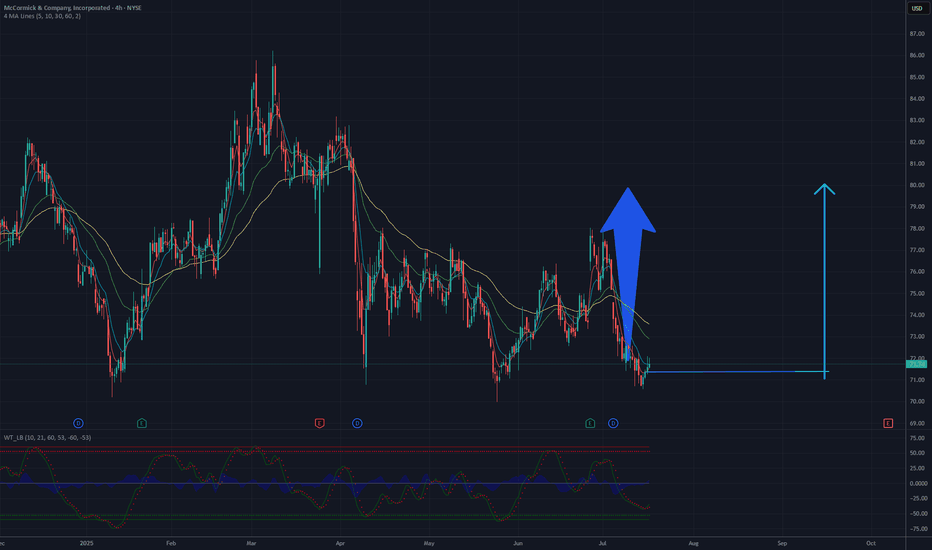

Ready for 80 USD? Time to grow for MKCThe chart analysis for this stock suggests a potential rise to 80 USD based on current technical patterns. The 4-hour chart shows a recent downtrend following a significant peak, with the price currently hovering around 71-72 USD. A key support level is evident near 70 USD, which could serve as a foundation for a potential rebound. The moving averages, including the 50-day and 200-day, indicate a prior bullish trend, and the current consolidation phase might precede another upward move.

Breaking through the resistance at 75-76 USD, a previous high, could signal the start of a new upward trend. With increased buying volume and bullish candlestick patterns, the price could target 80 USD, a notable psychological and technical resistance level. The RSI, currently in a neutral zone, could support this scenario if it begins to rise, indicating growing momentum. However, caution is advised, as a break below 70 USD support could negate this outlook and lead to further declines.

Potential TP: 80 USD

MKC trade ideas

MKC🧩 Chart Structure & Trend

The chart shows a bullish breakout from a short-term consolidation pattern, confirmed by a recent bounce from the uptrend support line (red ascending trendline).

The price is currently hovering near the entry level at 76, suggesting a good risk-to-reward setup if momentum continues upward.

🛡️ Risk Management

Stop Loss is well-placed below the trendline and key support level at 72.55. This helps limit downside risk if the breakout fails.

The risk from entry (76 to 72.55) is 3.45 units, and the reward (82.96 – 76) is 6.96 units, giving an R:R ratio of ~2:1, which is favorable.

📊 Technical Analysis Summary

Entry Point: 76

Stop Loss: 72.55

Target Zone: 82.50 – 82.96

MKC McCormick & Company Options Ahead of EarningsAnalyzing the options chain and the chart patterns of MKC McCormick & Company prior to the earnings report this week,

I would consider purchasing the 85usd strike price Calls with

an expiration date of 2024-10-18,

for a premium of approximately $1.45.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Pantry Staples: Macro Fib SchematicsGeneral Mills, Kellogg, Campbell, Hershey, Smuckers, Sysco, McCormick & Company, and ConAgra are a handful of the largest American pantry/snack favorites.

These Fib Schematics look pretty good and are easy to decipher. This makes this a good idea other than the fact that I should have grouped my tow food ideas differently. I have another Food Idea linked below with the rest of the Big Food Players.

MKC McCormick & Company Options Ahead of EarningsAnalyzing the options chain and the chart patterns of MKC McCormick & Company prior to the earnings report this week,

I would consider purchasing the 75usd strike price Calls with

an expiration date of 2023-10-20,

for a premium of approximately $2.53.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

MKC MAR75/FEB65 DIAGONAL PUTBEAR RALLY SET UP

I've had MKC on my watchlist for about a week now. ON January 18th, the 20 day crossed the 50 day and made a new swing low on January 20th. Since then, it had a small bear rally back to prior support resistance of 79.09ish which it hit on the 24th. On the 25th, it traded below the previous day's low, however I waited one more day because I didn't want to get into this before earnings. With the gap down today, I executed my trade as there could be more down side to come based on the technicals.

I won't have any stops since I'm set up for max loss and risking less than 2% of my portfolio.

I drew a downward trendline/channel from the high of March 2022. On the hour chart, it recognized this channel from about April 20th 2022, to about the middle of May before it sold off. This only has monthly contracts. I was originally going to select the 70 strike, but my idea is that it falls back into this downward channel within the next three weeks to reach my 65 target by the 17th of February.

Position management strategies when the stock goes lower

If this goes lower below my 65 target, I'll close out the entire combo and move on to my next trade.

Position management strategies when the stock goes sideways

If this goes sideways, I'll let my 65 strike expire and hang on to my 75 strike until March until it reaches my 65 target.

Position management strategies when the stock goes higher

If this goes higher, I'll let it all expire worthless since I'm set up for max loss.

Position management strategy at expiration

Come February 17th, if this is still above my 65 target, I'll hang on to my 75 strike until it does reach my 65 target. If we're at 65 or below 65 come the 17th, I'll close out the entire combo.