MTN Vail Resorts Options Ahead of EarningsAnalyzing the options chain and the chart patterns of MTN Vail Resorts prior to the earnings report this week,

I would consider purchasing the 240usd strike price Puts with

an expiration date of 2023-10-20,

for a premium of approximately $9.05.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

MTN trade ideas

$MTN with a slight bearish outlook The PEAD projected a slight bearish outlook for $MTN after a negative under reaction following earnings release placing the stock in Drift D

If you would like to see the Drift for another stock please message us. Also click on the Like Button if this was useful and follow us or join us.

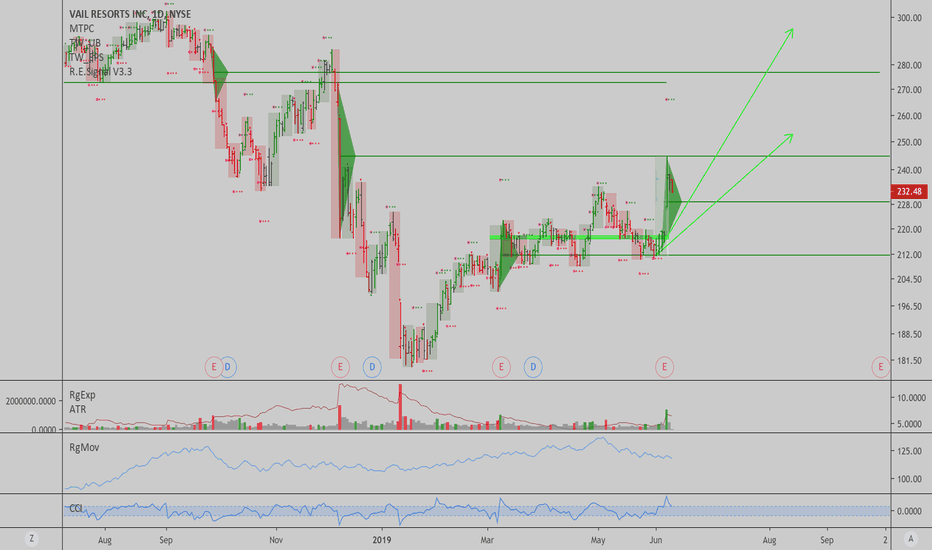

$MTN Vail Resorts On Breakout Watch

Vale Resorts has slowly but surly climbed higher despite the obvious issues.

Currently hitting the 2 year downtrend while supported from a perfect

rising trendline, which will break first.

Alerts are set for a break either direction.

RSI in a strong uptrend and volume increasing.

“Sometimes you shred the gnar; sometimes the gnar shreds you.”Vail was able to tumble down the slope in a fraction of time compared to its 2 year slide during the Financial crisis that erased 66% of its equity value. I expect the following run out of Vail Resorts: Some chatter and a uphill trek for MTN's stock price in the short-term, but with the 2019-2020 season cancelled, and the 2020-2021 guidance being cut back most likely. (Not to mention a crazy amount of acquisitions & mounting debt) I expect Vail Resorts to ultimately reach the 'value zone' before it becomes a very enticing long position.

TA interpretation + Personal Research = Not investment advice

MTN: Vail Resorts has a nice weekly trend...I like the chart here, $MTN has some nice upside potential, both from a technical and valuation stand point.

As long as prices don't slide below $216, we can expect a 10 week rally from here, reaching prices as high as $295 possibly.

Best of luck,

Ivan Labrie.

$MTN RISKY LONG INTO EARNINGS IN VAIL RESORTS INCThis may be a little risky but we think it has a good risk reward with strong support below from channel, trend line and 100ma. Sentiment is quite mixed in the name and analysts quite split with upgrades and downgrades of estimates recently but we are bias to upside potential.

AVERAGE ANALYSTS PRICE TARGET $241

AVERAGE ANALYSTS RECOMMENDATION OVERWEIGHT

COMPANY PROFILE

Vail Resorts, Inc. is a holding company, which engages in the operation of mountain resorts. It operates through the following segments: Mountain, Lodging, and Real Estate. The Mountain segment covers the operation of mountain resorts or ski areas, and related activities. The Lodging segment includes ownership of hotels, condominium management, Colorado resort ground transportation company, and mountain resort golf courses. The Real Estate segment holds real property at mountain resorts primarily throughout Summit and Eagle Counties in Colorado. The company was founded by Pete Seibert and Earl Eaton in March 1957 and is headquartered in Broomfield, CO.