Key facts today

President Trump urged 17 drug companies, including Pfizer, to lower U.S. drug prices, following an order to align prices with those in other nations.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.39 USD

8.02 B USD

63.63 B USD

5.68 B

About Pfizer

Sector

Industry

CEO

Albert Bourla

Website

Headquarters

New York

Founded

1849

FIGI

BBG000BR2B91

Pfizer Inc is a research-based global biopharmaceutical company. It engages in the discovery, development, manufacture, marketing, sales and distribution of biopharmaceutical products worldwide. The firm works across developed and emerging markets to advance wellness, prevention, treatments and cures that challenge the most feared diseases. The company was founded by Charles Pfizer Sr. and Charles Erhart in 1849 and is headquartered in New York, NY.

Related stocks

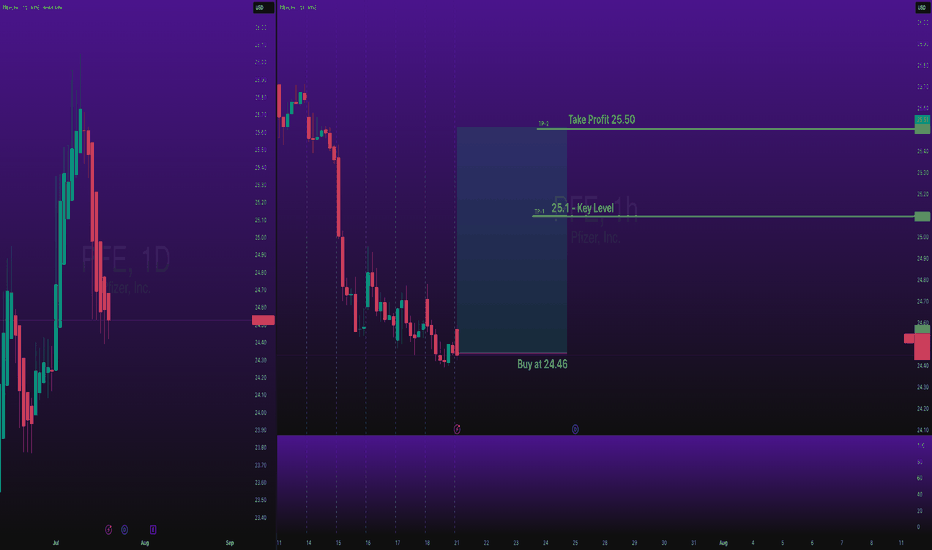

Pfizer May Be StallingPfizer has limped higher since April, but some traders may think the pharmaceutical giant is at risk of stalling.

The first pattern on today’s chart is the series of lower highs since January. PFE potentially just made another lower high at this falling trendline, which may suggest resistance is ta

PFIZER INC. (NYSE)For all vaccine enthusiasts, Pfizer shares are currently among the best options.

At the time of publication, the price is holding steady at $24.83 . Our forecast is that the price will rise to $27.48 (minimum)! Most likely by August.

Personally, I don't trade stocks, as I have decided to change

Aggressive Trend Trade 1HAggressive Trend Trade 1H

- short trend

+ volumed T1

+ support level

+ biggest volume 2Sp+

Daily Trend

+ long impulse

+ T2 level

+ support level

+ 1/2 correction"

Monthly CounterTrend

"- short balance

+ expanding ICE

+ support level

+ unsuccessful biggest volume manipulation"

Yearly Trend

"+ long

BUY Pfizer (PFE) growth by Viagra

Tomorrow, I’m entering a position in Pfizer Inc. (NYSE: PFE)—a globally recognized pharmaceutical giant with strong fundamentals and an attractive technical setup.

Pfizer maintains a solid revenue base, reporting $62.46 billion in total revenue in the last fiscal year. Despite recent fluctuatio

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

P

PFE5588844

Pfizer Investment Enterprises Pte. Ltd. 5.34% 19-MAY-2063Yield to maturity

6.02%

Maturity date

May 19, 2063

P

PFE5588843

Pfizer Investment Enterprises Pte. Ltd. 5.3% 19-MAY-2053Yield to maturity

5.88%

Maturity date

May 19, 2053

See all PFE bonds

Curated watchlists where PFE is featured.

Frequently Asked Questions

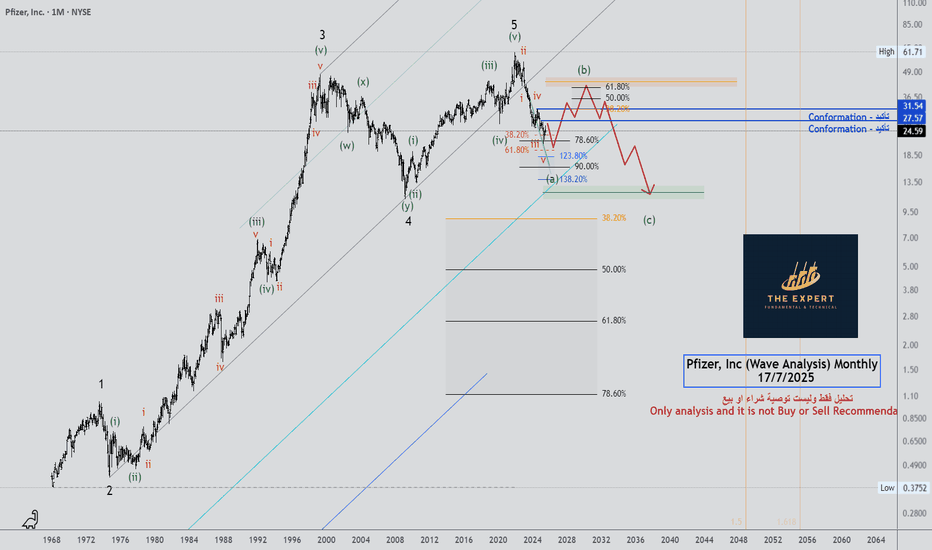

The current price of PFE is 23.49 USD — it has increased by 0.86% in the past 24 hours. Watch Pfizer stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Pfizer stocks are traded under the ticker PFE.

PFE stock has fallen by −5.93% compared to the previous week, the month change is a −6.53% fall, over the last year Pfizer has showed a −23.54% decrease.

We've gathered analysts' opinions on Pfizer future price: according to them, PFE price has a max estimate of 35.00 USD and a min estimate of 23.00 USD. Watch PFE chart and read a more detailed Pfizer stock forecast: see what analysts think of Pfizer and suggest that you do with its stocks.

PFE stock is 1.77% volatile and has beta coefficient of 0.38. Track Pfizer stock price on the chart and check out the list of the most volatile stocks — is Pfizer there?

Today Pfizer has the market capitalization of 133.55 B, it has decreased by −4.54% over the last week.

Yes, you can track Pfizer financials in yearly and quarterly reports right on TradingView.

Pfizer is going to release the next earnings report on Aug 5, 2025. Keep track of upcoming events with our Earnings Calendar.

PFE earnings for the last quarter are 0.92 USD per share, whereas the estimation was 0.67 USD resulting in a 38.23% surprise. The estimated earnings for the next quarter are 0.58 USD per share. See more details about Pfizer earnings.

Pfizer revenue for the last quarter amounts to 13.71 B USD, despite the estimated figure of 13.92 B USD. In the next quarter, revenue is expected to reach 13.56 B USD.

PFE net income for the last quarter is 2.97 B USD, while the quarter before that showed 403.00 M USD of net income which accounts for 636.23% change. Track more Pfizer financial stats to get the full picture.

Yes, PFE dividends are paid quarterly. The last dividend per share was 0.43 USD. As of today, Dividend Yield (TTM)% is 7.28%. Tracking Pfizer dividends might help you take more informed decisions.

Pfizer dividend yield was 6.37% in 2024, and payout ratio reached 119.94%. The year before the numbers were 5.73% and 444.50% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 81 K employees. See our rating of the largest employees — is Pfizer on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Pfizer EBITDA is 24.09 B USD, and current EBITDA margin is 36.93%. See more stats in Pfizer financial statements.

Like other stocks, PFE shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Pfizer stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Pfizer technincal analysis shows the sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Pfizer stock shows the sell signal. See more of Pfizer technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.