LW trade ideas

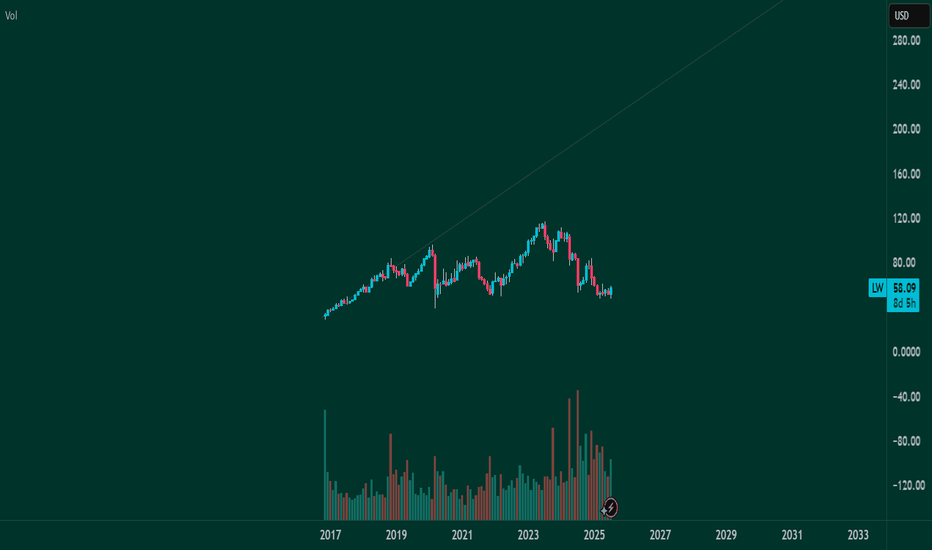

Trading Thesis: Frozen M&A Firestarter– Is LW the Next Takeover 🧠 Trading Thesis: “Frozen M&A Firestarter – Is LW the Next Takeover Pop?”

📉 Ticker: NYSE:LW

🗓️ Timeframe: Daily (1D)

📍 Current Price: $51.32

📈 Fibonacci Extension Target: $136.62 – $170.88

📉 Downside Risk: ~$47.90 if activist push fails

🔭 Time Horizon: 2–6 months

🔍 WaverVanir Thesis

Lamb Weston ( NYSE:LW ) is sitting at the intersection of activist disruption, undervalued fundamentals, and surging options flow. Our proprietary scanner is flashing multiple option sweeps — particularly short-dated call activity — signaling that institutional players may be positioning for a near-term event.

⚡ Catalysts in Focus

📢 Activist Campaign: Jana Partners is pushing hard for a strategic overhaul. With six new executive recruits and a potential board shakeup, institutional change is now not just possible — it's probable.

🔄 CEO Exit & Earnings Reset: The company recently ousted its CEO following a soft Q2 and issued a major guidance cut. These events often precede strategic restructuring or M&A.

🤝 Takeover Chatter: Both Reuters and Seeking Alpha confirm that Lamb Weston is a prime M&A candidate, with rumors swirling around Post Holdings and other potential bidders.

🌐 Macro Environment

🥔 Weak global demand in frozen potato products & foodservice channel.

📉 High OpEx + shrinking restaurant traffic = near-term pressure.

🧊 But with supply chain normalization and margins likely bottoming, the risk/reward starts favoring the upside — especially under new leadership.

📐 Technical Levels

📉 Demand Zone: $47.90–$50.79 (Previous support, 0% Fib)

📊 Target 1: $76.80 (38.2% retracement)

📊 Target 2: $136.62 (127.2% Fib extension – full revaluation)

🎯 Long-term Target: $170.88 (institutional re-pricing scenario)

⛓️ Stop-Loss: Daily close below $47.00 (invalidates structure)

🧠 WaverVanir DSS Signal

Our Decision Support System (DSS) is generating a bullish reversion setup with macro catalysts. Volume Profile confirms accumulation at $50–52 range. Watch for breakout from this base as institutional call flows build pressure.

🧭 Strategic Outlook

Base Case: Gradual recovery toward $76–90 range (re-rating after activist news).

Bull Case: Activist success + M&A = sharp revaluation toward $136–171.

Bear Case: Weak guidance persists, potential fade toward $40.

⚠️ Disclaimer: This is not financial advice. WaverVanir posts are for informational and educational purposes only. Trade with caution, manage your risk.

🧩 #Tags:

#WaverVanir #LambWeston #ActivistInvesting #OptionsFlow #MergersAndAcquisitions #TradingThesis #DSS #InstitutionalTrading #FrozenFoods #EarningsPlay #SmartMoney #TechnicalAnalysis #VolumeProfile #OptionsAlert #ValueSetup #MBO

Clear DayTrading strategy video. The "Inside Bar"🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Lamb Weston Holdings | LW | Long at $51.32Lamb Weston Holdings NYSE:LW , the potato / French fry king, has gone through a tremendous downturn since 2023. Yet, earnings are forecast to grow 22% per year into 2027. Debt is quite high at 2.5x and this company, like many others, will significantly benefit from lower interest rates in the future. If the US experiences another way of inflation, Lamb Weston Holdings could be on the beneficiary side of things.

From a technical analysis perspective, the price has entered my "crash" simple moving average zone. Typically, this area signals a bottom, but it's not guaranteed. I foresee the daily price gap near $50 being closed in the short-term before a true move up. A dip to $47-$48 is not out of the question. Regardless of trying to predict bottoms, at $51.32, NYSE:LW is in a personal buy zone.

Targets:

$62.00

$68.00

$77.00

Short | LW NYSE:LW

Technical Analysis of Lamb Weston Holdings, Inc. (LW)

Key Observations:

Current Price Action:

Price: $82.24

Recent Drop: -0.44 (-0.53%)

Bearish Line: $81.94

Support and Resistance Levels:

Immediate Support: $79.78 (Target Price 1)

Further Support: $76.45 (Target Price 2)

Resistance: The price recently stalled around $83.18, signaling a short-term ceiling.

Trendlines:

The price sharply broke above a previous resistance level around $79.78, but now shows signs of consolidation below $83.

A minor pullback to test lower supports ($79.78 and $76.45) is possible.

Relative Strength Index (RSI):

Current RSI: ~70 (Overbought Zone).

The RSI shows the stock is overbought, which could lead to a short-term correction.

Target Prices:

Target Price 1: $79.78

A key immediate support level that aligns with previous resistance.

Target Price 2: $76.45

A further downside target where multiple moving averages converge, acting as strong support.

Summary:

Lamb Weston Holdings, Inc. (LW) has shown strong upward momentum but is now consolidating near resistance at $83.18. With the RSI in the overbought zone, a pullback is likely toward $79.78 (Target 1) and potentially $76.45 (Target 2). A close below the bearish line ($81.94) could confirm further downside movement.

Long Lamb Weston $LW

🍟 NYSE:LW is one of the largest producers of frozen 🥔products

🍟 Large supplier to $ NYSE:MCD MCD NYSE:LW

🍟 Stock is bouncing after Jana Partners took a stake and the latest earnings

🍟 Unusual Call Options Activity using @Tradestation shows accumulation

🍟 Upside potential 25% to target 🎯 $96

Dang, those 🍟🍟 are getting salty 👿

LW Lamb Weston Holdings Options Ahead of EarningsIf you haven`t sold LW before the previous earnings:

Now analyzing the options chain and the chart patterns of LW Lamb Weston Holdings prior to the earnings report this week,

I would consider purchasing the 65usd strike price Calls with

an expiration date of 2024-10-18,

for a premium of approximately $5.15.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Stocks pairs trading: LW vs CLXLet's examine the trade potential for Lamb Weston Holdings (LW) and Clorox (CLX) by analyzing their key financial metrics and recent performance to determine reasons for going long on LW and short on CLX.

Price-to-Earnings (P/E) Ratio:

LW: P/E ratio of 10.50

CLX: P/E ratio of 68.01

LW has a significantly lower P/E ratio, indicating it is undervalued compared to CLX, which has a very high P/E ratio suggesting it might be overvalued.

Earnings Growth:

LW: EPS next Y of 10.59%

CLX: EPS next Y of 9.26%

LW shows higher expected earnings growth for the next year, reinforcing its potential for better performance.

Debt and Liquidity:

LW: Debt/Eq of 2.21

CLX: Debt/Eq of 33.19

LW has a considerably lower debt-to-equity ratio compared to CLX, indicating better financial stability and lower financial risk.

Profitability Metrics:

LW: ROA of 17.75%, ROE of 88.53%

CLX: ROA of 4.13%, ROE of 510.64%

Return on Assets (ROA) and Return on Equity (ROE) are both measures of profitability. ROA indicates how efficiently a company is using its assets to generate profit, while ROE measures how effectively the company is generating profit from shareholders' equity.

Although Clorox (CLX) has a higher ROE, implying it generates more profit per dollar of equity, its extremely high debt (33.19 Debt/Eq) inflates this figure. Lamb Weston (LW), with a higher ROA, shows better asset management efficiency, indicating it is more effectively utilizing its assets to generate earnings without relying heavily on debt.

Performance Metrics:

LW: Perf Year of -30.64%, Perf YTD of -27.31%

CLX: Perf Year of -15.00%, Perf YTD of -7.84%

Both stocks have underperformed, but LW's significant price drop could present a buying opportunity if recovery prospects are solid, as noted by recent improvements in its margin outlook and cost synergies.

Decision:

Long on 2 LW

Short on 1 CLX

LW's attractive valuation, strong earnings growth potential, and improving margins make it a strong buy, while CLX's high valuation and substantial debt pose risks, justifying a short position.

Stocks pairs trading: LW vs WRKLet's examine the trade potential for Lamb Weston Holdings, Inc. (LW) and WestRock Company (WRK) by analyzing their key financial metrics and recent performance to determine reasons for going long on LW and short on WRK.

Price-to-Earnings (P/E) Ratio:

LW: P/E ratio of 10.93

WRK: P/E ratio of 43.25

The lower P/E ratio of LW suggests it is relatively undervalued compared to WRK, indicating a potentially better investment opportunity in terms of earnings.

Profitability Metrics:

LW: ROA of 17.75%, ROE of 88.53%

WRK: ROA of 1.11%, ROE of 3.09%

LW's superior return on assets and equity indicates better management efficiency and profitability.

Recent News:

LW: Lamb Weston is facing a class action lawsuit related to securities law violations, which has negatively impacted its stock price recently. However, the fundamentals still appear strong for a recovery.

WRK: WestRock's shareholders have approved a merger with Smurfit Kappa, which could impact future performance and valuation due to integration risks.

Decision:

Long on 1 LW : Based on its undervaluation, strong profitability metrics, and potential for recovery despite recent legal issues.

Short on 2 WRK : Due to its high P/E ratio, modest profitability, and potential overvaluation despite strong recent performance.

$LW, possible reversal?As of April 2024, market seem to be moving forward for a correction after the bullish uptrend for a couple of months.

Needless to say, if you are holding on to some stocks, you are likely to experience some drawbacks at this moment of time. Yes, I am currently holding a couples such as NASDAQ:AMZN , NASDAQ:GOOG , NASDAQ:ADBE , NYSE:UNH etc.

NASDAQ:ADBE and NYSE:UNH are currently giving me some headache due to their drawdowns but after some analyzing, I decided to hold it for a longer period of time. More on that on future posts.

As of now, let's take a look at NYSE:LW , which is having a drawdown as well. I am entering this stock now due to a possible uptrend reversal.

Let me know what do you think.

Stocks pairs trading: LW vs EXPDLet's analyze the trade potential of Lamb Weston Holdings Inc. (LW) and Expeditors International of Washington, Inc. (EXPD) by examining key financial metrics and market performance to determine reasons for potentially going long on LW and short on EXPD.

Forward P/E Ratio: LW's forward P/E of 13.39 is lower than EXPD’s forward P/E of 22.92, suggesting that LW is priced more attractively relative to future earnings expectations. This lower valuation might make LW a more appealing investment.

EPS Forecast for Next Year: LW is expected to achieve an EPS of $6.25 next year, which indicates a robust growth of 12.40% over this year's performance. In contrast, EXPD's EPS growth next year is expected to be 6.63%, showing lesser growth potential.

Year-to-Date Performance: LW has seen a decline of 22.58% year-to-date, while EXPD also faced a decrease of 7.98%. Despite both showing declines, LW's greater dip might suggest a potential rebound opportunity if market conditions improve, given its lower valuation and expected earnings growth.

Profit Margin Comparison: LW operates with a profit margin of 16.71%, substantially higher than EXPD’s 7.81%. This suggests LW is more efficient in converting sales into net income, an attractive trait for long-term investments.

Market Performance Trends: LW has experienced significant negative performance over the last quarter and half-year period. However, its fundamentals like strong EPS growth and high profit margins support a potential recovery. On the other hand, EXPD’s relatively stable but underperforming financial indicators paired with a significant drop in sales year over year (-40.57%) make it a candidate for a short position.

Analyst Recommendations: LW has a more favorable recommendation score of 1.38 compared to EXPD’s 3.88, indicating stronger analyst confidence in LW’s market position and future performance.

Decision:

Long on 1 LW: This position is supported by LW’s lower forward valuation, impressive near-term earnings growth forecast, and stronger profit margins, which all suggest a potential for market revaluation upward.

Short on 1 EXPD: Given its higher valuation, weaker growth prospects in EPS, and significant reduction in sales, coupled with relatively poor market performance indicators, shorting EXPD could be advantageous if these trends continue.

LW Lamb Weston Holdings Options Ahead of EarningsIf you haven`t sold LW before the previous earnings:

Then analyzing the options chain and the chart patterns of LW Lamb Weston Holdings prior to the earnings report this week,

I would consider purchasing the 75usd strike price Puts with

an expiration date of 2024-10-18,

for a premium of approximately $0.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

LW Lamb Weston Holdings Options Ahead of EarningsIf you haven`t sold LW here:

Then analyzing the options chain and the chart patterns of LW Lamb Weston Holdings prior to the earnings report this week,

I would consider purchasing the 90usd strike price Puts with

an expiration date of 2023-10-20,

for a premium of approximately $2.02.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

LW long ideaLW performed well in the first inflation cycle 2021/2022.

As the dollar is testing a breakout on inflation fears, we may see some capital rotate into different sectors.

Last dollar bull cycle LW held up well in price. We are reaching very oversold levels and coming into big technical support.

Accumulation at these levels or lower provides good R/R

LW Entry, Volume, Target, StopEntry: with price above 115.31

Volume: with volume greater than 2.56M

Target: 127.21 area

Stop: Depending on your risk tolerance; Based on an entry of 115.31, 111.36 gets you 3/1 Reward to Risk Ratio.

This swing trade idea is not trade advice and is strictly based on my ideas and technical analysis. No due diligence or fundamental analysis was performed while evaluating this trade idea. Do not take this trade based on my idea, do not follow anyone blindly, do your own analysis and due diligence. I am not a professional trader.

LW , LONG Re-entry on LW , its showing a bit of stalling here who knows what will happen , not doing anything wrong at this point , lets see if it can follow-through in todays signal . Institutions are still accumulation , EPS and sales trend is awesome , no reason why we cant keep it up based on stats.

LW, LONGIt's tator time again y'all

And I have an inside rumor from " my guy " , Mr Legendary Investor , who we all need to listen to !

He says LW is using a secret proprietary patented tech to recycle waste potatoes and use them to further fuel the stock move up . I guess that recycled waste potatoes are essentially converted to energy through a decomposition process which has a symbiotic relationship with the mycelium network , the mycelium network then interacts with Smart AI to create a specific buying and selling process that they believe might be limitless and that is why LW stock keeps going up , clearly my guy knows his stuff , so BUY BUY BUY .

Disclaimer : Nothing aforementioned in this publication is even remotely true , except that I did indeed buy LW at close today .

On a serious note though :

LW still qualifies as a TT's name ( top trender ) it has tight moves , great RS and open 2/2 Major gaps . I really like the risk vs reward potential on the current entry , so lets see if it works :) .