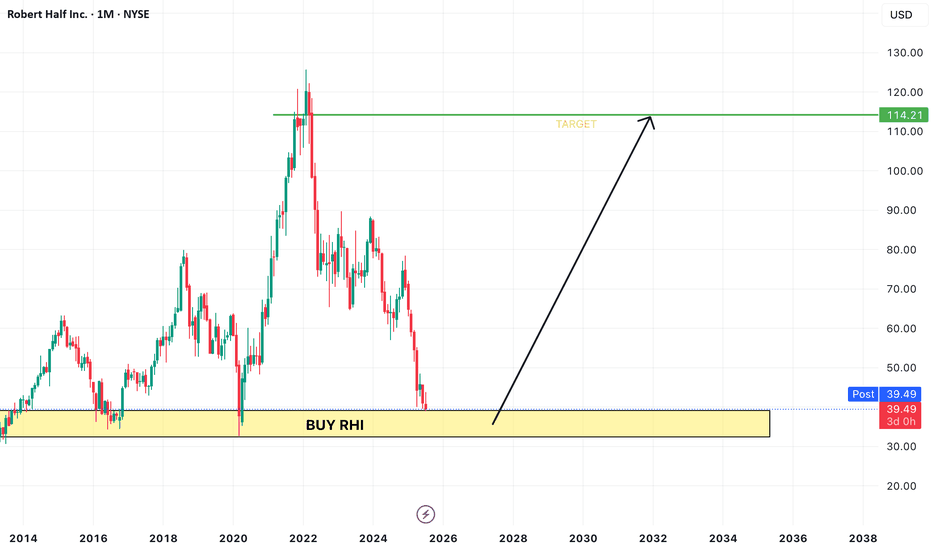

Robert Half | RHI | Long at $37.58Robert Half NYSE:RHI is a company that provides talent solutions and business consulting services in the US and internationally. It's a cyclical stock. Currently, the price has entered my "crash" simple moving average zone ($37-$33) and has historical bounced from this area. This doesn't mean the "major crash" area won't be reached ($26-$21 or below), but the company has been around since 1948 and survived many hurdles along the way.

Earnings are forecast to grow 8% annually and it has a 6.3% dividend. P/E = 21x and financially healthy (low debt-to-equity: .2x, low bankruptcy risk/Altmans Z Score: 5; and enough cash to pay current bills/quick ratio: 1.6).

Regardless of bottom predictions, I think there is a high chance the stock may reach $33 before a slight bounce. If the market flips for a bit, that "major crash" area ($20s) may be hit.

So, a starter position for NYSE:RHI has been created at $37.58 with additional entries near $33 and $25-$26.

Targets into 2028:

$46.00 (+22.4%)

$53.00 (+41.0%)

RHI trade ideas

White Collar job sentiment has been plunging since 2022Robert Half has been around for quite sometime...I look at this chart as a sentiment indicator for "white collar workers". While white collar workers and the American middle class are not synonymous you could say that many people in the middle class are employed as white collar workers so it is a chart to study when considering how the American middle class is "feeling" about their job situation which in turn leads to consumption habits either falling or rising.

Needless to say this chart has been plunging since early 2022 and is off to the worst start of a presidential turnover since Bush in 2000 (if you study only the last 25 years).

Typically once a president has been elected or re-elected this chart generally has gone up during the first 2 years after election or re-election...it then either continues upwards or begins to go down after the 2nd full year. As you can see during the Bush presidential term sentiment actually went down.

This chart is one of the reasons I believe charts like Target, Lululemon, LVMH, etc have been suffering.

Anyways, RHI is actually not a bad company...pays a pretty good dividend and has a solid balance sheet. Could this be the quarter for the turn around? Today had a very strong bullish reversal candle, not only for this company but also for the others I mentioned above. Only time will tell but this chart will eventually turn around.

RHI to $68My trading plan is very simple.

I buy or sell when price tags the top or bottom of parallel channels.

I confirm when price hits Fibonacci levels.

So...

Here's why I'm picking this symbol to do the thing.

Price in channel zones at bottom of channels (period 100 52 & 26)

Stochastic Momentum Index (SMI) at oversold level

VBSM is spiked negative and under bottom of Bollinger Band

Entry at $63.17

Target is $68 or channel top

5/30/24 - $rhi - detailed thinking: i'd remain greedier to buy.5/30/24 - vrockstar - NYSE:RHI - doing a follow up comment here given the stock now at 52wk lows and was flagged to me by a friend to take a look.

1) my valuation comments vs. the 4/25/24 comment don't change much. you're looking at a situation where it's a matter of where bottom EPS is and what lift off is from there. $3 of EPS seems low to me this yr, but is 3.5$ the trough? do we go to $4 or is it more like $4.5 next year. this matters - BUT - the problem is we don't have ANY visibility toward this and the macro holds all the cards, mgmt is simply steering the ship. so what multiple do you put on a scale but still-haven't-hit-cycle-bottom HIRING business? i'd posit 15x on $4 of EPS power remains generous, that's $60.

2) BUT we're in an environment that is being particular brutal to anything that's not mega-scaled-ai-will-eat-your-brains tech. and unfortunately even with net cash for RHI (that's a good factor), it's one of the marginal losers if we still get higher rates for longer, unemployment curve has JUST started to inflect. so the stock is anticipating this already - it's not as if this px correction hasn't happened at all.

3) looking back in history, you'd want to own this business anticipating the anticipation of the peak of unemployment. i'd argue that since we just started inflecting that UNLESS we get some sort of obvious pivot with gusto immediately (let's see what the jobs report brings next week - this could be a trading catalyst for a name like RHI), we can't even approximate what's going to happen.

4) vs. the SPY (do RHI/SPY) in trading view, we're at the most oversold readings in history. arguably the company remains on solid balance sheet footing, but it faces the above challenges AND consider the type of roles it helps hire for are becoming more and more consolidated into AI-at-risk-replacements in the coming cycle. while i'd argue it will take wall street a while to figure this out, i don't think RHI is a 10Y compounder. we play this just one more cycle.

5) i've set a greedy target to own this in the low GETTEX:50S , but have a flag set to begin a 50 bps starter position at ~$55. I still don't want to buy it today given my oppty set, $60 still seems like a compromise per the above (and considering if we get there - we also probably have a bunch of other companies on my short list I prefer). So bc it's not a "must own" name for me, my thinking on compounded for a long-term being low conviction - i need a good entry.

GL to the holders. lmk if you think differently. hope this helps frame thinking as we enter the balance of the year on this name.

-V

4/25/24 - $rhi print - +ve bias but only dip byr - vrockstar4/25/24 - vrockstar - well managed business, net cash helps in this global fiat debt chitshow, 20x PE not awful for scaled biz, employees churning like butter helps, ACN one way, TYL the other - not really even perfect comps by any sense, but think this would be a dip buy on a "miss" all else equal >10% down. tend to think this is a long into print given the sell off probably portends already mediocre #s and cons. already pricing in trough earnings elements this year. but '25/'23 cagr is barely double digits, so even 15x on 4.5 hardly gets you to curr share price. I think 12x on i'll give you 5 or $60 gives you some margin of safety. do i think this stonk goes red 15% on this print - no - in some sense it already has. so 10% is a good dip on the post or pre market puke. but i'm sidelines here

$RHI to head higher after breaking out of a tight 3week range?* Great earnings

* Very strong up trend

* High 3-month relative strength of 1.41 in the Healthcare sector

* High U/D volume ratio of 1.51

* Breaking out of a very tight 3 week consolidation of ~3.85% with higher than average volume

* If you have access to Volume Profiles you can see that the $113.04 area has tonnes of volume.

* We can expect the $113.04 area to serve as support moving forward.

Trade Idea:

* Looking at the weekly, this seems like a great time to enter as it's recovering from the pull back.

* If you are looking for a better entry you can wait for an opportunity around the $113 area as that should serve as support moving forward.

Go to the ATH!Do NOT buy now! In the case of a return to the support level, we buy with a target in the area of . Technically a very good picture will turn out.

❤️ If you find this helpful and want more FREE forecasts in TradingView

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 LIKE button,

. . . . . . . . . . . Drop some feedback below in the comment!

❤️ Your Support is very much 🙏 appreciated!❤️

💎 Want us to help you become a better Stock trader?

Now, It's your turn!

Be sure to leave a comment let us know how do you see this opportunity and forecast.

ROBERT HALF INTERNATIONAL Idea DailyHello traders, ROBERT HALF INTERNATIONAL is in a false bearish push with low sell volume made and a hammer candle shape. The TIMEFRAME M1 we see a kind of marubozu provided with a shadow with a high volume of purchase issued, it goes to the base of the bollinger to test it. Then the same VWAP before coming on the top of the bollinger and going on the top of the stabilization zone. Great potential for price breakout with the return of buying volume then at the same time zone the zone and reach the next one and land on the last higher. To come on the last one with three higher in front adjustment (on MULTI TIMEFRAME H4 and H1). Not enough buying force to test the middle mid-half of ANDREWS PITCHFORK.

Please LIKE & FOLLOW, thank you!