PNC trade ideas

PNC Financial Services Group, Inc.On the above weekly chart price action has corrected 50%. A number of reasons now exist to be long, including:

1) RSI resistance breakout.

2) Regular bullish divergence. Measured over 2-months.

3) A Double bottom prints.

3) Price action prints on the 100-week RMA with the divergence. Look left.

Is it possible price action corrects further? Sure.

Is it probable? No.

Ww

Type: trade

Risk: 6%

Timeframe for long: A week or two.

Return: 50% minimum

Stopless: 94

PNC The PNC Financial Services Group Options Ahead of EarningsIf you haven`t bought the dip on PNC:

Then analyzing the options chain and the chart patterns of PNC The PNC Financial Services Group prior to the earnings report this week,

I would consider purchasing the 125usd strike price Puts with

an expiration date of 2025-1-17,

for a premium of approximately $5.65.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

PNC Financial Services Group Inc.: Decoding Insider MovesIn the dynamic world of finance, insider activity can often serve as a valuable indicator for investors seeking deeper insights into a company's health and potential future performance. Recently, PNC Financial Services Group Inc. ( NYSE:PNC ) caught the attention of market observers with a notable insider transaction involving Executive Vice President Guild Deborah. Let's delve into the details of this transaction and explore its implications for investors.

The Insider Transaction:

On Thursday, November 30th, EVP Guild Deborah executed a sale of 1,533 shares of PNC stock at an average price of $132.51 per share, resulting in a total transaction value of $203,137.83. Following this transaction, Guild Deborah now holds 17,092 shares of NYSE:PNC stock, with an estimated value of approximately $2,264,860.92. The details of this sale were disclosed in a filing with the Securities & Exchange Commission (SEC).

Analyzing the Numbers:

The sale of shares by an executive insider raises several questions for investors. While it's essential to note that insider selling is not uncommon and may have various reasons, the timing and context of such transactions can offer valuable insights. In this case, the sale occurred at an average price of $132.51, prompting investors to assess whether Guild Deborah's decision to part with shares reflects a lack of confidence in the company's future prospects or is merely part of a broader financial strategy.

Key Considerations:

1. Magnitude of Sale: The relatively modest percentage of NYSE:PNC stock (0.39%) owned by company insiders suggests that this particular transaction, while noteworthy, may not be a significant factor in determining the overall sentiment toward the company.

2. Contextual Analysis: Investors should consider the broader market conditions, industry trends, and the company's recent financial performance to gain a comprehensive understanding of the motives behind the insider sale.

3. Historical Patterns: Examining historical insider trading patterns within NYSE:PNC , especially by Guild Deborah, can provide additional context. If this sale deviates from established patterns, it could signal a shift in the executive's outlook.

Conclusion:

In conclusion, insider activity within NYSE:PNC Financial Services Group Inc. demands careful consideration from investors. While EVP Guild Deborah's recent sale of shares is a notable event, it is crucial to interpret it within the broader context of the company's performance and the prevailing market conditions.

PNC The PNC Financial Services Group Options Ahead of EarningsIf you haven`t bought PNC here:

Then analyzing the options chain and the chart patterns of PNC The PNC Financial Services Group prior to the earnings report this week,

I would consider purchasing the 120usd strike price Puts with

an expiration date of 2024-3-15,

for a premium of approximately $8.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

Banking Segment Evolution. Hey TradingView. TiltonKy is bank to bring some new ideas for the quarter.

We are investing numerous positions, and a few we plan to share with trading view this quarter.

Firstly Banks.

"SVB Banking Crisis" has put a point and hold on the banking sector this year. Giving Financials a 2 year devalution on going. This bear market for the sector has gone on for long enough.

The technicals suggest a eclipse of the Downward Trend. And Overall bullish tend that has been intact for years.

We have Banking Quarterly Earnings for Q3 Due to begin reporting at the end of this week.

We are speculating a new resumption in the banking sector to follow up the the rally into end year. If banks can report solid earnings, in this new "higher for longer" rates enviroment. Certainly we can see this new adoption in the rally.

I think the attention has been steered away from Finanicals. We see to believe that the banking has been oversold, overreacted and Undervalued based on its valued to the economy.

Price Targets are set to Fair Valuation.

Technicals-Wedge breakout Pattern. Both stocks.

Expression. 130C or 125C Jan 24. =Time Dated for the entire Quarter. 90days. +

Macro Views.

NYSE:PNC - 35% Upside Potential. 160.00+

NYSE:JPM - 10% Upside Potential. 160.00+

This Year End Price Targets.

Earnings Journal 💵💵💵█ SIMPLISTIC ANALYSIS </

Current Market Trend: neutral/no defined trend.

Next Wave: buy wave to the deviation.

Next Swing: negative swing to support.

Trade Type: Touch & Go don't wait for a close.

█ EARNINGS AT A GLANCE </

Release Date: 10/13 BMO

Earnings Anticipations: positive surprise for EPS & positive surprise for Revenues.

Surprise-Confidence: on a scale of 0-5, #3

EPS & Revenue 2-Year Trend: the trend in EPS is neutral, the trend in Revenues is positive.

█ SYNOPSIS </

"I expect the market will buy the surprise if the earnings report hits the Wall Street consensus, or sell the surprise if the earnings report misses the Wall Street consensus."

█ RESEARCH DEPTH: </

Technical Analysis: daily chart.

Fundamental Analysis: EPS & Revenue data.

Press/News: none.

Social Media: none.

PNC The PNC Financial Services Group Options Ahead Of EarningsLooking at the PNC The PNC Financial Services Group options chain ahead of earnings , I would buy the HKEX:130 strike price Calls with

2023-6-16 expiration date for about

$4.80 premium.

If the options turn out to be profitable Before the earnings release, i would sell at least 50%.

Looking forward to read your opinion about it.

Oversold/Descending TrianglePrice is beneath a triangle so it has broken support.

Price is below bands set on an 80 DMA versus 20. This can indicate oversold conditions.

Deeply oversold on RSI.

Earnings are 4-14 and it appears analysts are not positive about the outcome for now.

No recommendation

EPS (FWD)

14.92

PE (FWD)

8.72

Div Rate (FWD)

$6.00

Yield (FWD)

4.61%

Short Interest

1.32%

Market Cap

$52.01B

💾 PNC Financial Services Group Looks Very Bad | Crash AheadIt is a repeat, the same over and over... Some banks are doing better than others which is expected yet PNC isn't part of the better group, this one looks pretty bad.

The previous bank had no volume on the drop, here we have high volume... Let me show you!

PNC Weekly:

✔️ PNC broke below EMA300 this week.

✔️ Bear volume has been increasing since Oct. 2021 and it keeps on going higher.

✔️ The MACD looks really bad and the RSI as well.

The crash is already pretty advanced but it can go much lower.

✔️ The monthly chart reveals the true story... It seems we are looking at the worst crash in 15 years.

The bear market should go fast in comparison with the bull market.

Ever since the Federal Reserved was established bear markets became short in duration and bull markets long, because troubled institutions could easily access credit once the central bank was established.

Before the Federal Reserve it was the opposite, bear markets were really long and bull markets short.

Everything has its positive and negative aspects.

I am getting tired of these... Not sure if I will make it to write the TOP10.

Namaste.

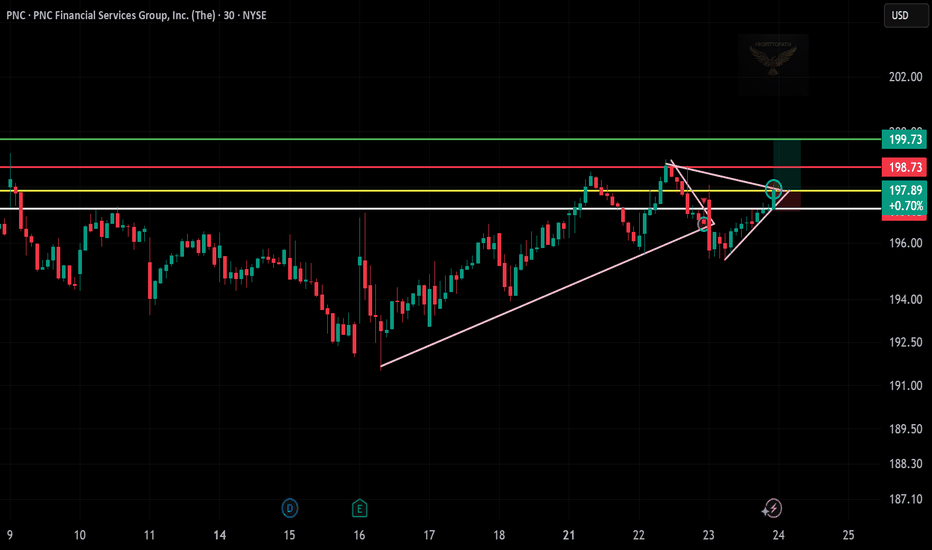

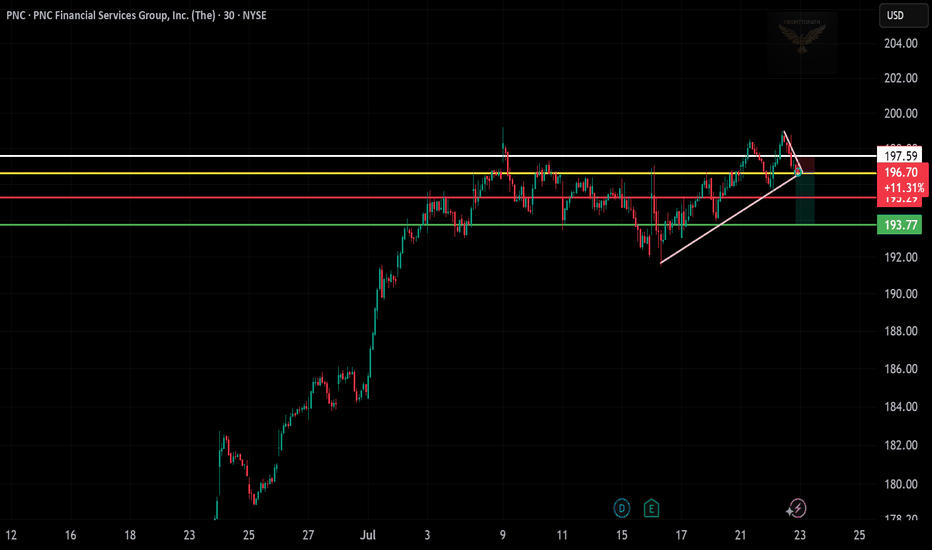

PNC Possible Ascending Broadening Wedge BreakoutPNC Possible Ascending Broadening Wedge Breakout

Wait for confirmation at what was resistance to for a support for that continuation upward

Failure to break previous day POC will send us down to the previous range before this formation formed invalidating the structure (path shown)