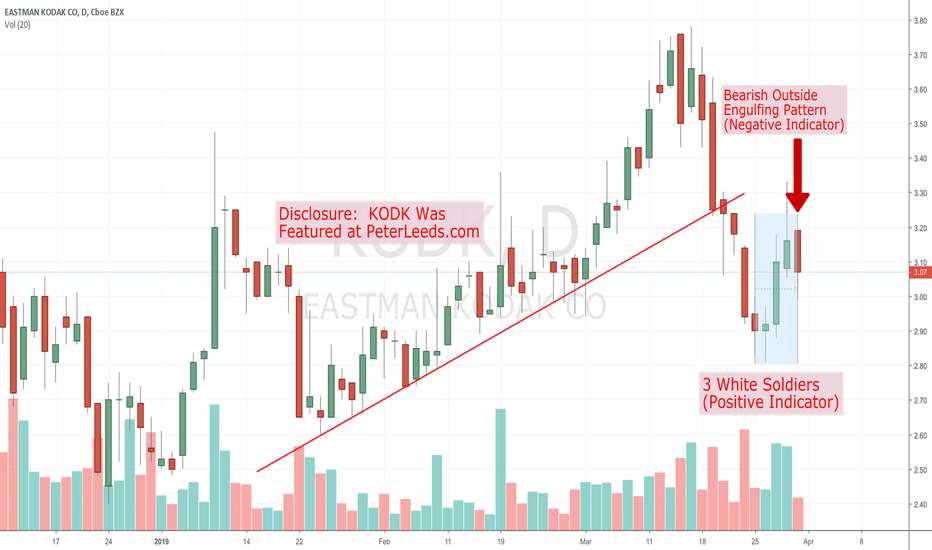

S/R Flip on Kodak (KODK / NYSE:KODK)Although long term I see potential for this stock the current chart is still bearish. The region that previously provided support has now turned into strong resistance, indicated by the strong rejection. Price previously consolidated in this region, but is now instantly rejected showing bears are now in control. I'd like to see price break this region and hold it as support before I have bullish sentiment.

KODK Fundamental playScreening market low marketcap 100-200M

Best Cost of Revenue

Best Entreprise Value / Revenue ratio

rumors division selling in next months

petapixel.com

big crypto ico scheme last year

en.wikipedia.org

www.newsbtc.com

huge good news last year

seekingalpha.com

new ceo 2 months ago

seekingalpha.com

last earning call hints on 9 APRIL

Jim Continenza

Welcome, everyone, and thank you for joining the fourth quarter 2018 investor call for Kodak. Before we begin, I’d like to say, moving from Chairman, to newly appointed Executive Chairman, I have become an integral part of day-to-day operations as the Company continues to execute on critical initiatives. I look forward to working with my team to help Kodak become cash flow positive, build long-term value for shareholders as we continue to deleverage our balance sheet, increase operational efficiencies, and maximize potential of our key growth drivers.

Before I turn it over Dave to discuss the 2018 financial results, I want to update you on the Flexographic Packaging Division sales process. The Company entered in to an agreement to sell FPD on November 11, 2018. Subject to the satisfaction of customary closing conditions, the Company expects to close the sale as early as April 8, 2019 and attempts to use the proceeds to repay over $300 million of the term loans outstanding under the Company’s first lien credit agreement.

Blackstone holds 20%

Name and Address of Beneficial Owner Number of

Common Shares

Beneficially

Owned Percent of Class

Beneficially

Owned Number of Shares of

Series A Convertible

Preferred Stock

Beneficially Owned Percent of Class

Beneficially

Owned

Blackstone Holdings I/II GP Inc., et al.

c/o The Blackstone Group L.P.

345 Park Avenue

New York, New York 10154 8,938,916 (1) 20.8% - - - -

George Karfunkel

1671 52 nd Street

Brooklyn, New York 11204 2,761,568 (2) 6.4% - - - -

GKarfunkel Family LLC

140 Broadway, Suite 3930

New York, New York 10005 2,380,154 (3) 5.5% - - - -

Moses Marx

160 Broadway

New York, New York 10038 5,690,002 (4) 13.2% - - - -

Paradice Investment Management LLC, et al.

257 Fillmore Street, Suite 200

Denver, Colorado 80206 2,288,946 (5) 5.3% - - - -

Southeastern Asset Management, Inc., et al.

6410 Poplar Avenue, Suite 900

Memphis, Tennessee 38119 16,454,200 (6) 30.2% 2,000,000 (6) 100%

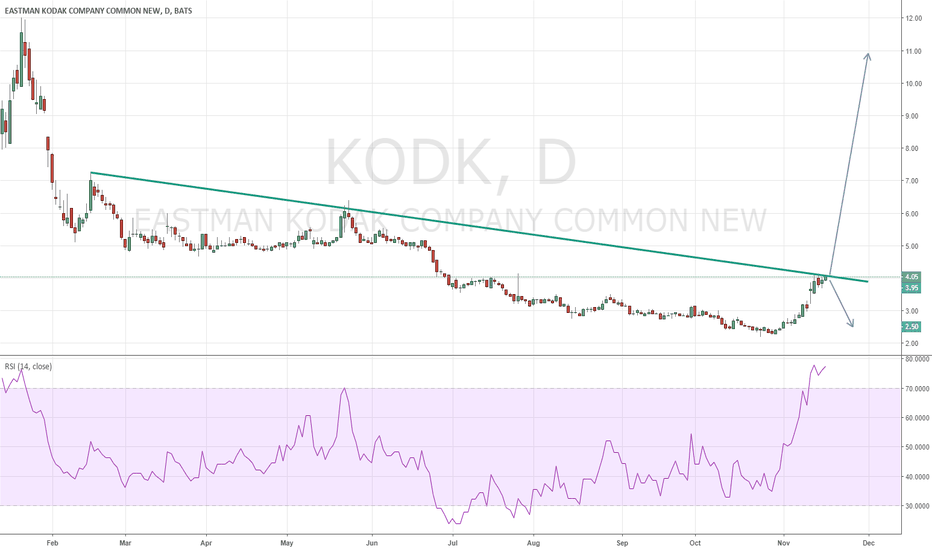

KODK - The Death March continuesThis play is about as straightforward as it gets. The Kodak blockchain project hasn't exactly hit the ground running, and the money has been pulling out. My previous play was taking a short position and target $6.8 - and it played out fantastic. This time around, the profits won't be so great, but I believe that we'll see KODK back to $3-$4 very soon.

KODK - TAShare prices are consolidating between 5.60 resistance and 5.00 support price point. It needs to break and hold above 5.60 before we see further moves to the upside.

Support is at around 5.00 and 4.70. You can follow the progress of this stock by clicking on the chart and on the play button on the right to load the latest price update on any trading day within the trading hours

Good luck and God bless you all