MBIA (MBI): Credit Protection Demand on the RiseMBIA Inc. (MBI) is a financial services company that specializes in bond insurance and investment management. It provides credit protection to municipal bonds and structured finance products, helping investors manage risk. As economic conditions improve and demand for insured bonds rises, MBIA benefits from increased market activity and the need for financial security.

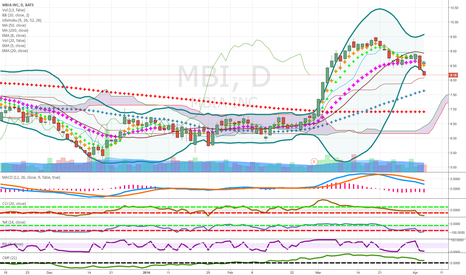

MBI recently showed a confirmation bar with rising volume, moving into the momentum zone. The momentum zone is price above the .236 fib level of the current trend. This suggests growing investor confidence and potential for continued upside. A trailing stop can be set at the Fibonacci 0.236 level using the Fibonacci snap tool, this allows traders to protect gains while staying in the trend.

MBI trade ideas

MBI: Bullish Pennant (49PC)Bullish Pennant (49PC)

Pros:

Volume during post formation

Descending volume during triangle formation

PPS above 50MA and 200MA

RS above 0, and ascending

ATR Ascending

R/R ratio above 7

250RSI above 50

Cons:

200MA Flat

May fill gap back to 7.77$

Target:

PT = 15.30$

Help how ever you can to keep this alive.

Thank you to those who have donated Coins!

Always do your own due dilligence. This is not financial advice

Stay Humble, have fun, make money!

Education:

www.dailyfx.com

pennies to thousands long term short candidatebollinger bands widening stock to down side

large long term put activity in volume

get our book for short ideas on amazon

macd crossed down

relative strength weak

cci and percent r in bottom range

looks unlikely fed raising interest rates

below 200 on weekly