Buy LOAR, sell High-ar! Holding key support around 75.

RSI uptrend in place, hovering around 50, plenty of room for an uptrend

MACD looks like it wants it to turn up

primo earnings numbers so far, what you want to see from a growth stock

chart has the look that this is serious company and I'll be glad to join in for the run back up to triple digits.

unfortunately no options to speak of at this time.

if it opens up with strong volume, that would be a sign.

May the Fed be with you!

Thank you for reading - not financial advice

LOAR trade ideas

LOAR – Long Trade Setup!📈 🟢

Ticker: Loar Holdings Inc. (NYSE: LOAR)

Chart: 30-Min Timeframe

Pattern: Symmetrical triangle breakout continuation

🔹 Entry: $96.49 (breakout from triangle pattern + resistance reclaim)

🔹 Stop-Loss: $94.03 (below ascending trendline and consolidation zone)

🔹 Take Profits:

TP1: $100.30 – Resistance level

TP2: $104.64 – Measured triangle target

⚖️ Risk-Reward Calculation:

– Risk/Share: $2.46

– Reward to TP2: $8.15

– R:R Ratio: ~1:3.3 ✅

🧠 Technical Highlights:

– Breakout from a clean symmetrical triangle

– Retest and strong reclaim of $96 zone

– Bullish momentum with rising volume trend

LOAR – 30-Min Long Trade Setup!📈 🟢

🔹 Asset: Loar Holdings Inc. (LOAR – NYSE)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Ascending Triangle Breakout + Retest

📊 Trade Plan – Long Position

✅ Entry Zone: $85.91 (Breakout + Support Flip)

✅ Stop-Loss (SL): $83.86 (Below ascending trendline + prior support)

🎯 Take Profit Targets:

📌 TP1: $88.63 – Resistance zone

📌 TP2: $91.78 – Major structural supply

📐 Risk-Reward Calculation

🟥 Risk: $2.05/share

🟩 Reward to TP2: $5.87/share

📊 R/R Ratio: ~1 : 2.86 – High-probability setup

🔍 Technical Highlights

📌 Bullish ascending triangle formation ✔

📌 Breakout with volume expansion ✔

📌 Trendline holds and price retests breakout zone ✔

📌 Clean resistance-to-support flip at yellow zone 🔄

📉 Risk Management Strategy

🔁 Trail SL to breakeven post TP1

💰 Secure partial profits at TP1

🚀 Hold remaining for full extension to TP2

⚠️ Setup Invalidation If:

❌ Break below $83.86 support

❌ Breakdown from ascending structure

❌ Weak price action + low volume

🚨 Final Thoughts

✔ Textbook bullish breakout setup

✔ Ideal for swing traders seeking solid R/R

✔ Setup backed by structure, psychology & momentum

🔗 #LOAR #SwingTrade #BreakoutPlay #ProfittoPath #SmartMoney #TechnicalSetup #NYSEStocks #ChartAnalysis #RiskReward #VolumeConfirmation

Loar Holdings Inc. (NYSE: LOAR) Set To Report Earnings TodayLoar Holdings Inc (NYSE: LOAR), a company that designs, manufactures, and markets aerospace and defense components for aircraft, and aerospace and defense systems in the United States and internationally is set to report earnings result on Monday, March 31, 2025, before market open.

Belonging to the aerospace and defence sector, Loar Holdings Inc (NYSE: LOAR) closed Friday's session down 2.61% trading within the psychological support zone formed prior a falling wedge pattern.

With the RSI at 45 a breakout above the resistant point could cement the grounds for a bullish campaign. Similarly, a breakdown below the psychological support zone could lead to a selling spree for NYSE:LOAR shares.

Analyst Forecast

According to 4 analysts, the average rating for LOAR stock is "Strong Buy." The 12-month stock price forecast is $83.5, which is an increase of 26.57% from the latest price.

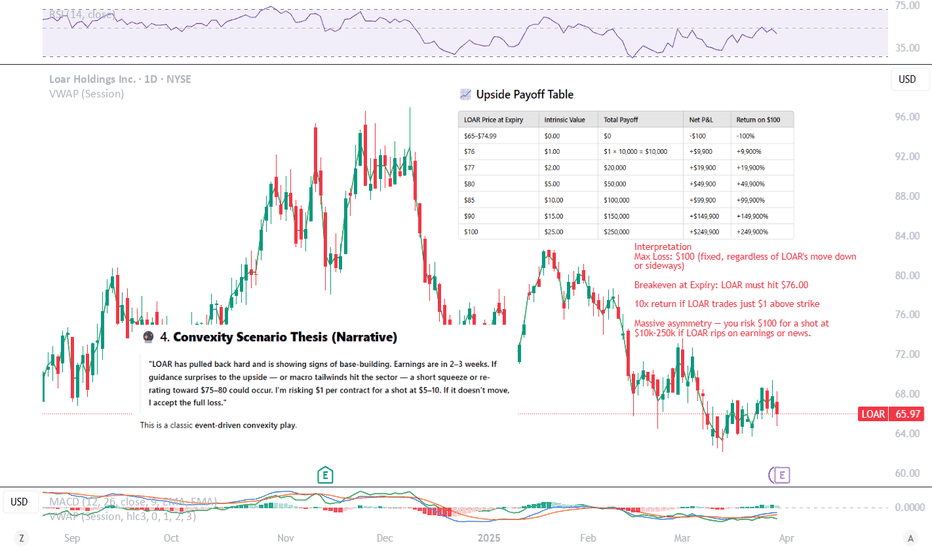

Convexity-based trade scenario using LOAR stock and the April 17Yo traders -

Let’s map out a convexity-based trade scenario using LOAR stock and the April 17, 2025 $75 Call option — currently trading at $1.00, with the stock at $65.97 and only 18 days to expiry.

🔍 Step-by-Step Breakdown:

🧠 1. Basic Structure

You’re buying the LOAR Apr17 $75 call at $1.00.

This is a deep OTM bet (~13.7% above current price).

You’re betting on a short-term move to $75+, meaning volatility spike or news catalyst.

⚙️ 2. Convexity Setup

Convexity means:

Small risk, asymmetric reward

If LOAR stays flat or dips → you lose $1 per contract

If LOAR rips to $80+ → this option could return 5x to 10x+

LOAR Price at Expiry Option Intrinsic Value Profit/Loss

$66 (flat) $0 -$1.00

$70 $0 -$1.00

$75 (strike) $0 -$1.00

$77 $2.00 +$1.00

$80 $5.00 +$4.00 (5x)

$85 $10.00 +$9.00 (9x)

🧾 3. Chart + Sentiment Setup

Looking at the TradingView chart:

Price Action:

LOAR is basing around $66 after a steep downtrend — potential reversal pattern

Volume is light, but some buy pressure is visible

MACD:

Appears to be flattening and potentially crossing bullish

RSI:

~40s: Oversold-to-neutral zone. Could support upward bounce.

Earnings coming up (E icon):

Strong potential for a catalyst move

This setup enhances convexity, because earnings can produce gap moves that DOTM options profit from disproportionately.

🔮 4. Convexity Scenario Thesis (Narrative)

"LOAR has pulled back hard and is showing signs of base-building. Earnings are in 2–3 weeks. If guidance surprises to the upside — or macro tailwinds hit the sector — a short squeeze or re-rating toward $75–80 could occur. I’m risking $1 per contract for a shot at $5–10. If it doesn’t move, I accept the full loss."

This is a classic event-driven convexity play.

⚠️ 5. Risks & Considerations

Time decay is brutal: With only 18 days left, theta decay accelerates daily

IV Crush post-earnings could hurt even if the stock moves

You need a fast, strong move, ideally before or at earnings

Position sizing is critical: This is a "lottery ticket" — don’t over-allocate

✅ 6. Ideal for Your Strategy If:

You're making many small bets like this across tickers/catalysts

You’re not trying to be “right” often, but “big” occasionally

You have capital discipline and uncorrelated base assets

🧮 Position Size:

Option price = $1.00 per contract

You buy 100 contracts of the $75 call

Total risk = $100

Each $1.00 move above $75 = $100 profit per $1, since 100 contracts × 100 shares/contract = 10,000 shares exposure

📈 Upside Payoff Table

LOAR Price at Expiry Intrinsic Value Total Payoff Net P&L Return on $100

$65–$74.99 $0.00 $0 -$100 -100%

$76 $1.00 $1 × 10,000 = $10,000 +$9,900 +9,900%

$77 $2.00 $20,000 +$19,900 +19,900%

$80 $5.00 $50,000 +$49,900 +49,900%

$85 $10.00 $100,000 +$99,900 +99,900%

$90 $15.00 $150,000 +$149,900 +149,900%

$100 $25.00 $250,000 +$249,900 +249,900%

🧠 Interpretation

Max Loss: $100 (fixed, regardless of LOAR's move down or sideways)

Breakeven at Expiry: LOAR must hit $76.00

10x return if LOAR trades just $1 above strike

Massive asymmetry — you risk $100 for a shot at $10k–250k if LOAR rips on earnings or news.

📌 Real-World Considerations:

You might exit early if the option spikes in value before expiry (e.g., stock runs to $72 with 5 days left).

Liquidity may limit large size fills.

Volatility matters: IV spike pre-earnings or a big gap post-earnings increases your chance of profit.

📊 Convex Payoff Table for LOAR Apr17 $75 Call (100 Contracts, $100 Risk)

LOAR Price at Expiry % Move from $65.97 Intrinsic Value Total Payoff Net P&L Return on $100

$65–$74.99 0% to +13.6% $0.00 $0 -$100 -100%

$76 +15.2% $1.00 $10,000 +$9,900 +9,900%

$77 +17.0% $2.00 $20,000 +$19,900 +19,900%

$80 +21.3% $5.00 $50,000 +$49,900 +49,900%

$85 +28.9% $10.00 $100,000 +$99,900 +99,900%

$90 +36.4% $15.00 $150,000 +$149,900 +149,900%

$100 +51.6% $25.00 $250,000 +$249,900 +249,900%

🧠 Takeaway:

Even a 15% move turns your $100 into $10,000 — this is why convex trades are so powerful.

But the trade-off is probability: the odds of a 15–50%+ move in 18 days are low, which is why risk is capped and position sizing matters.

8/13/24 - $loar - Short at $75. 20x sales no way jose8/13/24 :: VROCKSTAR :: NYSE:LOAR

Short at $75. 20x sales no way jose

- round up 20x sales on today's move

- nice results btw. i stayed out of the way bc often times you get these new IPOs that are set up to "crush"

- nothing against this thing. seems like a nice business but i can't do 8 bn valuation on 400 mm of sales.

- looking at funding shorts in this market. this is one.

- happy to keep adding to it up to the $80 level. usually it's bad practice to short without seeing a crack esp on a good chart. but i've been around long enough to call BS.

- so gl to the longs. but don't forget to take some bacon off the family bc i'm coming for your hog.

pigs get fat, hogs get slaughtered.

V