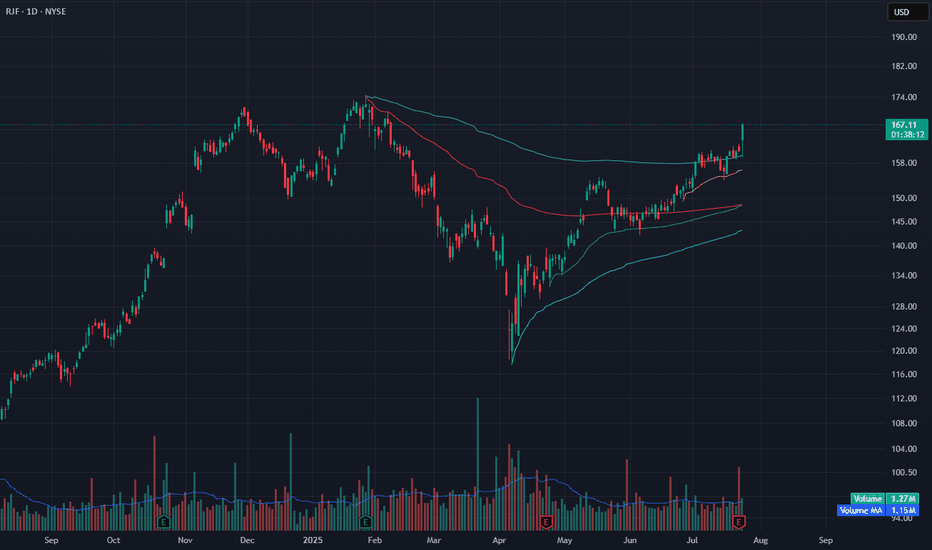

RJF Breaks Out Above Range – Fresh High on Anchored VWAP SupportRJF broke out with a strong +3.88% candle, clearing the previous range and reclaiming its upper VWAP zone. Price is now trading above all key anchored VWAP levels, with the yellow VWAP acting as near-term support.

Volume came in above average (1.27M vs. 1.15M MA), confirming demand. The breakout clears a long consolidation zone that started in February.

A sustained move above $166 opens the door for continuation toward the $172–174 zone, which lines up with the pre-breakdown highs from late 2023.

Indicators used:

Anchored VWAP (all major zones reclaimed)

Volume & Volume MA (breakout confirmation)

Trend structure

Entry idea: Hold above $166 or breakout continuation above $168

Target: $172–174

Stop: Below $158 or below yellow VWAP

RJF trade ideas

Crooked WBad pattern noted yet strong volume and a pocket pivot noted.

Possible bearish shark which can end at the .886 or the 1.113. If price reaches the 1.113, it would be a new ATH/Current ATH is 117.37

This one just does not look like it will go a whole lot higher, but the volume and PP look bullish for now. Also a bullish candle today.

Also a possible bull flag that I forgot to draw )o: Bullish patterns do not do well in bear markets or may not break to their full targets.

I will wait.

No recommendation