Nuke, baby nuke: Nuclear Revival in USA?☢️ Nuke, baby nuke: Can Europe Follow the U.S. Nuclear Revival?

Ion Jauregui – Analyst at ActivTrades

Nuclear energy is back in the spotlight. This week, former President Donald Trump signed four executive orders aimed at reviving the nuclear industry in the United States. Among the measures are plans to build 10 mega-reactors by 2030, boost domestic uranium production, and overhaul the regulatory processes of the Nuclear Regulatory Commission (NRC), which he accuses of stifling innovation with excessive bureaucracy.

The U.S. Hits the Nuclear Accelerator

The plan also aims to quadruple the country’s nuclear capacity by 2050, an ambitious goal that has sparked a wave of optimism across the sector. Startups developing modular and advanced nuclear reactor technologies — such as Oklo (OKLO), NuScale (SMR), and Centrus Energy (LEU) — have seen their share prices soar. The same applies to Cameco (CCJ), one of the world’s largest uranium producers. Meanwhile, major players like Constellation Energy (CEG) and Dominion Energy (D) have also recorded gains, albeit more moderate ones.

Financial Snapshot: Who's Leading the Nuclear Comeback?

Oklo Inc. (NYSE: OKLO)

• Recently went public in 2024, backed by Sam Altman.

• Still no significant operational revenues but enjoys strong venture capital support.

• Shares ↑ +45% since Trump’s announcement.

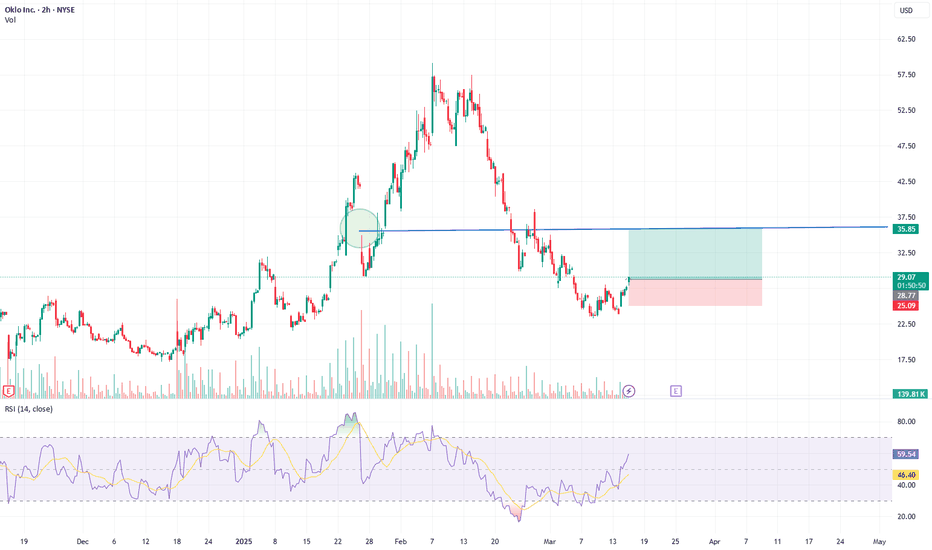

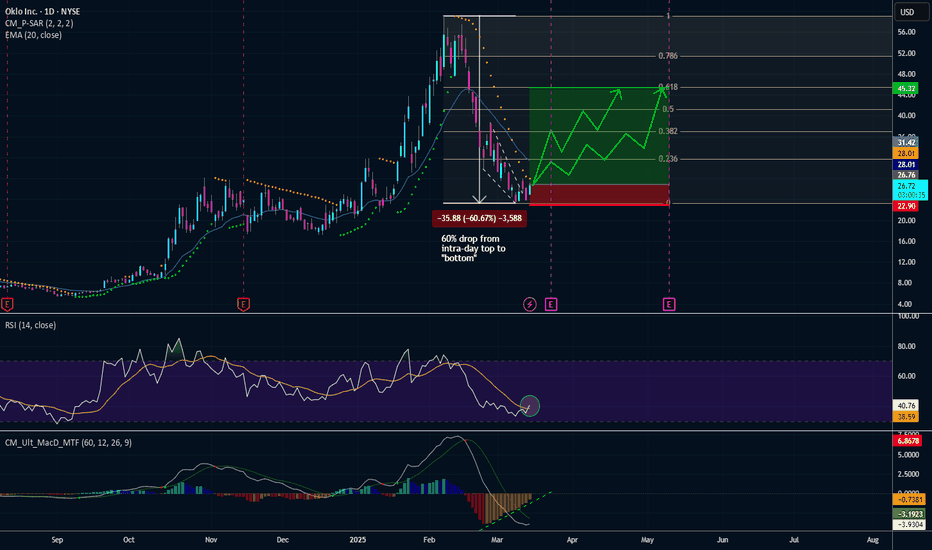

• Technical Analysis: The company’s stock is trending back toward its high of $59.14, closing Friday at $48.87 after jumping nearly $8 in a bullish gap. Currently, the stock is highly overbought with an RSI of 80.22%, suggesting a potential correction toward the $27.07–$15.48 range. The control point lies near $22.58. Friday’s close aligns with the 0.786 Fibonacci level, indicating possible retracement. However, moving average crossovers still signal bullish continuation.

Cameco Corp. (NYSE: CCJ)

• 2023 Revenue: CA$2.6 billion, +39% YoY.

• Net income: CA$361 million, driven by high uranium prices.

• Shares ↑ +28% in 12 months, reflecting nuclear cycle recovery.

• Technical Analysis: Trading at $58.69, heading toward the $62.55 high. The previous trading range was $35.46–$48.44, with the control point at $41.04. RSI is in overbought territory at 79.71%, and price is above the 0.786 Fibonacci retracement level, suggesting a possible pullback.

Constellation Energy (NASDAQ: CEG)

• 2023 Revenue: $24.5 billion, with stable growth.

• Adjusted EBITDA: $4.2 billion.

• Share buybacks and strong financials post-Exelon spin-off.

• Shares ↑ +16% YTD.

• Technical Analysis: Currently in a $155.60–$238.40 range, with a control point at $266.93. Friday’s close at $297.49 puts it closer to the January high of $352. RSI stands at 71.16%, indicating possible upward continuation. Moving averages support a bullish breakout.

Dominion Energy (NYSE: D)

• 2023 Revenue: $14.8 billion, flat YoY.

• Ongoing strategic restructuring with focus on nuclear and renewables.

• Shares ↑ +5% YTD, though challenged by debt and regulatory transition.

• Technical Analysis: Closed Friday at $56.29, within a $48.78–$58.78 range. Peaked at $61.97 in November, then dropped to $46.56 in early April. A recent bullish moving average crossover suggests a potential rally to the upper channel. RSI is at 56.82%, indicating a stable trading zone with room to move higher.

What About Europe?

The Old Continent is watching closely. While countries like France remain committed to nuclear — with EDF planning new EPR reactors — the European Union lacks a unified strategy, caught between Germany’s push for renewables and France’s defense of nuclear energy.

However, soaring energy demand — driven by transport electrification, digitalization, and AI — could force EU nations to reassess their stance. The potential of Small Modular Reactors (SMRs) — quicker to build and with a smaller footprint — could be key to unlocking political consensus.

Which European Companies Could Benefit?

• EDF (France): The nuclear powerhouse of Europe.

• Siemens Energy (Germany): While focused on renewables, it's involved in SMR-related automation and control systems.

• Rolls-Royce (UK): Developing its own modular reactor line.

• Orano (France): A key player in the nuclear fuel cycle, from mining to recycling.

Conclusion: Europe Faces a Global Nuclear Crossroads

The U.S. push toward a new nuclear era — faster, tech-driven, and energy-secure — signals a paradigm shift that Europe cannot afford to ignore. In the face of mounting pressure to ensure a stable, clean, and sovereign energy supply, nuclear — particularly in modular form — is emerging as a highly strategic option.

While Washington accelerates with political support, public funding, and buoyant stock markets, Europe still struggles with a lack of consensus that could translate into medium-term energy competitiveness risks.

The opportunity? Strengthen cross-border cooperation, channel investment into SMR development, and back key players like EDF, Rolls-Royce, and Orano already poised to lead Europe’s nuclear transition.

If the continent wants to keep pace with the unfolding energy revolution, the time to act is now — because this nuclear renaissance won’t be about mega-reactors. It will be compact, agile… and global.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.

OKLO trade ideas

Can Small Reactors Solve Big Energy Problems?Oklo Inc. has recently captured significant attention in the nuclear energy sector, propelled by anticipated executive orders from President Trump to accelerate the development and construction of nuclear facilities. These policy shifts are designed to address the US energy deficit and reduce its reliance on foreign sources for enriched uranium, signaling a renewed national commitment to atomic power. This strategic pivot creates a favorable regulatory and investment environment, positioning companies like Oklo at the forefront of a potential nuclear renaissance.

At the core of Oklo's appeal is its innovative "energy-as-a-service" business model. Unlike traditional reactor manufacturers, Oklo sells power directly to customers through long-term agreements, a strategy lauded by analysts for its potential to generate sustained revenue and mitigate project development complexities. The company specializes in compact, fast, small modular reactors (SMRs) designed to produce 15-50 megawatts of power, ideally suited for powering data centers and small industrial areas. This technology, coupled with high-assay, low-enriched uranium (HALEU), promises enhanced efficiency, extended operational life, and reduced waste, aligning perfectly with the escalating energy demands of the AI revolution and the burgeoning data center industry.

While Oklo remains a pre-revenue company, its substantial market capitalization of approximately $6.8 billion provides a strong foundation for future capital raises with minimal dilution. The company targets the commercial deployment of its first SMR by late 2027 or early 2028, a timeline potentially accelerated by the new executive orders streamlining regulatory approvals. Analysts, including Wedbush, have expressed increasing confidence in Oklo's trajectory, raising price targets and highlighting its competitive edge in a market poised for significant growth.

Oklo represents a high-risk, high-reward investment, with its ultimate success contingent on the successful commercialization of its technology and continued governmental support. However, its unique business model, advanced SMR technology, and strategic alignment with critical national energy and technological demands present a compelling long-term opportunity for investors willing to embrace its speculative nature.

SMR NNE OKLO – Breakout Setup Triggered by Nuclear CatalystNYSE:SMR is lighting up after Trump’s announcement on nuclear energy — and it’s not alone. NYSE:OKLO and NASDAQ:NNE are also setting up, but NYSE:SMR has one of the cleanest breakout structures on the board.

🔹 Catalyst: Trump’s nuclear energy announcement yesterday is putting serious momentum behind the sector.

🔹 Technical Setup: NYSE:SMR is building a textbook breakout formation, with $32 as the key breakout level.

🔹 Volume & sentiment are increasing — early signs that buyers are positioning.

My Trade Plan:

1️⃣ Anticipatory Entry: I’m looking to buy the first dip before the $32 breakout — getting in early with tight risk.

2️⃣ Add on Breakout: Will scale in above $32 if volume confirms.

3️⃣ Stop Loss: Just below the recent base — staying tight on risk.

Why I’m Watching This Closely:

Sector catalyst + technical setup = 🔥

Nuclear names have been under accumulation, and now they’ve got a narrative tailwind.

First dip after a big catalyst is often the best R/R opportunity.

OKLO – Base Breakout Setup with a Twist: The Inside Candle CombOKLO is shaping up for a powerful move, and this setup has my attention for a dual-play approach:

🔹 Base Breakout Setup (Primary Entry)

Already in from the initial base breakout around $25, which I shared last week.

Momentum kicked in with that strong May 6th thrust.

🔹 Three Inside Candles (Power Setup)

Since that momentum spike, we've seen 3 consecutive inside candles — a textbook signal of price compression.

Price is hugging the 9 EMA (support zone), a bullish indicator of strength.

🔹 My Trading Plan:

1️⃣ Starter Position: Already in from $25.

2️⃣ Add Position: On a clean breakout above the high of the inside candle range.

3️⃣ Stop Loss: Tight stop below the 9 EMA — keeps risk tight while capturing the breakout.

🔹 Why This Setup is Special:

Inside candles indicate a tug-of-war between buyers and sellers, but with price holding strong above 9 EMA, the bulls have the edge.

Breakout + inside candle combo = explosive potential.

⚠️ Risk Management: Discipline over FOMO — tight stop, but aggressive on breakout.

$OKLO ready for it's next leg!NYSE:OKLO has been outpreforming the market for a few months now but still has some power left. i except oklo to bounce of this strong bullish divergence and after flipping resistance into support at a 1.272 fib. Stochastic RSI is also oversold. would be carefull after this move tho

70% Upside Potential in this Nuclear StockOKLO is my personal favorite nuclear play that feeds off the AI energy. Really beat up since it's height in early February, down over 50% as of today (as are a lot of other stocks given the macroeconomic backdrop). Chris Wright, a member of its Board of Directors, was confirmed as the U.S. Secretary of Energy on February 3, 2025. As a result, Wright has stepped down from Oklo’s Board to assume this critical role in advancing the nation’s energy policies.

I can see upside trade heading closer to Q4 earnings March 24.

Bullish Technicals:

- Rounding Bottom

- RSI breaking above RSI MA

- MACD: histogram trending up

- Moving out of the falling wedge

- Just sitting below daily PSAR

OKLO's Key Focus Areas:

- Microreactors – Oklo’s primary product is the Aurora microreactor, a compact and efficient reactor designed to produce power for remote areas, industrial sites, and off-grid locations.

- Fast Reactors – Their reactors use a fast neutron spectrum and liquid metal coolant (like sodium) rather than water, making them more efficient and capable of reusing nuclear waste as fuel.

- Fuel Recycling – Oklo aims to use recycled nuclear fuel (like spent fuel from conventional reactors), reducing nuclear waste and increasing fuel efficiency.

- Long Lifespan – The Aurora reactor is designed to operate for up to 20 years without refueling, minimizing maintenance and operational costs.

OKLO/USD – 30-Min Long Trade Setup!📌 🚀🔹 Asset: OKLO Inc. (OKLO)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bullish Breakout Trade📌 Trade Plan (Long Position)

✅ Entry Zone: Above $30.29 (Breakout Confirmation)

✅ Stop-Loss (SL): Below $27.00 (Invalidation Level)🎯 Take Profit Targets:

📌 TP1: $34.99 (First Resistance Level)

📌 TP2: $41.08 (Extended Bullish Move)📊 Risk-Reward Ratio Calculation

📉 Risk (SL Distance): $30.29 - $27.00 = $3.29 risk per share

📈 Reward to TP1: $34.99 - $30.29 = $4.70 (1:1.4 R/R)

📈 Reward to TP2: $41.08 - $30.29 = $10.79 (1:3.3 R/R)🔍 Technical Analysis & Strategy

📌 Symmetrical Triangle Breakout: Price breaking above the resistance trendline, signaling bullish momentum.

📌 Support Rejection: Strong bounce from $27.00 support, indicating buying pressure.

📌 Volume Confirmation Needed: Ensure high buying volume when price holds above $30.29 to confirm bullish breakout.

📌 Momentum Shift Expected: If price sustains above $30.29, potential rally toward $34.99, then $41.08.📊 Key Support & Resistance Levels

🟢 $27.00 – Stop-Loss / Strong Support

🟡 $30.29 – Breakout Level / Long Entry

🔴 $34.99 – First Resistance / TP1

🔴 $41.08 – Final Target / TP2📉 Trade Execution & Risk Management

📊 Volume Confirmation: Ensure strong buying volume above $30.29 before entering.

📉 Trailing Stop Strategy: Move SL to entry ($30.29) after TP1 ($34.99) is hit.💰 Partial Profit Booking Strategy:

✔ Take 50% profits at $34.99, let the rest run toward $41.08.

✔ Adjust Stop-Loss to Break-even ($30.29) after TP1 is reached.⚠️ Fake Breakout Risk

❌ If price fails to hold above $30.29 and drops back, exit early to avoid losses.

❌ Wait for a strong bullish candle close above $30.29 before entering aggressively.🚀 Final Thoughts

✔ Bullish Setup – Breakout from consolidation suggests a potential trend shift.

✔ Momentum Shift Possible – Watch for volume confirmation.

✔ Favorable Risk-Reward Ratio – 1:1.4 to TP1, 1:3.3 to TP2.💡 Stick to the plan, manage risk, and trade smart! 🚀📈🔗 Hashtags for Reach & Engagement:

#StockMarket 📉 #OKLO 📊 #TradingNews 📰 #MarketUpdate 🔥 #Investing 💰 #Trading 📈 #Finance 💵 #ProfittoPath 🚀 #SwingTrading 🔄 #DayTrading ⚡ #StockTrader 💸 #TechnicalAnalysis 📉 #EconomicNews 🏛️ #FinancialFreedom 💡 #MarketTrends 📊 #StockAlerts 🔔 #TradeSmart 🤓 #Bullish 🐂 #RiskManagement ⚠️ #TradingCommunity 🤝

A Review of Multiple Charts Using TDA and Fibonacci, SMAs, StochEach morning, my partner and I go live for members of our mentorship and/or provide them with a pre-market analysis video to help them identify setups, entries and exits for stock options trading. This is simply a peek inside the content created for members.

2/5/25 - $oklo - Bagholder U 1012/5/25 :: VROCKSTAR :: NYSE:OKLO

Bagholder U 101

- won't see revenue for 3 years

- but mom, valuation doesn't matter

- k

- added it today to the list of 10ish small shorts i have on to hedge this overbaked cake of a market

let's see, anything's possible in the casino

but if u don't have an exit plan, go take a look in the mirror to see who others are planning to dump to

V

OKLO: mid-term topping potential in nuclear space The swing long set-up from Dec pullback is about to fully realize its potential

From my Dec chart archive:

pbs.twimg.com

And Jan update:

pbs.twimg.com

when I wrote: "It wouldn't not surprise me to see price pulling back bellow Oct's highs slightly and finding support on rising 8/21 emas before continuing its advance. Until price is above 21 ema, next important macro-resistance zone: 33-40"

As for now my operative scenario that price is preparing either to finish its upside momentum extending towards: 46-50 resistance zone or already have finished it and in the process of bouncing before a larger corrective way starts unfolding in the coming weeks.

If we have the mid-term top already in place, then 20-12 macro support zone might be a good place for the larger bottom to start forming before the new larger upside trend beginnes.

The same kind of pattern (bounce and new larger corrective way down) I expect to manifest itself in the coming weeks in other leading energy names (NNE, CLS, VST, GEV)

If price moves above the resistance zone mentioned, the proposed scenario needs to be re-assessed.

Thank you for your attention and wishing you the best trading and investing results in 2025!

$NYSE:OKLO breaking a Wedge/Flag with short term 25%-60% upsideNYSE:OKLO is breaking out of a consolidation pattern (falling wedge) And what appears to be a flag pattern.

Confirmation is a 24% uptick in price along with strong volume.

Initial Price Target is ~$34.50 to complete the falling wedge pattern, which is a short term 25% upside.

Secondary Price Target is ~$42.90 to complete the flag pattern, which is a longer term 60% upside

Good Luck!

Oklo Inc. (OKLO) AnalysisCompany Overview:

Oklo Inc. NYSE:OKLO is at the forefront of the clean energy revolution, specializing in compact nuclear reactors designed for efficiency and scalability. Its innovative solutions position it as a transformative player in addressing the global demand for clean, reliable energy.

Key Catalysts:

Landmark Partnerships:

Switch Partnership: A deal to supply 12 gigawatts of nuclear power highlights Oklo’s leadership and demonstrates its capacity to scale operations, significantly boosting its revenue potential.

RPower Memorandum: Supporting data centers, a rapidly growing market, Oklo expands into industries with high energy demands, further solidifying its presence in strategic high-growth markets.

Robust Order Book:

With 14 gigawatts of secured orders, Oklo demonstrates strong market demand and a clear path toward sustained growth and market leadership in advanced nuclear energy solutions.

Market Potential & Expansion:

Oklo’s compact nuclear technology offers cost-effective, carbon-free energy, positioning it to capitalize on global trends toward decarbonization, increased data center energy needs, and clean energy mandates.

Investment Outlook:

Bullish Case: We are bullish on OKLO above the $31.00-$32.00 range, driven by strong partnerships, robust order growth, and expanding applications for its technology.

Upside Potential: Our target for OKLO is $60.00-$61.00, supported by its innovative solutions, increasing market adoption, and entry into high-demand sectors like data centers.

🚀 OKLO—Powering a Clean Energy Future with Innovation and Scalability. #NuclearEnergy #CleanTech #Innovation

Trading JournalSpeculative play

Decided to play this one as there were other speculative play that were moving higher,

original stop of 8% loss ( didn't hold true, kept it for -12% loss) thinking it could potentially shakeout and move higher but there was no buying coming in.

Stupid play, stupid result

Oklo getting ready to moveOklo, Smr energy play, Trumps pick for DOE on the board. Imo, looks like a wycoff accumulation in a wave 2 structure, w a target of 1.618-2.618 fib extension. I am wrong, if this trades back below 17.20 area, should set up and play w 18.56 and move higher. Good rr right here.