RKT trade ideas

RKT Rocket Companies Options Ahead of EarningsIf you haven`t bought RKT before the previous earnings:

Now analyzing the options chain and the chart patterns of RKT Rocket Companies prior to the earnings report this week,

I would consider purchasing the 13usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $1.37.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

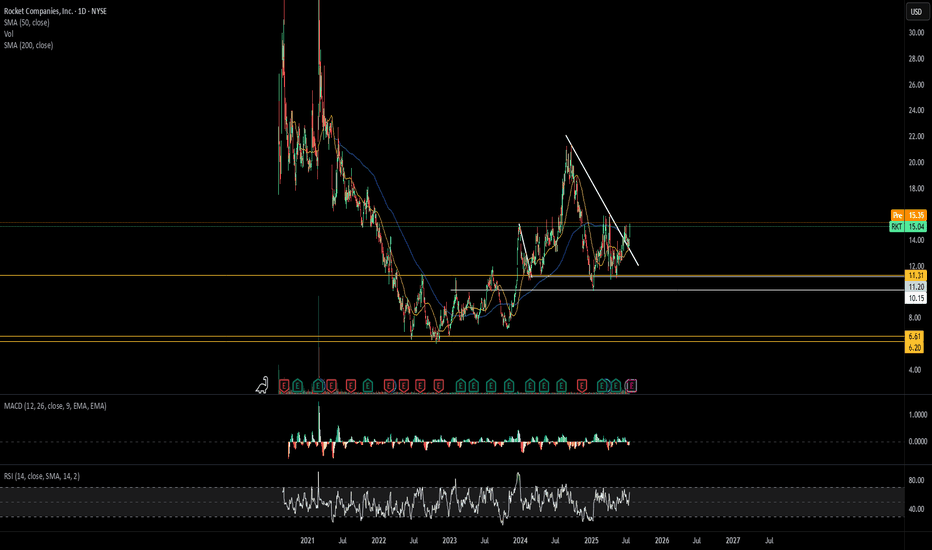

RKT Consolidates Above $10 Ahead of $18 BreakoutNYSE:RKT has been consistently making higher highs since late 2022.

A rally toward the end of 2023 drove the price up from $7 to around $18. Although the expanded supply block at that level has capped further gains, the price continues to consolidate above $10, still finding support from the mitigation block in that area.

However, because the consolidation is ongoing, the current price trend remains unclear—both the 30- and 50-period EMAs are flat.

In the medium term, once this consolidation phase completes, the price is expected to resume its move back toward $18 and beyond.

Rocket Companies (RKT) – Fintech-Driven Mortgage GrowthCompany Overview:

Rocket Companies NYSE:RKT is a fintech leader in mortgage and real estate solutions, leveraging AI-driven efficiency to enhance profitability and market share.

Key Catalysts:

Surging Profitability & Efficiency 💰

Adjusted EBITDA margin rose to 18% in Q4 2024, up from 2% a year prior, reflecting strong financial performance.

Rocket Mortgage Growth 📊

Net rate lock volume surged 47% YoY to $23.6 billion, far outpacing industry trends.

Expanding Servicing Portfolio 📈

The $593 billion servicing portfolio (+17%) provides stable revenue and cross-selling opportunities, acting as a hedge against rate volatility.

Resilient Market Share Expansion 🏆

Despite industry headwinds, Rocket continues to grow market share, proving its competitive edge in mortgage lending.

Investment Outlook:

Bullish Case: We are bullish on RKT above $11.80-$12.00, driven by profitability gains, market expansion, and portfolio strength.

Upside Potential: Our price target is $20.00-$21.00, reflecting sustained growth and operational efficiency.

🔥 Rocket Companies – Powering the Future of Mortgage & Fintech. #RKT #MortgageTech #FintechGrowth

RKT Rocket Companies Options Ahead of EarningsAnalyzing the options chain and the chart patterns of RKT Rocket Companies prior to the earnings report this week,

I would consider purchasing the 13usd strike price Calls with

an expiration date of 2025-4-17,

for a premium of approximately $1.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Speculative Price Prediction of Rocket Companies, Inc. (RKT)Price Prediction:

Short-term (1-3 months): The price is likely to test the $10.00 support zone. If breached, expect a rapid decline to $7.38.

Mid-term (6-12 months): A potential recovery to $13.69 depends on improved earnings and bullish technical patterns, with $15.47 as the upper bound.

The technical and fundamental outlook for RKT remains bearish in the short term, with a speculative potential for mid-term recovery contingent on structural improvements and positive earnings surprises. Aggressive traders may capitalize on short opportunities near $10.20, while conservative traders should await a confirmed breakout above $12.50 for long positions. Adherence to strict risk management is paramount due to heightened volatility.

Trade Idea RKT Rocket MortgageRecently mortgage application starts came in higher than expected and with the anticipation of rate decreases going forward it appears people are trying to front run a busy home buying season next spring. By my count we are due at least 1 more high before a pullback and as we know wave 3's can extend.

Price Target is $25

NYSE:RKT

Rocket Companies Inc. | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Rocket Companies Inc.

- Hypothesis Entry Bias | VWAP

- Retracement 1 | Double Formation At 21.30

- Double Bottom & Falling Wedge | 0 & 0.382 | Retracement 2

- Forecast Template | Range Structure

Active Sessions On Relevant Range & Elemented Probabilities;

London(Upwards) - NYC(Downwards)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Neutral

BONANZA BOYS EP 3: BLAST OFF 100%'erBONANZA is a quick increase in money yada yada yada

we usually looking for quick pumps in price before the dump but we got a good discount here on NYSE:RKT id add this to a more long term portfolio to survive disaster alongside NYSE:UPS in coming market crash im looking for bulls within the bear so this guy makes the cut however to keep safe monitor with alligators any cross below in the recession is a sign to take profit

steady insider buying as well from mr cfo made sure to keep it real low key building up positions to a whooping 1 million in share purchases of this 640 million dollar mkt cap company he's definetly aware of whats coming next year hes rich hes informed but he insisting and so am i

shout out to @ChartMeNot for this one

Rocket Companies, Inc. (NYSE: RKT)1. Company Overview

Background: Founded in 1985 and headquartered in Detroit, Rocket Companies is a fintech platform known for its flagship subsidiary, Rocket Mortgage. The company offers a range of services, including mortgage origination, personal finance, and real estate services under brands like Rocket Homes and Rocket Money. The company's mission is centered around AI-driven, accessible homeownership.

Innovation Focus: Recently, Rocket has heavily invested in AI and technology-driven solutions for mortgage and real estate markets, positioning itself as a digital-first player amid the broader trend towards online financial services.

2. Financial Highlights and Performance

Current Revenue and Profitability: Rocket reported revenue growth of 35.6% for 2024 and is expected to continue this growth trajectory into 2025 with a forecasted revenue increase of approximately 28%. The company projects adjusted earnings per share (EPS) growth as high as 125% by the end of 2024, reflecting operational efficiency improvements and higher loan originations.

Earnings Call: Rocket's upcoming Q3 2024 earnings report on November 12 is anticipated to reveal further insights into its financial position. This report will likely be significant as it may impact stock sentiment depending on Rocket's performance relative to mortgage market conditions.

3. Strategic Moves and Growth Drivers

Executive Appointments: Recently, Rocket appointed Papanii Okai, a former Venmo CTO and PayPal executive, as EVP of Product Engineering. This move underscores Rocket's commitment to enhancing its technology infrastructure and positioning itself as a leader in AI-fueled homeownership.

Strategic Partnerships: In October 2024, Rocket Mortgage partnered with Annaly Capital, one of the largest mortgage real estate investment trusts (REITs), to manage a segment of Annaly’s mortgage servicing clients. This deal may boost Rocket's market share while streamlining servicing operations.

Customer Engagement Initiatives: Rocket introduced a temporary "RateBreak" buydown program through Rocket Mortgage, allowing homebuyers to access lower interest rates for the initial two years. This program is aimed at attracting new customers amid rising interest rates.

4. Market and Competitive Landscape

Interest Rate Environment: The recent stabilization and expected cuts in the federal funds rate are likely to benefit Rocket's primary markets, with projected increases in refinancing activity and mortgage originations. However, with strong competition from traditional and digital lenders, Rocket’s ability to maintain its market share is crucial.

Competitive Advantage: Rocket’s technology-centric approach, including advanced data utilization and customer experience initiatives, is widely recognized. The company ranks highly in customer satisfaction in mortgage origination and servicing, according to recent J.D. Power rankings.

5. Stock Performance and Analyst Sentiment

Current Price and Valuation: Rocket’s stock closed at $15.87 on November 8, 2024, with a modest increase in after-hours trading. The consensus 12-month price target is approximately $14.89, indicating a potential downside of 6.2% based on current trading levels.

Analyst Ratings: Market sentiment leans bearish, with the majority of analysts maintaining a "Sell" rating on the stock. This conservative stance largely stems from concerns around Rocket’s sensitivity to interest rate fluctuations and potential challenges in sustaining growth amidst housing market volatility.

6. Future Outlook

Opportunities: The expected rate cuts in 2025 could significantly bolster Rocket’s refinancing and origination volumes. Coupled with its AI initiatives and new customer engagement programs, Rocket is positioned to capitalize on a rebound in housing demand.

Risks: Despite the positives, the company faces risks from housing market fluctuations, rising competition in digital finance, and the economic sensitivity of its primary services.

Summary

Rocket Companies is strategically positioned for growth, especially as mortgage markets potentially recover. However, the company’s near-term outlook remains cautious as analysts express concerns regarding its competitive environment and the housing market's unpredictable nature. The upcoming Q3 earnings report will be a key indicator for investors and analysts watching for any signs of improvement in Rocket’s financial health and market adaptability.

Overall Sentiment: Cautiously bearish, with potential for positive momentum contingent on mortgage market recovery and the success of Rocket’s strategic initiatives.

Top 5 Weekly Trade Ideas #2 - RKT Bear FlagRKT was recently on the top 5 list, that one was a bullish idea that worked out nicely. We've seen some of the rate cut hype start to fall recently and RKT has gone down with it. So far it has held within its bull flag from the previous idea and is holding up, but now we have a shorter term bear flag as well.

If the bear flag breaks first downside target would be the bottom end of the bull flag and then the previous swing low around 14.75. Stop loss above the top end of the bear flag.

Top 5 Weekly Trade Ideas #1 | RKT Bull Flag | Part 2This is part 2 for the RKT trade idea this week. This is nearly the exact same setup we see on the 4hr, but it's on the 15m. If we get a break to the upside, first target will be the trendline from the bull flag on the 4hr. Final target would be around the 21.28 mark, a previous swing high which is at the top of this bull flag.

You can play this smaller time frame pattern for a quicker move, or buy some more time and play the 4hr bull flag instead. This is nice to see for bulls because have both timeframes indicating continued bullish momentum may be coming.

Top 5 Weekly Trade Ideas #1 | RKT Bull Flag | Part 1It's no secret that the fed is planning to cut rates this week, although unclear on how big of a cut. Either way. RKT is sensitive to interest rates and has seen some strong momentum as rate cut expectations have risen. I'd be careful trading around FOMC and this week may be prone to fakeouts. However, the chart is currently bullish in addition to the fundamental reasons above.

We have a nice bull flag here on 4hr, it closed near the top end last week. If we get a break to the upside, I'd enter calls targeting resistance from 2020 around 22.80. That area also lines up with the target projected using the length of the flag pole. In addition to this bull flag on the 4hr, we also have a shorter term one which I'll share in part 2 of this trade idea.

Rocket Companies (RKT) AnalysisCompany Overview:

Rocket Companies, a fintech mortgage loan originator, entered 2024 with strong momentum. CEO Varun Krishna highlighted top-line growth acceleration for the third straight quarter and the highest profitability in two years, along with expanded market share in both purchase and refinance sectors. The company is leveraging its proprietary AI tech stack for future growth, aiming to modernize the fragmented homeownership space.

Institutional Interest:

Investor confidence is evident, with the Swiss National Bank increasing its stake by 4.1% in Q1, now holding 237,000 shares.

Financial Performance:

Rocket Companies reported an adjusted revenue of $1.2 billion in its latest quarterly report, exceeding guidance and marking year-over-year growth acceleration for the third consecutive quarter.

Investment Outlook:

Bullish Outlook: We are bullish on NYSE:RKT above the $13.00-$14.00 range.

Upside Potential: With an upside target set at $20.00-$21.00, investors should consider Rocket Companies' impressive financial performance and strong institutional interest as key drivers for future stock appreciation.

📊🏡 Monitor Rocket Companies for promising investment opportunities! #RKT #FintechStocks 📈🔍

ROCKET COMPANIES $RKT - Apr. 5th, 2024ROCKET COMPANIES NYSE:RKT - Apr. 5th, 2024

BUY/LONG ZONE (GREEN): $13.55 - $14.75

DO NOT TRADE/DNT ZONE (WHITE): $12.80 - $13.55

SELL/SHORT ZONE (RED): $11.50 - $12.80

Weekly: Bullish

Daily: DNT

4H: Bearish

The weekly timeframe has a bullish trend with strong bearish momentum on the most recent candle as the week is wrapping up. The daily timeframe has a breakdown of bullish structure and a retest of the most recent zone that I am using as my trend determiner, I would label this as DNT until we see a new lower low created, even if it were only a wick below 12.80. The 4H timeframe gives a better showing of the strong bearish momentum and the retest of the broken zone. After the retest the bearish momentum continued to reinforce the bearish trend. Any break below 12.80 would confirm the bearish trend and where I'd start to look for short entries. A break above the zone bottom at 13.55, where the bearish momentum continued and where price retested, would signal a reversal into a bullish trend.

This is what I would personally look at before entering trades, everything is subject to change on a daily basis and as I analyze different timeframes and ideas.

EDUCATIONAL/ENTERTAINMENT PURPOSES ONLY, NOT FINANCIAL ADVICE!

trendanalysis, trendtrading, priceaction, priceactiontrading, technical indicators, support and resistance, rocketcompanies, rkt, NYSE:RKT , rocketmortgage, rktstock, rkttrend, rocket, rocketcompaniesstock, rktlong, rktshort, rktanalysis, interestrate, mortgagerate, ratecuts,

ROCKET COMPANIES $RKT - Mar. 5th, 2024ROCKET COMPANIES NYSE:RKT - Mar. 5th, 2024

BUY/LONG ZONE (GREEN): $12.35 - $14.20

DO NOT TRADE/DNT ZONE (WHITE): $11.75 - $12.35

SELL/SHORT ZONE (RED): $10.20 - $11.75

WEEKLY: Bullish

DAILY: Bullish

4H: Bullish

Bit messy today but hoping this provides more insight and support into how I've been following price movement.

Labeled previous bullish trends letters A-E.

Labeled previous bearish trends letters F-I.

Previous bullish trend and bearish trend beginnings are labeled with arrows.

Last week we saw price go from a DNT zone into a bullish trend on the weekly timeframes after breaking above level $11.75 and zone top level $12.35. Currently seeing rejection of level $12.80 down to the previous zone (top level $12.35; bottom level $12.20). Despite the test and the two red days the bullish trend is still holding, but it should be noted the 4H has wicked into a new low.

This is what I would personally look at before entering trades, everything is subject to change on a daily basis and as I analyze different timeframes and ideas.

ENTERTAINMENT PURPOSES ONLY, NOT FINANCIAL ADVICE!

Rocket ready to rocket? Taking a look at RKT here on the daily

As long as this name can hold above the $11 range I think there could be some big upside in the weeks. Months to come. This is a longer term play. Maybe till around June but after a huge pump up and a fall back down to earth to reset and test support, I think we could get some movement here.