Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.02 USD

29.37 M USD

4.66 B USD

143.96 M

About Rocket Companies, Inc.

Sector

Industry

CEO

Varun Krishna

Website

Headquarters

Detroit

Founded

1985

FIGI

BBG00VY1MYW7

Rocket Cos., Inc. engages in the provision of a suite of services related to homeownership and other personal financial transactions. It operates through the following segments: Direct to Consumer and Partner Network. The Direct to Consumer segment consists of performance marketing and direct engagement through the Rocket Mortgage App. The Partner Network Segment focuses on partnerships with premier consumer-focused organizations, brokers and mortgage professionals who leverage the platform and scale to provide mortgage solutions to clients. The company was founded by Daniel Gilbert in 1985 and is headquartered in Detroit, MI.

Related stocks

RKT Rocket Companies Options Ahead of EarningsIf you haven`t bought RKT before the previous earnings:

Now analyzing the options chain and the chart patterns of RKT Rocket Companies prior to the earnings report this week,

I would consider purchasing the 13usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximate

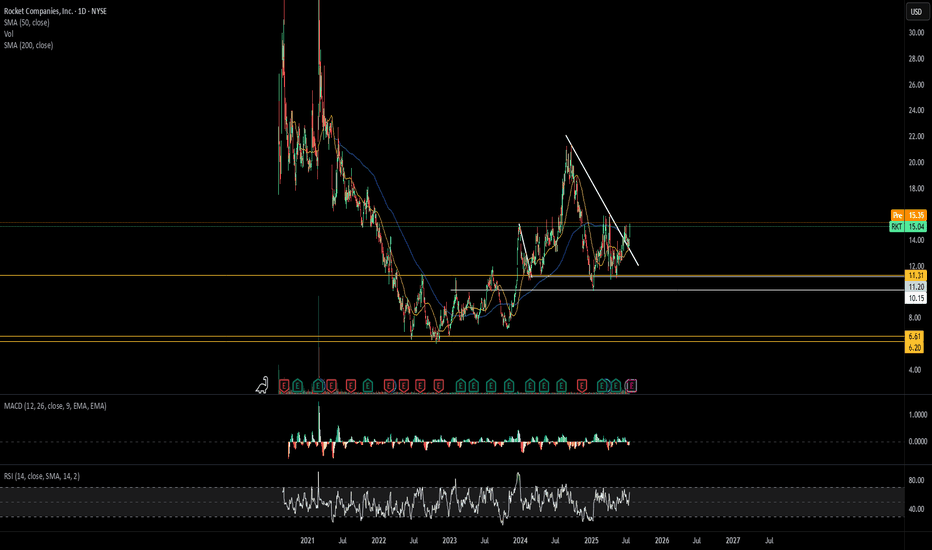

RKT Consolidates Above $10 Ahead of $18 BreakoutNYSE:RKT has been consistently making higher highs since late 2022.

A rally toward the end of 2023 drove the price up from $7 to around $18. Although the expanded supply block at that level has capped further gains, the price continues to consolidate above $10, still finding support from the miti

Rocket Companies (RKT) – Fintech-Driven Mortgage GrowthCompany Overview:

Rocket Companies NYSE:RKT is a fintech leader in mortgage and real estate solutions, leveraging AI-driven efficiency to enhance profitability and market share.

Key Catalysts:

Surging Profitability & Efficiency 💰

Adjusted EBITDA margin rose to 18% in Q4 2024, up from 2% a year

RKT Rocket Companies Options Ahead of EarningsAnalyzing the options chain and the chart patterns of RKT Rocket Companies prior to the earnings report this week,

I would consider purchasing the 13usd strike price Calls with

an expiration date of 2025-4-17,

for a premium of approximately $1.25.

If these options prove to be profitable prior to the

Speculative Price Prediction of Rocket Companies, Inc. (RKT)Price Prediction:

Short-term (1-3 months): The price is likely to test the $10.00 support zone. If breached, expect a rapid decline to $7.38.

Mid-term (6-12 months): A potential recovery to $13.69 depends on improved earnings and bullish technical patterns, with $15.47 as the upper bound.

The techni

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of RKT is 15.00 USD — it has increased by 0.94% in the past 24 hours. Watch Rocket Companies, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Rocket Companies, Inc. stocks are traded under the ticker RKT.

RKT stock has risen by 7.22% compared to the previous week, the month change is a −0.07% fall, over the last year Rocket Companies, Inc. has showed a 3.02% increase.

We've gathered analysts' opinions on Rocket Companies, Inc. future price: according to them, RKT price has a max estimate of 17.00 USD and a min estimate of 13.00 USD. Watch RKT chart and read a more detailed Rocket Companies, Inc. stock forecast: see what analysts think of Rocket Companies, Inc. and suggest that you do with its stocks.

RKT stock is 3.61% volatile and has beta coefficient of −0.15. Track Rocket Companies, Inc. stock price on the chart and check out the list of the most volatile stocks — is Rocket Companies, Inc. there?

Today Rocket Companies, Inc. has the market capitalization of 2.27 B, it has decreased by −1.38% over the last week.

Yes, you can track Rocket Companies, Inc. financials in yearly and quarterly reports right on TradingView.

Rocket Companies, Inc. is going to release the next earnings report on Jul 31, 2025. Keep track of upcoming events with our Earnings Calendar.

RKT earnings for the last quarter are 0.04 USD per share, whereas the estimation was 0.04 USD resulting in a 4.17% surprise. The estimated earnings for the next quarter are 0.03 USD per share. See more details about Rocket Companies, Inc. earnings.

Rocket Companies, Inc. revenue for the last quarter amounts to 1.04 B USD, despite the estimated figure of 1.24 B USD. In the next quarter, revenue is expected to reach 1.27 B USD.

RKT net income for the last quarter is −10.38 M USD, while the quarter before that showed 33.87 M USD of net income which accounts for −130.65% change. Track more Rocket Companies, Inc. financial stats to get the full picture.

As of Jul 27, 2025, the company has 14.2 K employees. See our rating of the largest employees — is Rocket Companies, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Rocket Companies, Inc. EBITDA is 741.14 M USD, and current EBITDA margin is 26.80%. See more stats in Rocket Companies, Inc. financial statements.

Like other stocks, RKT shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Rocket Companies, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Rocket Companies, Inc. technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Rocket Companies, Inc. stock shows the strong buy signal. See more of Rocket Companies, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.