MODG - Algorithms are setting up for a HTF bounce!With our recent earnings move towards teal, this is setting up beautifully to make its way toward our HTF target that we identified a while back and still expect to be a target. Once there, we will have a tight stop considering its a HTF level that we are trading off of, and a long term hold plan.

Awesome to see the Algos give us such nice preparation!

Happy Trading :)

MODG trade ideas

TopGolf | MODG | Long at $7.85 TopGolf NYSE:MODG finally closed the last price gap on the daily chart from the 2020 pandemic crash. All price gaps (as of this analysis) are now above the current price. While I am not stating this is bottom (high $6's or even low $5's are not fully off the table given the downward momentum), there is a lot of growth still on the table for this company. The current fair value is probably near $18-$19 and this stock has a cyclical nature to it. So, while it may be a bumpy near-term investment, the earnings growth, cashflow, and low debt of this company is appealing. Thus, at $7.85, NYSE:MODG is in a personal buy zone (starter position) with more investment is if dips into the $6- or $5-range.

Target #1 = $10

Target #2 = $12

Target #3 = $14

Target #4 = $15

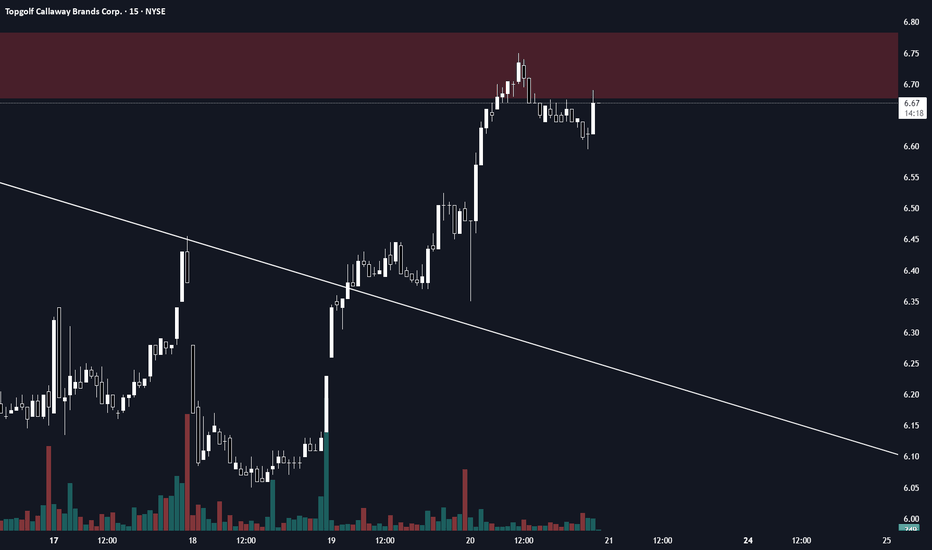

MODG - How to identify and enter a LTF tradeHere's a quick idea and how I could simply analyze a potential trade like this short on MODG:

1. Higher Time Frame intentional target

2. LTF Supply zone (level where known sellers exist)

3. Certain technical confluences within the algorithms, volume, and price action

1-2-3 punch and we've set ourselves up with a potential 1:12 Risk-Reward trade!

Happy Trading :)

GOOGL Strong Move Post-Earnings. My AnalysisHey, guys. Not going to go into too much detail on the description here. Just wanted to get my thoughts out there on NASDAQ:GOOGL . Certainly seems to have a strong long term trend here. As always, in long term trends, there could be various counter trend moves so always be prepared in that regard. Hopefully this offers some more insight for you as you think about NASDAQ:GOOGL from an investment perspective, or even a trading perspective. Even if you are looking for short term trades in GOOGL, I find it helpful to know how your trade might fit in to the longer term trend (whether to the downside or upside).

Hope you enjoy the review, and best of luck out there!

TopGolfThe new golf that is taking place is Topgolf and it is showing out in the earnings. This company has room to expand and become a big player over time. Take a look at the support and resistance zones to see where we could be headed. They generally increase in prices after a good earnings call like they just had and the directors of the company purchased shares back in December of 2023. This looks like a good place to enter for a long term swing.

Topgolf Callaway's Stock Surges Amidst Acquisition RumorsIn a whirlwind of market activity, Topgolf Callaway ( NYSE:MODG ) finds itself at the center of speculation and volatility as rumors swirl regarding a potential acquisition. Despite initially soaring on reports of acquisition interest, the stock saw gains trimmed after the company denied any ongoing sale talks.

Shares surged by a remarkable 15% earlier in the day, marking the largest intraday jump since May 2022. The surge came following a report from Chosun Daily, indicating interest from multiple parties, including a South Korean investor, in acquiring the Callaway Golf business, with a potential deal valued at nearly $3 billion. However, the euphoria was short-lived as Topgolf Callaway moved swiftly to address the speculation, attributing the unusual market activity to the report.

The golf industry, like many others, has faced challenges in maintaining the momentum gained during the pandemic. Yet, despite these uncertainties, investors have shown continued interest in the sector. Centroid Investment Partners, owner of TaylorMade, recently announced plans to raise a $500 million fund for potential acquisitions in the United States, demonstrating ongoing confidence in the market's potential.

Topgolf Callaway's journey has been marked by strategic maneuvers and transformative acquisitions. In 2021, Callaway Golf Co. finalized its acquisition of the remaining stake in Topgolf Entertainment Group, valuing the popular driving-range chain at approximately $2 billion. However, the subsequent decline in share price, halving since the deal's closure in March 2021, underscores the challenges faced by the company amid evolving market dynamics.

As Topgolf Callaway ( NYSE:MODG ) navigates these turbulent waters, investors remain keenly attuned to any developments regarding potential acquisitions or strategic partnerships. While the denial of sale talks may have tempered immediate excitement, the underlying interest in the company's future prospects remains palpable.

Topgolf Callaway ( NYSE:MODG ) finds itself at a critical juncture, balancing market speculation with strategic imperatives to drive growth and shareholder value. Whether through potential acquisitions, partnerships, or organic initiatives, the company's ability to navigate uncertainty while capitalizing on emerging opportunities will be instrumental in shaping its trajectory in the dynamic landscape of the golf industry.

MODG pushing to resistanceMODG is one to watch as it heads back to resistance at ~$14. Should it clear that level, there is room to run to ~$16. Looks to be forming inverse Head and Shoulders. Nice divergence on the MACD over the last couple of months. Today pushed through the 50 day without much issue.

A tough one to chartOne of the uglier charts I have seen but I love the story. Hard to find the right entry with this one but I started with a couple Jan calls here. Could see the small cap momentum continuing and Callaway has been making all the right moves. They just opened another top golf location in Florida recently too.